Shades of Growth

"Growth" is a broad description that doesn't account for meaningful differences between strategies.

Introduction Growth investors target stocks with competitive advantages and promising outlooks, believing that these firms' strong businesses will equate to strong long-term returns. These enviable attributes are embedded in stock prices, so these firms come at a hefty cost. However, investors willing to "buy high, sell higher" have seen their investments outperform value strategies over the past decade.

Value reigned for decades, but the tide turned in growth’s favor in the wake of the global financial crisis. From March 2009 through August 2020, the Russell 1000 Growth Index outperformed the Russell 1000 Value Index by 6.75 percentage points annually. The two indexes’ volatility has been comparable, but value has experienced steeper drawdowns during periods of turmoil. Growth dominated the 2010s, and when--or whether--value rebounds remains to be seen.

That said, “growth” is a broad style that includes a variety of strategies, which aren’t all worthy of investment. Here, I’ll examine a subsect of index-tracking funds that land in the large-growth Morningstar Category. All these funds invest in U.S. companies, have been in existence for at least 10 years, and track unique benchmarks from one another (this avoids double-counting).

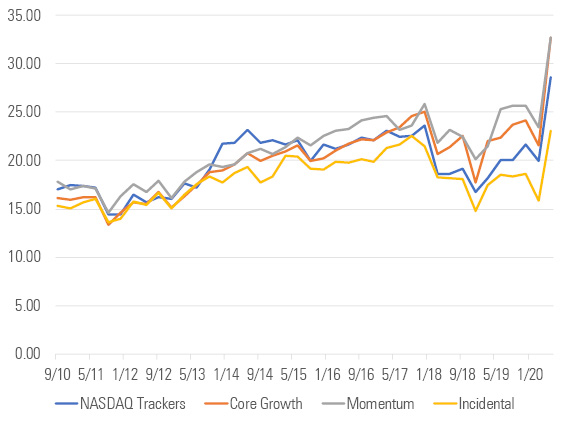

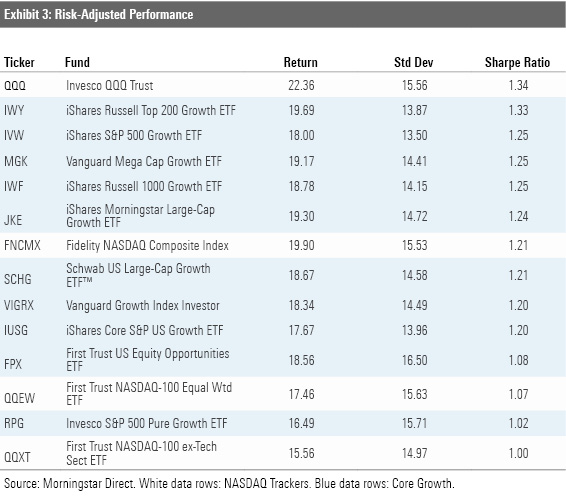

Reviewing these funds’ performance offers a snapshot of growth’s excellent run. Of the 19 funds considered, 15 led Vanguard Total Stock Market ETF VTI over the trailing 10 years through August 2020. However, there was still a wide performance disparity among the growth strategies. Over that period, the group’s strongest-performing fund beat the weakest by 10.39 percentage points annually. This spread indicates that the growth label fails to account for meaningful differences in performance drivers.

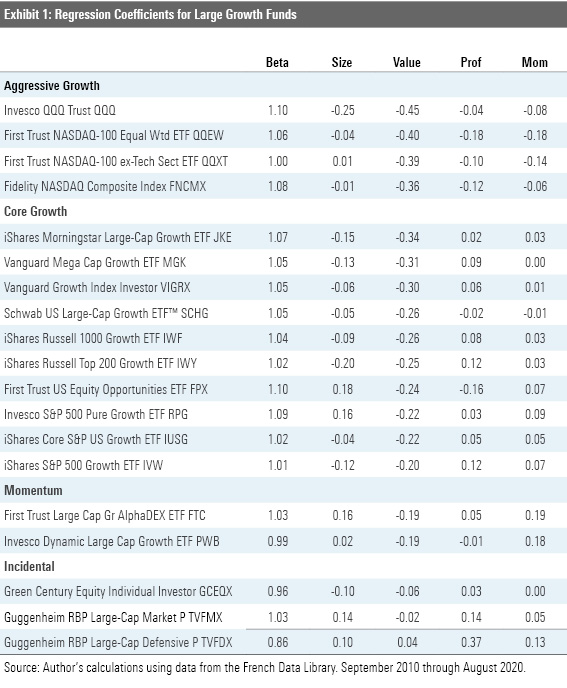

To analyze the intra-category differences, I ran a five-factor regression using data from Ken French’s data library, following my colleague Dan Sotiroff’s approach in his deep dive on value investing. This study considered the following factors: market (beta), size, value, profitability, and momentum. After analyzing this group of 19 growth funds along these lines, I then filtered them into four different buckets: NASDAQ Trackers, Core Growth, Momentum, and Incidental.

