Some High-Quality Utilities Available at Reasonable Prices

Sector fundamentals remain strong and dividends keep growing.

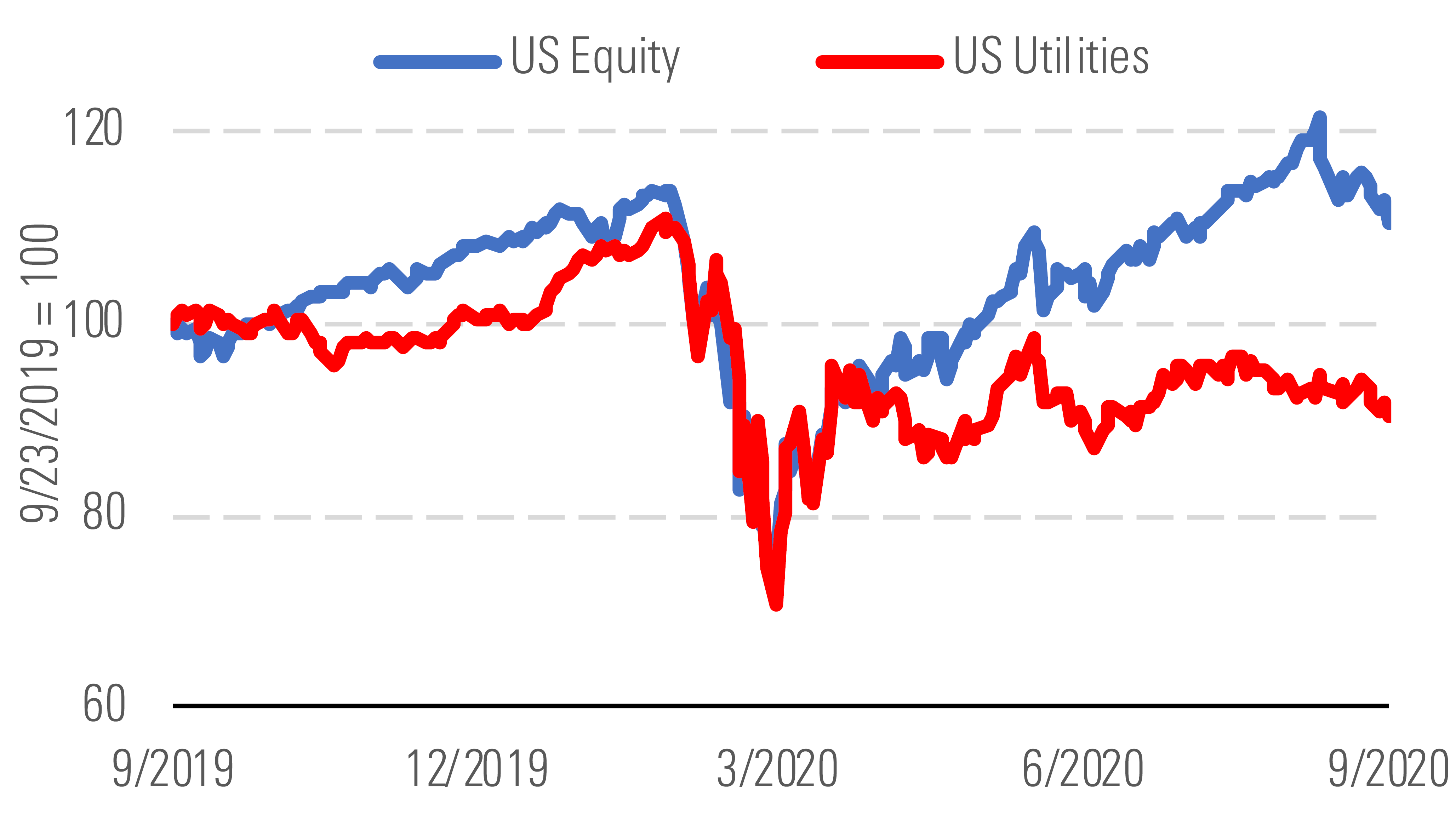

For many U.S. utilities, the new normal looks a lot like the old normal. Even though utilities have missed out on the market rebound since April, sector fundamentals remain strong and dividends keep growing. The harelike tech giants have jumped ahead in the bull market race for now, but tortoiselike utilities are healthy and well conditioned for the long run. Utilities are down 11% year to date through Sept. 23, including dividends, trailing all sectors except financials and energy.

