Quarterly Markets Summary: 7 Charts on Q3 Stock and Bond Markets

We share some highlights from this quarter.

Editor’s note: This article originally appeared in Morningstar Direct Cloud and Morningstar Office Cloud. Morningstar Direct and Office clients can find our full-length quarterly markets report here.

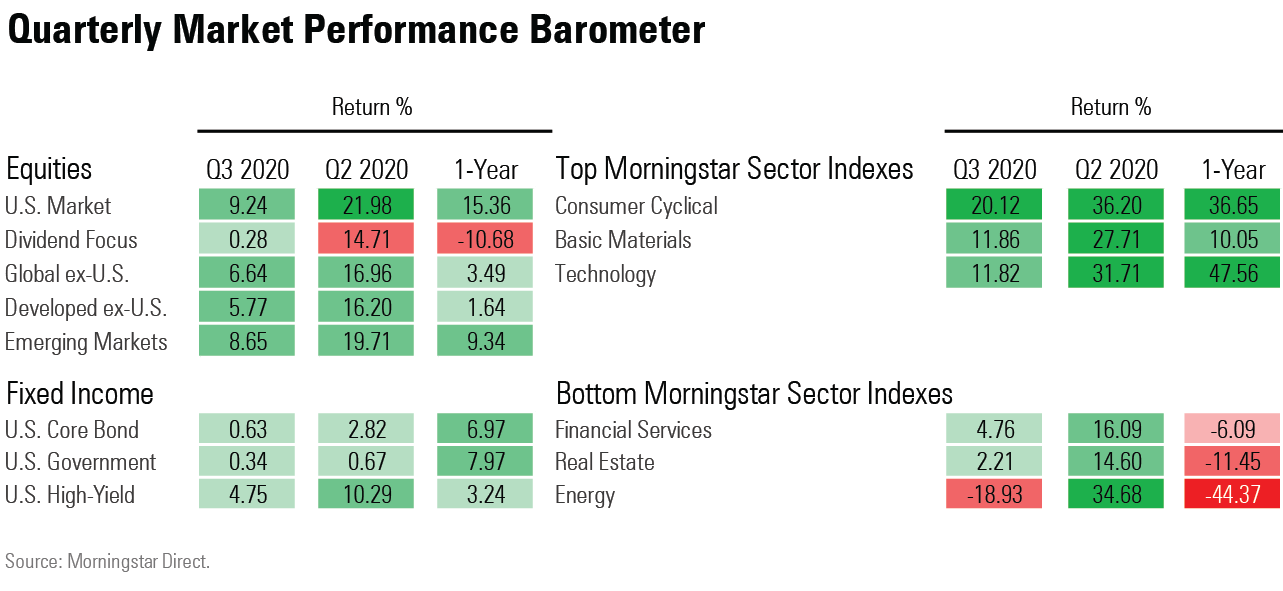

U.S. equities continued their upward momentum in the third quarter, but stocks fell back from new peaks in September amid worries over increasing coronavirus cases in the United States and Europe and jitters ahead of the upcoming U.S. election.

