Lots of Opportunities in Yield-Rich Real Estate Sector

A fourth of the real estate sector trades in 5-star territory.

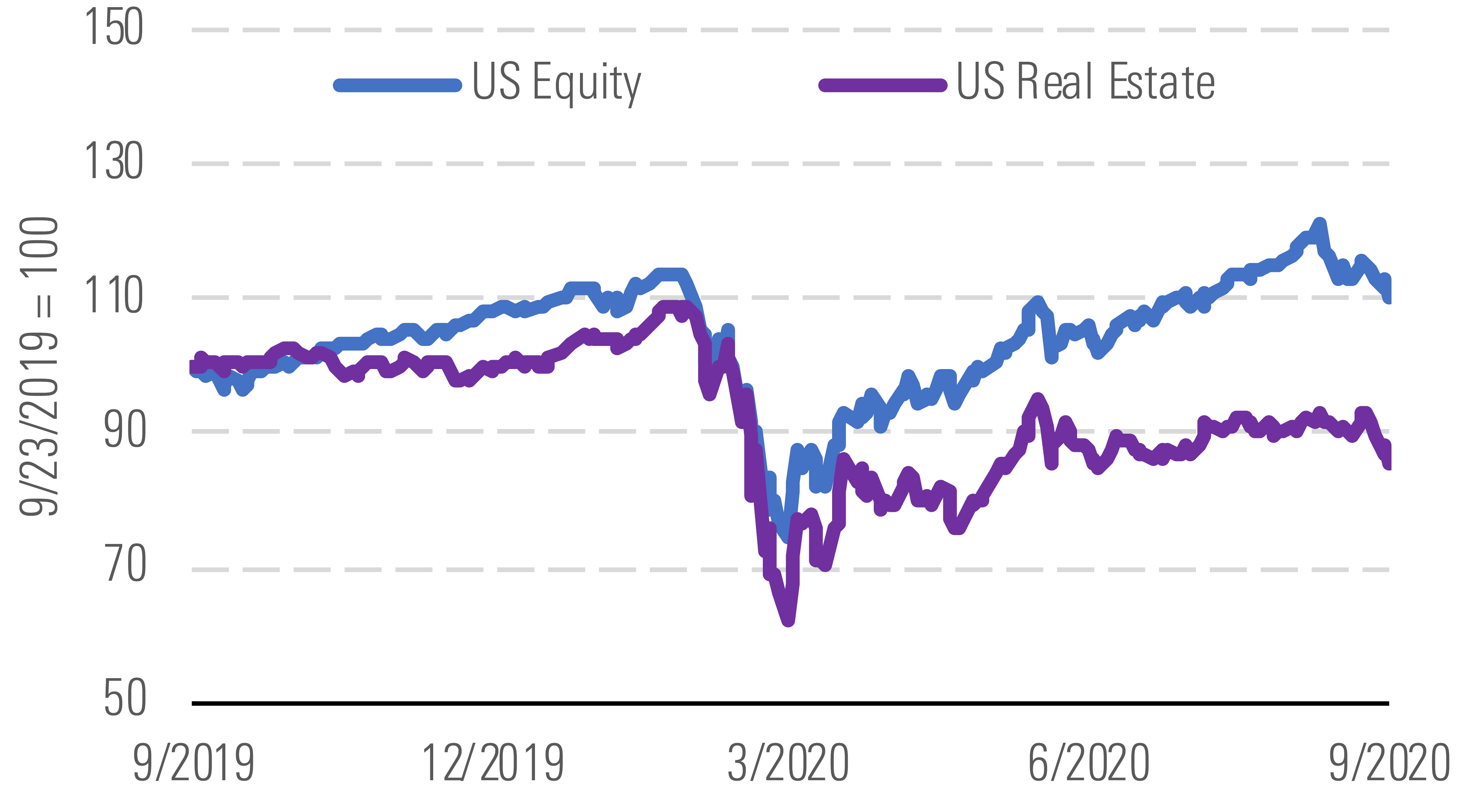

The Morningstar US Real Estate Index fell 14.3% over the trailing 12 months and is underperforming the broader U.S. equity market by 24.6%, as the sector has not shown the same recovery in the second and third quarters as the broader equity market. However, we have seen significant divergence in real estate performance by subsector.

