Can American Funds Maintain Its Edge?

Even well-rounded active managers can get better.

American Funds' parent Capital Group now has a strong claim to be the world's most well-rounded active manager. But getting there wasn't easy, and staying there will be hard.

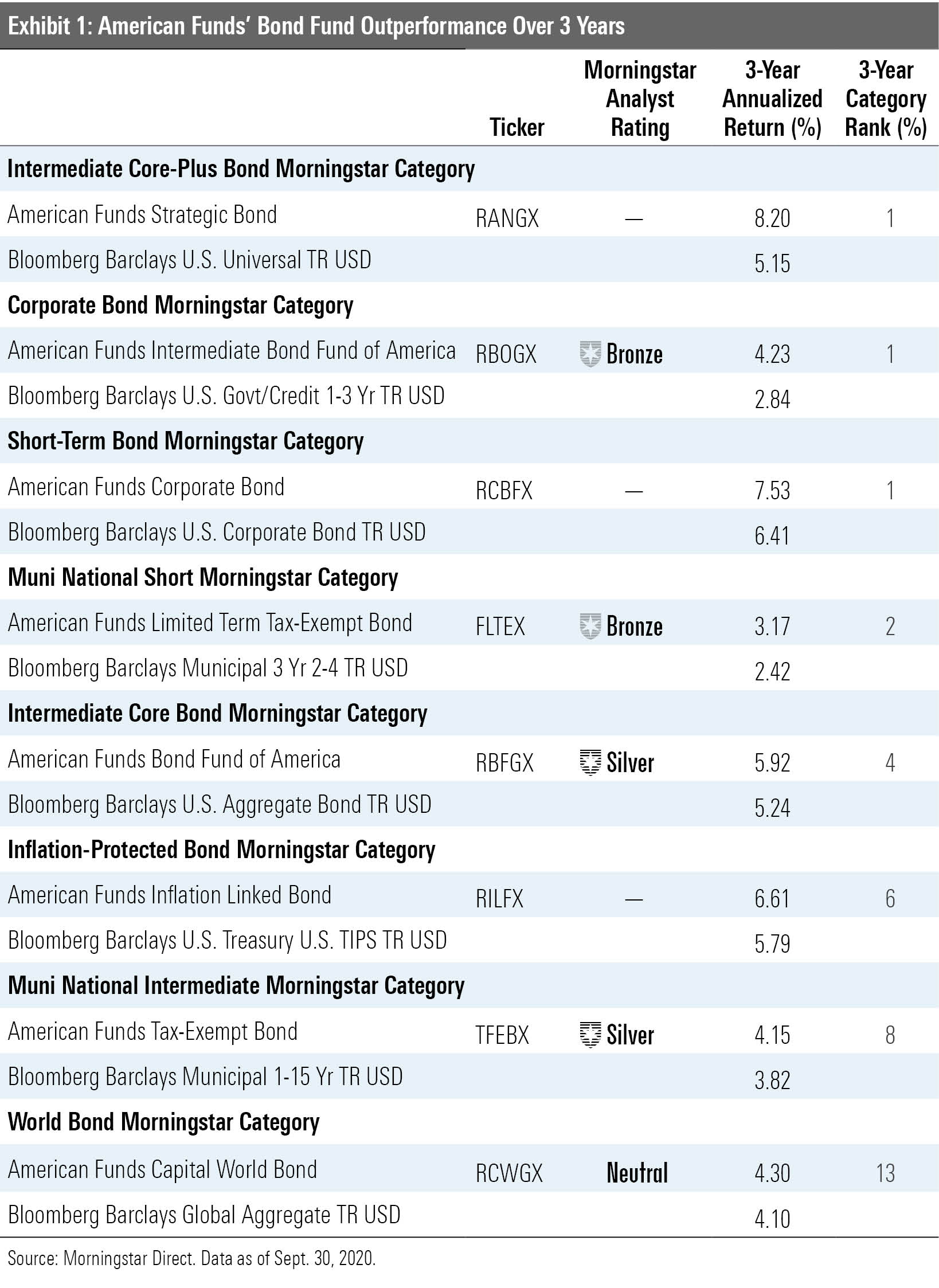

A Better Bond Lineup The firm's fixed-income operations are no longer a laggard. After the credit-heavy flagship American Funds Bond Fund of America RBFGX performed poorly in 2008, Capital bolstered risk analytics and derivatives capabilities, recruited seasoned investors, and increased coordination between portfolio managers. Fixed-income and global trading head Mike Gitlin, a recruit from T. Rowe Price in 2015, also prioritized providing more ballast in in the next equity bear market.