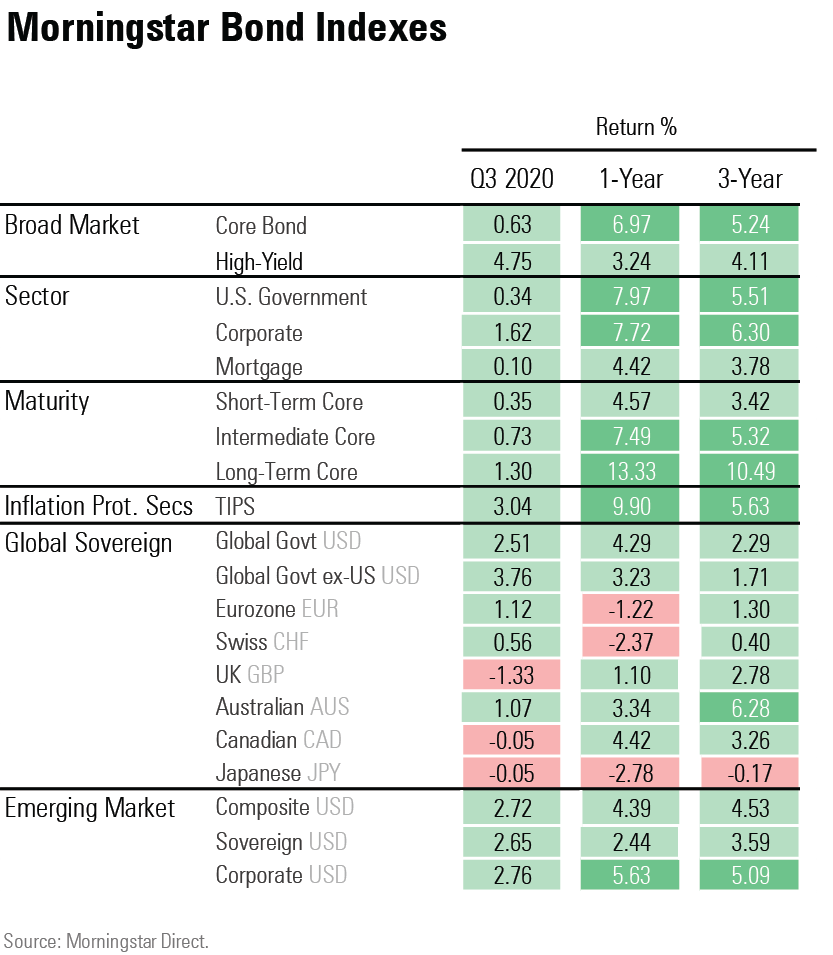

For bonds, it was a quiet quarter as markets were supported by the Federal Reserve's message that it would keep interest rates low for an extended period of time.

Highlights for the quarter included:

- The Morningstar US Market Index gained 9.2% during the quarter, despite a 3.6% drop in September.

- Consumer cyclical stocks performed the best among U.S. equities, rising 20.1%, while energy stocks lost 18.9%.

- Large-growth stocks led the quarter, with large blend narrowly placing second. Small-value stocks again lagged far behind.

- Global and emerging-markets indexes also fell in September, though not as severely as the Morningstar US Market Index.

- High-yield bonds rose 4.8% in the third quarter, and the emerging-markets bond index returned 2.7%.

- On the year, bonds are ahead of U.S. equities. The Morningstar US Core Bond Index returned 6.8% year to date, while the US Market Index was up 5.8% since Jan. 1.

- The Federal Reserve's policy shift toward greater flexibility on inflation led to a rally in gold prices in the U.S., while the dollar suffered. The U.S. dollar declined 2.7% from the start of the quarter, and gold prices reached a new high at $2,063 an ounce.

