Energy Stocks Historically Cheap

We expect demand to catch up in 2021 and 2022.

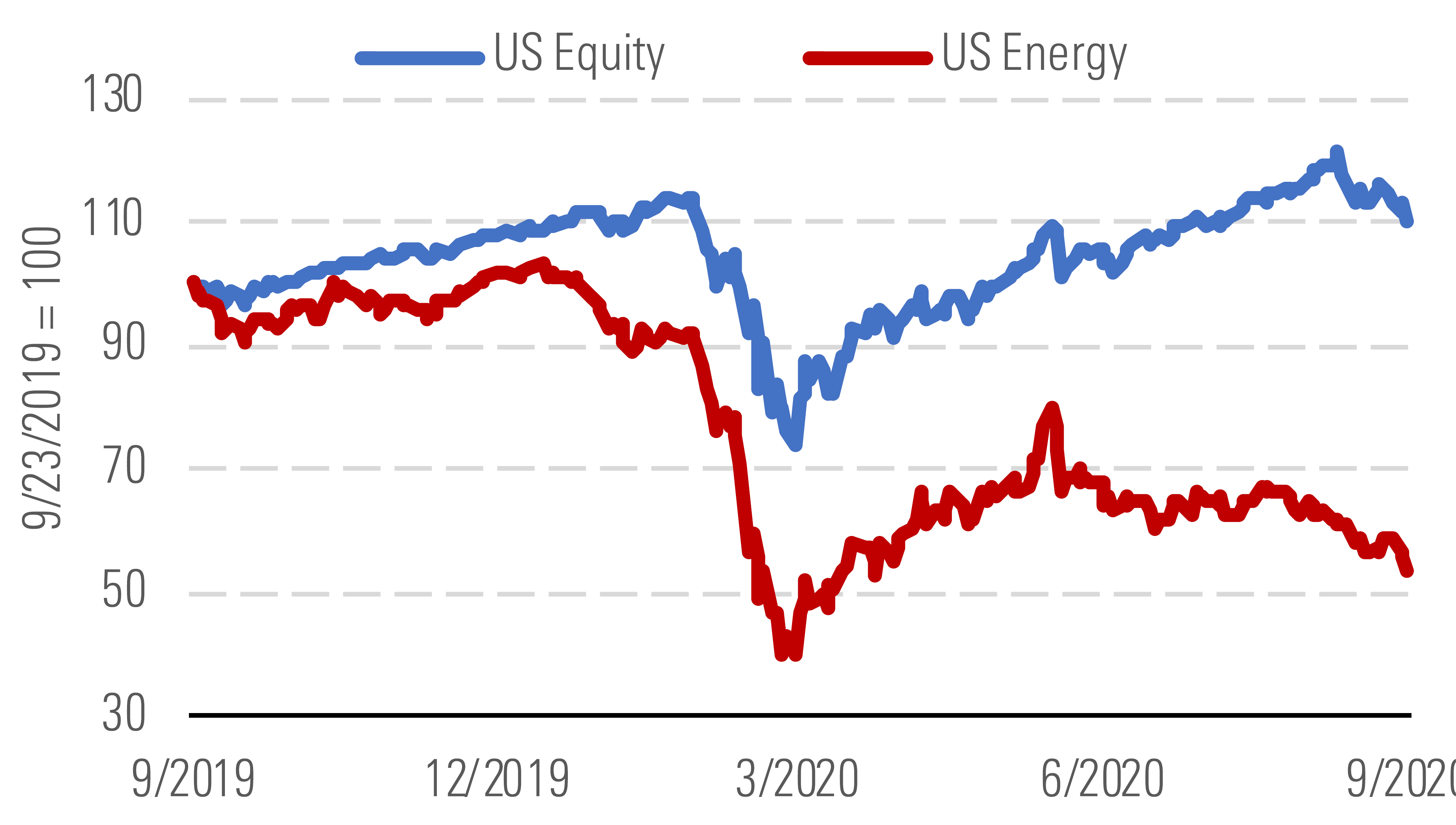

The Morningstar US Energy Index has continued to lag the broader domestic market, underperforming by 23.6% in the third quarter, as crude oil prices have remained stubbornly flat and well below the midcycle level of $55 per barrel West Texas Intermediate ($60/bbl Brent) that would incentivize the right level of development from swing producers like U.S. shale firms and OPEC. However, we believe the market is still extrapolating bottom-of-the-cycle crude prices to infinity, making energy stocks look historically cheap. Energy remains the most undervalued sector, trading at a 40% discount compared with a 7% discount for the overall market.

