Seven Top-Rated Allocation Funds Worth a Look Amidst a Backdrop of Market Uncertainty

Diversification is the best defense against the unknown.

With the presidential election about a month away, heightened coronavirus concerns as fall and winter approach, high unemployment, and numerous other lingering risks, uncertainty remains elevated. Investors looking to diversify their portfolio or put new money to work may want to consider investing in a highly diversified allocation fund to weather this shaky economic backdrop.

Below, we’ve identified seven high-conviction allocation funds that earn Morningstar Analyst Ratings of Gold or Silver. All offer high diversification and generally targeting a 60/40 stock/bond split. Two funds focus primarily on U.S. securities, two have U.S. biases with moderate international exposure, and three have global portfolios. Notably, each fund has a lower-risk profile relative an all-equity portfolio, with each capturing about 60% of the S&P 500’s downside over the past three years.

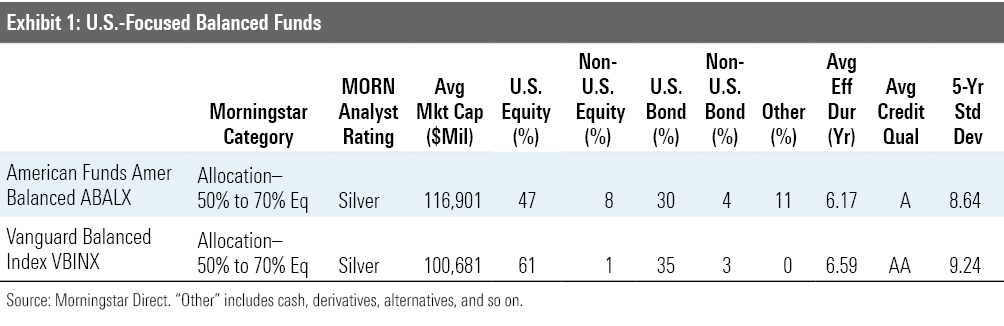

U.S.-Focused Balanced Funds

American Funds American Balanced ABALX keeps its allocation close to 60% stocks and 40% bonds. Ten managers run separate sleeves of the fund, including six equity managers, three bond managers, and one manager that invests across stocks and bonds, resulting in high diversification. The fund courts less risk than the others highlighted in this article. Its high-quality stock sleeve consists primarily of blue-chip, mega-cap names, with an average market cap of $116 billion. Its bond portfolio has an average credit rating of A and a duration of more than 6.0 years, which should help provide a reliable ballast in tumultuous market environments. Capital Group’s vast resources and strong fundamental analysis should continue to lead to compelling results for investors over the long term.

Stalwart Vanguard Balanced Index VBAIX keeps a steady 60/40 stock bond split, replicating the U.S. total stock market and the Bloomberg Barclays U.S. Aggregate Float-Adjusted Bond Index. That results in a vast portfolio of more than 3,000 stocks and 10,000 bonds. Its rock-bottom fees provide a consistent edge versus actively managed peers in the space, and its use of passive underlying strategies offers appeal to hands-off investors. The fund has had slightly higher volatility than American Funds American Balanced, partially because of its greater exposure to mid- and small-cap stocks. But its bond sleeve’s meaningful government debt exposure and high duration relative to peers helps cushion risk.

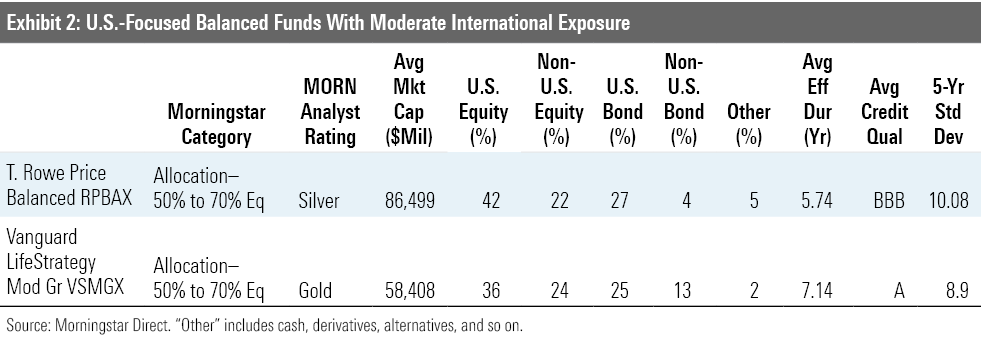

U.S.-Focused with a Modest Foreign Tilt

T. Rowe Price Balanced RPBAX takes a slightly more aggressive approach than the prior two funds, targeting 65% in equities, plus its bond sleeve includes about a 5% weighting in high-yield bonds. Yet it remains highly diversified, dividing its assets across seven underlying T. Rowe Price strategies and allocating more than 20% of assets to foreign stocks. The equity sleeve primarily consists of well-regarded large-cap strategies and a foreign large-blend strategy. A greater than 30% weighting to an enhanced core-bond index strategy anchors the portfolio and offers ballast, and a small weighting to T. Rowe Price Real Assets PRAFX should provide modest protection against inflation.