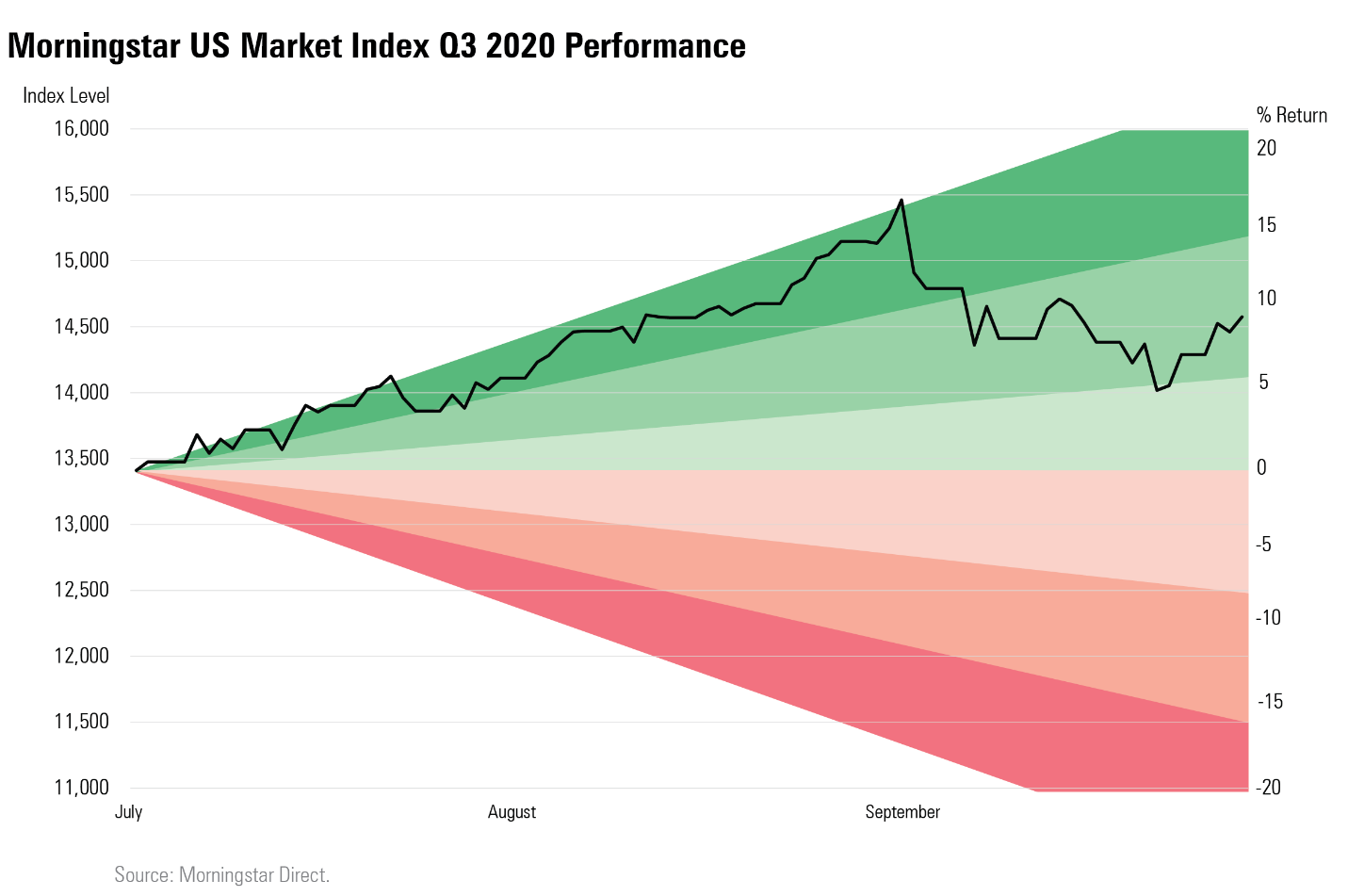

Equities The third quarter began with stock markets extending their rapid rebound from lows set in March during the COVID-19-driven sell-off. The rally was driven by optimism about the global economic recovery from the spring shutdown, coupled with messaging from the Fed that it would keep monetary policy extremely loose for the foreseeable future.

However, the rally ran out of steam in early September as U.S. coronavirus cases began to spike higher, and as investors began to pull back from richly valued technology stocks. Still, the scope of the bounceback from the March lows remains impressive, with the Morningstar US Market Index carving out a new all-time high on Sept. 2. At its peak, the index was up 12.3% for 2020.

