3 Funds for an Evolving Market

Is the market overvaluing growth, undervaluing innovation, or getting things right?

A version of this article previously appeared in the September 2020 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

The world is rapidly evolving. Consumers are increasingly purchasing goods and services online (a trend the novel coronavirus accelerated), there is growing pressure to shift away from fossil fuels, and low interest rates and fee pressure are changing the economics of the financial-services industry. Disruptive innovation is also reshaping the economy, and new technology platforms are allowing market leaders to reap strong profits and build durable competitive advantages.

Given these seismic shifts, it's not surprising that the composition of the U.S. stock market has changed considerably over the past decade. Technology stocks had grown to 24% of the S&P 500 at the end of July 2020, up from 16.1% a decade earlier, while the energy sector shrank to 2.5% from 11.0%. The index has also become more concentrated, reflecting the disproportionate share of profits accruing to the market's big winners. The top 10 holdings represented 28% of the index at the end of July, up from 19% 10 years earlier.

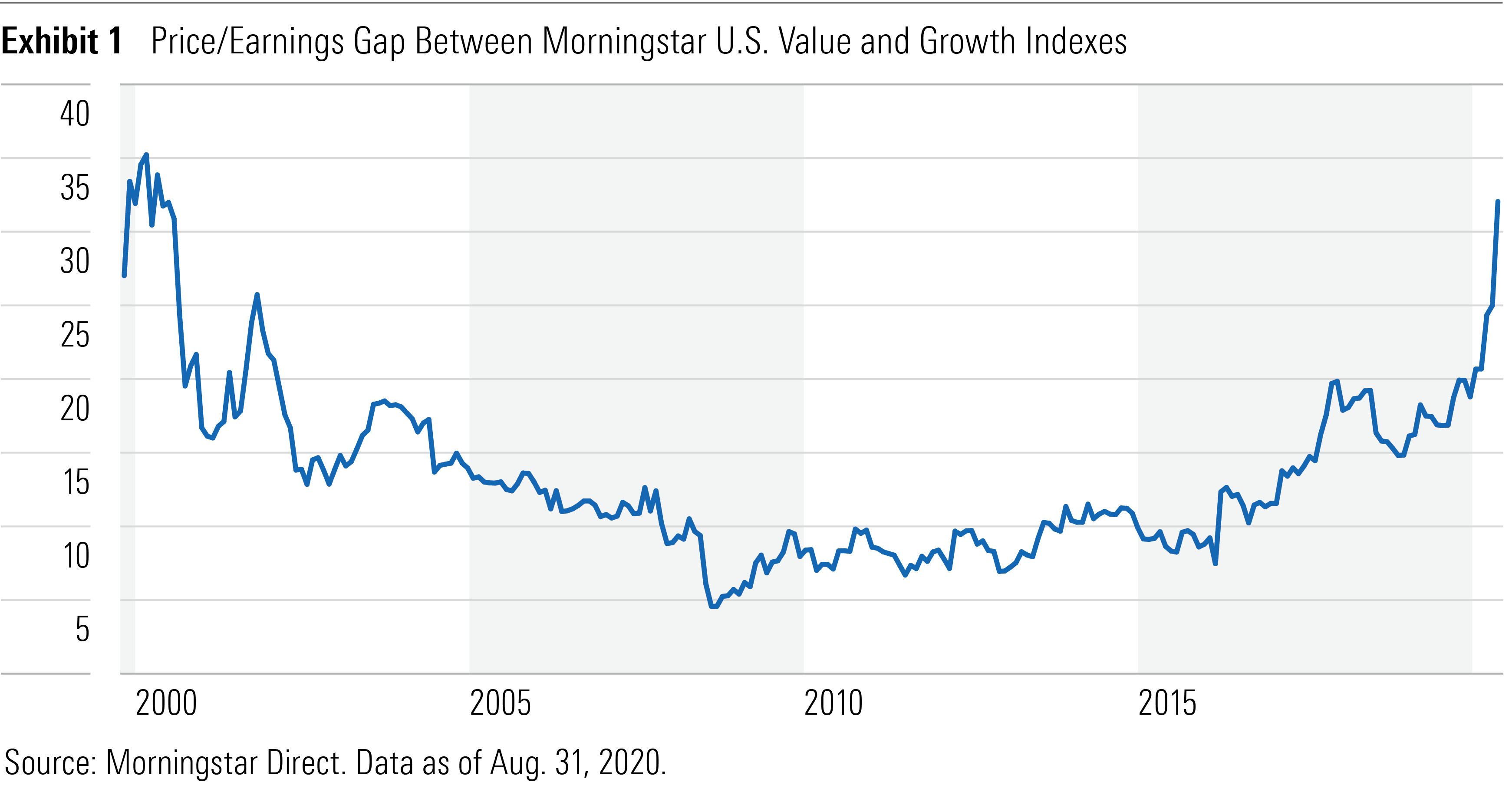

It's fair to ask whether this shifting landscape may create pockets of mispricing that might warrant tactical active bets against the market. We've seen this before: In the late 1990s, investors became overly excited about Internet companies, giving them crazy valuations on the promise of future profits that, for many, never materialized. Similar to that era, growth (including tech) stocks have trounced their value counterparts over the past decade. This is partially because of widening valuation spreads between value and growth stocks, which have nearly reached their highest levels since June 2000, as shown in Exhibit 1.

Yet there are important distinctions between now and the late 1990s. Unlike then, many of the market's darlings are now growing profitably or are on track to reach profitability in the near term and have established or are digging economic moats. And this time, innovation isn't as concentrated in a single sector.

So, the key questions are: Is the market is correctly valuing stocks' growth opportunities, is it getting ahead of itself, or is it directionally correct but still undervaluing fast-growing and innovative companies? The answers are impossible to know for certain. However, it's helpful to understand each of these scenarios and how to position for it if you find one more likely than the others, or if you just want to hedge your bets.