No surprise: defensive utilities have trailed tech-driven market. - source: Morningstar

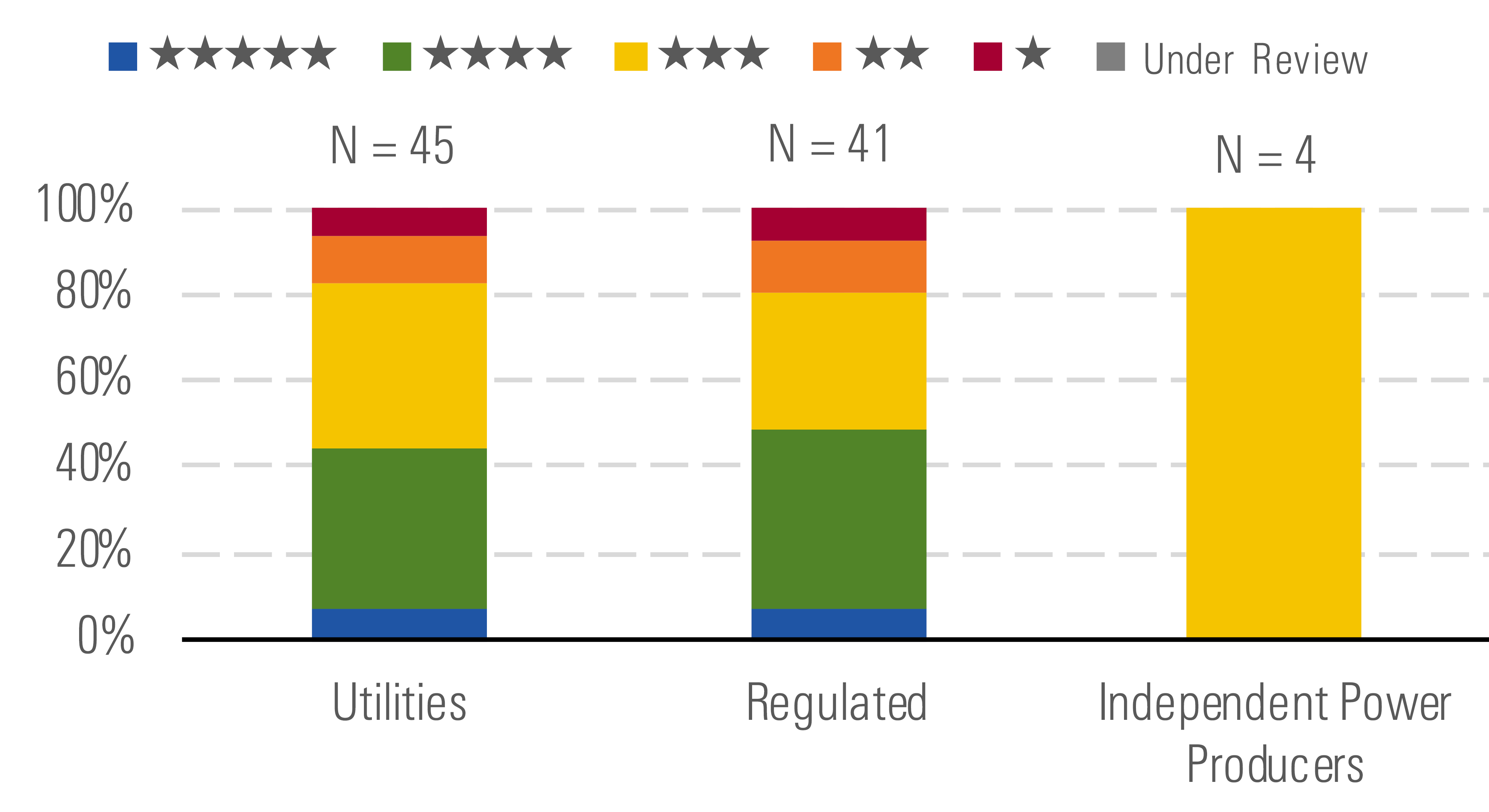

The soft bounce leaves utilities’ valuations modestly attractive. The sector went from 22% overvalued at its peak in late February to 25% undervalued at its bottom in March and now trades slightly below fair value. After nearly a decade of bloated valuations, we think investors finally have opportunities to buy high-quality utilities at reasonable prices with yields approaching 4%.

Utilities valuations remain attractive heading into fourth quarter. - source: Morningstar

Income investors should appreciate that utilities’ 3.3% average dividend yield remains historically attractive relative to interest rates. And investors don’t have to sacrifice dividend growth. Low financing costs, public policy support, and constructive regulation in most jurisdictions suggest a long runway of growth for the sector.

West Coast utilities are in a hot mess. The silver lining is that the California blackouts and wildfires demonstrate the need for huge infrastructure investment nationwide. Climate activists have called for more renewable energy investment, but the blackouts show that the distribution grid is not equipped to handle a large share of intermittent power. This means growth investment opportunities for all U.S. utilities.

Since the market downturn, utilities facing headline risk have traded at sharp discounts to peers. West Coast utilities such as Edison International, PG&E, and Portland General are among the cheapest in our coverage as of late September despite earnings and dividend growth potential that should outpace the industry average. FirstEnergy, which was caught up in an Ohio political scandal, has similarly attractive growth but trades well below peers. Gas distribution such as New Jersey Resources, CenterPoint, and NiSource also have fallen out of favor.

On the premium side, we think valuations have far outstripped growth potential and regulatory risk facing utilities like Xcel Energy, Eversource Energy, and American Water Works.

