We'd Welcome a Pullback in Overvalued Tech

We're still fond of software and cybersecurity firms.

Technology has significantly outperformed the broader market in 2020 and over the past 12 months. We're hesitant to say that tech is in a bubble, as we see robust fundamental tailwinds supporting future growth for most of our coverage, such as cloud computing, remote working, 5G network rollouts, and the "Internet of Things." But a pullback in tech stocks would likely be healthy, as we view the sector as largely overvalued, with few buying opportunities today.

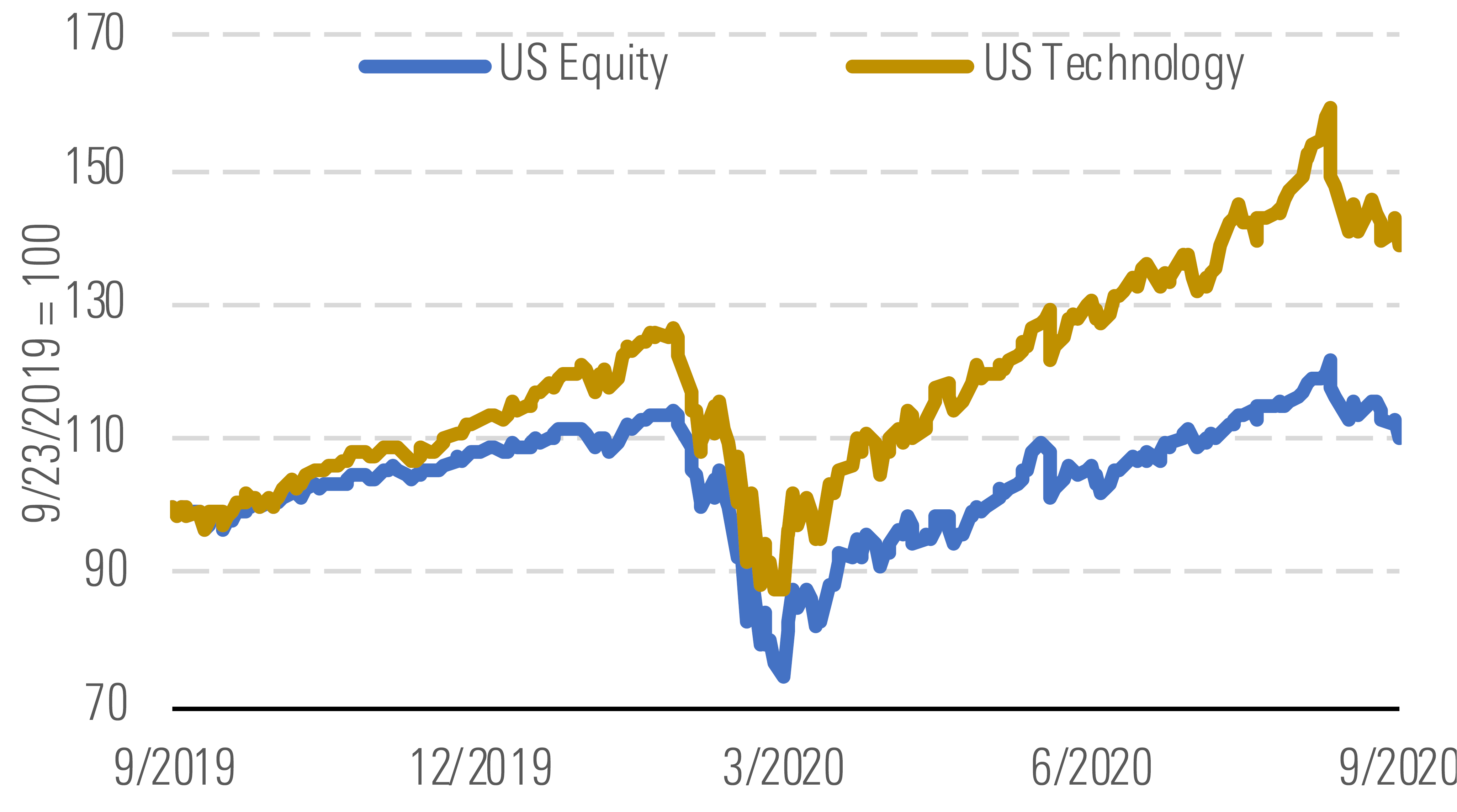

As of Sept. 23, the Morningstar US Technology Index was up a whopping 38.8% on a trailing 12-month basis, vastly outperforming the U.S. equity market, which is up 10.3% on a TTM basis. Over the past three months, tech also outperformed the broader market, up 6.0% compared with the broader U.S. equity market, up 5.1%.

Tech outperformed the broader market in both the sell-off and rebound. - source: Morningstar

