33 Undervalued Stocks for the Fourth Quarter

Here are our analysts’ top ideas in each sector.

For the new list of Morningstar’s top analyst picks, read our latest edition of ”33 Undervalued Stocks.”

Despite a challenging September, the S&P 500 continued its upward march in the third quarter, rising almost 9%. We think stocks overall are about fairly valued.

"However, the broad market-cap-weighted valuation is upwardly skewed by several significantly overvalued mega-cap stocks," observes Dave Sekera, Morningstar's chief U.S. markets strategist in North America. More than a third of the stocks we cover are trading at 4- and 5-star levels, suggesting they're undervalued.

Stocks in the technology sector look the most expensive, while plenty of opportunities remain among energy stocks.

Here are our analysts’ top undervalued ideas across sectors.

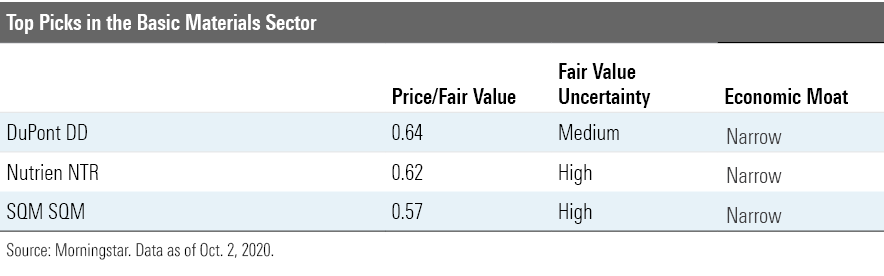

Basic Materials Basic-materials stocks outperformed during the third quarter, reports senior analyst Seth Goldstein in his quarterly outlook. As a result, less than a third of the stocks we cover in the sector look undervalued by our metrics. We see attractive opportunities in the agriculture and chemicals industries, specifically.

"We expect potash demand to grow over the next few years, which will soak up excess supply. We think specialty chemicals producers will enjoy profit recovery as volumes return," adds Goldstein. And we believe lithium demand will pick up as electric vehicle sales rise.

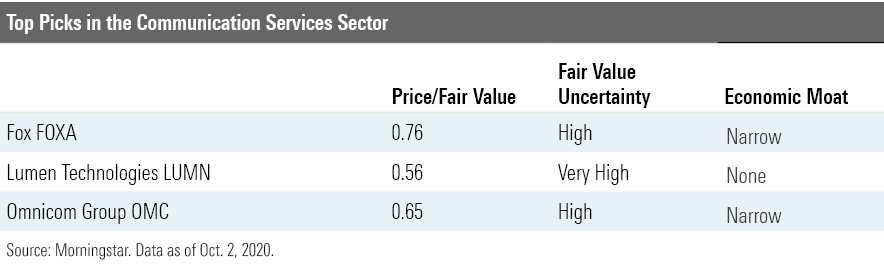

Communication Services "The mega-cap FAANG stocks continued to drive both the broader market and the communication services sector last quarter. Facebook FB, which makes up about one fifth of the sector index, was again the biggest positive contributor to performance over the period, despite headlines about potential antitrust actions and proposed content regulation changes," observes sector director Mike Hodel.

"Within the sector, we think traditional media firms look the most attractive from a valuation perspective. Further, activist investor Nelson Peltz’s interest in Comcast CMCSA might lead the firm to spin off its media business, which could signal one last major round of M&A in the media space," argues Hodel.

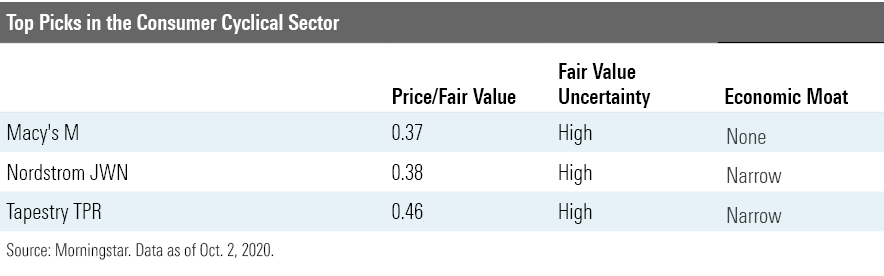

Consumer Cyclical "As nonessential businesses continued to reopen last quarter, the consumer cyclical sector continued its rebound, outpacing the broader market," says sector director Erin Lash. "Although the sector now appears to be fairly valued, we see opportunity in travel and leisure, where more than half of the stocks we cover trade in buying range.