For investors making active bets against the market, hedging can be prudent. For example, the market may overreact to growth potential (or lack thereof) on average but still underreact to (and undervalue) some truly transformative business models because it doesn't understand them and is often focused on the short term.

The Market Is Right When in doubt, it's almost always a good idea to stick to a broad market portfolio, like Vanguard Total Stock Market ETF VTI (0.03% expense ratio), which carries a Morningstar Analyst Rating of Gold. This portfolio is hard to beat. It includes virtually all publicly traded stocks with decent trading volume and weights them by market capitalization.

This reflects the market's consensus view about the relative value of each stock, based on investors' expectations for the future. The individuals who constitute the market clearly make mistakes, and some are certainly better-informed than others. But when investors have diverse views, as they often do, their errors are largely uncorrelated. So, the market tends to be better at valuing companies than most of its participants. For example, only 6% of the active managers in the large-blend Morningstar Category at the end of July 2010 went on to survive and outperform VTI over the subsequent decade.

That's not to say investors will never regret the prices the market assigns to stocks as new information comes out. However, market prices tend to reflect information available to the public. It's hard to find anyone who consistently does better.

As the business landscape evolves, so does the composition of the market. Faster-growing areas of the market command higher valuations because investors expect them to generate a larger share of the market's profits in the future. This gives the market portfolio a built-in bias toward large-growth stocks; that bias has paid off over the past decade, though it doesn't always. If the market overpays for growth, that tilt can hurt performance. Yet, this construction allows passive investors to profit from growth that exceeds expectations, especially from the market's big winners. These have historically more than made up for the market's many losers.

So, passive investors don't need to do anything to stay on top of shifting trends and emerging opportunities--the market does that work for them. As long as there aren't systematic valuation errors, it isn't necessary to look any further than VTI for exposure to U.S. stocks.

