Economic Outlook: We Don't Think the Market's Too Optimistic

We forecast a strong long-run U.S. recovery.

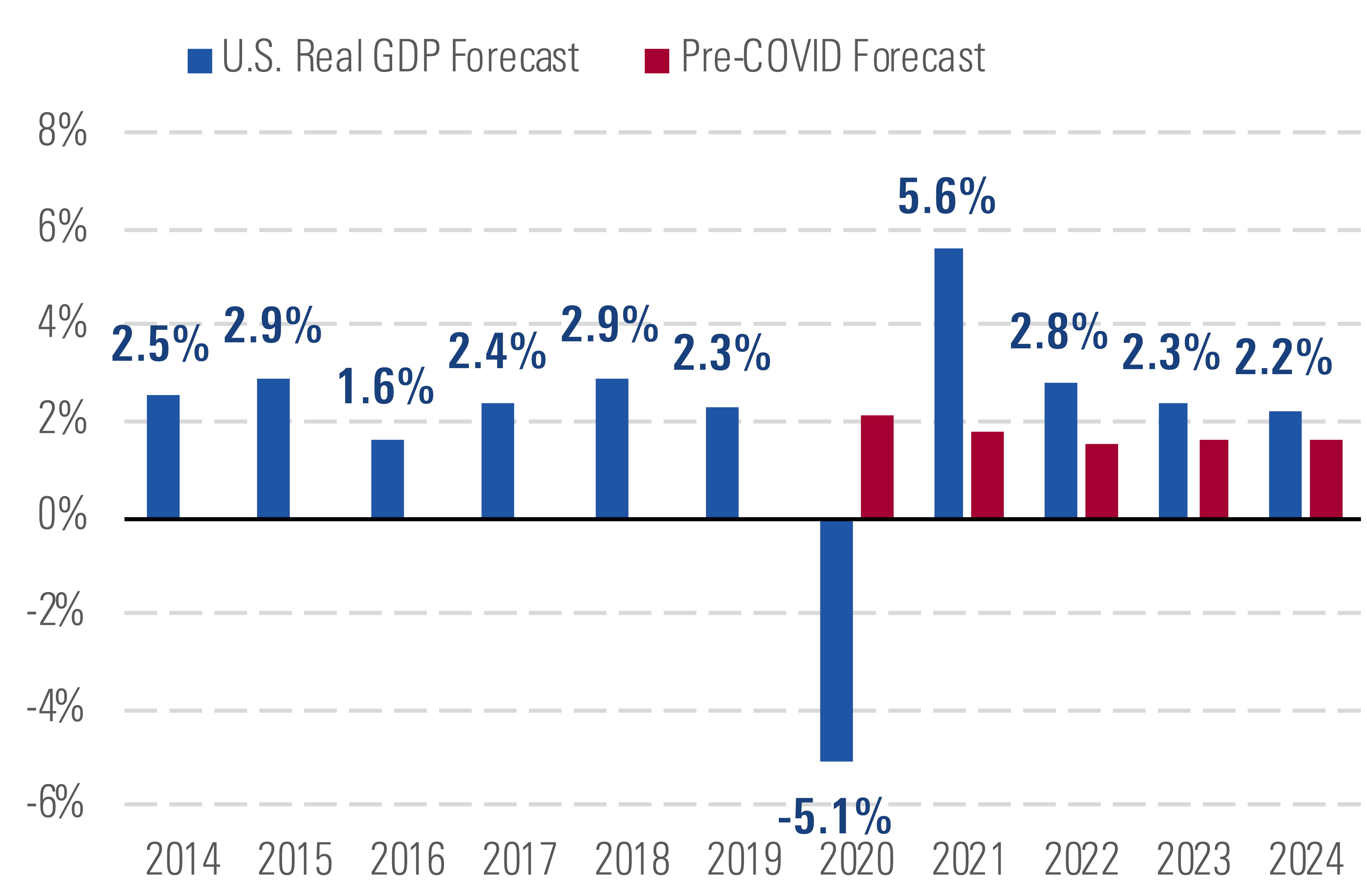

The Morningstar US market index has staged a complete recovery from COVID-19 and now is up 3% year to date even as the pandemic remains at large. While many investors are wondering if the market is exhibiting irrational exuberance, we think the rebound has been broadly warranted, as we forecast a strong long-run recovery in the U.S. economy. We expect U.S. GDP to drop 5.1% in 2020 but surge back in 2021 and experience further catch-up growth in following years. By 2024, we think U.S. GDP will recover to just 1% below our prepandemic expectation.

