Has 'Moral Hazard' Been Fueling the Corporate Bond Market?

Record issuance and more defaults may warrant a rethink of high-yield exposure.

"Moral hazard" involves someone taking an action that will benefit them if it succeeds, while knowing they won't have to bear the consequences if it doesn't. The term is typically used to describe an economic risk, but in a simpler form it is ultimately about the power of incentives. For example, someone who rents skis rather than owning them would be less inclined to treat them with precious care, especially if the rental includes insurance. They might not hesitate to cruise over rocks and tree branches on the slopes, for example, and might toss rather than carefully place the skis into the back of a truck. That's easy to envision if they never see the skis at the end of a vacation and the rental shop has to deal with the damage. You're more inclined to take on risk--particularly if cruising over rocks and branches is more fun--if you're insured against the potential consequences.

The concept has again come to the fore in 2020 as the Federal Reserve has backstopped credit markets in response to the coronavirus. The Fed’s actions have benefited many, but they have arguably created artificially high prices--affecting the risk/reward trade-off for investors in the high-yield bond market. The Fed essentially made it safe for buyers to get the benefits of owning junk bonds, while knowing that the prices of those debts will likely be kept from falling too far given the Fed's support.

The costs associated with moral hazard on the ski slopes might be minimal, but moral hazard risks in markets and the economy can be much more expensive. One of the most striking ones occurred with "too big to fail" banks during the 2008 credit market collapse. Congress and the Fed took numerous steps, including the Troubled Asset Relief Program in 2008, with which taxpayers bailed out large banks from the consequences of their poor decisions. Many believed the bailouts reinforced bad behavior by supporting the banks after their own risky actions led to a systemic economic failure. If there is no downside for seeking short-term profits, what would prevent banks from padding their bottom lines in the short run again at the expense of taxpayers if another collapse were to happen? The Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in 2010, was Congress' answer to this question. The legislation reformed the way the banking system is regulated with the purpose of curbing risky behavior and solving this version of moral hazard.

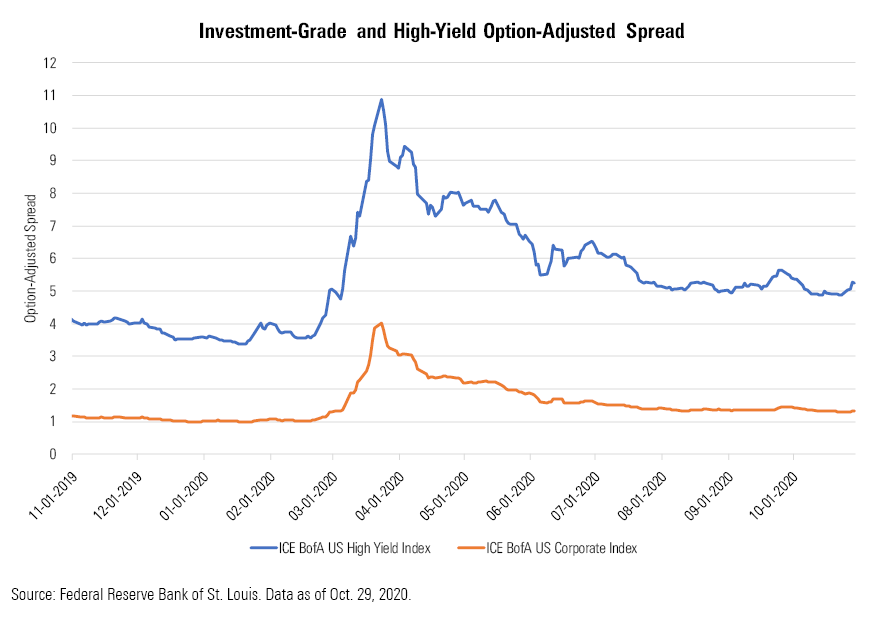

2020's Moral Hazard The Fed's actions to support financial markets during the pandemic have reignited the question of moral hazard, specifically in leveraged corporate credit markets. The Fed stepped in to shore up liquidity and looked to support the credit of large employers when markets sold off early in the year. For the first time in history, the Fed announced a purchasing program of both investment-grade and junk-rated corporate bonds. Investors responded to the March 23 announcement as the Fed had hoped, and liquidity in those markets improved even before the Fed bought any bonds. For example, yield spreads for high-yield bonds over Treasuries blew out to more than 10% in mid-March, a level reached in the past two decades only twice: after the 2008 global financial crisis and the 2001 tech bubble. After the Fed stepped in, credit spreads peaked, corporate bond prices improved immediately, and their yields came down. That lowered borrowing costs, allowing corporations to issue new debt and to continue operating and paying their employees.

