How Will Stock Buybacks Affect Future Market Returns?

The answer is otherwise than appears at first impression.

Caught Out Using Warren Buffett’s formula that long-term equity returns equal 1) gross domestic product growth plus 2) the current yield from stock dividends plus 3) inflation, Friday’s column estimated that stocks would gain an annualized 6.5% over the next 30 years. The projection expected GDP growth to chug along at its historic average of 3%, with dividends and future inflation each contributing 1.75% of return.

A reader responded, “Since buybacks have reduced dividends, should they be added back to dividends? If so, what would the amount be?” Oh, dear. It's the kindest objections that cut the deepest. My article had indeed failed to address the effect of stock-repurchase programs.

And they matter. When corporations generate excess cash, they can reward their investors either by distributing those proceeds as dividends or by using the money to repurchase their company’s equity. The first method directly increases shareholder wealth, while the second does so indirectly by boosting earnings per share. (This holds only if the company truly uses surplus cash, rather than monies required to support the business.) Either way, the consequences are similar.

On the Rise The numbers would come out in the wash if stock repurchase programs were steady over time. But stock-buyback activities have been anything but consistent. Regarded for decades as unscrupulous behavior, following the "pump and dump" scandals of the Roaring 20s, buyback programs were almost nonexistent until the early 1980s. They then steadily increased, until in 1997 the amount of money spent on share repurchases exceeded that spent on dividend distributions.

Since the start of the New Millennium, companies have settled into a relatively dependable routine, spending about 50% more on stock buybacks than on dividend payouts. (The exception occurred from 2005 until the global financial crisis in 2008, when corporate executives exhibited ghastly market-timing by dramatically increasing their share-repurchase activities, shortly before stock prices plummeted.) In other words, in addition to its 1.75% dividend yield, the S&P 500 carries a 2.6% stock-purchase rate.

Considering Payout Rates Naively, one would think that if Buffett's formula accurately described the long-term prospects for equities back when stock-buyback plans did not exist, then his formula should be adjusted upward by the addition of those extra 2.6 percentage points, to reflect this new version of dividend payouts. His equation should therefore expand to four terms from three, thereby upgrading the stock-market's long-term prognosis to a robust 9.1% from a humble 6.5%.

Wouldn’t that be nice! However, the math is neither so simple nor so generous. Adding the full effect of stock buybacks to Buffett’s formula makes sense only if those equity repurchases substitute entirely for dividend payments. If every current dollar that companies spend on repurchasing their shares represents a dollar that once would have been distributed as yield, then such an approach would be correct. But such is far from the case.

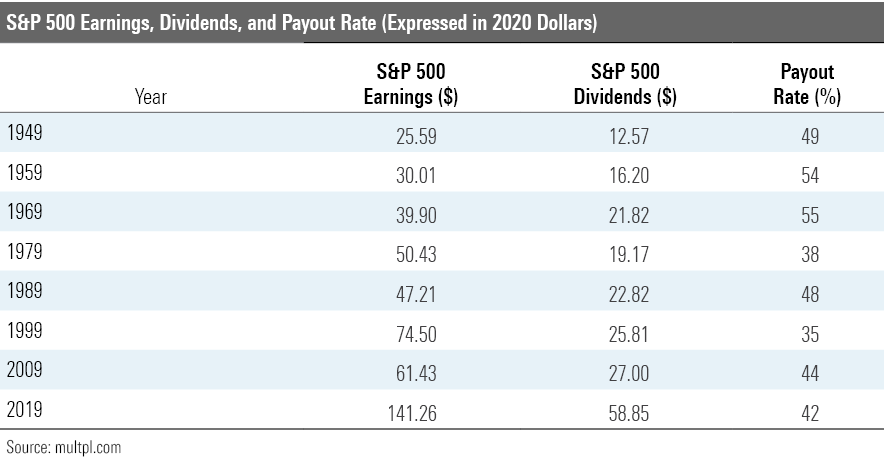

Consider, for example, the following figures, obtained from the site multpl.com. (As these are publicly available numbers, I should have compiled them myself, from the primary sources of Standard & Poor's and Robert Shiller. I will do so shortly after filing this column, for future reference.) The chart below depicts the per-share reported earnings for the S&P 500's companies, calculated in 2020 dollars, along with their dividend distributions. Also provided, by dividing the first term by the second, is the dividend-payout rate.

Despite the jump in share repurchases, the payout rate didn’t much change. It hovered near 50% from 1949 through 1989 before dropping to roughly 40% from 1999 through 2019, when stock-repurchase policies became rampant. As stock-buyback programs have become half again as large as dividend payouts, this means they consume 60% of corporate profits. Ten of those percentage points arise from replacing dividends. The other 50 points come from replacing corporate reinvestment.

Only a Bump Consequently, rather than hike the Buffett formula's output by a substantial 260 basis points per year, as the initial glance at the data suggested, the growth of stock buybacks increases the projection only by the amount of dividend substitution, something north of 40 basis points. Doing so bumps the long-term expectation for U.S. stock returns to slightly under 7% from 6.5%.

The analysis is not yet complete. There remains the question of whether today's businesses are starving themselves by spending their entire operating profits (on average, of course; there are always exceptions) on rewards for shareholders. That would seem to be taking the doctrine of shareholder value too far. It would also seem to necessitate lowering the expected corporate growth rate, as companies receive less capital from their owners than in the past.

Perhaps, but not necessarily. It is true that the first component of Buffett’s formula, GDP growth rate, has slowed substantially since stock buybacks became common. From 1999 through 2018, real U.S. GDP growth averaged an annualized 1.9%, as opposed to more than 3% over the preceding 70 years. While that period began with a recession, thereby skewing the results, the growth rate has declined even during the expansion years. Very likely, that reduction owes in part to companies investing less aggressively in their businesses.

At the same time, the S&P 500’s operating margins have never been higher. Although revenue growth has been modest, profits have grown handsomely, thanks to fatter margins. It would seem that by diverting more of their wealth to shareholders through stock-buyback programs, corporate executives have done a better job of avoiding the sin of “empire building.” Their operations are smaller than they otherwise would be, but they compensate with greater profitability.

In summary, although share-repurchase programs have increased dramatically in recent decades, their effects on future stock-market returns appear to be minimal, because they have mostly replaced corporate reinvestments rather than dividend distributions.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_d910b80e854840d1a85bd7c01c1e0aed_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)