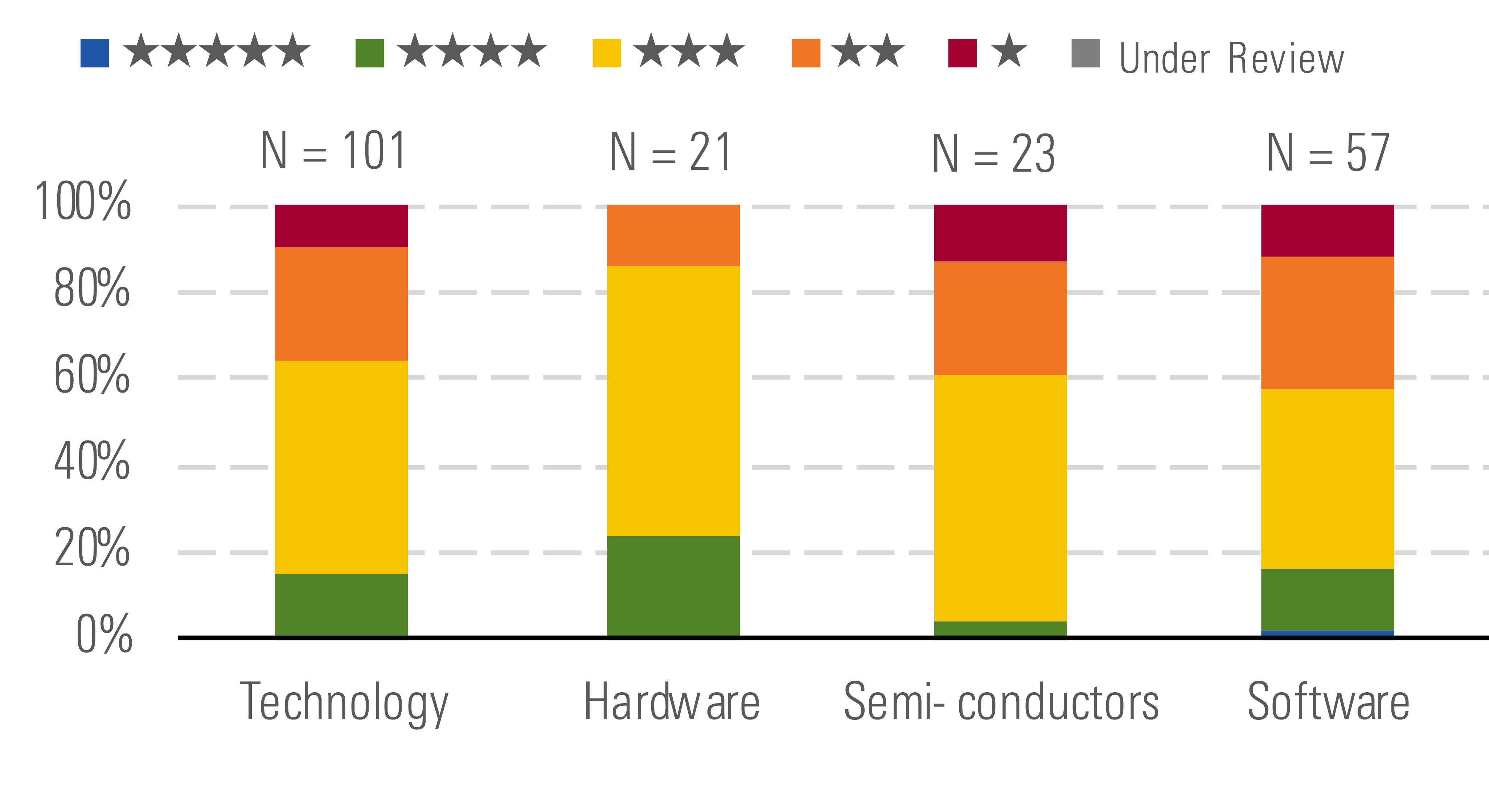

Earlier in the quarter, the median U.S. technology stock traded at around a 15% premium, which represents one of the frothiest valuations we've seen for tech since 2007. The median U.S. technology stock now trades at a 4% premium. We see very few buys today, similar to last quarter and even the months immediately before the pandemic. Hardware is still the cheapest subsector but it doesn't provide much value, as it's only 6% undervalued. However, the higher-quality names we cover tend to be in semiconductors and software. Most buying opportunities in these sectors evaporated with the COVID rebound, and the median stock in semis and software are now 7% and 6% overvalued, respectively.

Buying opportunities are rare in technology despite COVID-19. - source: Morningstar