U.S. GDP will fall sharply in 2020, but we expect rapid catch-up. - source: Morningstar

While U.S. equities have recovered in aggregate, we've seen very large disparities in share price performance across sectors and companies. Therefore, equity markets are implying a major reshaping of the U.S. economy compared with how it looked before the pandemic. Likewise, many have argued that the coronavirus will dramatically accelerate ongoing shifts in the economy (such as the one toward e-commerce from brick-and-mortar retail), or that it will create new trends entirely.

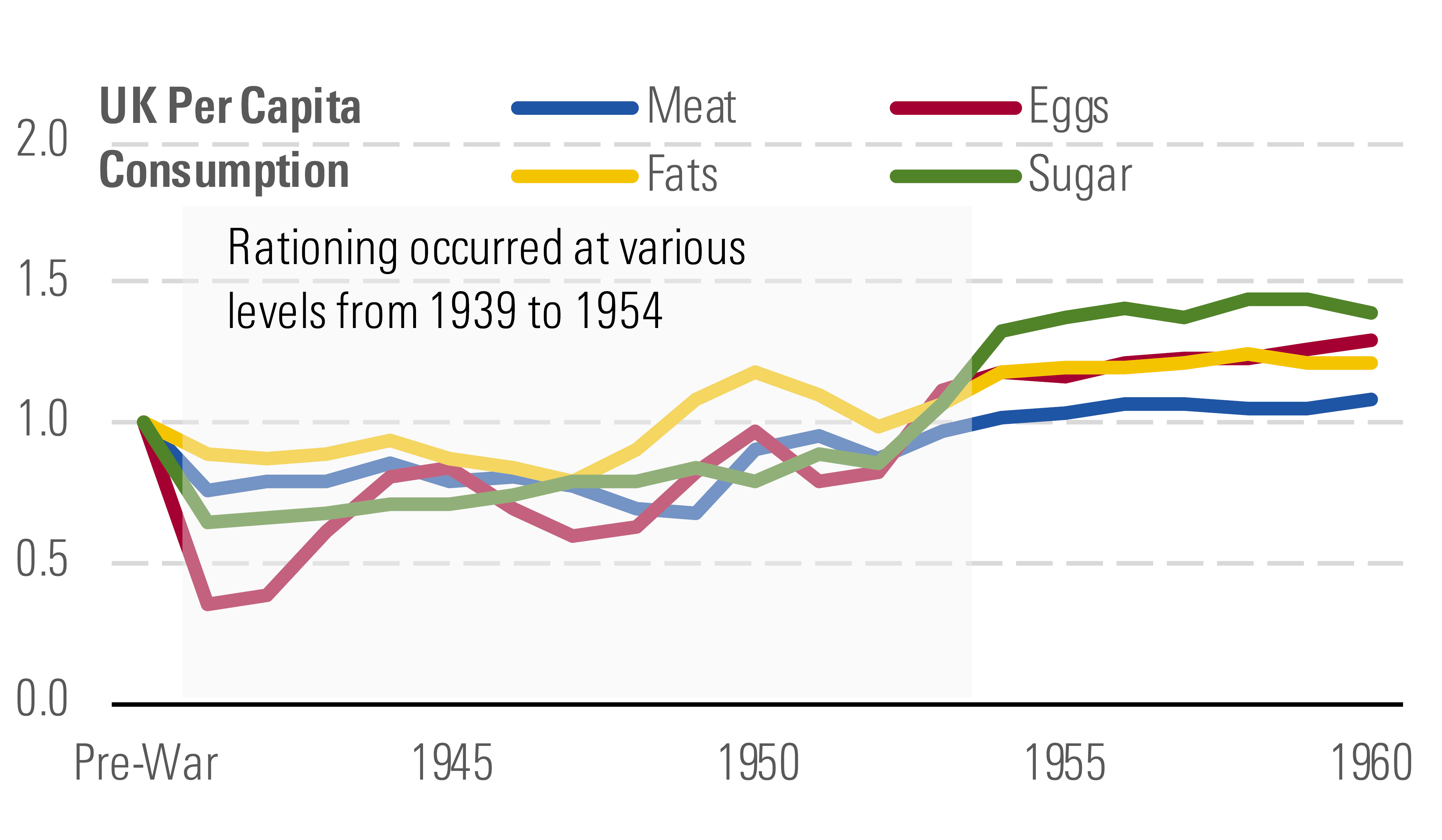

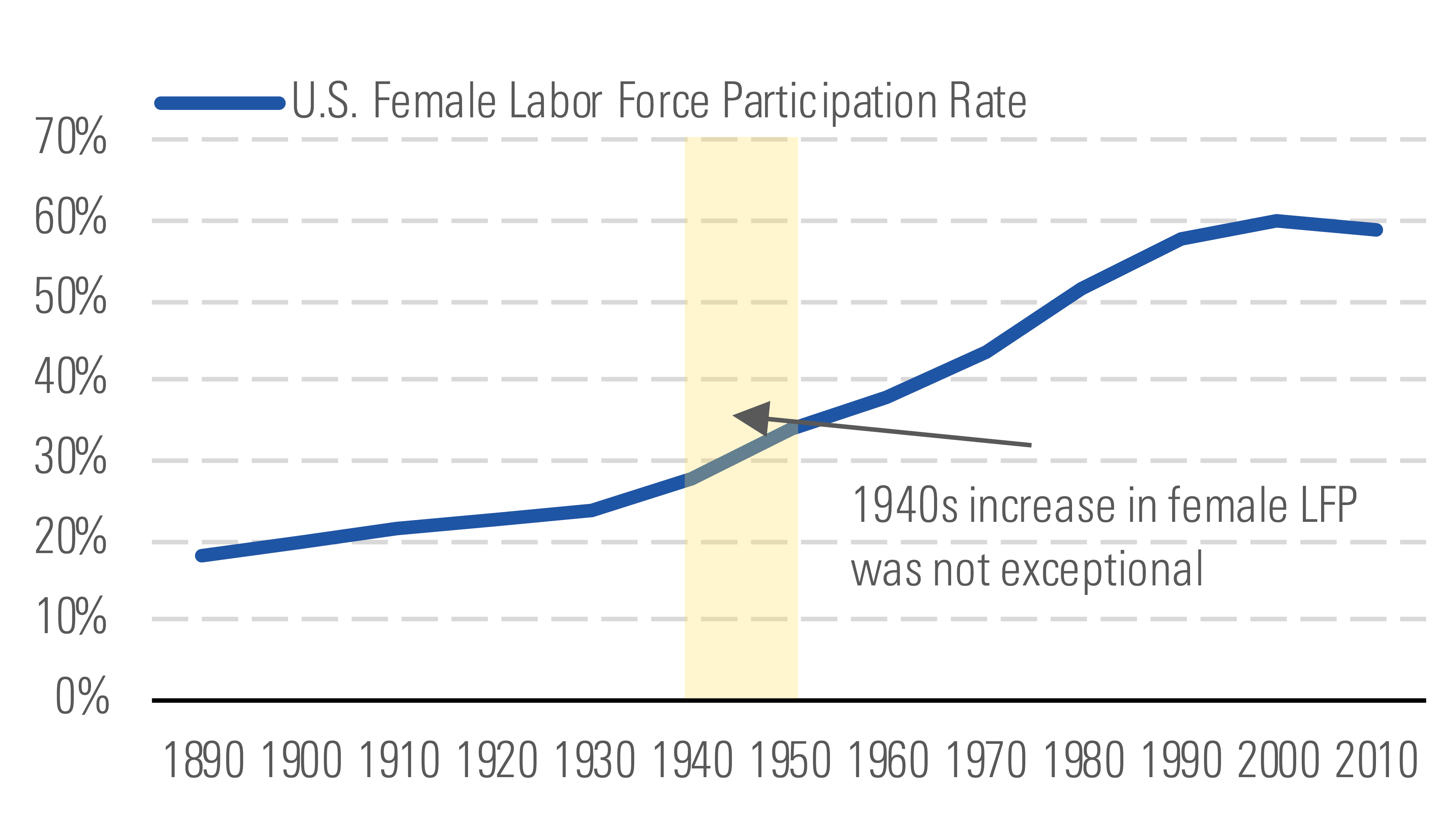

We've looked at several historical episodes in order to best understand the world after COVID-19. Our goal is to understand, in general, what happens when the economy is perturbed by an extreme but temporary external shock. Pandemics are one type of this class of events, but so are wars, political upheaval, and related disruptions. Our analysis shows that U.K. rationing in World War II didn't depress long-run consumption of rationed goods via a change in habits. Instead, demand for rationed goods generally mounted a full recovery. While U.S. female labor for participation surged during WWII, this had little impact on the long-run trend. At the very least, these episodes suggest we should think carefully before proclaiming that any aspect of pandemic life will become a "new normal."

