The Top HSA Providers of 2020

Fidelity continues to stand out as the best HSA for investing and for spending.

Editor's note: We have published new research and enhanced our methodology. Read our evaluation of the best HSA providers of 2022.

Health savings accounts are the most effective vehicles for covering current medical costs and for holding investments to save for future medical expenses--needs that have particularly been brought to the forefront this year.

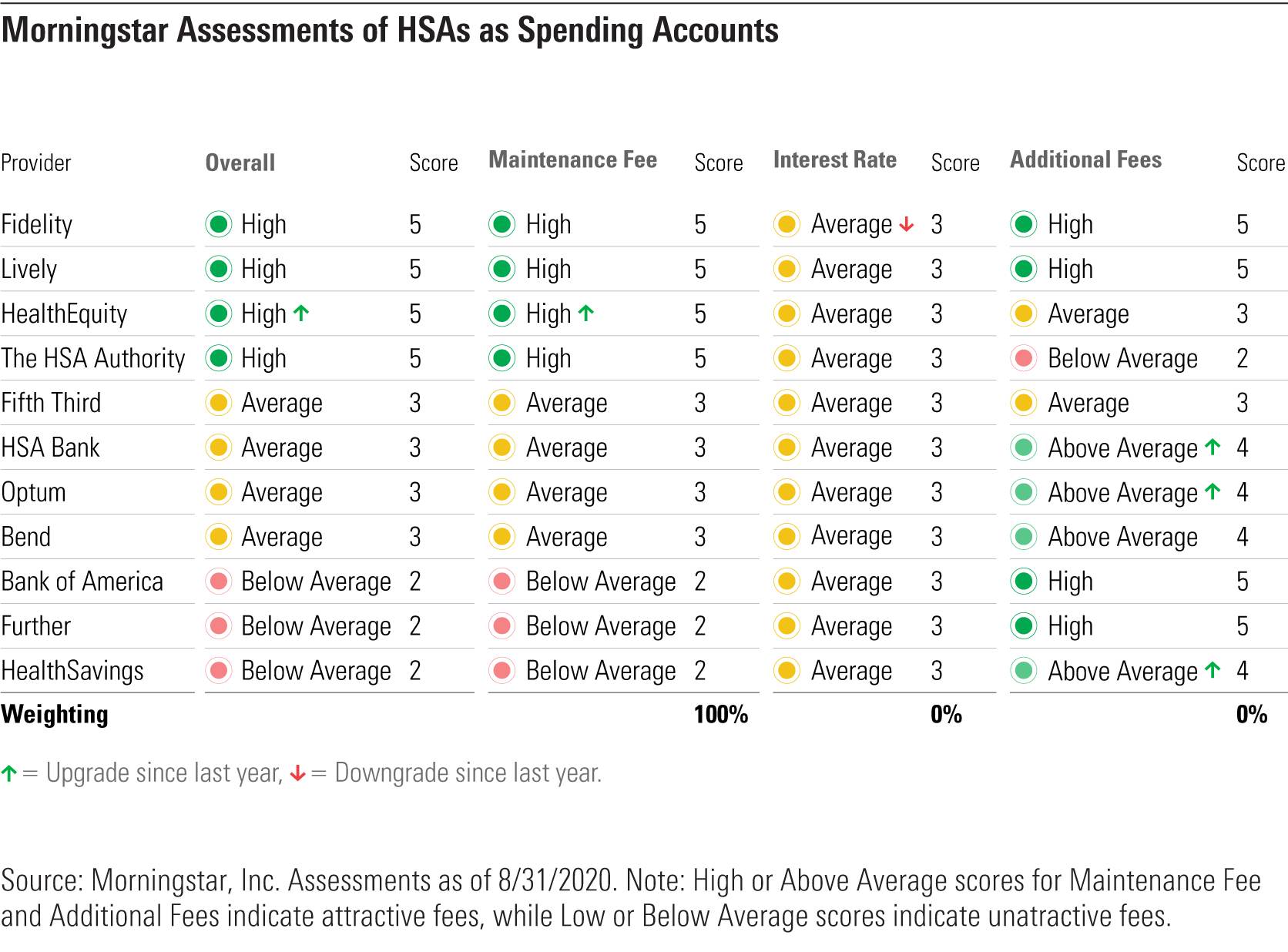

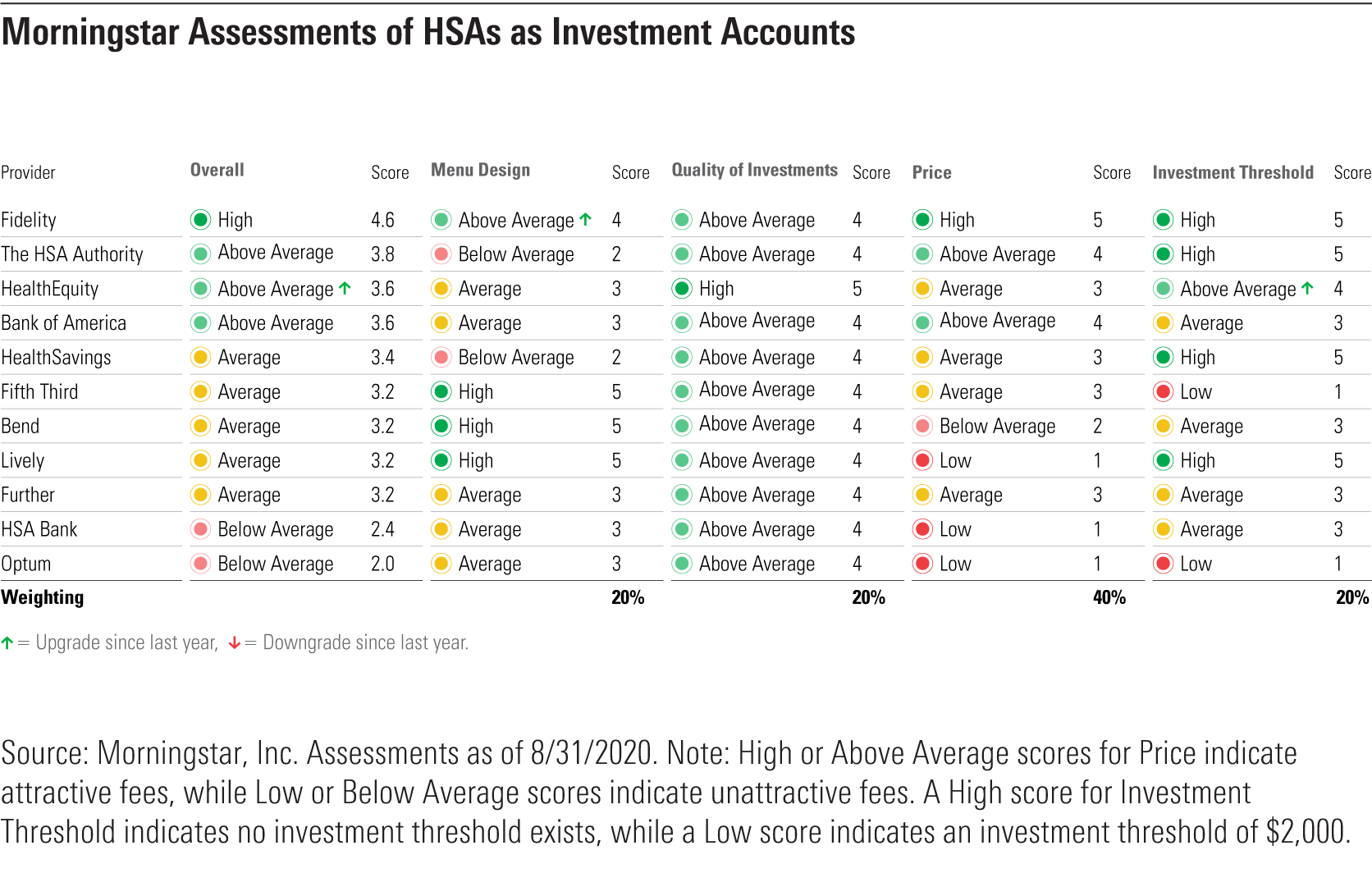

In our 2020 Health Savings Account Landscape, we rank 11 of the largest or most popular HSAs available to individuals from these two different standpoints: HSAs as a spending account to cover current medical costs, and HSAs as an investment account to save for future medical expenses. (Note that these rankings may be different when evaluated for use by employers, where fees are often negotiable based on several factors.) Choosing an HSA is challenging given the industry's opaque and frequently changing nature, and our evaluations aim to empower investors by helping them choose the best HSA for their situation. (Morningstar Direct and Office clients can download the report here.)

This year, our report also revealed asset-growth trends and changes in market share over the past several years at some of the most prominent HSA providers. We also enhanced our methodology by assessing HSAs on a five-point scale instead of a three-point scale to improve transparency and better help individuals compare HSAs.