The Fed’s purchases of corporate bonds have been tiny relative to the size of the overall corporate bond market, demonstrating the power of their signaling. The Fed’s primary and secondary market credit facilities have a combined capacity of $750 billion, which is roughly 8% of the $10 trillion U.S. corporate bond market. Of that allowance, only $13 billion of corporate bonds and corporate bond exchange-traded funds were held by the Fed, roughly 0.001% of the corporate bond market as of Sept. 30, 2020.

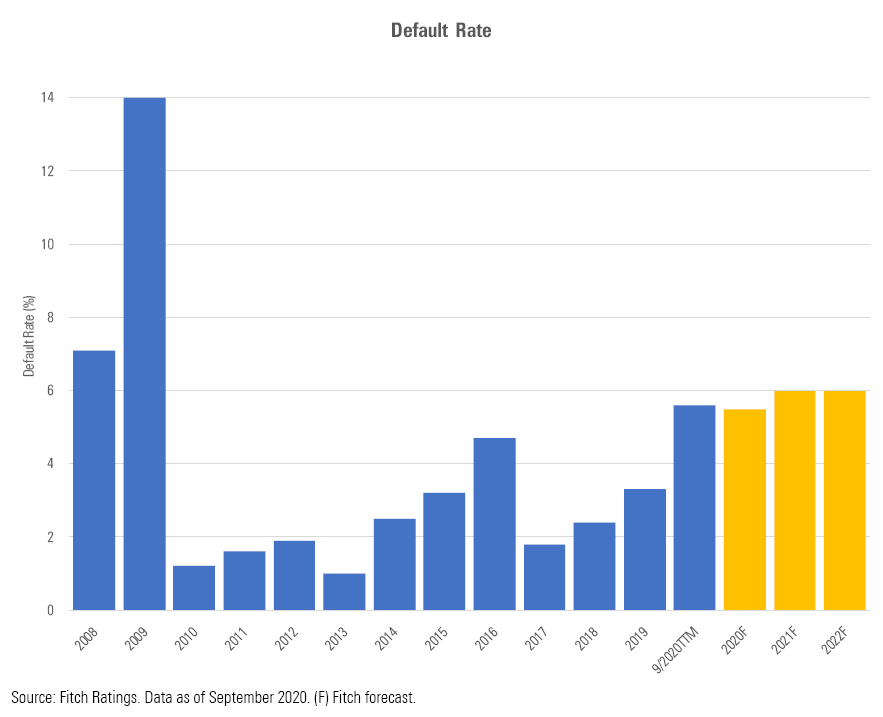

These credit facilities are not a direct bailout of corporations; bonds purchased by the Fed still need to be repaid by the issuers. However, investors are clearly optimistic that the Fed’s presence will improve the creditworthiness of U.S. corporations, trusting that it will step in if necessary. If nothing else, that has allowed some companies to borrow or refinance debt they would not otherwise have been able to with bond markets in freefall. Yields and credit spreads have come back down to levels close to what they were before the coronavirus outbreak, even despite higher projected default rates and record debt issuance. The rebound in corporate bond prices can largely be attributed to investors’ sense of security knowing that in many cases they reap the benefits of owning bonds that might otherwise be in danger without the Fed to backstop them, a classic case of moral hazard.

At the Morningstar Investment Conference in September 2020, Brian Krug, portfolio manager of Artisan High Income ARTFX (which earns a Morningstar Analyst Rating of Bronze), commented that that he and other high-yield fund managers have been beneficiaries of the Fed’s presence, as investors have committed capital at record levels. Strategies in the high-yield bond Morningstar Category received net inflows of $38 billion from April through September 2020, the best six-month period of net flows in decades. Strong demand for yield and investors’ sense of security--thanks to the Fed--have bolstered the rebound for corporate bonds.