WWII rationing had little long-term impact on U.K. food demand. - source: Morningstar

WWII jump in female labor participation didn't have major long-run effect. - source: Morningstar

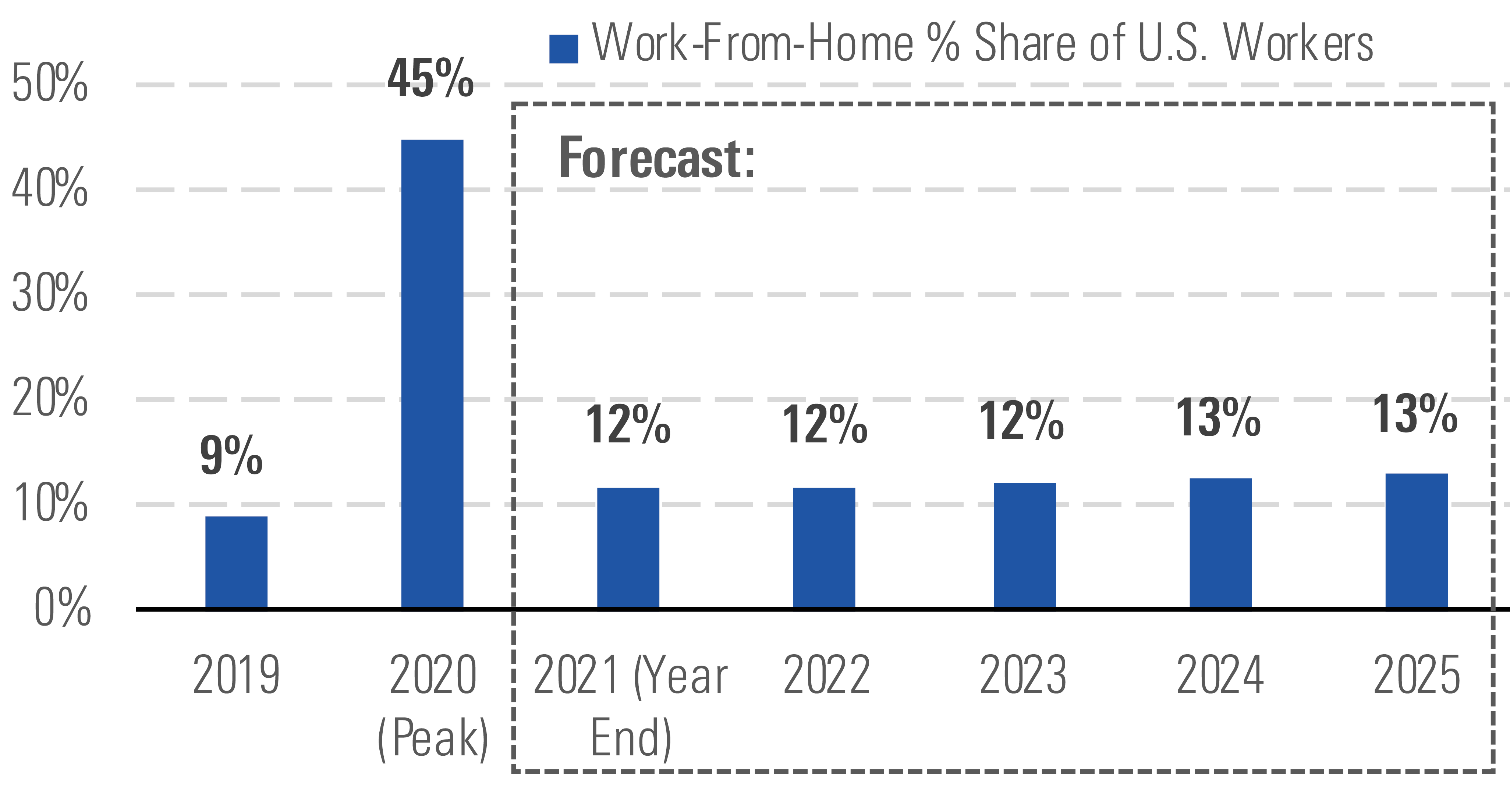

About 45% of U.S. workers were working from home at the 2020 pandemic peak. We project that 13% of U.S. workers will be working from home full-time by 2025. This is a solid uptick from prepandemic levels, but it implies that most workers are going to return to the office. Working from home isn't for everyone. It requires the right occupation, permission from the employer, and ultimately choice of the worker. Only 13% of the U.S. workforce will clear all three of these hurdles. The market is overrating work-from-home adoption, contributing to our view that energy and real estate stocks are undervalued.

We expect most workers to return to the office. - source: Morningstar

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)