"Our long-term outlook calls for a full recovery in travel demand by 2024, with the exception of cruise lines, which may take longer," relays Lash. “We believe companies with a robust balance sheet are best positioned to weather the current travel uncertainty.”

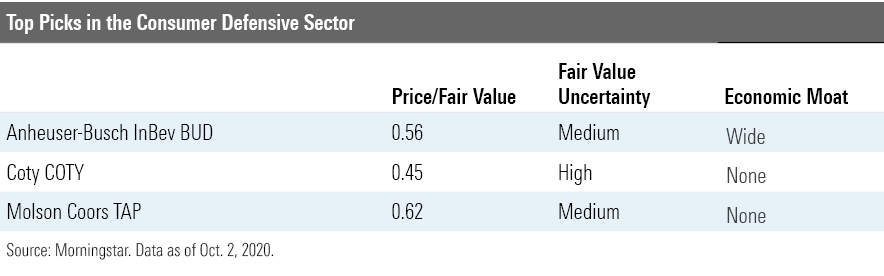

Consumer Defensive "The consumer defensive sector is about fairly valued, with the median stock we cover trading at a 2% discount to our intrinsic valuation," says Lash. "We're finding bargains in the alcoholic beverage and tobacco industries, both of which have been hit by health concerns and consumers staying home," she reports.

Social distancing due to the pandemic has led to increased spending on food for at-home consumption. “We think investors are overexaggerating the concern that the pandemic will impair food away-from-home spending longer term,” argues Lash. "And as consumers continue to purchase consumer products online, it’s more important than ever that companies spend on marketing their brands to stay in front of customers."

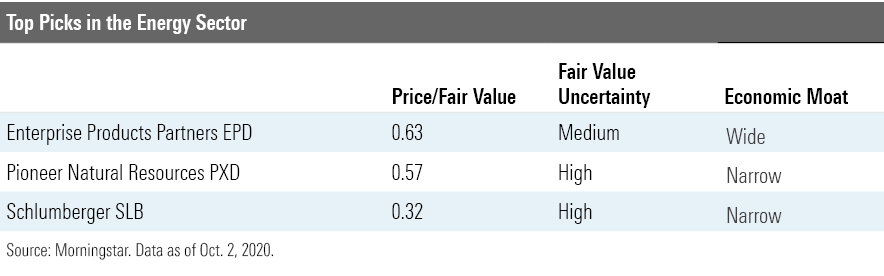

Energy Energy stocks have continued to lag the broader market as oil prices remain stubbornly flat, relays sector director Dave Meats. "Global demand remains anemic. Not surprisingly, energy remains the most undervalued sector in our eyes, trading at a 40% discount to fair value. We believe the market is still extrapolating bottom-of-the-cycle crude prices to infinity, making energy stocks look historically cheap," he posits.

"Although things don’t look much better for crude producers in the coming quarter, we continue to forecast catch-up growth in 2021 and 2022. If oil prices don’t rebound in 2021, producers are unlikely to grow their production, which could eventually turn the current glut into a shortage," suspects Meats.

