Stellar Teams Take These Franklin and Pimco Funds Up a Notch

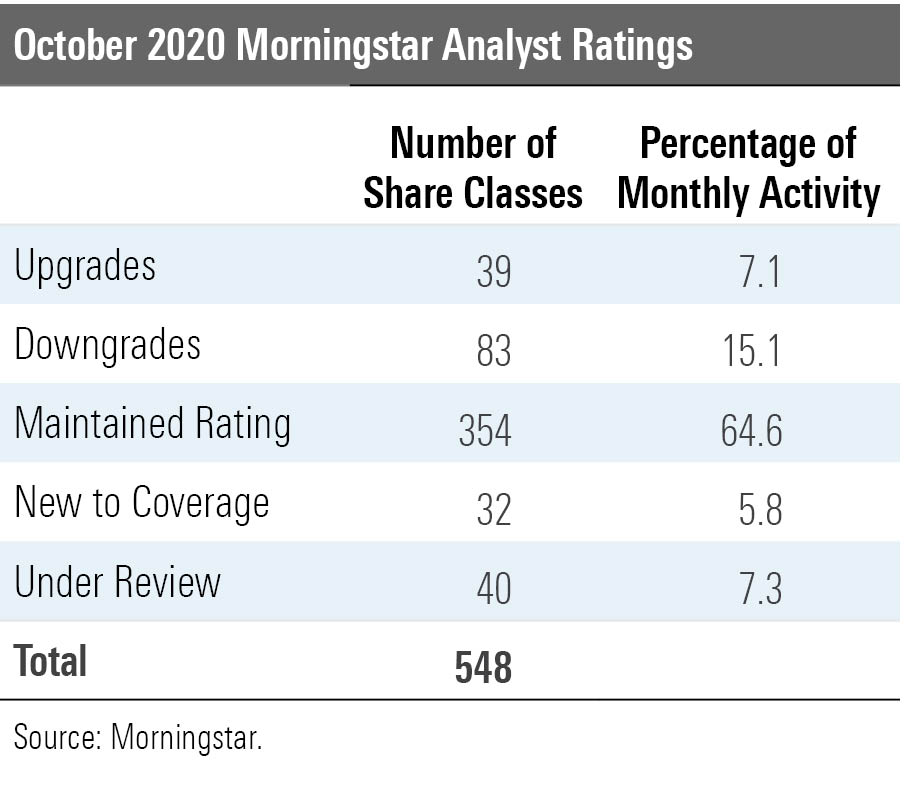

Morningstar analysts rated 548 share classes and vehicles and 141 unique strategies in October 2020.

Morningstar updated the Analyst Ratings for 548 fund share classes, exchange-traded funds, and separately managed accounts/collective investment trusts in October 2020. Of these, 354 maintained their previous rating, 83 were downgrades, 39 upgrades, 32 were new to coverage, and 40 were put under review because of material changes, such as manager departures.

Sifting out multiple share classes and vehicles, Morningstar rated 141 unique strategies in October. Of these, 11 received an Analyst Rating for the first time, with the rest having at least one investment vehicle type that a Morningstar analyst previously covered. Below are some highlights of the upgrades, downgrades, and funds new to coverage.

Upgrades Franklin Small Cap Value's FVADX up-and-coming team earned a People rating upgrade to Above Average from Average, bringing its an overall Morningstar Analyst Rating to Silver from Bronze for its cheapest share classes. Its more expensive shares improved to Bronze from Neutral. Lead manager Steven Raineri has more than three decades of industry experience and works with a five-person team. Raineri uses bottom-up analysis to look for small-cap firms with below-average debt relative to peers and strong, shareholder-friendly leadership. The team forecasts expectations under different scenarios and invests in stocks with 3 times as much upside as downside. The resulting portfolio has been less volatile than the Russell 2000 Value Index in every rolling three-year period of Raineri's tenure.

Pimco Global Bond Opportunities' (U.S. Dollar-Hedged) PAIIX three experienced, skilled, and well-supported managers earned a People Pillar rating upgrade to High from Above Average and an Analyst Rating upgrade to Gold for the strategy's cheapest share classes. Its most expensive shares landed at Silver. Lead manager Andrew Balls took over this strategy in September 2014 along with comanagers Sachin Gupta and Lorenzo Pagani; all three have worked at Pimco for more than a decade. The firm's top-down views guide the managers, who also consider relative valuations to determine sector, country, and yield-curve positioning. That's common among world-bond peers, but this fund can be more flexible with its duration and high-yield stake. The strategy hedges most of its non-U.S. currency exposure back to the U.S. dollar.

New to Coverage IShares MSCI International Quality Factor ETF IQLT debuted with an Analyst Rating of Silver. This fund tracks the MSCI World ex USA Sector Neutral Quality Index and scores stocks on three fundamental measures of quality. It ranks names from each sector by return on equity, debt/equity, and earnings-per-share growth rates over the trailing five years and weights them by market cap in the MSCI World ex USA Index, creating a portfolio dominated by large, high-quality firms. These large profitable firms with strong balance sheets and persistent earnings growth tend to be less risky than the market and hold up better during downturns.

Downgrades Vanguard Health Care's VGHCX People rating dropped to Above Average, bringing its Analyst Rating to Silver from Gold. Jean Hynes, lead manager since 2013, will become the CEO of subadvisor Wellington Management Company when the current CEO retires in June 2021. This fund will still have a personnel edge over peers, but serving as CEO will be a significant time commitment for Hynes. Her team is deep and qualified but not as experienced as her.

Fidelity New Markets Income's FNMIX People and Process ratings fell to Average, leading to an Analyst Rating downgrade to Neutral from Bronze. Lead manager Jonathan Kelly stepped down from the fund in mid-September 2020, barely 19 months after he took over from longtime manager John Carlson, who retired. Newly appointed lead manager Tim Gill, who only became a comanager in January 2019, has never had full authority over such a large pool of assets. New comanager Nader Nazmi has no experience running money. Gill intends to bring the portfolio somewhat closer to the JPMorgan EMBI Global Index. Kelly previously favored corporates and found quasi-sovereign and agency bonds less attractive. While Gill intends to bring these allocations closer to the benchmark's, the process can still lead to some significant deviations from the index, leading to concerns over execution.

T. Rowe Price Emerging Markets Bond's PREMX high-conviction approach hampered risk management and warranted a downgrade of its Process Pillar to Average from Above Average. The fund's institutional shares thus moved to Neutral from Bronze. Michael Conelius, who has run this strategy since its 1995 launch, will hand the fund over to Samy Muaddi in June 2021. Muaddi has never managed such a large pool of assets with a heavier focus on sovereigns and quasi-sovereigns. This strategy can allocate across emerging-markets debt sectors based on relative value and currency forecasts, and it can have up to 35% in corporates and up to 25% in local-currency debt. Conelius' willingness to stick with high-conviction country overweightings and missteps in sizing and timing decisions since 2017 have been responsible for large drawdowns and a long stretch of underperformance. This has lowered confidence in the investment process.

/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)