Where to Find Attractive Stocks in Industrials Sector

The aerospace, defense, and industrial distribution industries look undervalued.

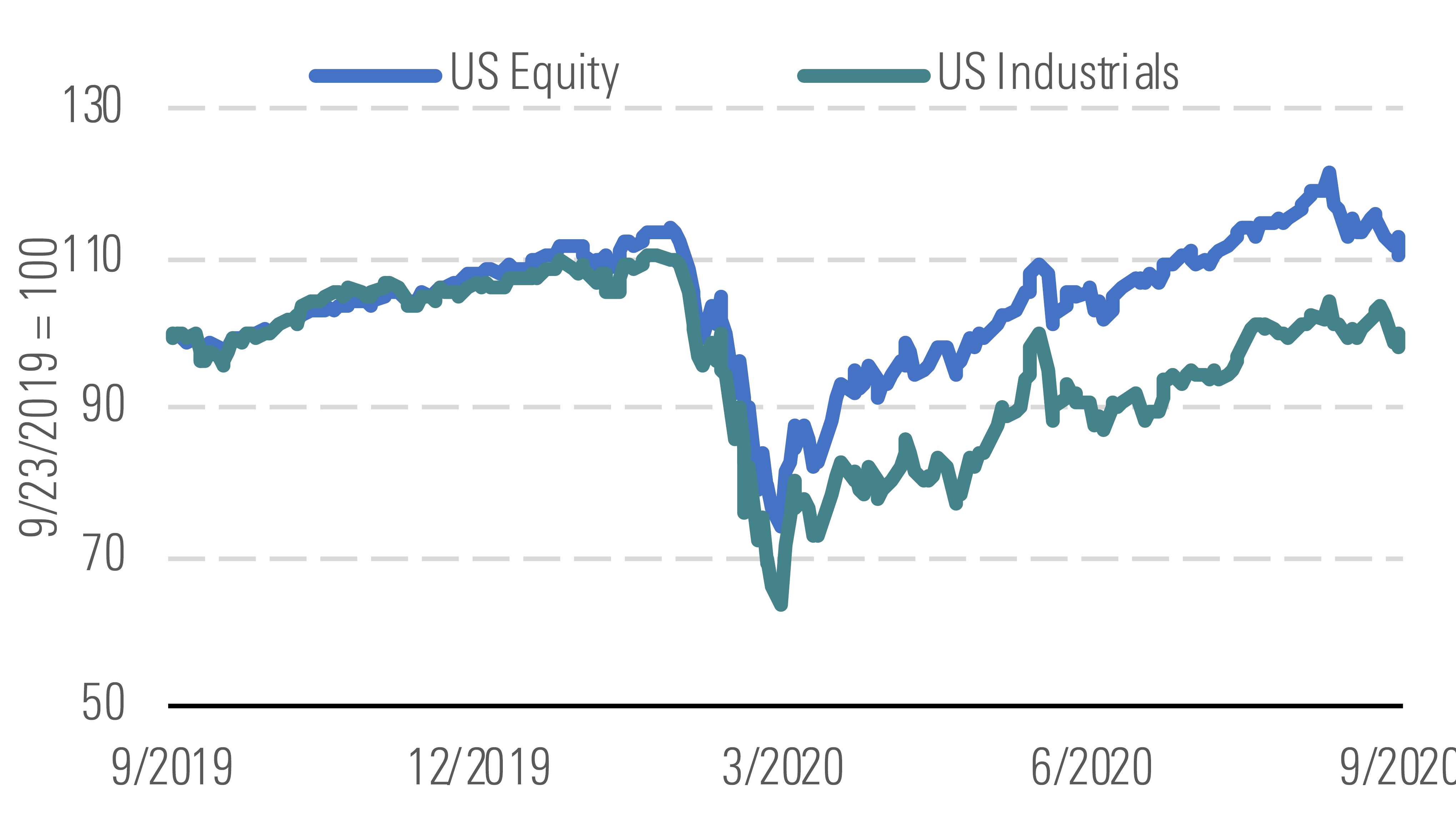

The Morningstar US Industrials Index has significantly underperformed the broader U.S. equity market over the trailing 12 months, due in part to steep equity value declines across the airlines and aerospace and defense industries, which have been hit particularly hard by the coronavirus pandemic. However, the industrials index rallied during the quarter, led by farm and heavy construction machinery, trucking, and freight and logistics, as investors became more optimistic about the prospects for a sustained economic recovery.