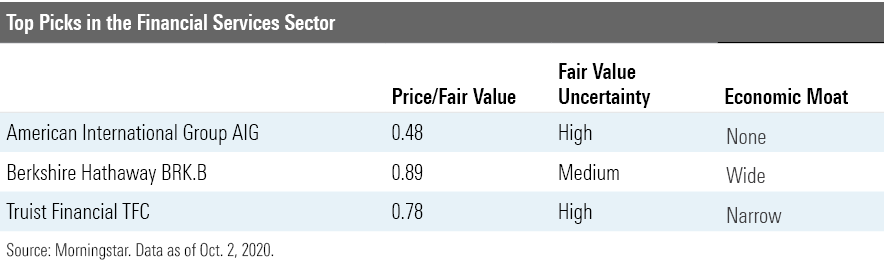

Financial Services Financials services stocks continue to lag the broader market; the sector looks about 15% undervalued by our metrics. Banks remain the most undervalued industry in the sector, reports sector director Michael Wong. "They've been dogged by the low interest rate environment and loan losses. Charge-offs may rise without more stimulus. That said, we believe that banks have enough capital to survive these medium-term negatives and that they can be suitable for long-term investors," he concludes.

The online brokerages and financial advisory-focused investment banks are undervalued, but we think the earnings of the former may be depressed for quite some time, and merger advisory revenue may soon dry up for the latter.

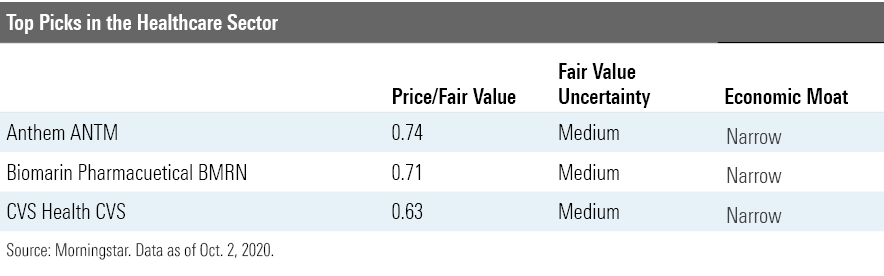

Healthcare "Despite a recent rebound, we think the healthcare sector remains slightly undervalued overall," says sector director Damien Conover. "About one third of our coverage universe is trading in 4- and 5-star range. The best values lie in the drug manufacturer and managed-care industries. The valuations of these industries seem to imply significant expected changes in the U.S. healthcare policies potentially driven by newly elected politicians," argues Conover. "However, we view the most likely path for U.S. healthcare policy is incremental changes to existing laws that shouldn't have a major impact on drug or insurance companies.

"Healthcare firms are adapting well to the coronavirus impact and related economic pressures," he continues. "We expect an effective vaccine in the next six months, which we think will give the industry a windfall of goodwill that might be used in U.S. healthcare policy negotiations."

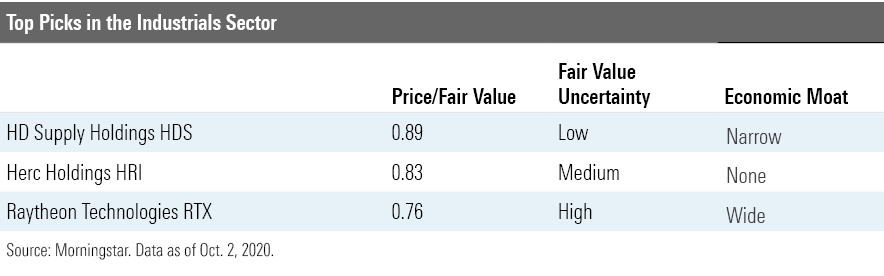

Industrials The industrials sector showed signs of life in the last quarter, led by farm and heavy construction machinery, trucking, and freight and logics, reports sector director Brian Bernard. "Just one fifth of our coverage universe looks undervalued, with opportunities in the aerospace and defense, construction, and industrial distribution industries.

“While the upcoming presidential election introduces budget uncertainty, we think it will be difficult to materially decrease the defense budget without sweeping political change,” says Bernard. "Meanwhile, we expect commercial air travel to pick up after broad coronavirus vaccine availability by mid-2021, and we maintain a bullish outlook for the U.S. residential construction market."