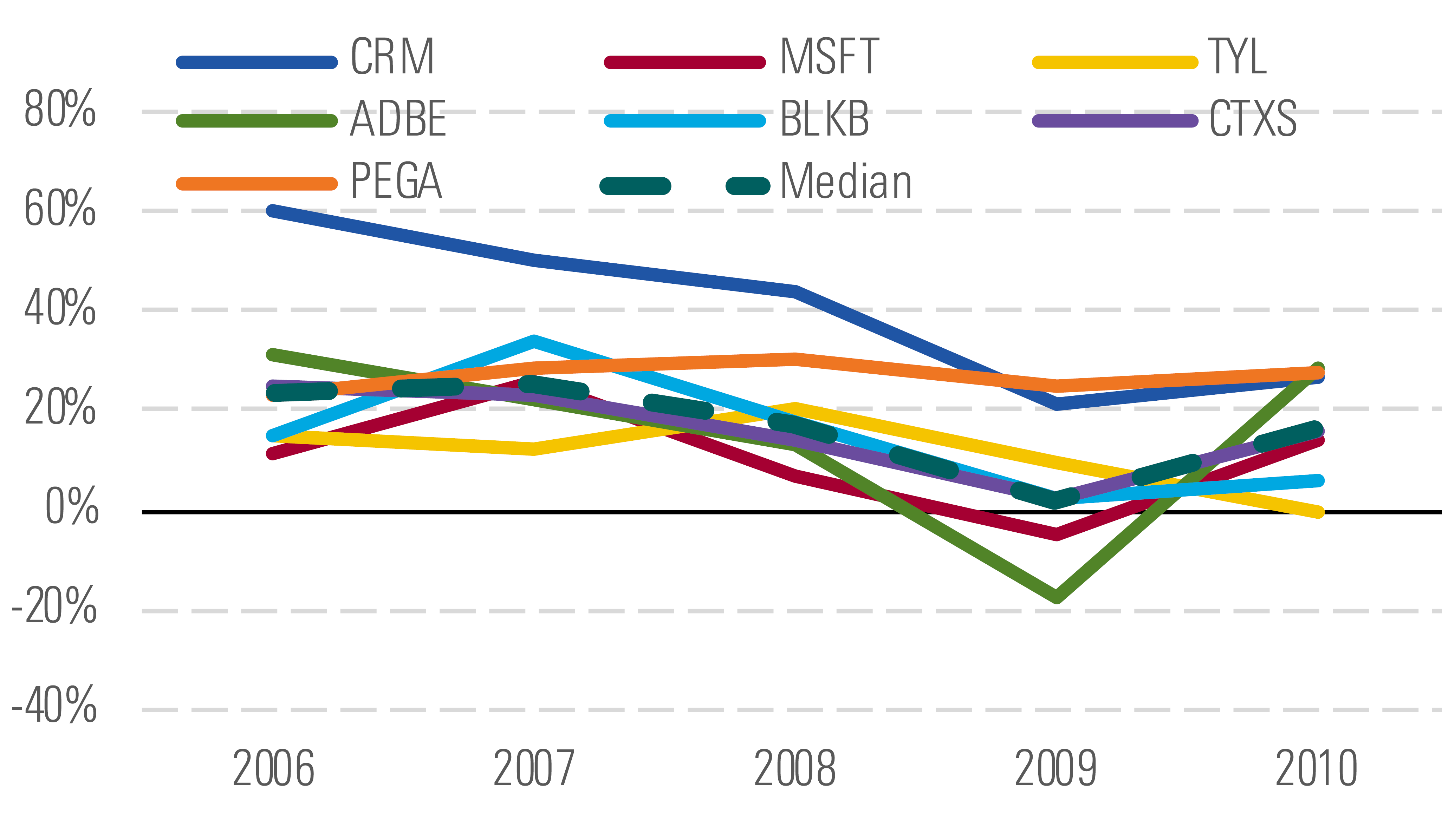

Independent of valuation, we remain especially fond of moaty software businesses, as these firms generate revenue on a subscription basis with little risk of cancellations, even as work shifts to homes and away from the office. Software was resilient during the credit crisis and has held up well in 2020 thus far. We continue to look at software as a bit of a safe haven in a COVID, remote working world.

Sample of software firms in '08-09 point to robust revenue amid a recession - source: Morningstar