Real estate is down and has underperformed the global equity index. - source: Morningstar

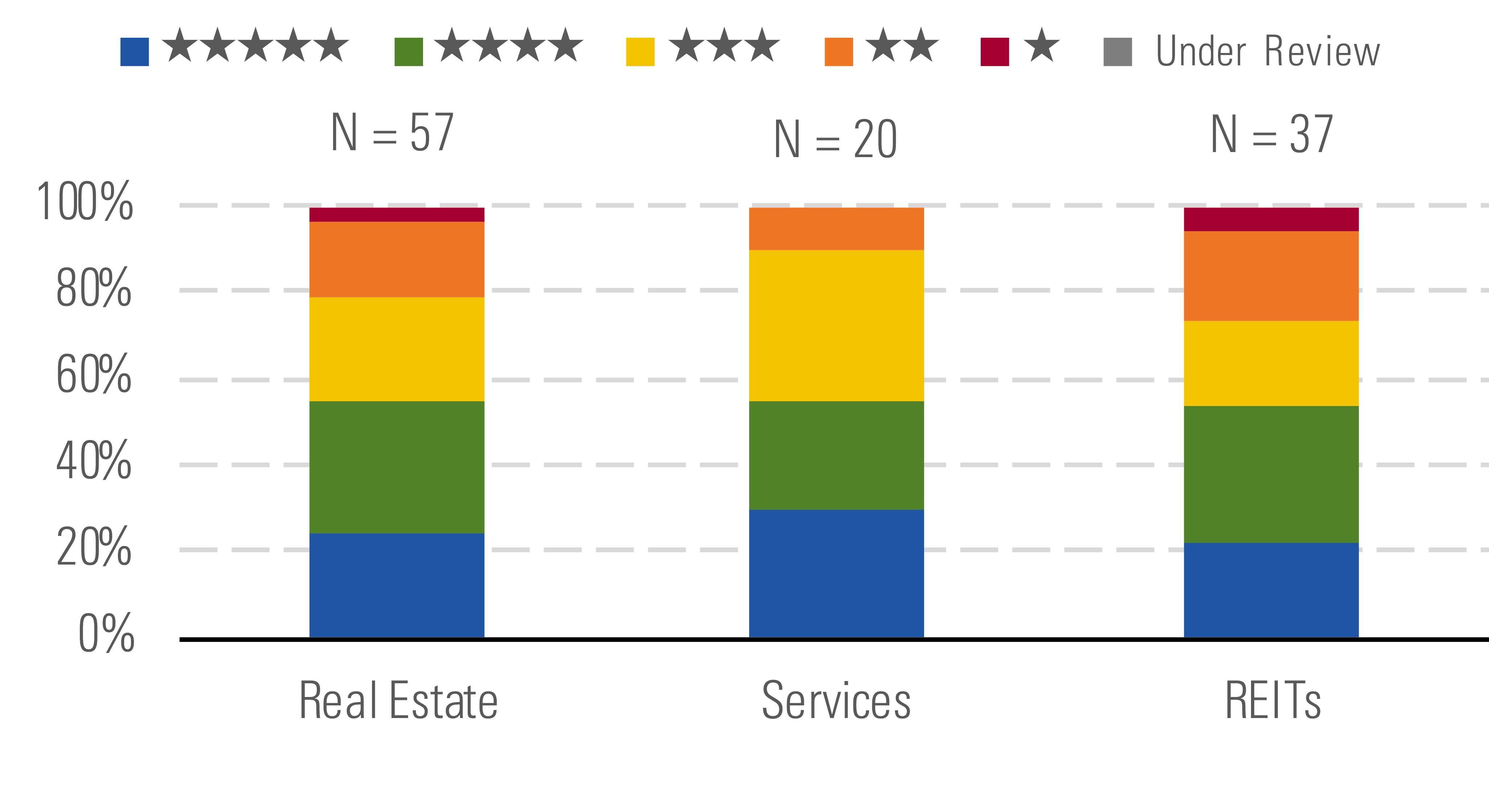

The real estate sector is currently trading at a significant discount. Our coverage currently trades at a 21% discount to our estimate of intrinsic value compared with our total coverage trading in line with our fair value estimates on average at the end of the third quarter. Currently, the real estate sector is 25% 5-star and 30% 4-star, with only 21% of the total sector trading in either 1- or 2-star range.

4-star and 5-star companies currently represent half of the sector. - source: Morningstar

The average dividend for real estate firms is higher than the rest of our coverage. To receive tax-free status, REITs are required to pay out most of their net income as dividends to shareholders. These companies are frequently included in portfolios of income-oriented investors. As a result of the recent equity sell-off, dividend yields have dramatically increased. We currently believe that most REITs will continue to pay their dividend, making these high yields very attractive to investors.

REITs have higher dividend yields than service firms and other sectors. - source: Morningstar