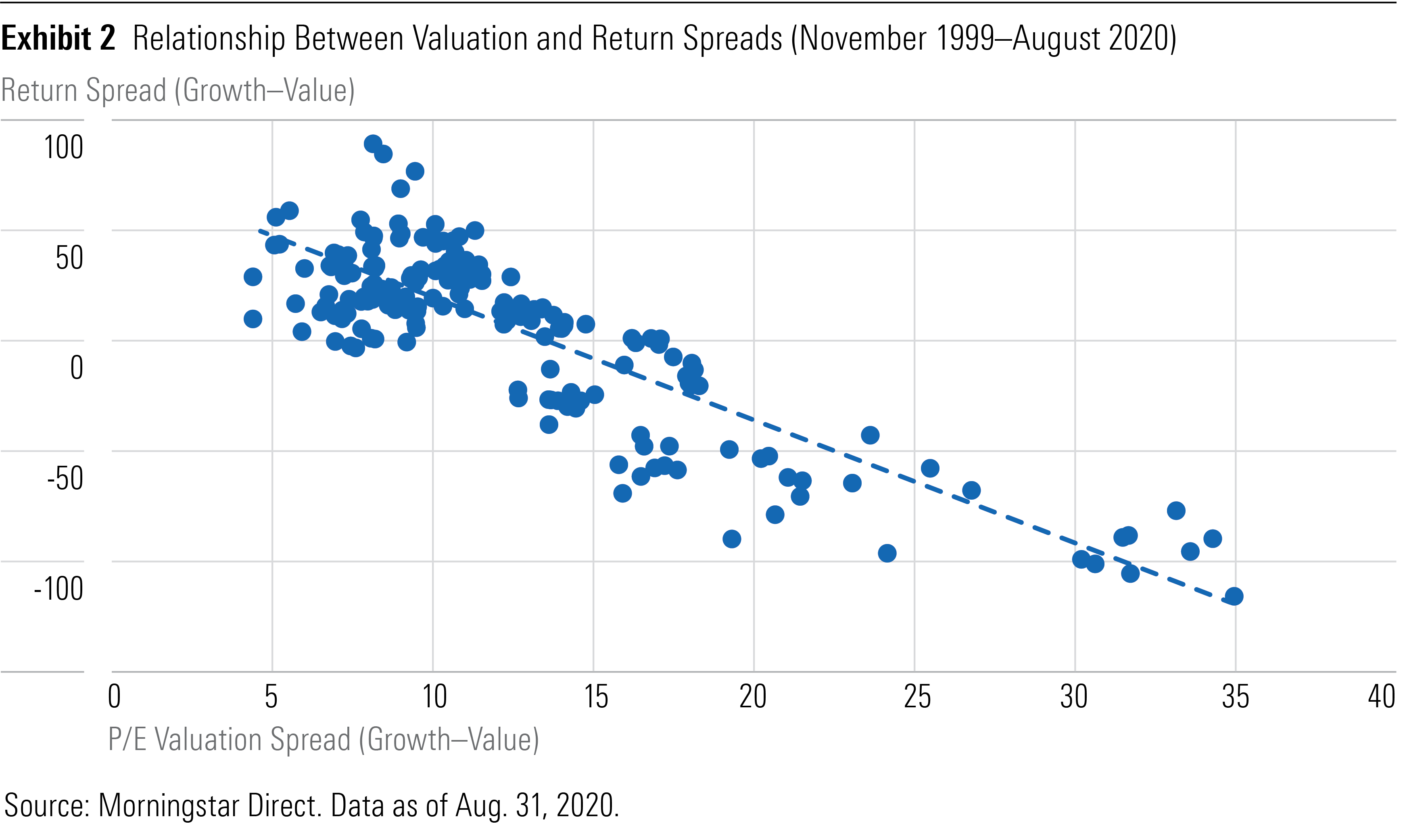

The Market Is Overpaying for Growth If market history can teach us anything, it's that investors typically don't undervalue growth, particularly when the valuation gap between value and growth stocks is unusually wide, as it is now. Exhibit 2 shows the relationship between the valuation spread of the Morningstar US Value and Growth indexes and their returns over the next five years. The wider the valuation spread is, the better value stocks tend to do relative to growth.