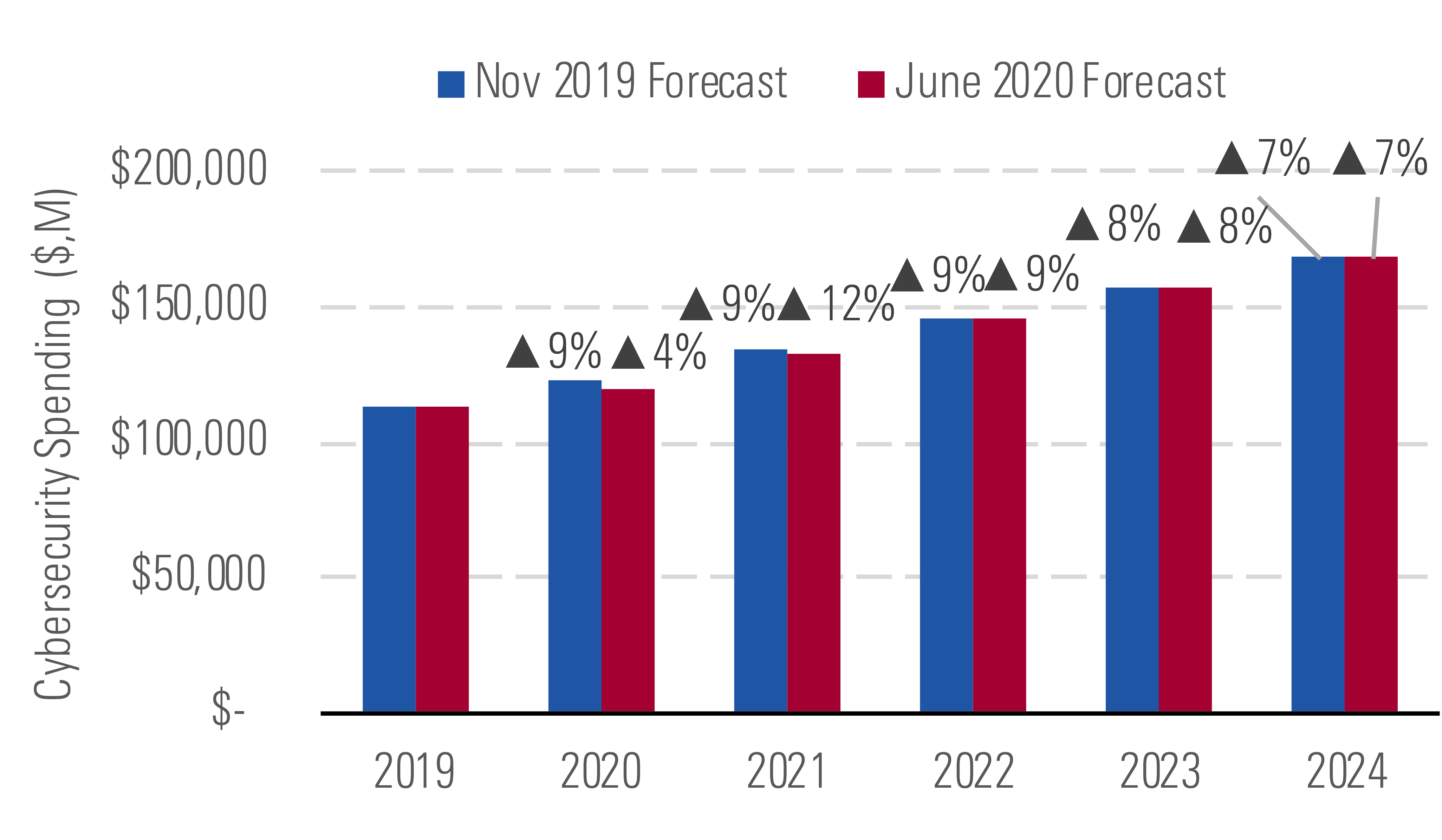

Cybersecurity also appears to be a bit of a haven. We've recently updated our security industry forecast but foresee minimal disruptions to prior spending patterns due to the pandemic. Besides their subscription revenue model, additional cyber solutions are being deployed as more people work remotely. The risk for bad actors disrupting data traffic won't slow down any time soon, so IT departments will remain proactive in monitoring its various software and solutions that each employee needs to be productive.

Cybersecurity spending should rise at a 9% CAGR through 2023 - source: Morningstar

Top Picks

VMware VMW Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $202 Fair Value Uncertainty: High

We believe that VMware's position as the commonality between public clouds, private clouds, and on-premises ecosystems gives it an enviable position. In our view, the company has nicely made the transition away from relying on server sales and has established itself as a key player in more nascent high-growth areas. The diversification into markets such as container management, end-user computing, software-defined networking, and security should help insulate VMware from hardware spending pauses or softer virtualization demand.

Palo Alto Networks PANW Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $305 Fair Value Uncertainty: Very High

Narrow-moat cybersecurity pure play Palo Alto Networks trades at an attractive discount to our fair value estimate. In our view, cyber threats do not yield to any global economic condition concerns, and the severely increased fines for data privacy woes and a dearth of talent within security make cybersecurity a top concern for enterprises. To supplement its firewall market leadership, Palo Alto aggressively built out a platform that contains cloud security and threat response automation. In our view, entities will favor adding on Palo Alto's security subscriptions over managing various vendors to alleviate toolset management burden.

Intel INTC Star Rating: ★★★★ Economic Moat Rating: Wide Fair Value Estimate: $70 Fair Value Uncertainty: Medium

Wide-moat Intel trades at an attractive discount to our fair value estimate of $70 per share. The chip titan's comprehensive product portfolio tailored to computers from the data center to the edge gives us confidence in the firm's long-term growth prospects, despite a declining PC market and a recent delay in the rollout of cutting-edge chip manufacturing. We applaud Intel's scattershot approach to address challenges in computing (artificial intelligence and cloud), connectivity (5G), and memory, while its acquisitions have unlocked new growth vectors outside of PCs and the data center.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)