Opportunities in Basic Materials Limited to Agriculture and Chemicals

Lithium demand took a hit as a result of the pandemic, but we expect it to rebound.

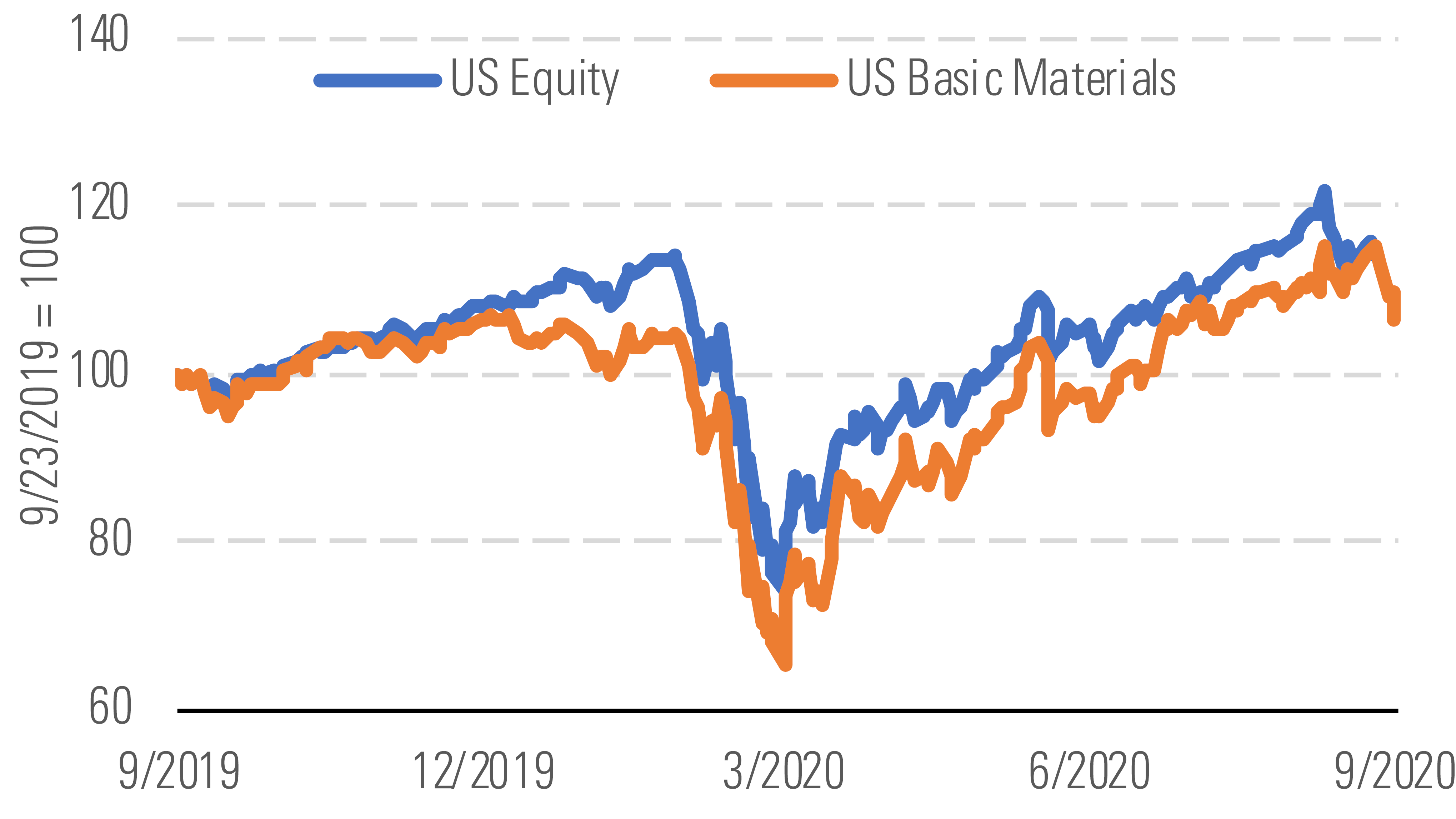

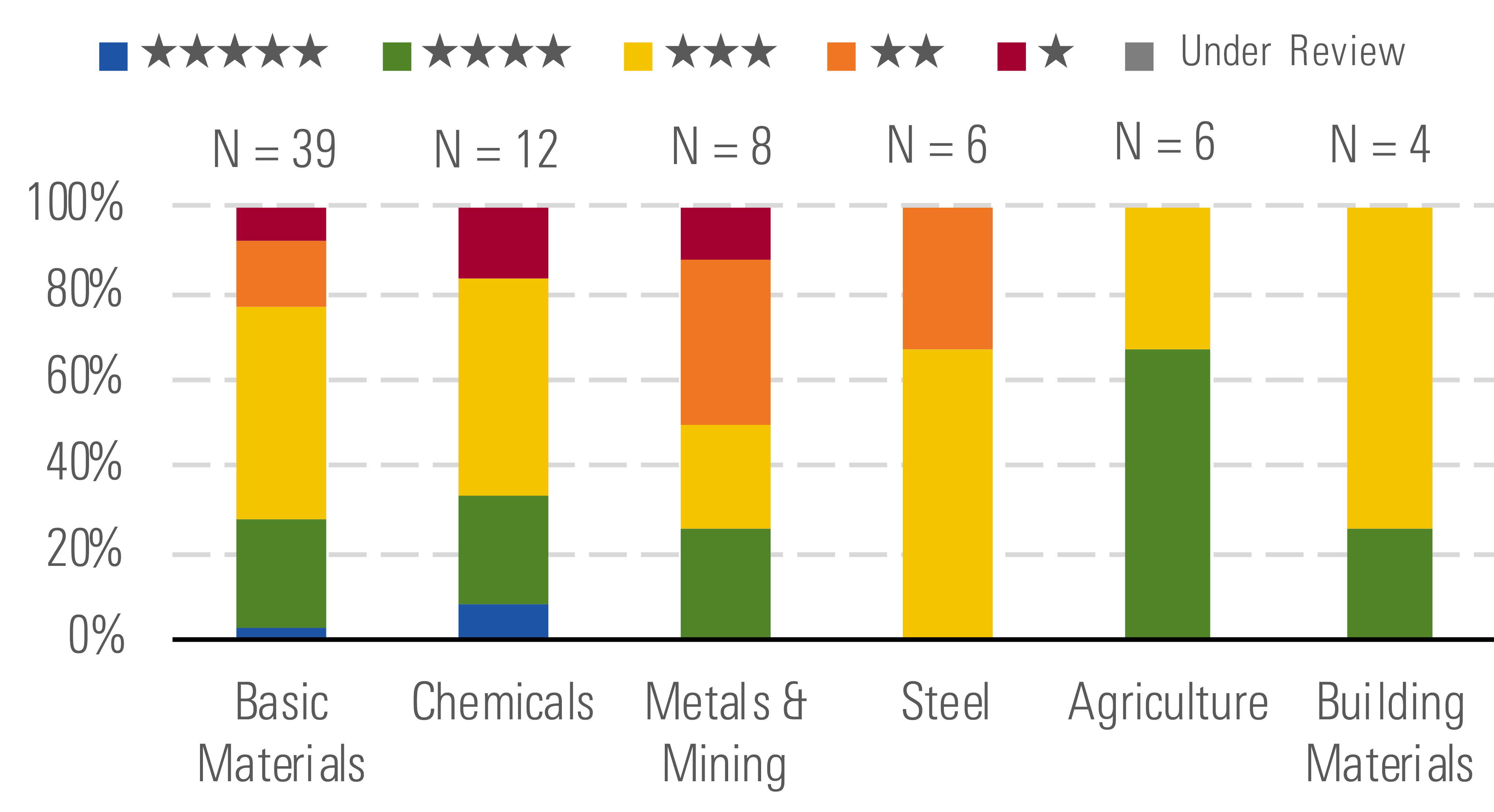

The Morningstar US Basic Materials Index outperformed the broader market during the third quarter by 330 basis points. Year to date, the sector has still underperformed the Morningstar US Market Index by roughly 240 basis points, though this is an improvement from an underperformance of roughly 520 basis points during the first half of the year. Trailing one-year underperformance improved to 380 basis points, down from 530 basis points a quarter ago. As a result of the third-quarter rally, about 30% of the U.S. basic materials stocks we cover now trade in 4- or 5-star territory. However, we think investors can still find attractive long-term opportunities in the sector, particularly in the agriculture and chemicals industries.

U.S. materials index versus the U.S. equity index. - source: Morningstar

About 30% of materials stocks trade at attractive discounts. - source: Morningstar