Despite rebound, industrials have still underperformed year to date. - source: Morningstar

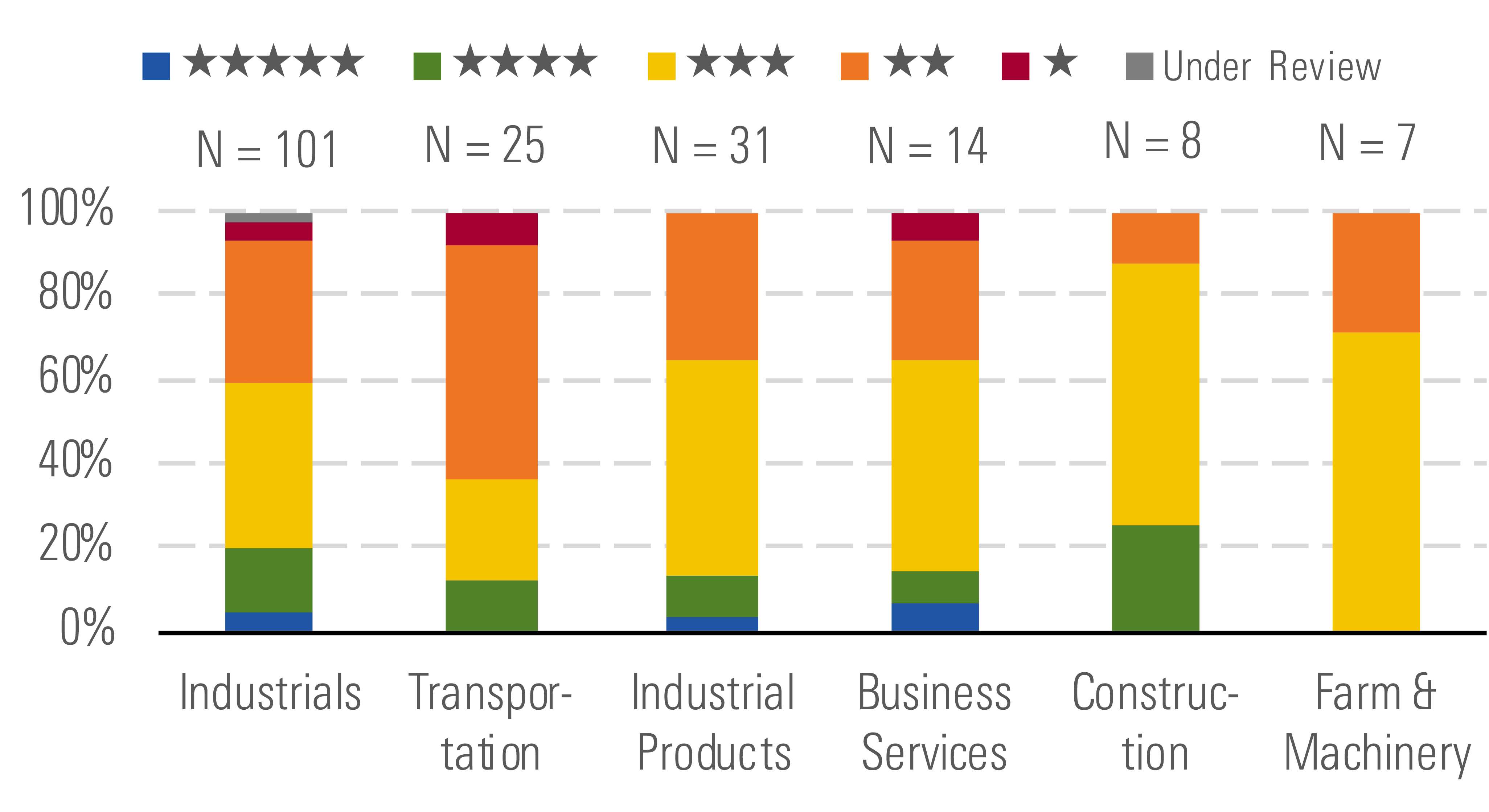

Stock prices for many industrials companies have recovered since the late March equity market trough, and only about 20% of our U.S. industrials coverage currently looks undervalued to us. However, we still see attractive investment opportunities across the aerospace and defense, construction, and industrial distribution industries.

About 20% of our U.S. industrials coverage is undervalued. - source: Morningstar

We expect the U.S. military's increased focus on defending against great powers conflict will drive elevated defense spending for missiles, missile defense, and space militarization. While the upcoming presidential election introduces budget uncertainty, we think it will be difficult to materially decrease the defense budget without sweeping political change. U.S. air travel is still significantly below prior-year levels, but demand has been on an increasing trend since mid-April as more Americans set aside their fears and returned to the skies. We don't think there are structural barriers to travel beyond the virus, and we’re anticipating that consumers will be comfortable flying after broad COVID-19 vaccine availability, which we expect by mid-2021.