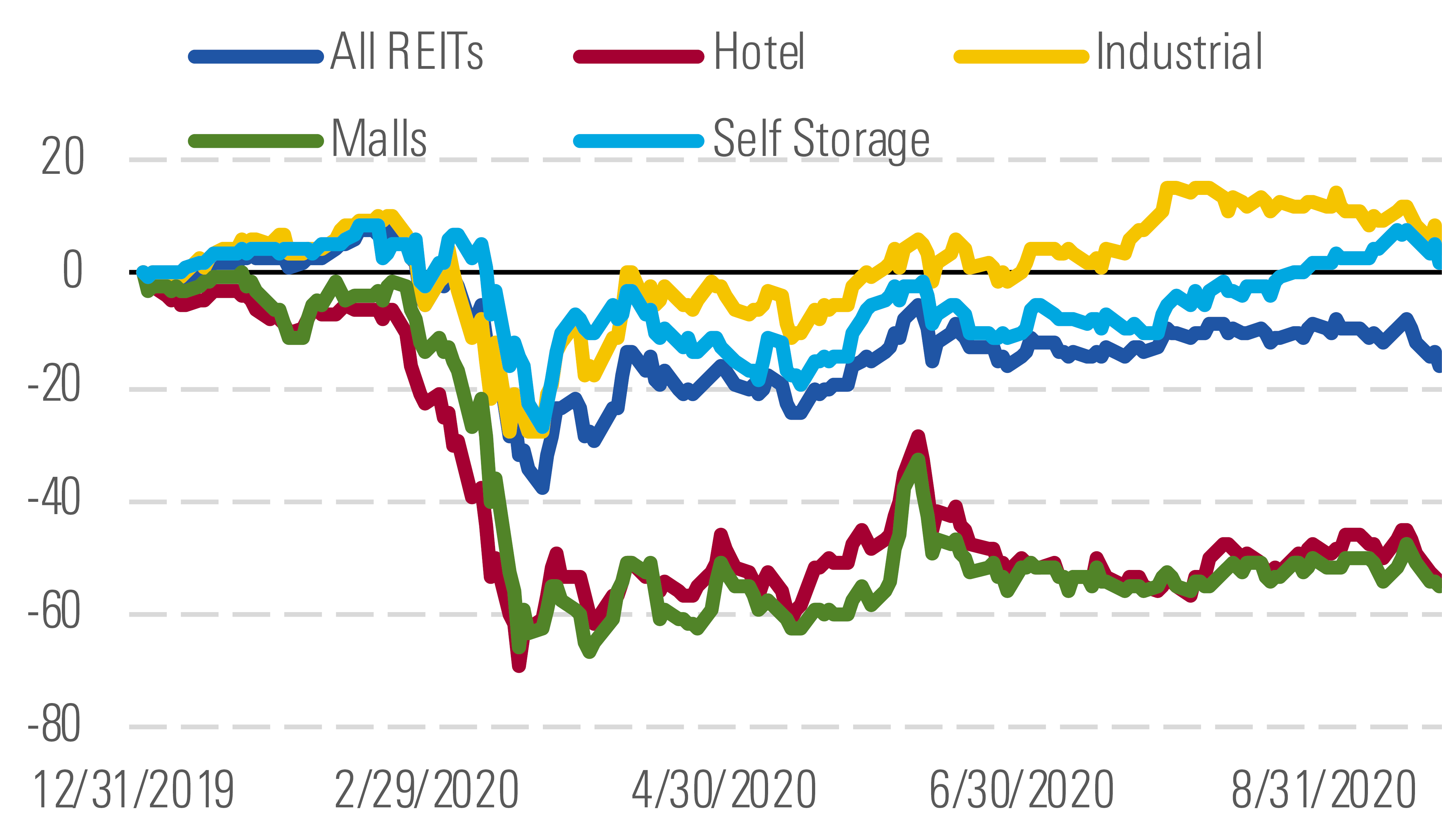

We have seen significant bifurcation in the performance of the different real estate subsectors. Sectors that are more sensitive to the impacts of the coronavirus fallout have seen significantly worse total return performance year to date.

Real estate subsectors most impacted by the virus have underperformed. - source: Morningstar

Global travel restrictions and consumers canceling vacation plans have caused massive occupancy declines for the hotel industry. Malls across the country were closed for several months and many retailers are struggling as consumers have shifted many of their shopping habits online. Both the hotel and the mall sectors have underperformed the broader real estate sector. Meanwhile, while the industrial and self-storage sectors saw initial declines, they have outperformed the broader real estate sector and with a positive return year to date in 2020. These sectors are outperforming as they should be relatively insulated from the worst effects of the virus on the global economy. That said, we currently see some of the best values among the hardest-hit subsectors. Given our long-term outlook, we believe that the hotel and mall sectors will rebound and see years of strong growth once the global crisis is over.

Top Picks

Simon Property Group SPG Star Rating: ★★★★★ Economic Moat Rating: None Fair Value Estimate: $152 Fair Value Uncertainty: High

Class A malls continue to outperform other forms of brick-and-mortar retail. Over the 12 months ending in February, Simon's tenants produced 6.5% sales per square foot growth and the company ended the second quarter of 2020 with a healthy 93% occupancy level. The stock has sold off significantly over the past few months as fears of the coronavirus impact on