We found that, as before, Fidelity offers the best all-around HSA for individuals, as it is the only HSA provider that earns a High assessment for both its spending and investment accounts. Here, we take a closer look at each set of rankings and the factors that contributed to each HSA provider's standing.

5 Key Takeaways on HSA Providers A few of our main findings on HSA providers include:

- Overall, providers continued to improve on multiple fronts over the past year, with several HSAs cutting fees, improving investment menu designs, or lowering investment thresholds, which require participants to maintain a minimum checking account balance before they can invest. Still, there's plenty of room for progress. Fees generally remain high and vary significantly across providers, and most continue to impose investment thresholds.

- HSAs posted healthy growth rates in the first half of 2020 despite market turmoil triggered by the pandemic. Total assets at the four largest HSA providers, which account for more than half of the industry's assets, grew by about 12% during this period and have more than doubled since the start of 2017.

- Fidelity's market share catapulted to roughly 10.5% as of midyear 2020 from 4.5% at the end of 2016. Optum remains the largest HSA, though its market share shrank to about 17% from 21% over that same period.

- In the first half of 2020, Fidelity's assets grew by $2.2 billion, roughly matching the combined asset growth of the three other largest HSA providers.

- According to the 2020 Midyear Devenir HSA Research Report, industry assets have grown about 10-fold over the past decade, reaching $73.5 billion as of midyear 2020.

The Best HSAs for Spenders Our rankings for HSAs as spending accounts show that:

- Fidelity and Lively come out on top. Among the HSA providers we evaluated, these are the only HSAs that charge no fees to spenders, avoiding maintenance and additional fees.

- HealthEquity is the third-best choice. It eliminated its annual maintenance fee of $35.40, though it still has a handful of additional fees.

- The HSA Authority comes in fourth place. It's always waived maintenance fees but has many additional fees.

Still, additional fees, such as those levied on paper statements, account closings, and excess contributions, are mostly avoidable or infrequent and don't affect those providers' High assessments as spending vehicles.

The full list of rankings for HSAs as spending accounts is shown below.

It's worth noting that interest rates offered on checking accounts are no longer a differentiator, since the pandemic led the Federal Reserve to slash interest rates to near zero in March, causing yields on checking accounts to fall to near zero across all providers. Last year, Fidelity offered a higher yield than other competitors, making it by far the most attractive offering for spenders, but it no longer sports a yield advantage versus its peers.