Investors’ different preferences and portfolio needs may pull them toward different buckets, but funds that comprise the Core Growth bucket tend to be the best-positioned to deliver strong risk-adjusted performance over the long term. Core Growth funds should offer the most consistent growth exposure as well. Their past performance has consistently been driven by growth and--unlike other funds in this study--it is central to their portfolio construction. However, the NASDAQ Trackers’ reliance on growth over the past decade was even stronger.

NASDAQ Trackers Funds in this bucket have shown the strongest growth orientation over the past decade. Since these funds' performance is the most negatively exposed to value, they have been the most reliant on growth to power their performance. These funds pay handsomely for the most promising stocks available.

These funds each track an index that draws its constituents from the NASDAQ exchange. The NASDAQ leans into growth-oriented sectors. It is notoriously tech-heavy, but the pronounced growth orientation of First Trust NASDAQ-100 ex-Technology Sector ETF QQXT demonstrates that other sector tilts contribute to its growth orientation.

Each fund in this group is either equally or market-cap weighted. The strategies do not target stocks based on valuation metrics or growth indicators. By fishing exclusively in the growth-focused NASDAQ pond, these funds embody a pronounced growth tilt.

Because they capture growth as a byproduct of their constituent stocks’ primary listing venue rather than by explicitly pursuing it, the NASDAQ Trackers may offer inconsistent growth exposure. Their portfolio valuations comfortably exceeded the Core Growth funds’ in the mid-2010s, but now these strategies are not as growth-bent as some of their peers.

Exhibit 2: P/E Ratios

Source: Morningstar Direct.

These funds’ performance over the past decade has been terrific. Invesco QQQ Trust's QQQ large allocation to technology helped make it one of the best-performing large-growth exchange-traded funds of the decade, and each of the other three funds outpaced the broad market. The stars aligned for this bucket, as it leaned the hardest toward growth right as it took off. Now, the NASDAQ Trackers’ more tempered growth tilts may inhibit it from capitalizing on growth the way they did in the 2010s, when their growth orientations were more pronounced than they are now.

Core Growth Funds that land in the Core Growth bucket have leveraged growth's run to post an excellent decade of performance as well. Their current price/earnings ratios range from 28 to 44, indicating a definitive growth focus.

Unlike the NASDAQ index-trackers, these funds target stocks based on their growth characteristics. Most of these funds cast a wide net, select constituents whose valuation metrics suggest that they are poised for growth, and weight them by market capitalization. For example, Silver-rated Schwab US Large-Cap Growth ETF SCHG targets stocks representing the faster-growing half of the U.S. large-cap market, based on a collection of valuation metrics, and assigns larger weightings to larger stocks, not necessarily the fastest-growing.

While Core Growth funds’ broad reach and market-cap weighting can blunt their growth orientations, they improve diversification and reduce risk. Every fund in this group beat VTI over the past decade, and most did so with less volatility than the NASDAQ Trackers.

Even in an environment that favors growth, sacrificing growth exposure for better diversification is a worthy trade-off.

Momentum The Momentum bucket features just two funds whose exposure to momentum was nearly in line with their exposure to growth. Momentum centers around the theory that recent performance persists in the short term. This idea seems to align with growth investing, as neither philosophy shies away from paying up for promising stocks.

First Trust Large Cap Gr AlphaDEX ETF FTC and Invesco Dynamic Large Cap Growth ETF PWB are the only funds in this study who saw momentum materially affect their 10-year returns. (There were other momentum strategies on the market 10 years ago, but none were index funds in the large-growth category.) Neither of these funds is explicitly a momentum strategy, showing that funds that target broad styles like growth can have material factor exposures.

Like the Core Growth funds, these strategies select stocks based on the strength of their growth characteristics. Unlike the Core Growth funds, the growth characteristics they consider emphasize recent performance, which invites momentum exposure. For example, FTC selects stocks based on their three-, six-, and 12-month price changes; one-year sales growth; and price/sales ratio. The former two traits directly reflect momentum and tilt the fund in that direction.

That these portfolios adopt a momentum bent while targeting growth highlights the overlap between the two styles. These funds have trailed their core and aggressive growth peers over the past decade. Their relative struggles point to the difficulty of beating more broadly diversified cap-weighted strategies over the long term.

Incidental The final bucket earns the title "Incidental" because they do not intentionally pursue growth stocks. Green Century Equity Individual Investor GCEQX targets firms with strong environmental, social, and governance characteristics and avoids fossil fuels. While this mandate isn't specific to growth, it effectively eliminates the value-leaning energy sector and favors growth-oriented stocks. Both Guggenheim strategies target stocks that they believe will deliver sustainable future cash flows. This is a more profitability-minded approach, as evidenced by the relatively high exposures in the profitability column. Here, growth is a byproduct rather than an objective.

These funds’ relatively modest growth tilts have led to underwhelming performance over the trailing decade through August 2020. In fact, all three of these funds have trailed the broad market over that span. However, they will likely hold up better than their growth-chasing peers in an environment that favors value.

The different characteristics of each of these buckets demonstrates that the “large-growth” designation includes different shades of growth. Core Growth funds tend to be the best-diversified and deliver the most consistent growth exposures, which makes them attractive core holdings. Other funds in the category require a greater level of due diligence and should be approached with caution.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)