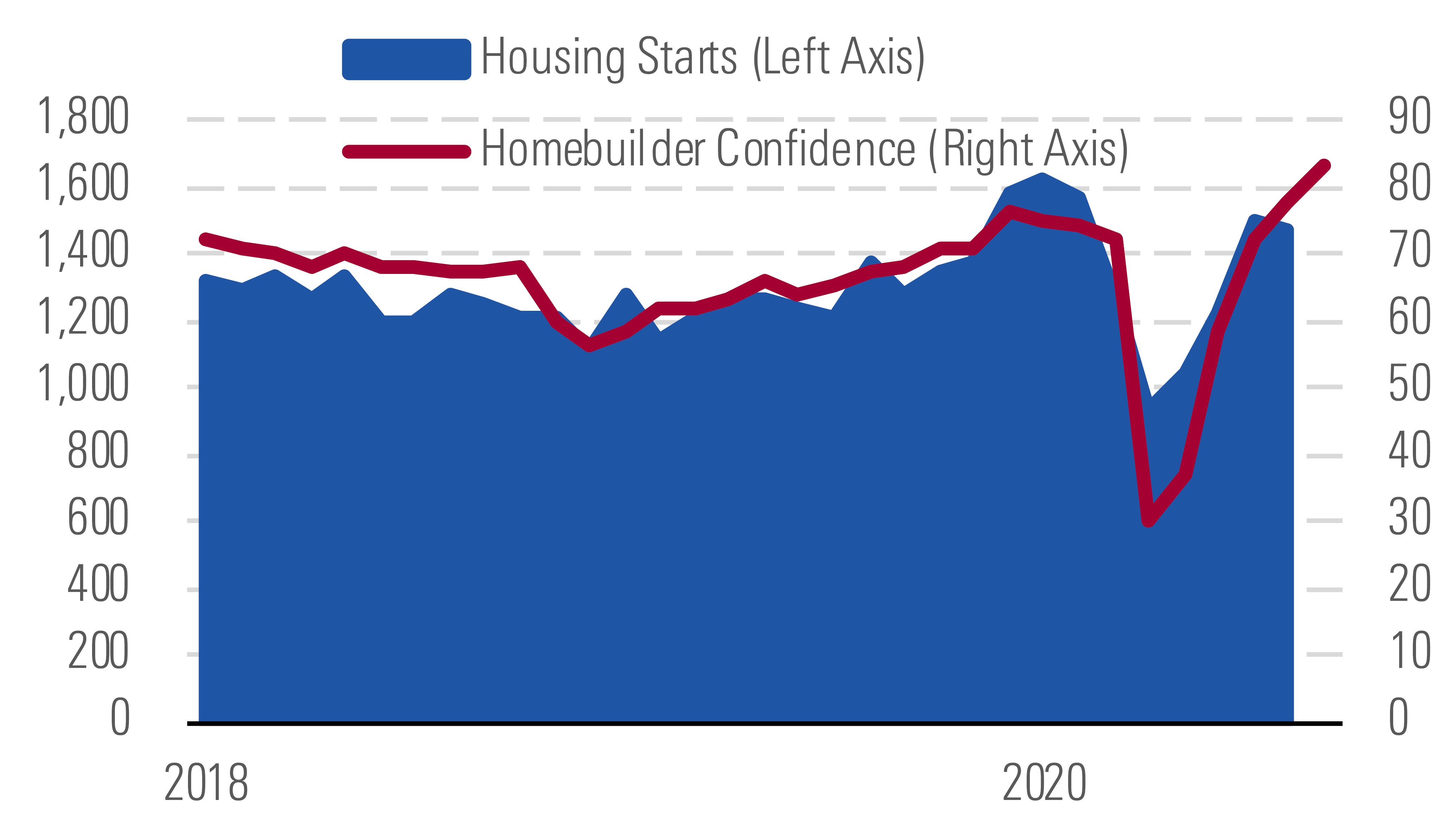

The housing market has been a bright spot during the pandemic, and many residential construction metrics have returned to prepandemic levels. We have a bullish outlook for the U.S. residential construction market, supported by our view that favorable supply/demand dynamics will persist for the foreseeable future. In addition to a strong housing market, potential infrastructure legislation would be a boon for construction-oriented industrials companies.

Residential construction has been a bright spot for the U.S. economy. - source: Morningstar