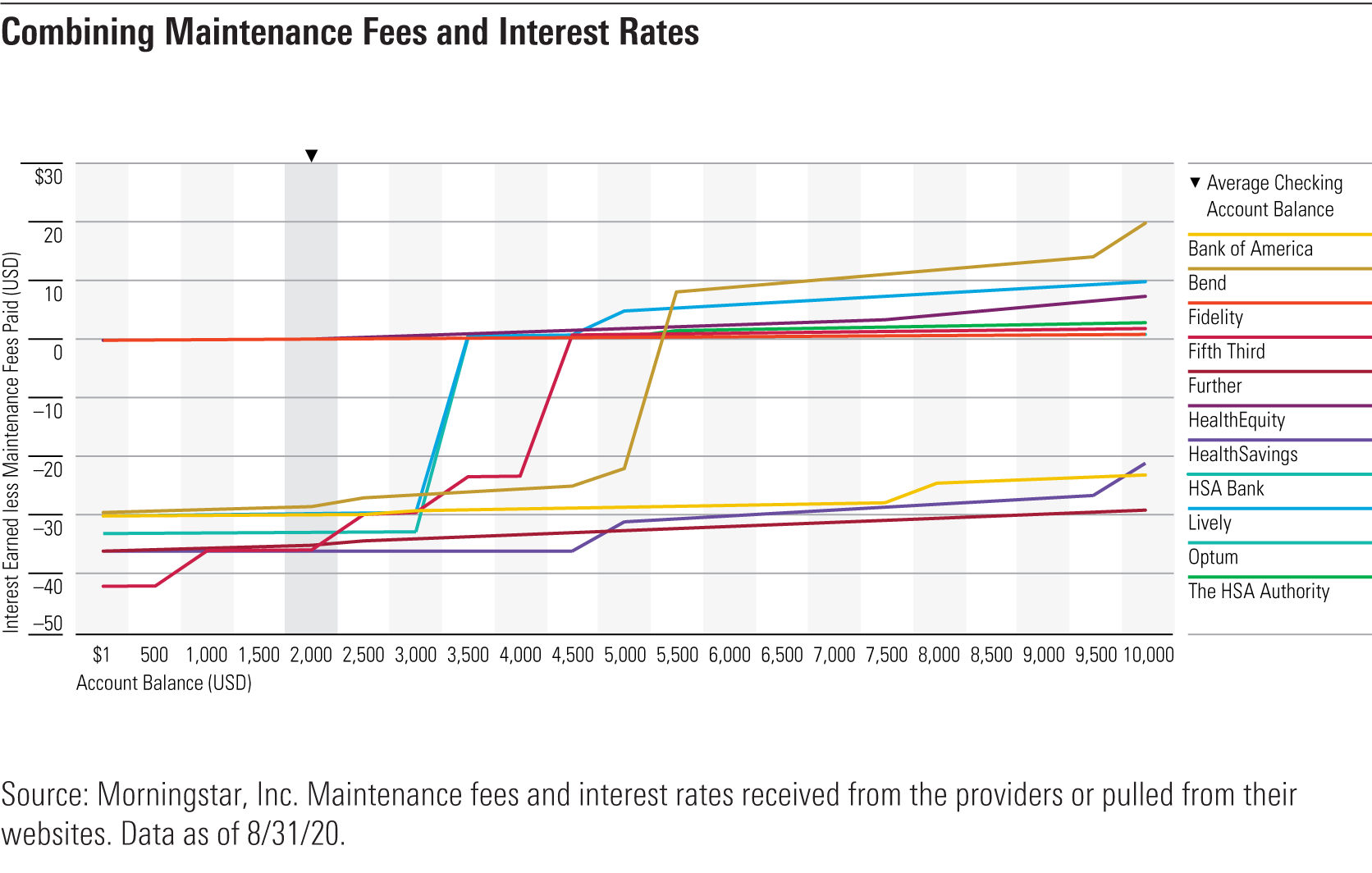

Illustrating the advantage that Fidelity, Lively, HealthEquity, and The HSA Authority have relative to other providers, the chart below shows how providers stack up when considering both maintenance fees paid and interest dollars earned at account balances ranging from $0 to $10,000. The chart shows:

- Accountholders at Fidelity, Lively, HealthEquity, and The HSA Authority essentially break even across all account balances.