Performance in early 2020's sell-off wasn't flawless, but it was competitive. The cheapest share class of 10 of 18 American Funds fixed-income strategies held up better than their Morningstar Category index between Feb. 20 and March 23, when the S&P 500 shed 33.8%. American Funds Bond Fund of America was one of the eight strategies that underperformed, but it lagged the Bloomberg Barclays U.S. Aggregate Bond slightly and beat the intermediate core bond Morningstar Category average by 2 percentage points.

Overall, the bond lineup has fared much better than in the past. Of the 17 bond strategies with at least a three-year record through September, the cheapest share classes of 15 were ahead of their respective category peer norms, including eight that also beat their category benchmark. Exhibit 1 shows those eight funds.

It is premature to declare victory. Morningstar fixed-income strategy analysts still worry about how different American Funds bond offerings' sleeves interact and have less conviction in the firm's noncore and non-U.S. strategies. American Funds Capital World Bond RCWGX, for example, receives a Morningstar Analyst Rating of Neutral. The firm's fixed-income operations, though, are now on more solid ground.

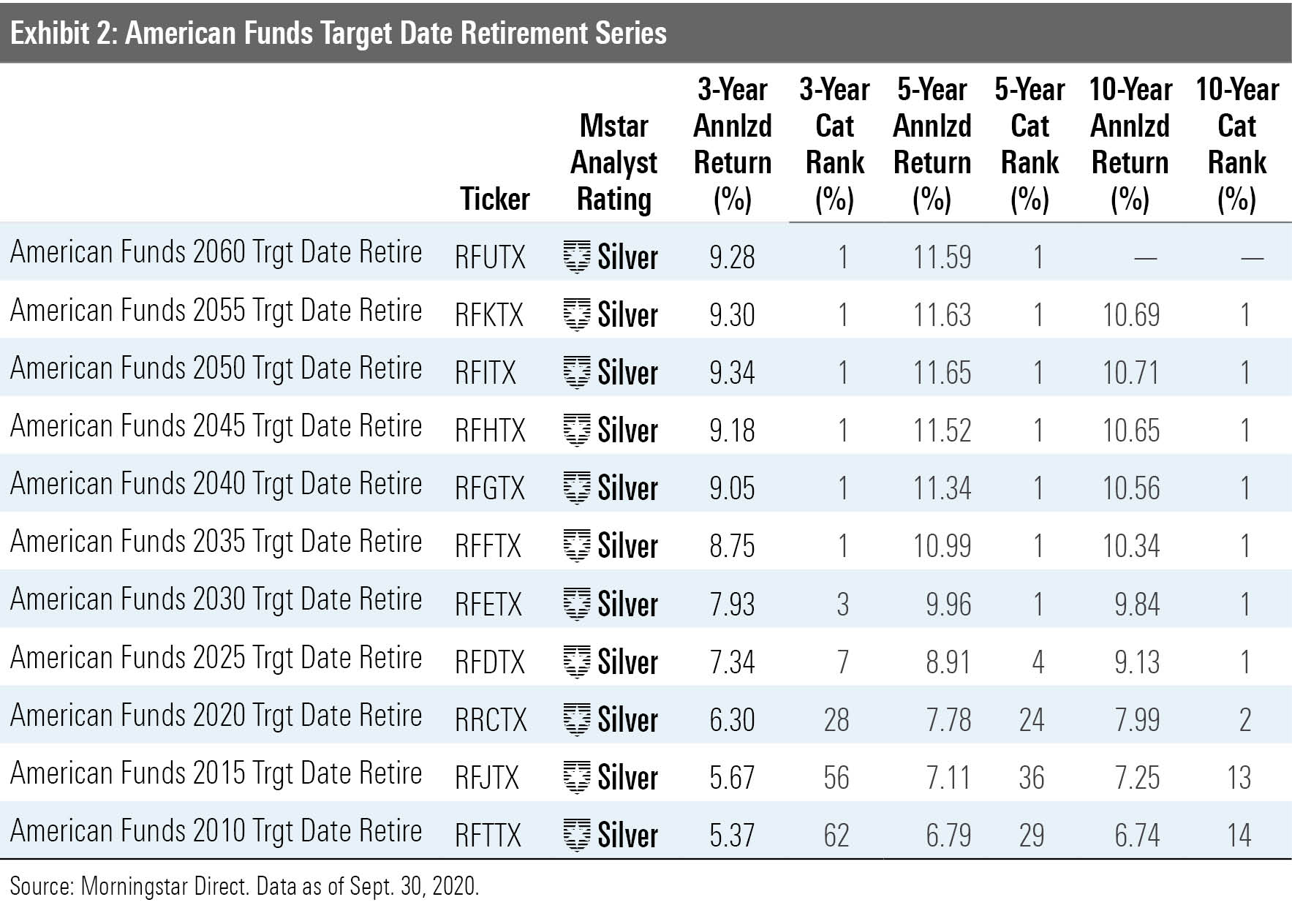

Target-Date Improvements Enhanced bond capabilities have helped American Funds Target Date Retirement Series' results. Most of its vintages ranked in their peer group's top 1% over the past three, five, and 10 years through September 2020, as Exhibit 2 shows.