brick-and-mortar retail sales grew among investors. Simon has long-term leases with tenants, so it should continue to receive rent even during the current crisis. While many weaker retailers may go bankrupt due to the lack of sales, we think Simon's attractive portfolio will be able to quickly fill any vacancies.

Pebblebrook Hotel Trust PEB Star Rating: ★★★★ Economic Moat Rating: None Fair Value Estimate: $23.50 Fair Value Uncertainty: Very High

Global travel bans and canceled vacation plans have significantly affected the hotel industry. We think that Pebblebrook's upper-upscale hotel portfolio could see almost a 50% decline in revenue in 2020 and a nearly 100% decline in operating profit. However, we think that the industry should rebound with several years of strong growth and that the company will eventually return to 2019 peak levels. While we have lowered our outlook for the company, we think that the sell-off in the name is overdone, given our long-term outlook for the hotel industry.

Ventas VTR Star Rating: ★★★★ Economic Moat Rating: None Fair Value Estimate: $50 Fair Value Uncertainty: High

Ventas owns high-quality assets in the senior housing, medical office, and life science fields. While the company's medical office and life science portfolios should be relatively unaffected by the coronavirus outbreak, the senior housing portfolio is likely to experience a very significant impact to occupancies as the virus has the highest lethality rate among senior citizens. However, while virus will negatively affect net operating income for the industry in 2020 and potentially 2021, the industry should see strong long-term growth from the coming demographic wave of baby boomers aging into senior housing facilities.

/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)