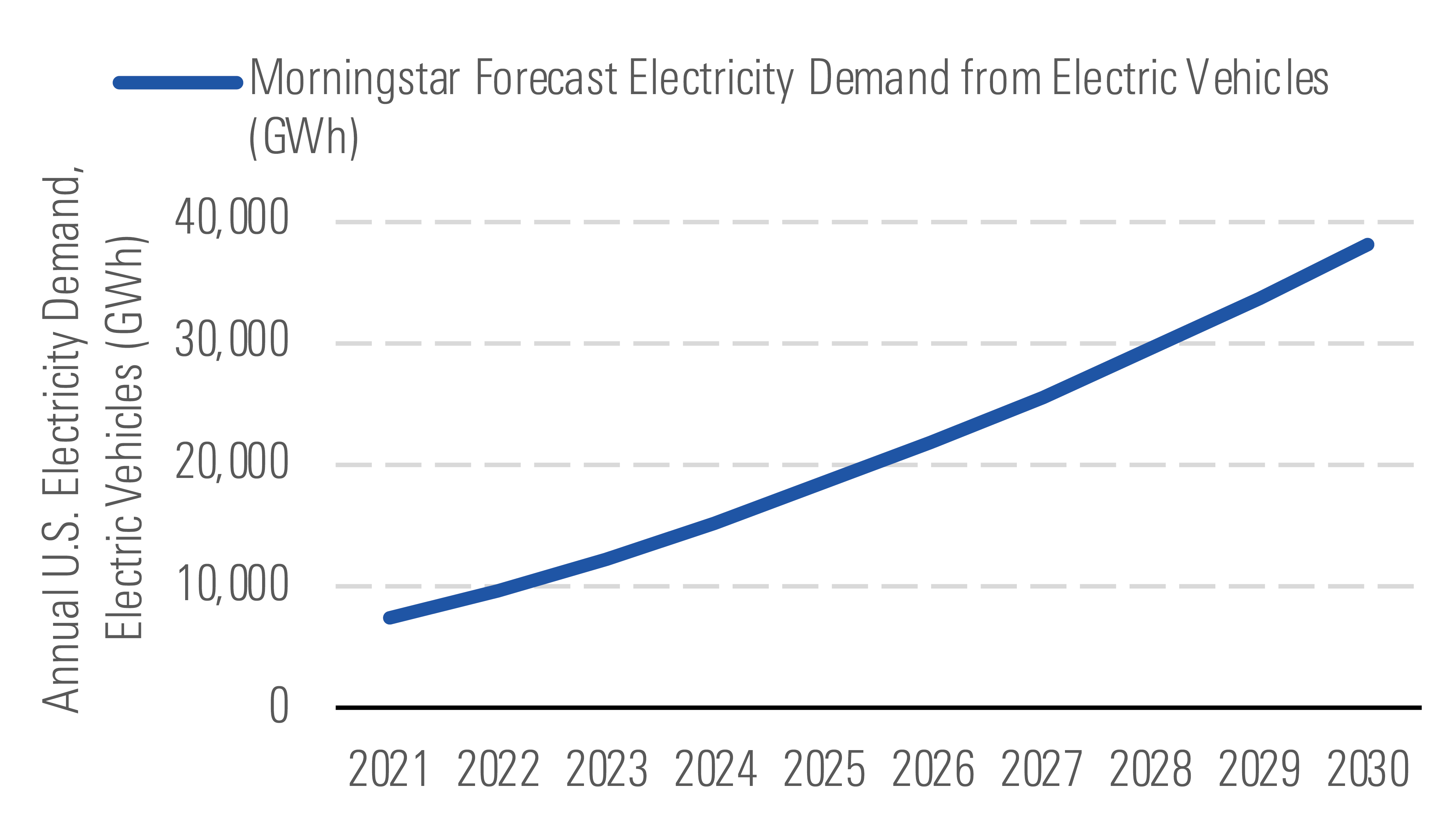

Electric vehicles help drive growing electricity demand. - source: Morningstar

Top Picks

FirstEnergy FE Star Rating: ★★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $44 Fair Value Uncertainty: Low

FirstEnergy's shares fell 30% in July following the arrest of the Ohio House Speaker and four others on racketeering charges. Although no FirstEnergy executives have been charged, this will strain regulatory and political relationships in Ohio for several years. However, FirstEnergy's underlying businesses are solid. Its three Ohio distribution utilities represent less than 20% of operating earnings and base rates are fixed until May 2024. As the bribery headlines and COVID-19 issues fade, we estimate 6.4% annual EPS and dividend growth driven by strong FERC-regulated transmission investment.

Edison International EIX Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $70 Fair Value Uncertainty: Medium

With the stock trading at a sizable discount to its peers and above a 4% yield, Edison offers a triple play of value, growth, and income. California political risk will always be a concern. However, California’s progressive energy policies also create more growth opportunities than most other U.S. utilities. Edison’s electric-only business, recent regulatory success, and $5 billion annual investment plan give us confidence that it can grow earnings 6% beyond 2020. Edison has stakeholder support to harden the grid against natural disasters, integrate renewable energy, and support electric vehicle adoption.

Duke Energy DUK Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $92 Fair Value Uncertainty: Low

Although Duke Energy likely will grow more slowly than its peers, we think its steep valuation discount is unjustified given its constructive regulation and investment opportunities that support consistent earnings and dividend growth. Florida remains one of the most constructive regulatory jurisdictions in the U.S., with sector-leading allowed returns on equity, automatic base rate adjustments, and strong growth investment potential. North Carolina continues to support Duke’s electric and gas infrastructure growth investments. South Carolina regulation has become more challenging, but we think Duke has enough growth investment potential in the state to compensate.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)