Only in January 2020 did Capital Group create a distinct fund-of-funds research team for personnel with asset-allocation and quantitative research backgrounds. It also streamlined the responsibilities of the seven-person fund-of-funds committee by splitting it in two: Portfolio Solutions and Target Date Solutions.

The target-date committee still uses a simple objectives-based approach that allocates assets to broad categories, such as "growth" and "growth and income," but new additions Michelle Black and Samir Mathur bring asset-allocation and quantitative research backgrounds, respectively. Their expertise could help the series glean additional insights from modeling and top-down analysis.

These changes helped boost the target-date series' People and Process ratings to High and Above Average from Above Average and Average, respectively, in early 2020. The series' Analyst Rating stayed at Silver, though, because of higher fees than peers that use passive underlying strategies or a mix of passive and active. Concerns that asset-allocation improvements aren't yet comparable to the industry's best also figured in. Still, an already strong lineup is poised to get stronger.

Stocks at the Center Equity strategies remain American Funds' center. Even though bond strategies have gotten bigger flows of late, more than two thirds of the lineup's roughly $1.9 trillion in assets, as of August 2020, were in stock strategies, not including the equity portion of American's allocation funds. From a personnel standpoint, Capital Group's three equity subsidiaries at year-end 2019 had 71 portfolio managers and 159 analysts, versus 27 portfolio managers and 42 analysts for its one fixed-income subsidiary.