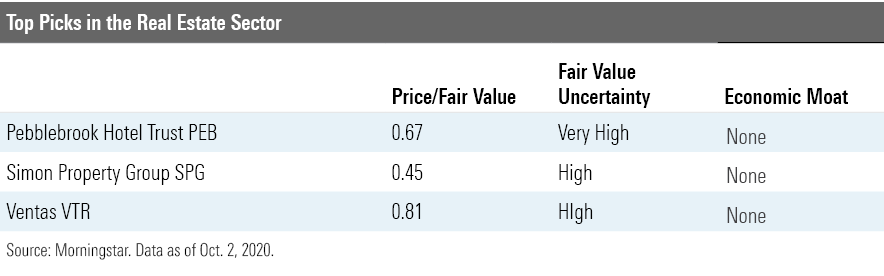

Real Estate “The real estate sector is significantly undervalued today, with the median stock in our coverage universe trading 21% below fair value; more than half of the stocks we cover are trading in 4- and 5-star range,” reports analyst Kevin Brown. As a result of the recent equity selloff, dividend yields have increased substantially. “We currently believe that most REITs will continue to pay their dividend, making these high yields very attractive to investors,” observes Brown.

"Both hotel and mall sectors have underperformed the broader real estate sector while the industrial and self-storage sectors have outperformed. Yet we see some fine values among the hardest-hit subsectors," suggests Brown.

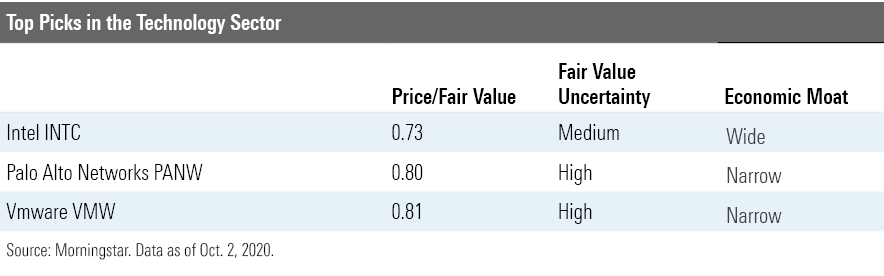

Technology Tech stocks have substantially outperformed the rest of the market, so it's no surprise the sector is overvalued by our metrics. "We're hesitant to say that tech is in a bubble, as we see robust fundamental tailwinds supporting future growth for most of our coverage, such as cloud computing, remote working, 5G network rollouts, and the 'Internet of Things,'" posits sector director Brian Colello.

“Hardware is still the cheapest industry--undervalued by about 6%--while the highest quality names we cover cluster in the overvalued semiconductor and software industries,” asserts Colello. Software has proved to be a somewhat safer haven in a pandemic, remote working world, as have cybersecurity firms.

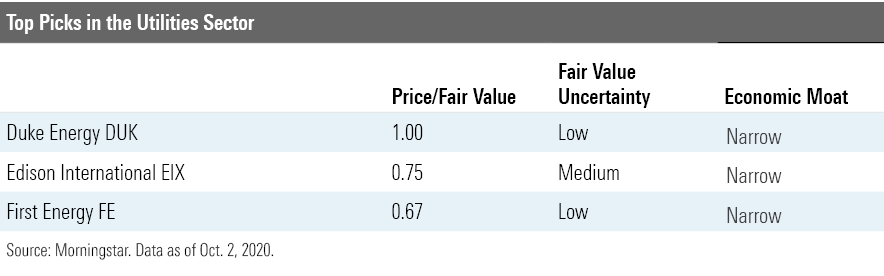

Utilities Although utilities haven't rebounded with the same vigor as other sectors, sector fundamentals remain strong and dividends keep growing, and that's good news for income-seekers. "After nearly a decade of bloated valuations, we think investors finally have opportunities to buy high-quality utilities at reasonable prices with yields approaching 4%," suggests sector strategist Travis Miller.

Utilities facing headline risk--such as many West Coast utilities tied to blackouts and wildfires--have suffered excessively, no matter their earnings and dividend growth potential. Gas distribution names look attractive, too.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)