While many investor errors are uncorrelated, there are some common mistakes that could create systematic mispricing. Among these is the tendency to extrapolate the past too far into the future, which could push the prices of fast-growing companies above fair value. There is also a common desire to own promising stocks everyone is talking about and avoid stocks with weak fundamentals that might fail. As John Maynard Kenyes said, "Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally."

Fast-growing stocks could meet or exceed the market's high expectations, but to the extent that there is mispricing among a large group of growth stocks, it is more likely that investors set their expectations too high than too low. After all, who doesn't love a good growth story? Strong execution doesn't always follow, and success often attracts competition.

If the market is overpaying for growth, a fundamentally weighted fund, like Schwab Fundamental U.S. Broad Market ETF FNDB (0.25% expense ratio), should profit from it. This fund offers broad exposure to U.S. stocks of all sizes but weights them based on fundamental measures of size, including sales (adjusted for leverage), retained operating cash flow, and dividends plus share buybacks. This gives the fund a value tilt and causes it to double down on stocks as they become cheaper relative to their fundamentals and trim positions as they become more expensive.

This contrarian rebalancing approach should help the fund profit from mean-reversion in valuations, wherever it may occur. If cheap stocks become more expensive, or expensive stocks become cheaper, the fund benefits, as it overweights the former and underweights the latter.

The main drawback is that the fund may be overweight in stocks with deteriorating fundamentals, as the metrics it uses to size its holdings are backward-looking and slower to detect souring prospects than market prices. However, pairing this with a market-cap-weighted fund like VTI can help mitigate this drawback while reducing exposure to the most expensive areas of the market and hedging against a mean-reversion in valuations that can hurt VTI.

The Market Is Undervaluing Innovative Companies Fast-growing companies aren't always overvalued, even when they are trading at high valuations, as the strong performance of the Russell 1000 Growth Index over the past decade demonstrates. While it is unlikely the market is undervaluing a large swath of growth stocks at their current valuations, it is possible that it still doesn't fully appreciate the magnitude of changes in the economy and business. As a result, it may undervalue some innovative companies with strong yet risky growth prospects.

The more uncertainty there is about future cash flows, the more the market tends to discount them. There is a great deal of uncertainty about how nascent markets will evolve. Yet leaders that shape those markets can offer spectacular upside. These include firms like Amazon.com AMZN, which invested heavily to become a leader in e-commerce, forgoing short-term profits to strengthen its long-term competitive position. Similarly, Netflix NFLX exceeded expectations by significantly expanding the streaming entertainment market. Nvidia NVDA and Tesla TSLA have also exceeded expectations by capitalizing on their strong positions to meet the growing demand for self-driving and electric vehicles.

It's especially risky to invest in innovative companies. Their value relies heavily on changes in the future, where small differences in execution and consumer behavior (like delays and slight differences in adoption rates) can have a big impact on their growth trajectories. And they tend to reinvest heavily and often have weak or no profits. As such, these stocks are difficult to value. In many ways, these are like call options on the future, with lots of upside potential that, if realized, could pose a threat to established market leaders.

Those looking to hedge against this risk might consider a fund like ARK Innovation ETF ARKK (0.75% expense ratio). This actively managed fund targets stocks that will likely benefit from the development of new products or improvements in technology linked to DNA technologies, energy storage, autonomous technology, next-generation Internet services, and financial technology. Although the fund's holdings tend to look expensive on standard valuation metrics, valuations play an important role in lead manager Catherine Wood's stock-selection process. She buys only stocks that she believes are priced to offer at least a 15% annual return over five years. However, this is a concentrated portfolio, so it's best as a satellite position.

The Market Is Built to Evolve Change is nothing new. The market has always evolved to reflect expectations of where profits will be in the future. Occasionally, it gets ahead of itself, as in the late 1990s. Other times, it may be slow to pick up on emerging trends. Investors concerned about those risks might consider picking up funds like FNDB or ARKK. Still, the market is tough to beat over the long term. There's nothing wrong with sticking to a total stock market index fund, like VTI, and letting the market do the work for you.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)