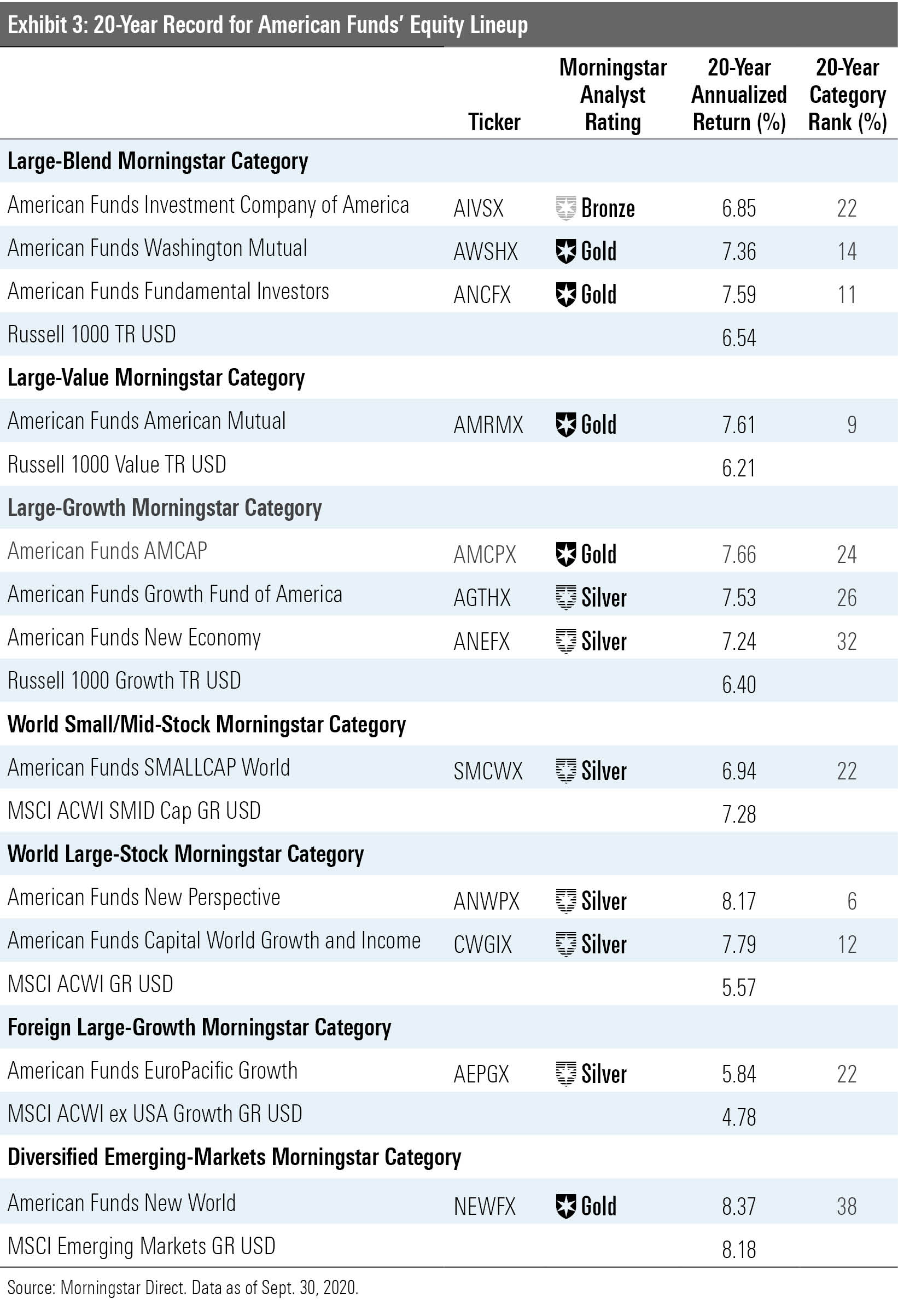

American Funds' retail equity lineup has earned investors' trust by producing excellent results over multiple market cycles. Eleven of its 12 open-end stock funds have beaten their respective category benchmarks and peer group norms over the past 20 years through September, as Exhibit 3 shows.

Credit Capital Group's signature multimanager system and talented investment personnel for the equity lineup's success. The system divides each fund into independently run sleeves and lets managers invest in line with their styles, enhancing diversification and reducing the overall portfolio's volatility. Funds' analyst-led research portfolios help develop the next generation and recruit top talent with the promise of running money from the start.

Mistakes that might cripple other approaches have less impact. On March 31, 2020, two managers of American Funds SMALLCAP World SMCWX had top-10 sleeve positions in China's Luckin Coffee LKNCY days before the firm admitted to fraud, causing its shares to fall more than 80% in April. Even though a third SMALLCAP World manager also held Luckin, its weight in the overall portfolio only reached around 40 basis points as the fund's then 15 other named managers didn't own it. As a result, Luckin's nosedive hasn't been a major drag on fund's top-third 12.6% year-to-date gain through September.

Individual stocks can still affect American Funds portfolios. Consensus among managers is typically what decides top positions, but that isn't always the case. Only one of American Funds New Perspective's ANWPX seven sleeve managers was responsible for its top-10 stake in electric carmaker Tesla TSLA at the start of 2020. The stock's nearly 500% year-to-date gain through August then made it the fund's top holding at 7.3% of assets and its biggest single-stock position since the 1980s.