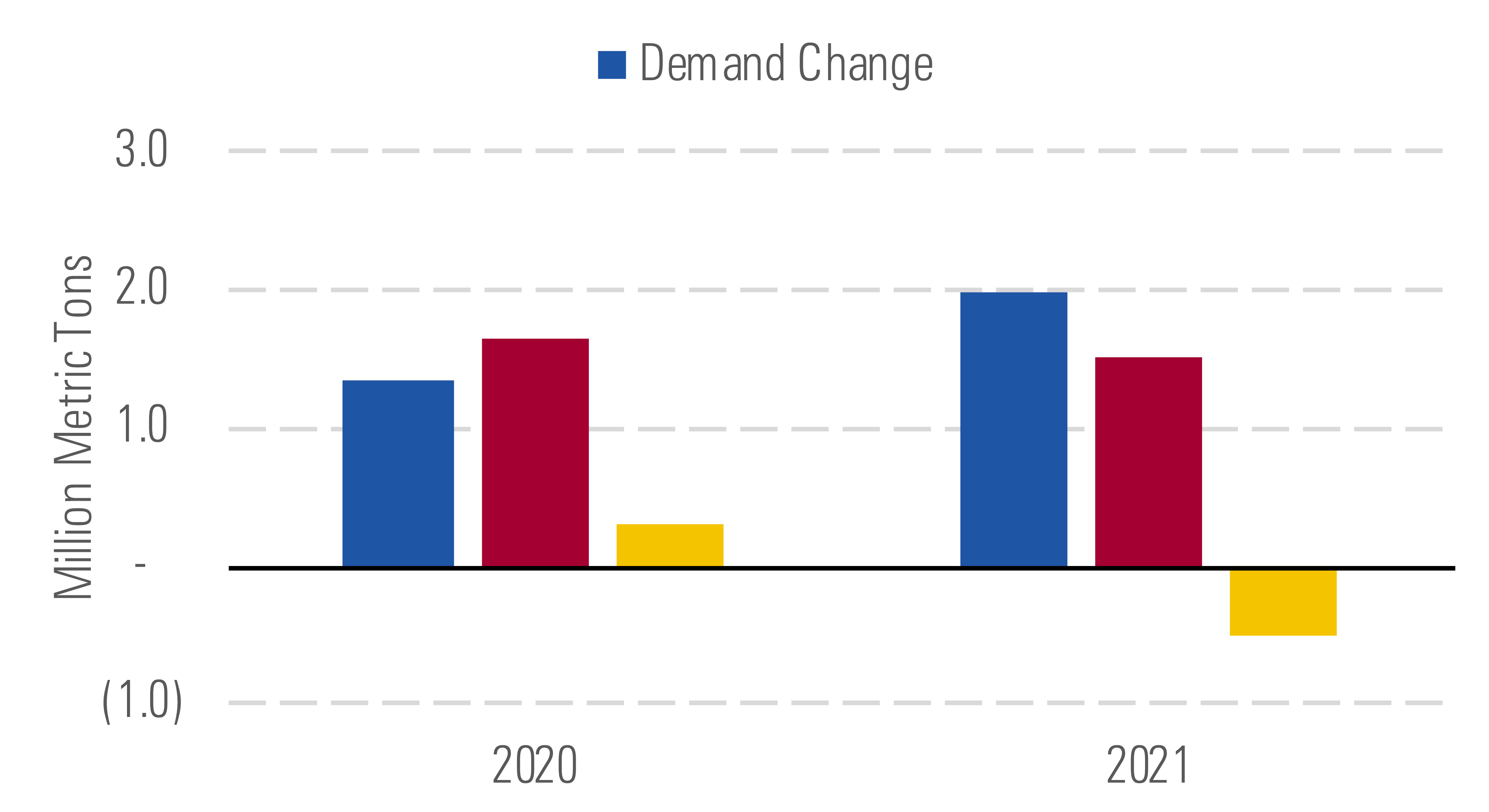

In agriculture, we expect potash demand will grow over the next several years. As the fertilizer helps plants grow in stressed weather conditions, including mild drought and flooding, farmers globally should continue to apply potash in greater quantities to maximize crop yields. Although demand should grow in 2020, new supply has weighed on prices. However, we forecast that demand growth in 2021 will sop up excess supply, leading to higher prices.

Potash market is currently oversupplied but will balance in 2021. - source: Morningstar

Chemicals producers saw demand begin to recover sequentially after falling sharply during the second quarter because of pandemic-driven closures. We expect a continued sequential volume recovery in the fourth quarter and into 2021. This should bode well for specialty chemicals producers, whose differentiated products command premium pricing, driving profit recovery as volumes return.