- Accountholders at the other seven providers incur net costs of about $26 to $42 on HSA balances of $3,000 or less, when some providers begin to waive fees. However, because the average accountholder has a $2,000 balance, those waivers don't help most individuals. Plus, some providers never waive maintenance fees regardless of account balance.

The Best HSAs for Investors Fidelity again represents the best HSA for investing, as it:

- Has strong investment options.

- Offers a well-designed investment menu.

- Allows first-dollar investing by not requiring investors to maintain a minimum checking account before investing.

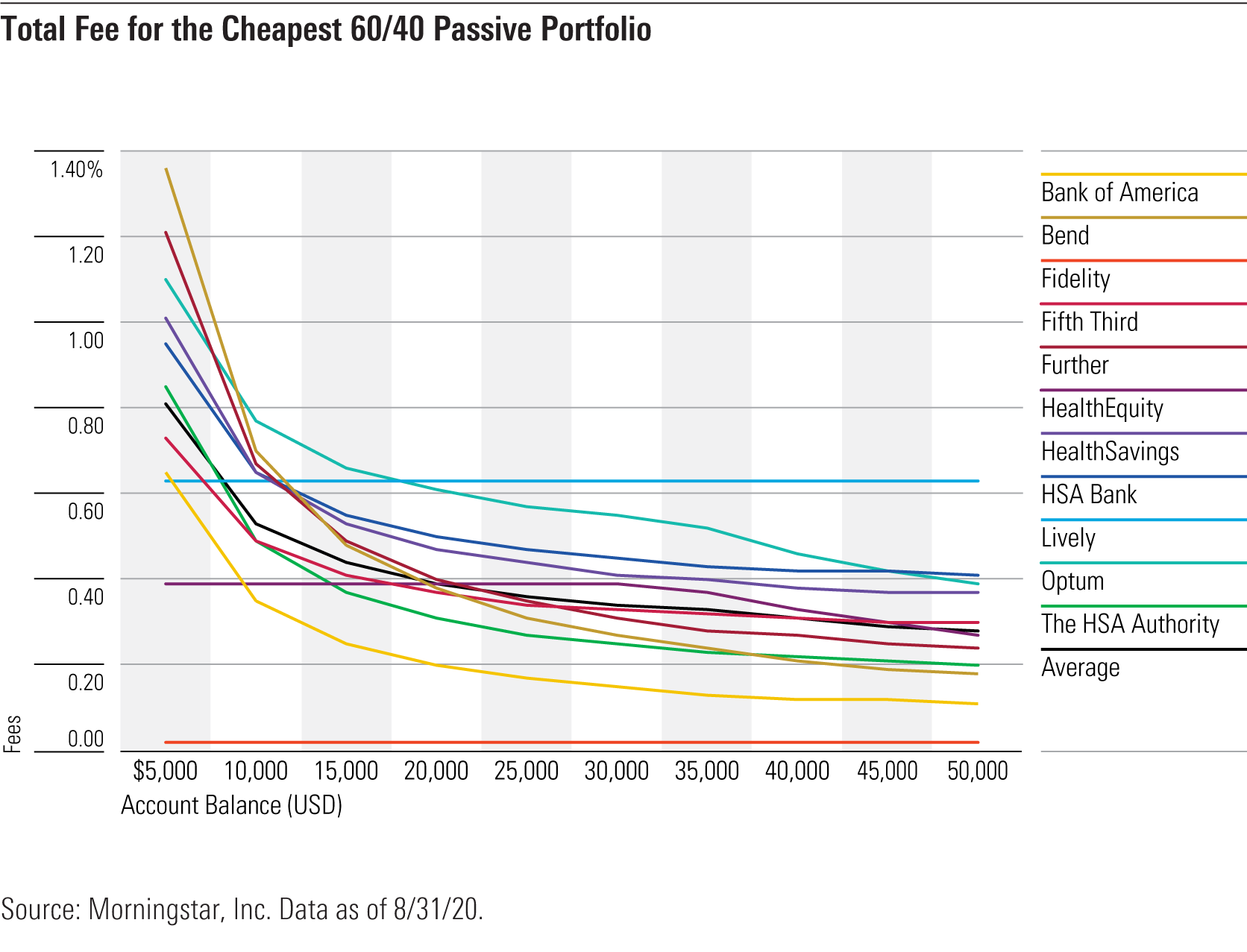

- Charges rock-bottom fees that no other provider can compete with. Investors at Fidelity can buy a passive 60% stock/40% bond portfolio for an all-in cost of 0.02% regardless of account balance.

Conversely, other providers charge higher fees that typically vary depending on the account balance. Assuming the average HSA investment account balance of $14,000, Bank of America has the second-cheapest passive 60/40 portfolio, with a 0.26% fee. The HSA Authority and HealthEquity are the next cheapest, offering passive 60/40 portfolios for 0.38% and 0.39% on a $14,000 balance.

Slightly detracting from the appeal of Bank of America and HealthEquity's HSAs is that they require investors to keep $1,000 and $500, respectively, in their checking accounts before investing, creating an opportunity cost for individuals seeking to invest. The HSA Authority allows first-dollar investing, but its expansive investment lineup isn't easy to navigate. Still, these three HSA providers represent solid picks for investors, supporting their Above Average investment account assessments.

The full list of rankings for HSAs as investment accounts is shown below.

Illustrating Fidelity's advantage versus other providers, the chart below shows the total fee that investors pay at each provider for account balances ranging from $5,000 to $50,000. You can see that:

- Fidelity's all-in fee of 0.02% is consistent across account balances.

- At Bank of America and The HSA Authority, fees decline as account balances grow. Both charge dollar-based fees that that become less pronounced when expressed in percentage terms as assets grow.