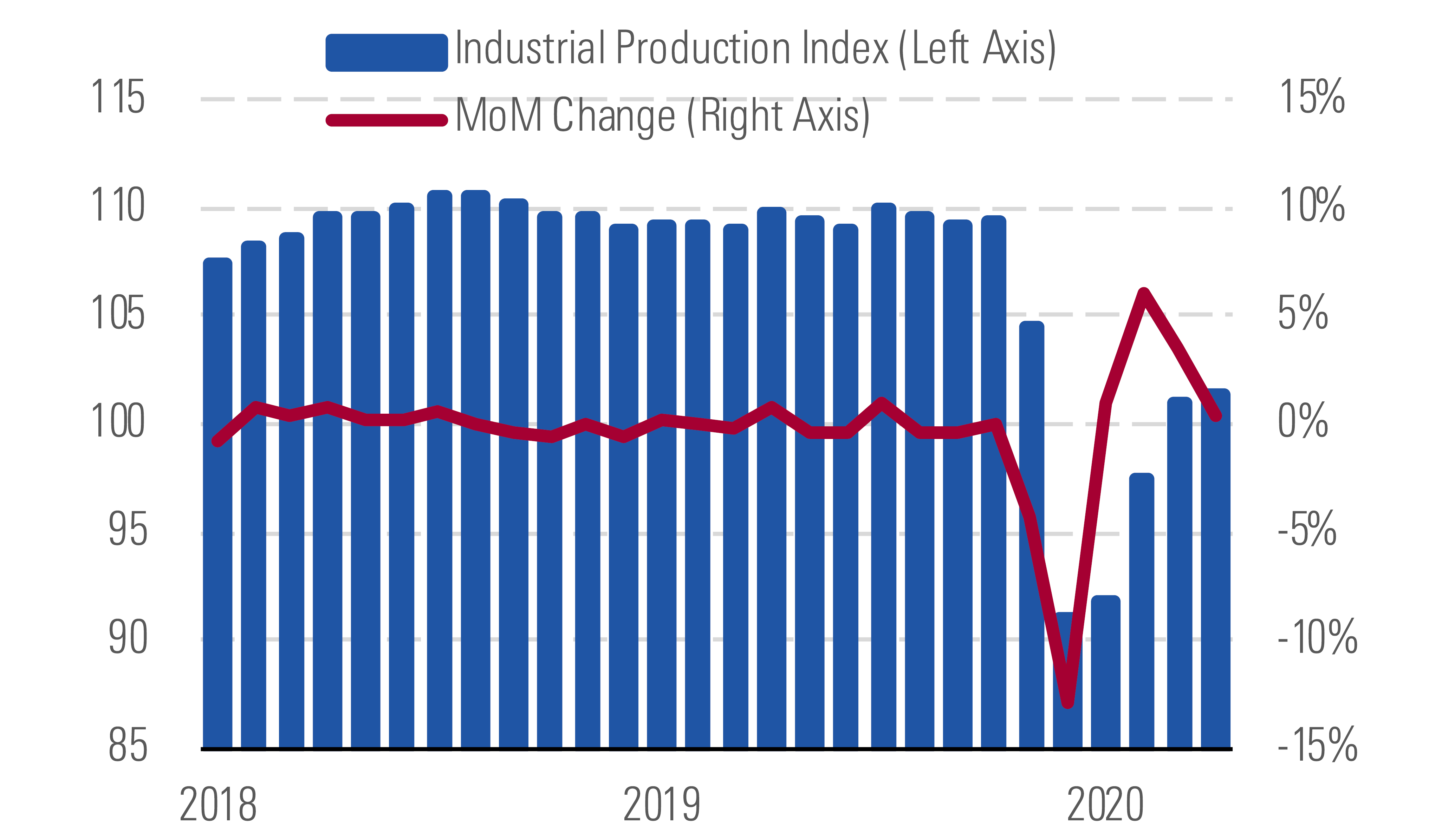

Industrial production rebounded in June and July, but expansion moderated in August. We expect industrial production will continue to rebound as the U.S. economy recovers and supply chain reshoring efforts bring more manufacturing back to the U.S.

U.S. industrial production has rebounded. - source: Morningstar

Top Picks

HD Supply Holdings HDS Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $47 Fair Value Uncertainty: Low

HD Supply expects to complete the $2.9 billion sale of its construction and industrial business to private equity in October 2020. The remaining facilities maintenance business sells living space products across four historically steady verticals—multifamily, hospitality, institutional, and healthcare—where its leading market share and its predominantly "break-fix" demand flow has resulted in top-line stability and strong profit margins. We expect sales will normalize as the hospitality market recovers and deferred maintenance projects are addressed. Without the C&I business, HD Supply is a less cyclical and more profitable firm.

Herc Holdings HRI Star Rating: ★★★★ Economic Moat Rating: None Fair Value Estimate: $51 Fair Value Uncertainty: Medium

Herc Holdings is the third-largest equipment rental company in North America, with 3% market share, trailing United Rentals and Sunbelt. Despite disruptions from COVID-19, the North America rental industry remains strong as key customers have avoided lockdowns. We think equipment rental will become increasingly favored over ownership, and we expect Herc will take market share from smaller rivals. There's support for government-funded infrastructure spending from both sides of the political aisle, which would be a boon for Herc. Last, as the economy reopens, we believe Herc will experience strong demand from entertainment customers.

Raytheon Technologies RTX Star Rating: ★★★★ Economic Moat Rating: Wide Fair Value Estimate: $78 Fair Value Uncertainty: High

Raytheon Technologies is composed of United Technologies' aerospace businesses and legacy Raytheon; the firm is a powerhouse in the commercial aerospace supply chain and defense prime contracting. Once a COVID-19 vaccine is well distributed by mid-2021, we expect a broad rebound in air travel and a subsequent rebound in revenue passenger miles, which will benefit Raytheon’s aerospace businesses by increasing maintenance and repair shop visits. Raytheon's defense business is well positioned in missiles, missile defense systems, and space militarization, which we see as attractive growth markets for the firm.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)