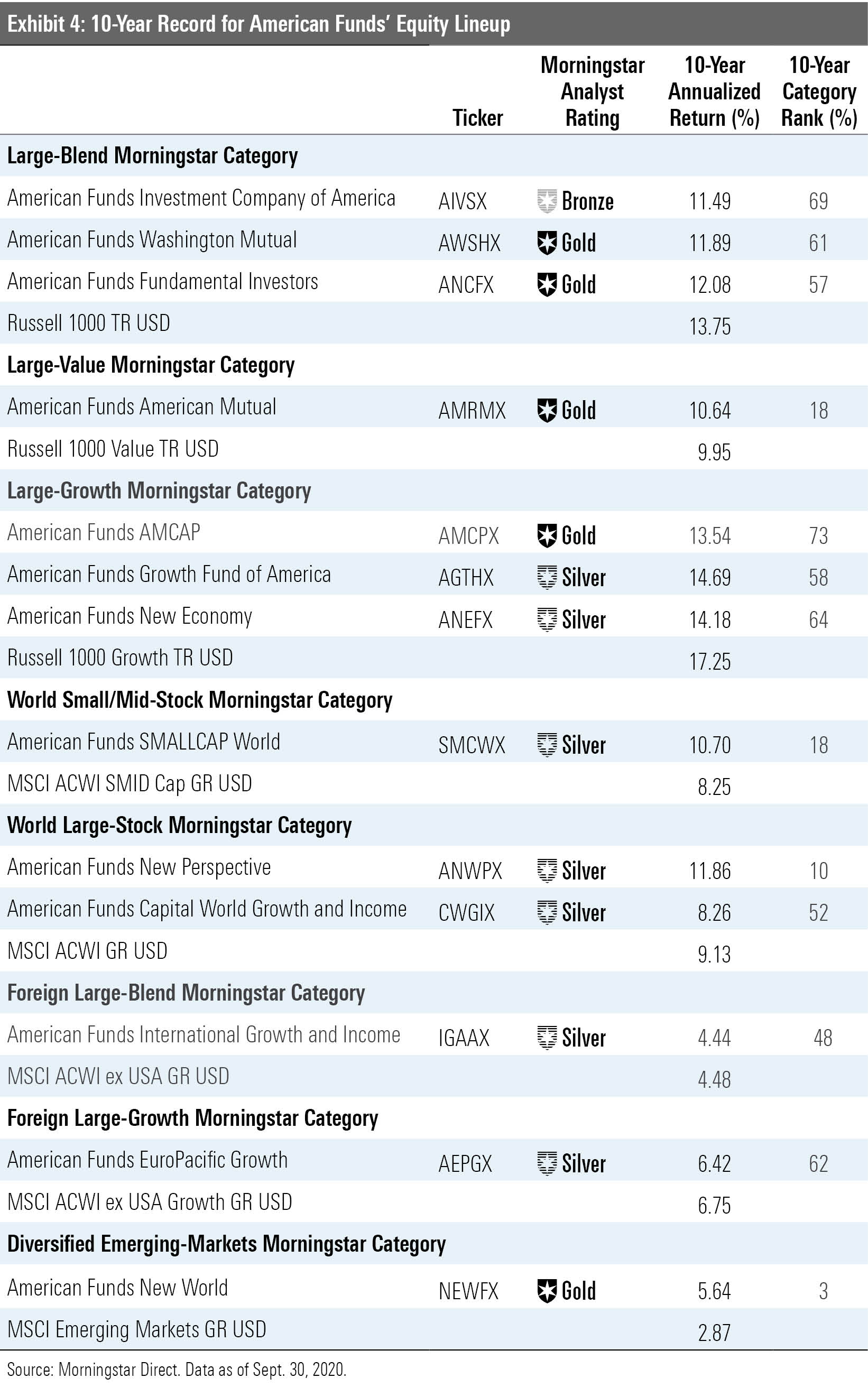

Keeping Its Edge: Clarifying Capacity Limits Is Still a Need Even with its considerable strengths, Capital Group will be hard-pressed to maintain its edge in increasingly competitive markets. While 10 of 16 equity funds lost less than their respective category indexes and peer group norms in early 2020's sell-off, on average they afforded less downside protection than in past bear markets. The American Funds equity lineup's downside-capture ratio versus category benchmarks was 85.9% in the 2000-02 dot-com downturn, 92.7% during the 2007-09 credit crisis, and 94.8% in the coronavirus pandemic.

With diminished downside protection and the failure of most strategies to keep pace in recent rising markets, the equity lineup's record over the past decade through September 2020 isn't compelling. Only four of 13 funds beat their respective category benchmarks and peer group norms during that period, as Exhibit 4 shows.

Capacity could be an issue. The firm still hasn't adequately addressed concerns about the capacity limits of its stock funds, as detailed in a 2019 Fund Spy. That keeps the Process ratings of most of its equity strategies at Above Average.

Consider American Funds SMALLCAP World, a strategy that has done well of late but might have done even better. The firm divides its now roughly $56 billion in assets between 16 named managers, whose sleeves range in size from less than $1 billion to nearly $4 billion. Although there is considerably more capacity at the sleeve level, the fund's overall asset base is a constraint. At its September 2020 size, the fund could not accumulate an initial 50-basis-point position in more than 70% of the MSCI All-Country World SMID Cap Index's holdings without breaking its internal 9.5% cap on ownership of shares outstanding in a single firm.

There are also signs that American Funds SMALLCAP World's asset base makes it harder to run concentrated, high-conviction portfolio sleeves. Andraz Razen, for instance, is one of American Funds New Perspective's most concentrated managers, holding on average 24 stocks there, including a huge position in Tesla. Razen, however, has averaged 90 stocks over the same period in SMALLCAP World. Even after accounting for the larger number of stocks in SMALLCAP World's investment universe, his sleeve in that fund is still more diffuse.

An Opportunity Remains Capital Group could do more to reassure investors that it knows its limits and has taken steps to stay within them. In fact, an opportunity remains for the firm to set a new industry standard for transparency in monitoring and managing capacity, including outlining the conditions that would lead to proactive closure of a fund to new investors, something the firm has said it would be willing to do.

Any improvements to Capital Group could make one of the best asset managers even better. It would also increase the likelihood that the firm can serve investors as well in the future as it has in the past.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)