- HealthEquity is attractively priced for investors with smaller balances of $10,000 or less. However, it charges a flat percentage-based fee instead of dollar-based fees, so its fee advantage erodes once assets surpass $20,000.

- Accountholders at some of the other providers pay hefty fees regardless of account size. Optum, Lively, and HSA Bank are expensive, where investors with a $14,000 balance pay between 0.56% and 0.68% for a passive 60/40 portfolio.

How We Evaluated HSAs Three criteria influence our assessments of HSAs as spending accounts: maintenance fees, interest rates offered, and additional fees. We score each criterion on a five-point scale of High (5), Above Average (4), Average (3), Below Average (2), and Low (1). The criteria scores are then used in conjunction with their weights to derive a score that reflects our view of an HSA's merits. We weight each criterion differently based on its importance. Weightings can change from one year to the next if there are material changes to any of the three criteria. Notably, maintenance fees represent the most important consideration and entirely drove this year's spending account assessments. Since our last report, we adjusted the criteria weightings as follows:

- Maintenance fees: Increased weighting to 100% from 75%.

- Interest rates: Decreased weighting to 0% from 25%.

- Additional Fees: Maintained weighting at 0%.

We have identified four criteria that we believe are crucial to determining the overall merit of HSAs as investment accounts: Menu Design, Quality of Investments, Price, and Investment Threshold. We score each criterion on a five-point scale of High (5), Above Average (4), Average (3), Below Average (2), and Low (1). The criteria scores are then used in conjunction with their weights to derive a score that reflects our view of an HSA's merits. The weightings assigned to each criterion remained unchanged since last year:

- Menu Design: 20%

- Quality of Investments: 20%

- Price: 40%

- Investment Threshold: 20%

More details about our research and methodology, as well as an overview of industry asset growth and changes in market share at each provider, are available in the full report.

And for more insights from our team on the HSA ratings, sign up for our webinar.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)