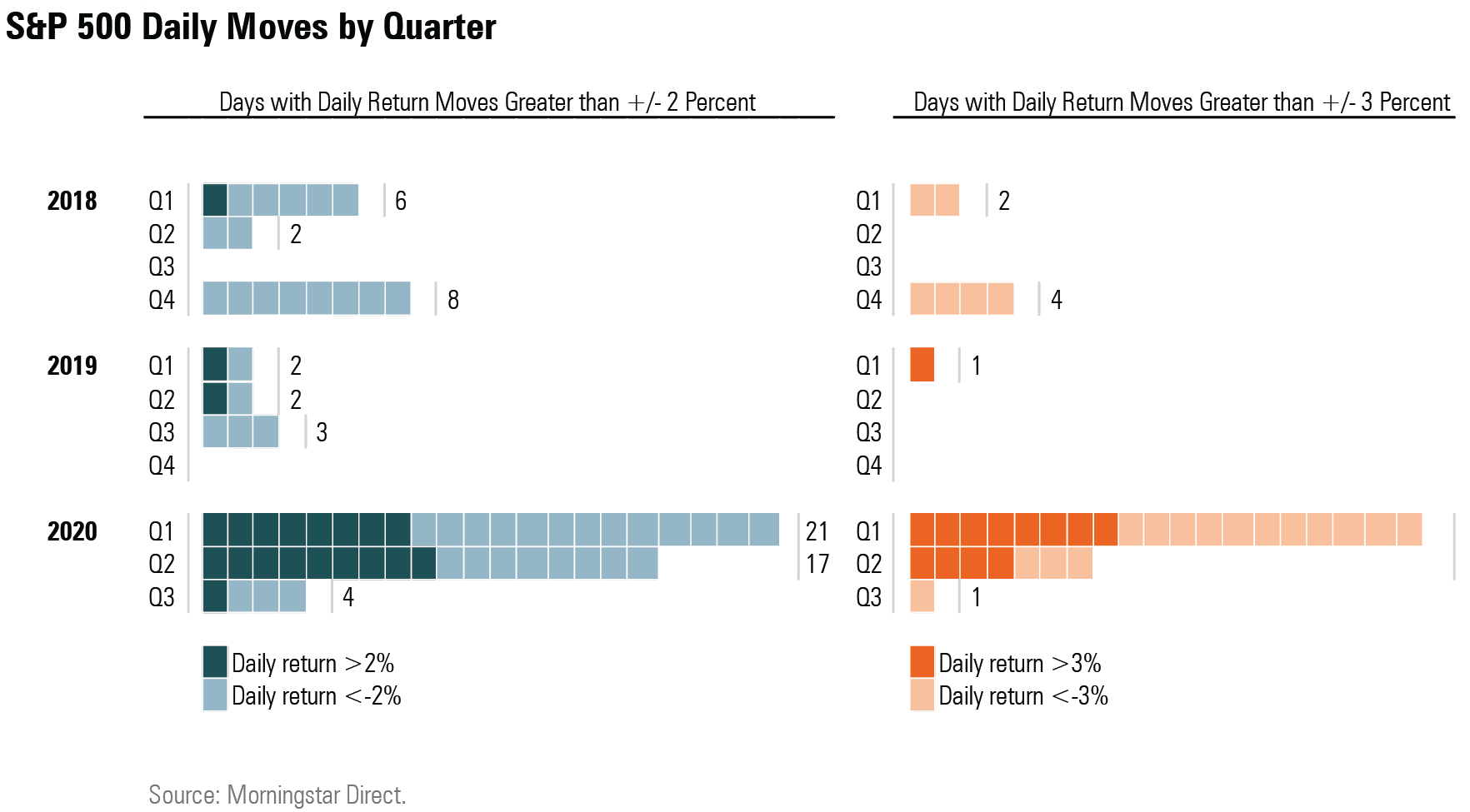

The third quarter showed an easing of volatility from its historic highs seen in the first quarter. The S&P 500 only experienced three days where the index fell more than 2% compared with eight days in the second quarter and 13 days in the first quarter.

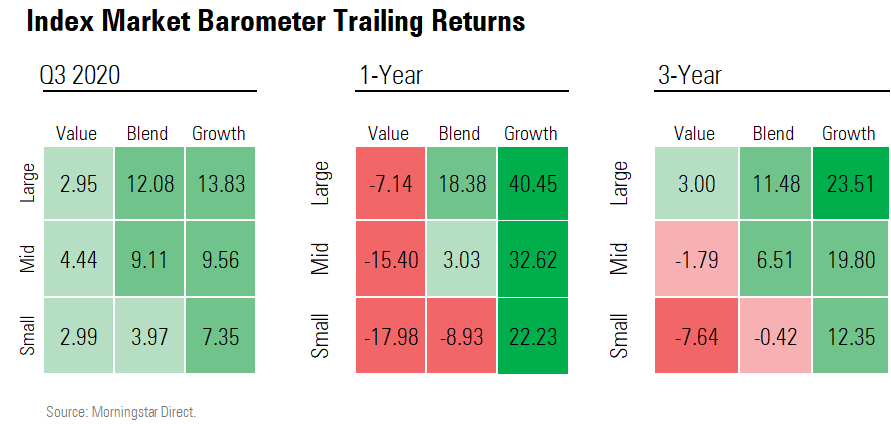

Breaking down U.S. stock market returns by style, growth stocks continued their dominance.

The large-growth Morningstar Category came out on top of the nine Morningstar Style Box categories during the third quarter, followed by large blend. Value categories across all market caps performed the worst. Large-growth stocks were up 40.1% from a year ago while large-value stocks were down 7.1%.

Small-value stocks again performed the worst during the quarter and bring up the rear over the past 12 months.