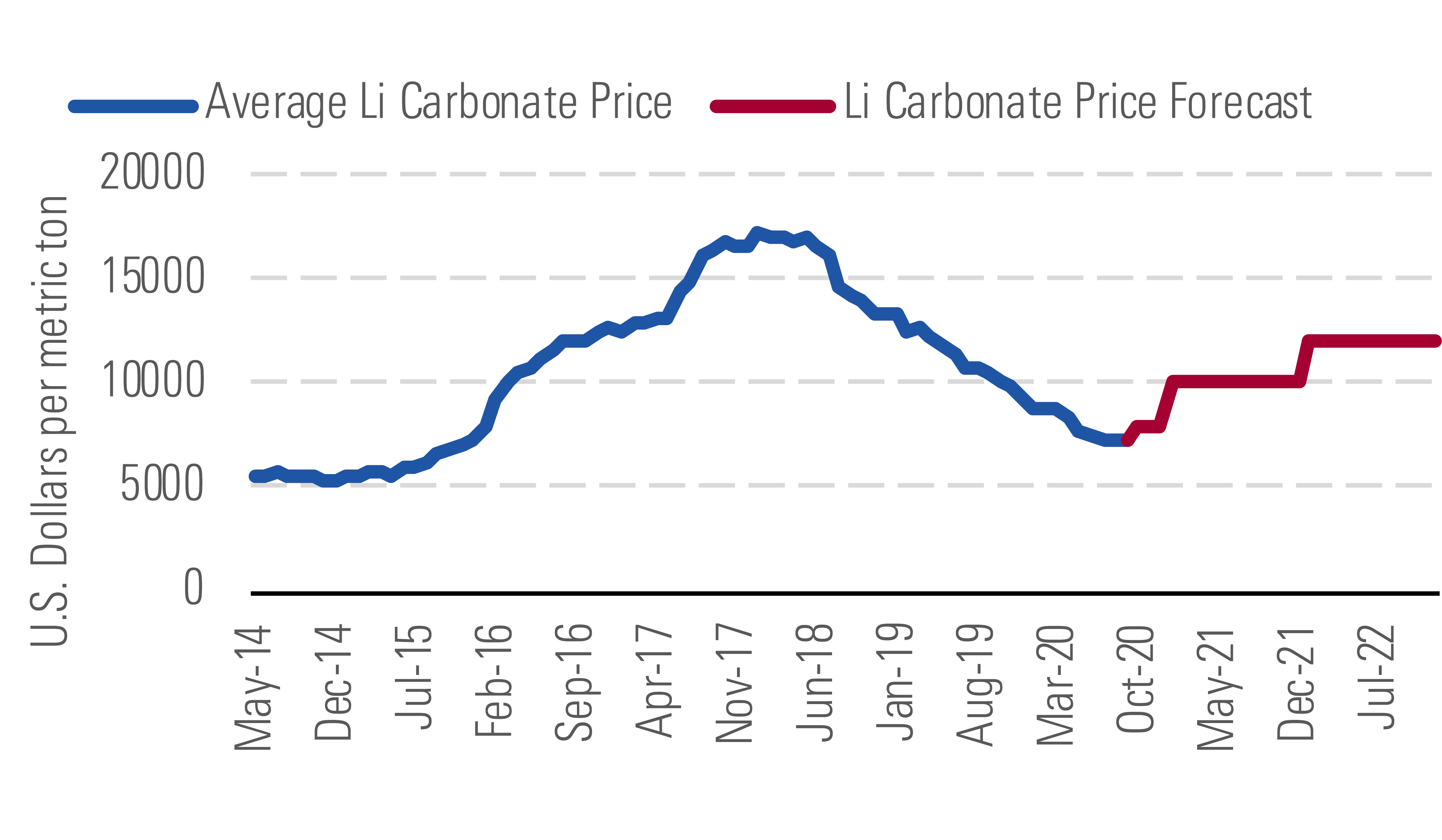

Although the impact of COVID-19 will result in reduced lithium demand in 2020, the decline should be short-lived. The largest source of lithium demand comes from electric vehicles. During the third quarter, EV sales began to rise sequentially in Europe and China, and we expect this growth to continue during the fourth quarter and into 2021. This should boost lithium demand and balance the market in 2021, with larger price increases in 2022.

Lithium prices should bottom in 2020 and rebound by 2022. - source: Morningstar

Top Picks

Nutrien NTR Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $62 Fair Value Uncertainty: High

With our outlook for a recovery in potash fertilizer prices, our top pick is narrow-moat Nutrien. The company’s cost advantage stems from its low-cost potash and nitrogen production. The stock currently trades in 4-star territory at roughly a 35% discount to our $62 per share fair value estimate. We view current prices as an attractive entry point for long-term investors.

DuPont de Nemours DD Star Rating: ★★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $85 Fair Value Uncertainty: Medium

Our top pick to play the specialty chemicals demand recovery is narrow-moat DuPont. The stock trades in 5-star territory at roughly a 35% discount to our fair value estimate. DuPont is well positioned to benefit from several underlying trends, including the growth of 5G-enabled devices, increased electric vehicle adoption, and a recovery in U.S. housing starts. We view the current share price as an attractive entry point for the quality specialty chemicals producer.

Sociedad Quimica Y Minera De Chile SQM Star Rating: ★★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $57 Fair Value Uncertainty: High

Narrow-moat SQM is one of the largest lithium producers globally. The stock trades in 5-star territory at nearly a 50% discount to our $57 per share fair value estimate. As one of the lowest-cost lithium producers globally, SQM can maintain profitability even as lithium prices fall. Over the long term, we contend that higher lithium prices will be needed to incentivize lower-quality supply to meet demand from growing electric vehicle adoption. We view current share prices as an attractive entry point for a quality lithium producer.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)