Energy stocks have lagged the broader market in 2020. - source: Morningstar

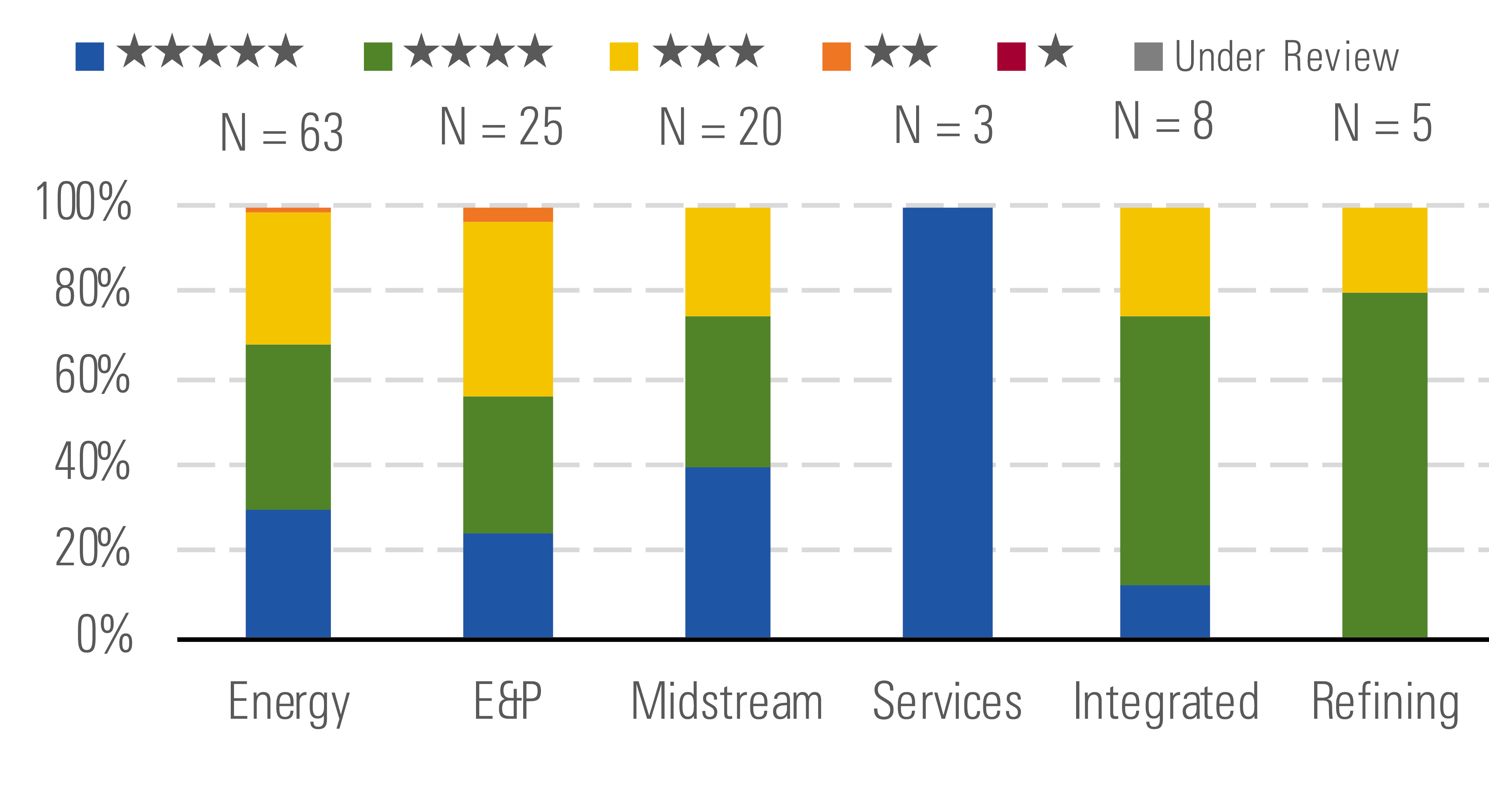

Energy stocks priced very attractively. - source: Morningstar

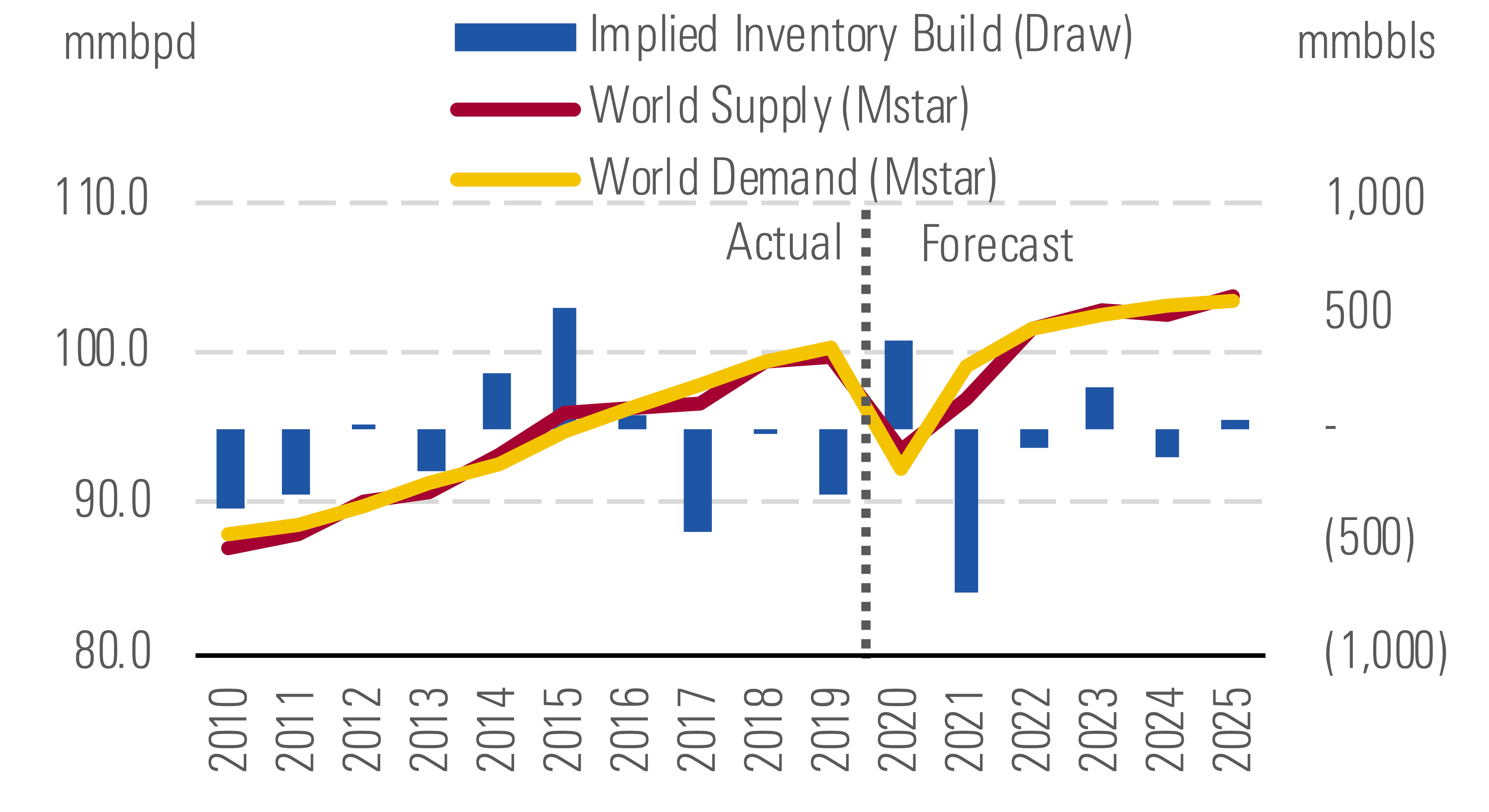

The massive impact of the COVID-19 pandemic on global demand is the primary reason that crude prices and energy stocks have not recovered along with the broader markets thus far. We estimate a year-over-year decline in consumption of around 8 million barrels per day, easily surpassing prior downturns. To mitigate the impact of record stockpiles on crude-oil prices, producers, including OPEC+ and U.S. shale firms, have made dramatic production cuts, and very little development is taking place. As a result, we think worldwide production will decline by about 5.7 mmbpd this year. This narrows what would otherwise be an unmanageable surplus, though inventories are still expected to spike significantly above normal levels by year-end.

