Where to Find Bargains Today? Look to Small- and Mid-Caps, Value Stocks

Several mega-cap stocks significantly overvalued.

By using our bottom-up-derived fair value estimates for individual stocks, we have calculated that the broad equity market is trading near its fair value. Market performance this quarter has mainly been driven by increases in the prices for cyclical and economically sensitive sectors, which have been partially offset by declines in the energy and real estate sectors. Traditionally defensive sectors, such as utilities, have also lagged the broad market returns. In addition, the broad market-cap-weighted valuation is upwardly skewed by several mega-cap stocks that we think are significantly overvalued. As growth stocks have outperformed and several mega-cap stocks have soared this past quarter, the dispersion between overvalued and undervalued stocks has also increased. In fact, the standard deviation of our price/fair value ratio has doubled over the past year.

Morningstar US Market Index posts quarter- and year-to-date gains. - source: Morningstar

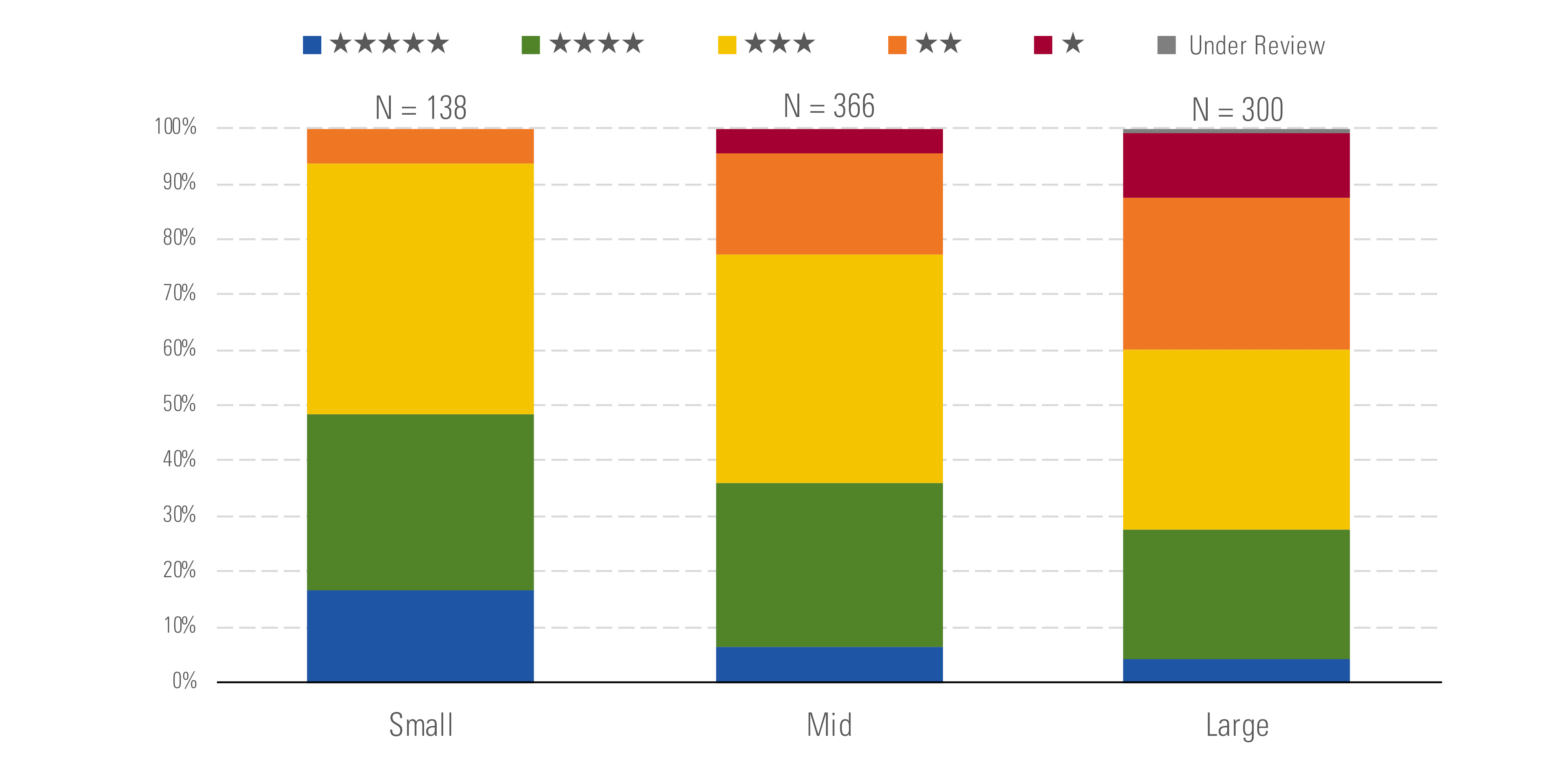

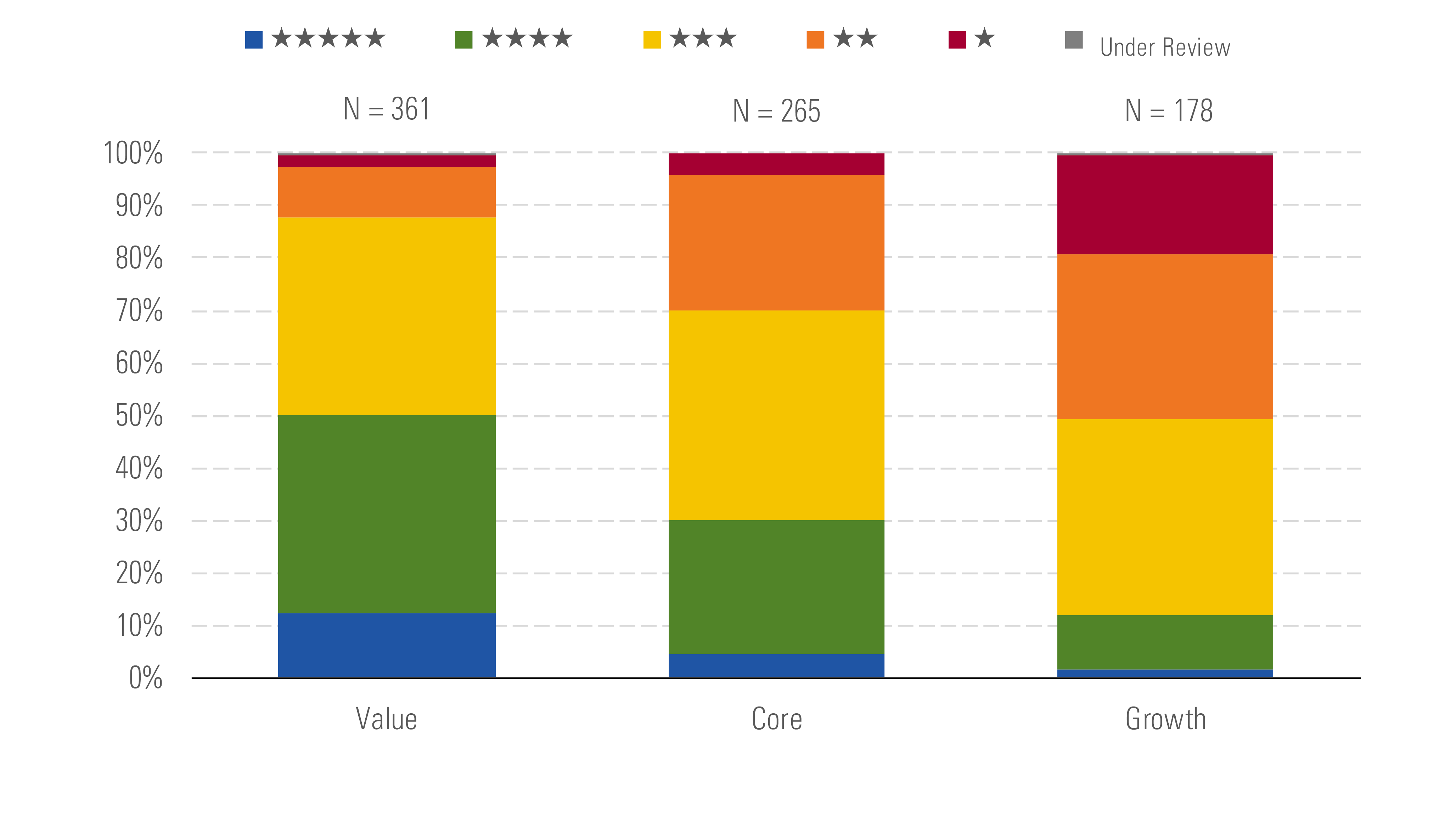

Looking ahead, for long-term investors, we expect that stock prices in the value category will catch up to growth stocks over time as the economy continues to recover. Currently, half of the stocks we cover that fall into the value category are rated 4 or 5 stars, whereas only 12% of the growth stocks and 30% of the core category (core has attributes of both value and growth) are rated 4 or 5 stars. In addition, we expect that mid-cap and small-cap stocks, which have lagged the broad market rebound, will outperform. Across our coverage, we find that the greatest number of stocks that are rated 4 or 5 stars are in the mid-cap category and that the highest percentage of 4- and 5-star stocks are encapsulated within the small-cap category.

Mid-caps have greatest number of undervalued stocks, small-caps highest %. - source: Morningstar

Yet, while we continue to see pockets of undervaluation, long-term investors may need to exhibit substantial fortitude in the fourth quarter. With many mega-cap stocks trading at levels that are significantly overvalued and the broad market not providing any margin of safety, there are numerous potential catalysts that could lead to sharp risk-off corrections. While we do not think that the outcome of the presidential election will significantly alter our valuations or meaningfully change our economic outlook, a contested result and drawn-out ballot-counting litigation would heighten volatility. In addition, while we expect that an effective COVID-19 vaccine will be approved over the next few months and rolled out in the first half of 2021, any change to this timeline would also likely lead to sharp corrections.

Value stocks attractive compared with core and growth stocks. - source: Morningstar

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)