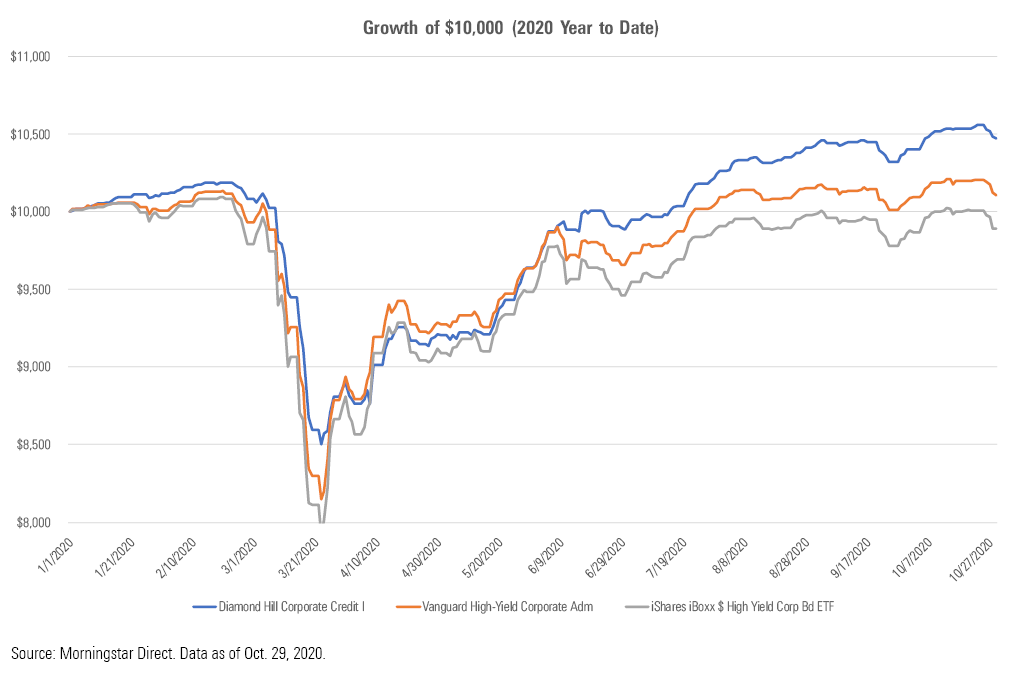

The Case for Active Corporate Bond Management in the Aftermath of Lockdowns Even as the Fed puts a floor under corporate debt prices, a strong case can be made for active corporate bond management with a long-term orientation over passive ETFs. A passive, market-weighted portfolio may work well for equity ETFs because companies with the largest market caps are typically strong businesses. Corporate bond ETFs such as Neutral-rated iShares iBoxx $ High Yield Corporate Bond ETF HYG do typically hold the largest, most-liquid issues in their markets, but by definition those are also companies with the largest debt loads.

Active corporate bond managers have a strong opportunity to outperform relative to their ETF competitors as long as the underlying strengths and weaknesses of borrowers are eventually reflected in bond prices. They can avoid overpriced bond issues in market indexes, for example, and identify and avoid companies that appear likely to default on their debt. Furthermore, unlike passive ETFs, active portfolios can choose to avoid industries such as energy, transportation, and leisure, which have come under immense pressure during the pandemic. In the corporate credit world, a strong defense is usually better rewarded over the long term than an aggressive offense given that you can generally lose a lot more when a bond fails than you can when it stays in good shape. In the face of the current market environment where defaults are projected to be higher than the past decade and moral hazard is arguably rampant, long-term investors seeking high-yield exposure could be better off with a conservatively managed active strategy.

Some of the best defensively minded strategies in the high-yield category include Gold-rated Vanguard High-Yield Corporate VWEAX and Silver-rated Diamond Hill Corporate Credit DHSTX. Both have proved their worth in 2020, outperforming category peers and ETF competitors by significant margins in the sharp sell-off from Feb. 20 through March 23 and ultimately for the year to date. Vanguard High-Yield Corporate takes a cautious stance toward high-yield investing in general and offers strong liquidity management and low fees. Although Diamond Hill Corporate Credit takes a more concentrated approach, it avoids the lowest-quality bonds in the junk-bond market and relies on thorough fundamental research and valuation discipline to limit risk.

Conclusion The Fed deserves considerable credit for unlocking the corporate debt markets during the sell-off in 2020. Its power to reverse investor sentiment has fueled the rebound in much larger measure than the physical dollars it injected into the market. The Fed's presence and pledge to support credit markets has given investors a sense of security, but this has likely added considerable moral hazard in cases where corporate bond prices are much higher than they would be without its support. This rebound in prices, when combined with higher projected default rates, has arguably created a much weaker overall value proposition for investors in the high-yield corporate market. In that environment, cautious active management could be a healthier choice for risk-conscious investors who want to hold high-yield debt.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)