2020 oil demand clobbered by COVID-19. - source: Morningstar

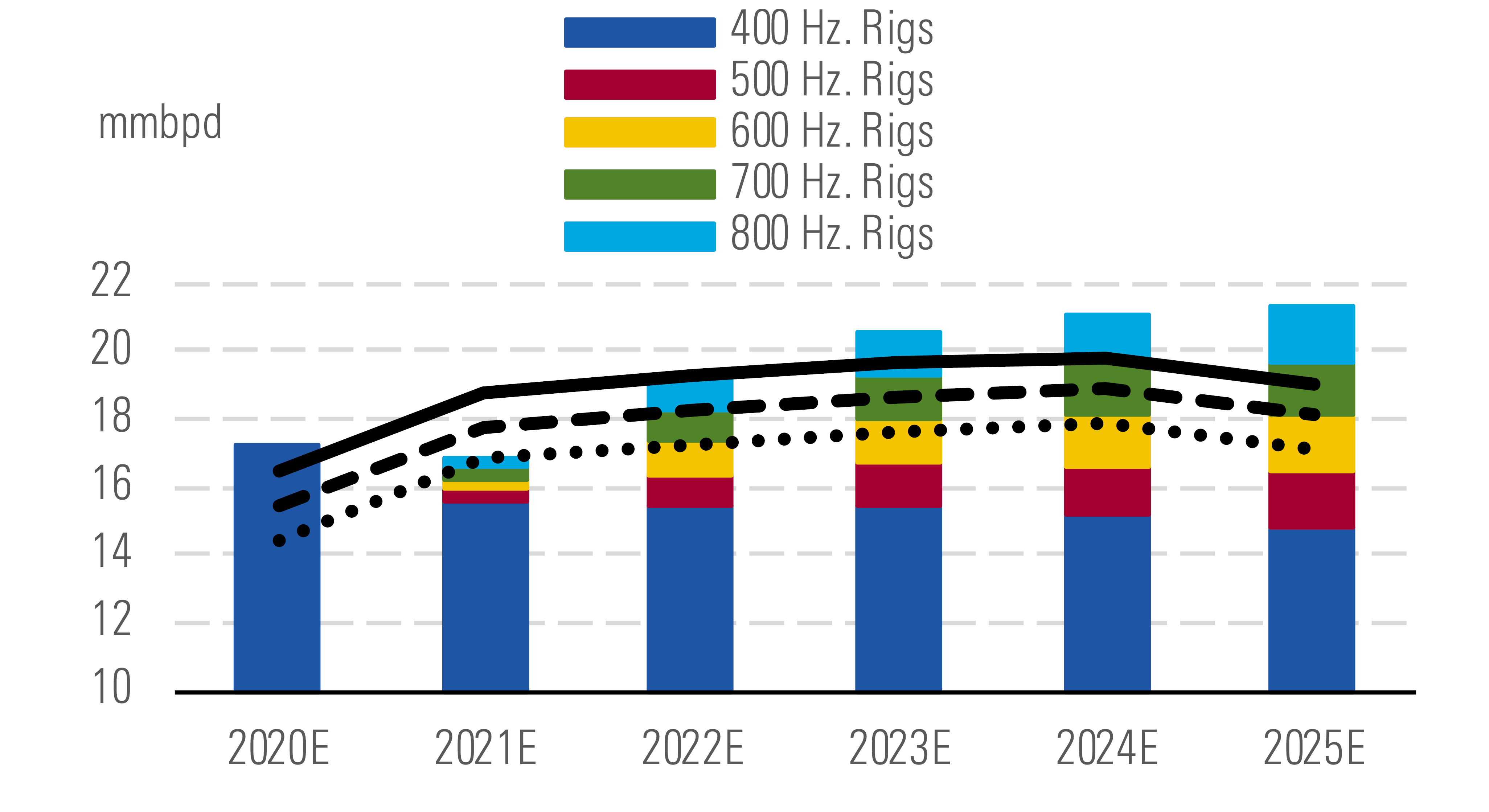

The environment for crude producers does not look much better in the fourth quarter, as the pandemic has not yet subsided enough to allow for a meaningful surge in travel that would drive up gasoline and jet fuel consumption. But we continue to expect catch-up growth in 2021 and 2022, bringing long-term demand almost back in line with our pre-COVID projections. But after making major cuts this year, producers aren’t geared up to meet that demand (in the U.S., the horizontal rig count has slumped to about 200, well below the 600-rig “Goldilocks” level needed). Without a rebound in oil prices in 2021, producers will have no incentive to grow their production or even replace declines, resulting in a downward spiral for supply that could eventually turn the current glut into a shortage.

About 600 U.S. rigs needed to keep up with global demand. - source: Morningstar

Top Picks

Enterprise Products Partners EPD Star Rating: ★★★★★ Economic Moat Rating: Wide Fair Value Estimate: $25.50 Fair Value Uncertainty: Medium

Enterprise Products Partners is well positioned to deal with the industry downturn over the next one to two years. The partnership has liquidity of $7.3 billion and adjusted debt/EBITDA is about 3.4 times, which we consider prudent. 78% of its customer base is investment-grade. Fee-based earnings make up 80%-90% of earnings. Take-or-pay commitments make up 45%-55%, more resilient areas such as storage and demand-driven pipeline exposure make up about 20%-30%, and volume-exposed fees make up the balance.

Schlumberger SLB Star Rating: ★★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $48 Fair Value Uncertainty: High

Schlumberger remains our top oilfield-services pick. Thanks to its strong balance sheet and focus on less-volatile international markets, we expect it to weather the storm facing oil markets over the next two years. Investors shouldn’t be discouraged by the temporary dividend cut, which is a wise precautionary move given the severe near-term industry environment. In the long run, we think Schlumberger will benefit from secular growth in international capital expenditures. Also, we think the company is poised to gain market share and improve margins via its efficiency-boosting integrated and performance-linked project initiatives.

Pioneer Natural Resources PXD Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $151 Fair Value Uncertainty: High

Historically one of the shale industry's more profligate capital allocators, Pioneer is now a poster child for capital discipline and intends to reinvest only 70%-80% of cash flows (still enough to keep output growing at 5% annually). Much of the remainder will be redistributed to shareholders via a variable dividend that will keep payouts calibrated with the commodity cycle, setting an example all peers should follow. Its zero-basis Midland Basin acreage contains enough top-tier drilling opportunities to support decades of high-margin drilling.

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)