Vanguard LifeStrategy Moderate Growth VSMGX has more foreign exposure than most U.S.-focused allocation funds, investing 40% and 30% of its stock and bond sleeves overseas, respectively. For equities, the series holds Vanguard Total Stock Market Index VTSMX and Vanguard Total International Stock Index VGTSX, both rated Gold. The two fixed-income funds are Vanguard Total Bond Market II Index VTBIX and Vanguard Total International Bond Index VTIBX, both rated Silver. Using index funds for the bond allocation results in a tilt toward high-quality government debt and a higher duration relative to peers. Such allocations can result in a headwind during credit rallies but provide better downside protection in volatile markets. Overall, the fund has turned in strong results, thanks to its sound allocation approach and rock-bottom fees. The fund offers greater diversification and has been slightly less volatile than Vanguard Balanced Index thanks to its foray into foreign markets.

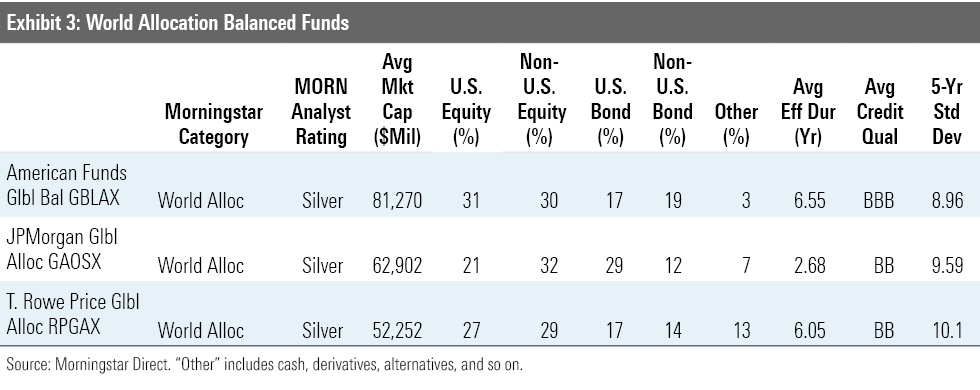

World Allocation Balanced Funds

Investors seeking even broader diversification should consider world allocation funds, which invest a minimum of 40% or total assets overseas and typically hold more niche asset classes that their U.S.-focused counterparts.

American Funds and T. Rowe Price offer more globally diversified versions of their aforementioned U.S.-focused funds. American Funds Global Balanced GBLAX has exhibited lower volatility than the other world allocation picks, thanks to its high-quality stock and bond portfolios. It divides assets among three balanced managers, one equity specialist, and three fixed-income experts. The balanced managers invest in stocks and bonds and can shift the fund’s composition, but the stock stake has normally landed within 5 percentage points of its targeted 60% weighting. The stock sleeve is relatively defensive, with a bias toward dividend-payers that at times leads to a modest value tilt. The bond portfolio offers ballast, keeping its duration (currently above 6.0 years) close to the Barclays Global Aggregate Bond Index, but it does court some risk; emerging-markets debt recently comprised more than 20% of fixed-income assets.

T. Rowe Price Global Allocation RPGAX has a more differentiated and slightly riskier approach: It targets 60% in stocks, 29% in fixed income, and 11% in alternatives. The portfolio includes more than 20 strategies, with many niche holdings, such as an equity call option overlay, European and Japan stock funds, and an emerging-markets local-currency debt strategy. It also invests in a hedge fund-of-funds managed by Blackstone, as its research indicates that position should improve total portfolio risk-adjusted returns. Overall, the underlying strategies are a strong bunch; nearly every strategy we rate is a Morningstar Medalist. The fund has performed well over time thanks to its strong underlying managers.

JPMorgan Global Allocation GAOSX is by far the most tactical manager of the group, and it’s well-equipped to navigate the currently uncertain environment. Lead manager Jeff Geller has the flexibility to adjust the stock or bond exposure anywhere from 10% to 90% of the portfolio based on where he finds opportunity. Most dramatically, Geller has at different points dialed up international government bonds to 50% of the portfolio, and sold them short by more than 10%. More recently, in the second quarter of 2020, the fund dialed up equity risk by more than 15 percentage points. The fund’s differentiated approach is currently on display; its bond portfolio’s duration is only about 2.7 years and sports a below-investment-grade average credit quality of BB. Still, Geller takes a very risk-aware approach, typically keeping volatility in line with a 60% MSCI World Index/40% Bloomberg Barclays Global Bond Index over the long haul. JPMorgan runs one of the longest-standing tactical processes of any allocation group, dating back to 1999, and it has typically added value through its shifts. The fund currently consists of 14 separate sleeves run by JPMorgan managers.

Conclusion Overall, these vehicles represent strong choices for investors looking to guard against the unknown. All of these balanced funds offer well-rounded portfolios, though investors looking to maximize diversification should consider the more globally oriented portfolios.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)