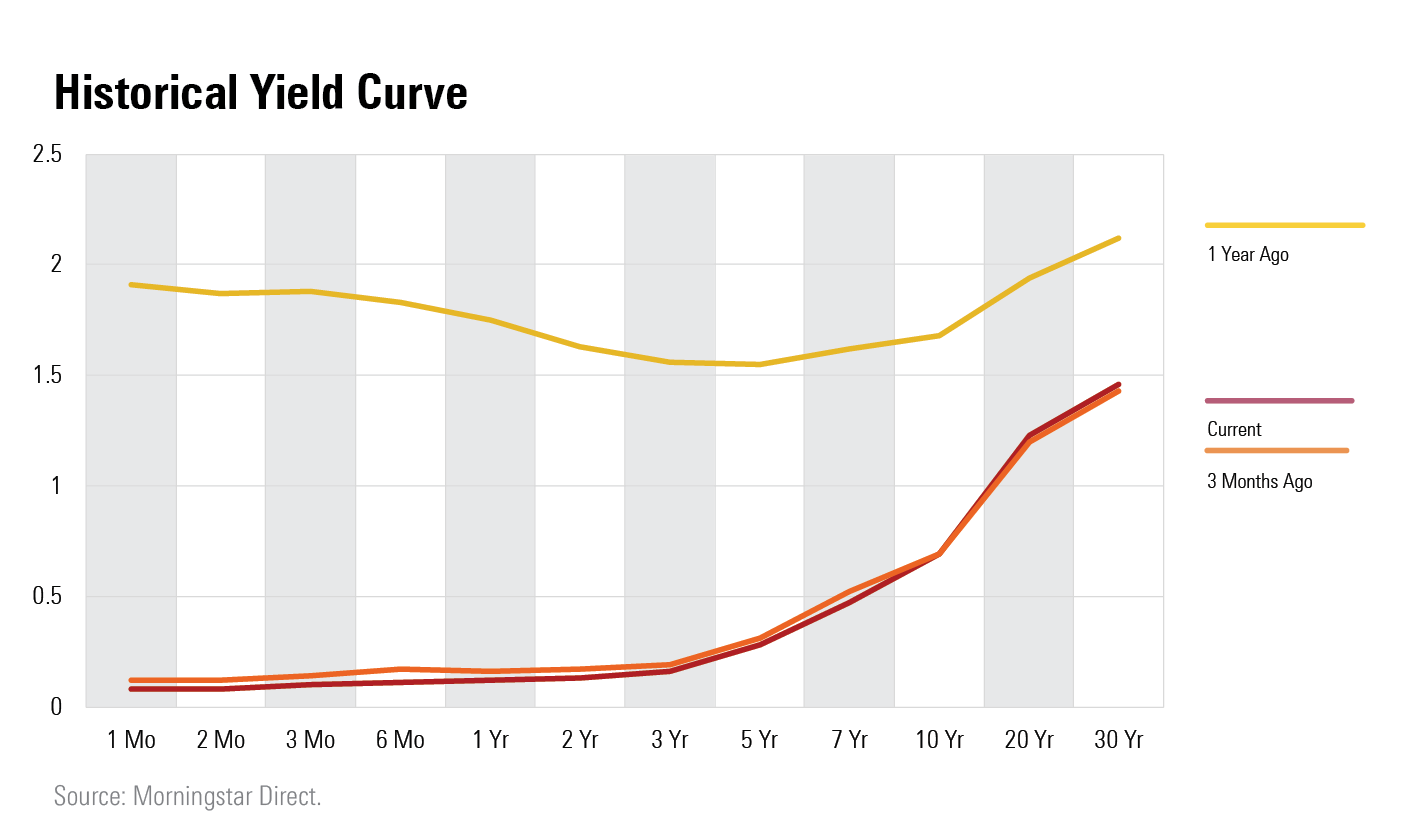

Fixed Income Bonds had a quiet quarter with interest rates likely locked at low levels for an extended period of time.

With stocks rallying and investors seeking out higher yields, riskier sectors such as U.S. high-yield bonds and emerging-markets bonds led returns.

Global government bonds excluding the U.S. were another bright spot, and Treasury Inflation-Protected Securities posted a strong quarter as the Fed's policy stance led investors to hedge against the potential for higher inflation.

Yields barely changed from the second quarter but remain historically low. The current 10-year Treasury yield is a full percent lower than it was in October 2019.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)