Travel and Leisure Companies Ready as Americans Venture Out Again

We expect car and local travel to rebound before international and air travel.

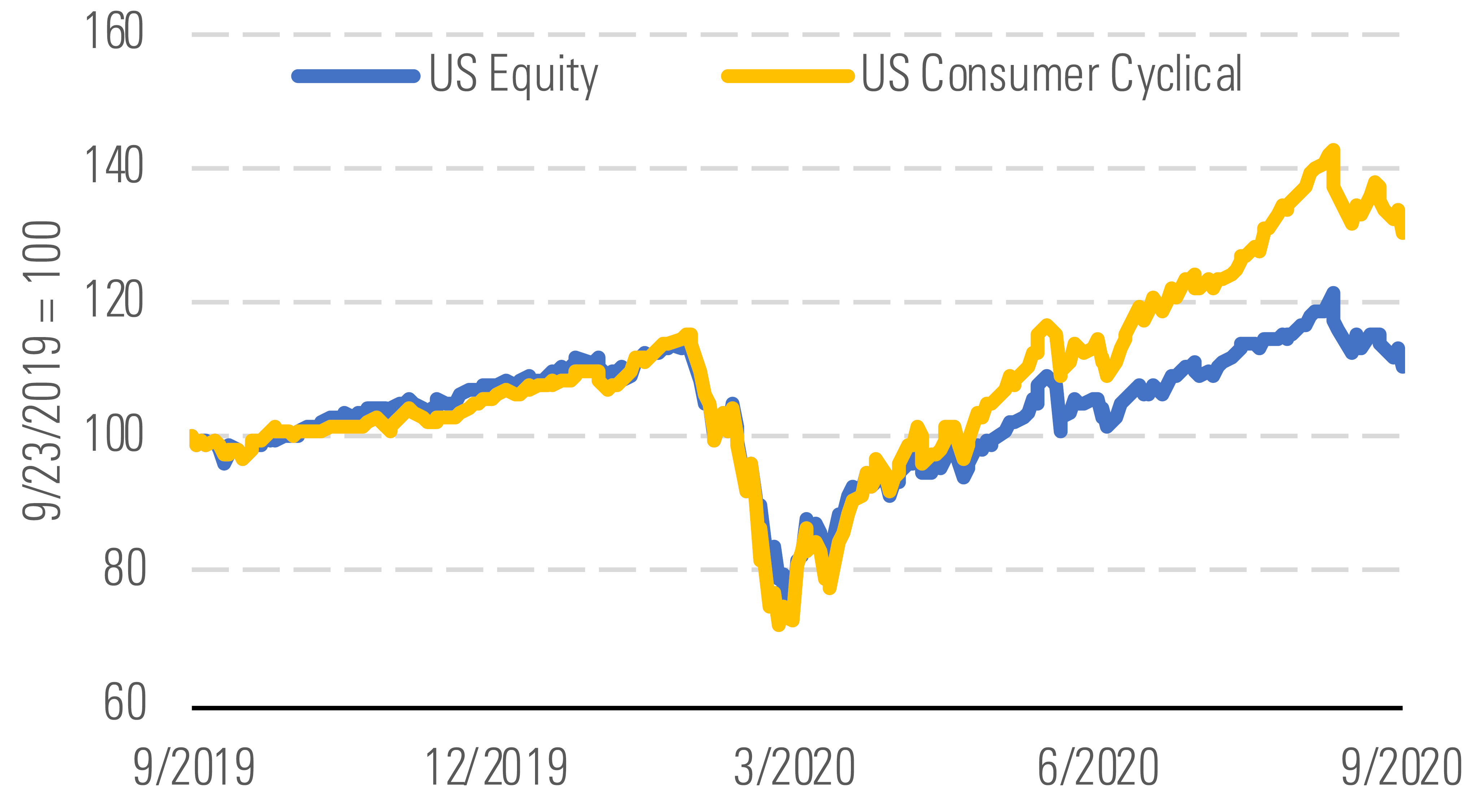

The consumer cyclical sector has continued to rebound as more nonessential businesses reopen, building on the trends we saw in the second quarter. More specifically, the sector outperformed the market in the quarter through Sept. 23, returning 15.2% compared with the market’s 5.1%.

Consumer cyclical has overperformed the broader market. - source: Morningstar

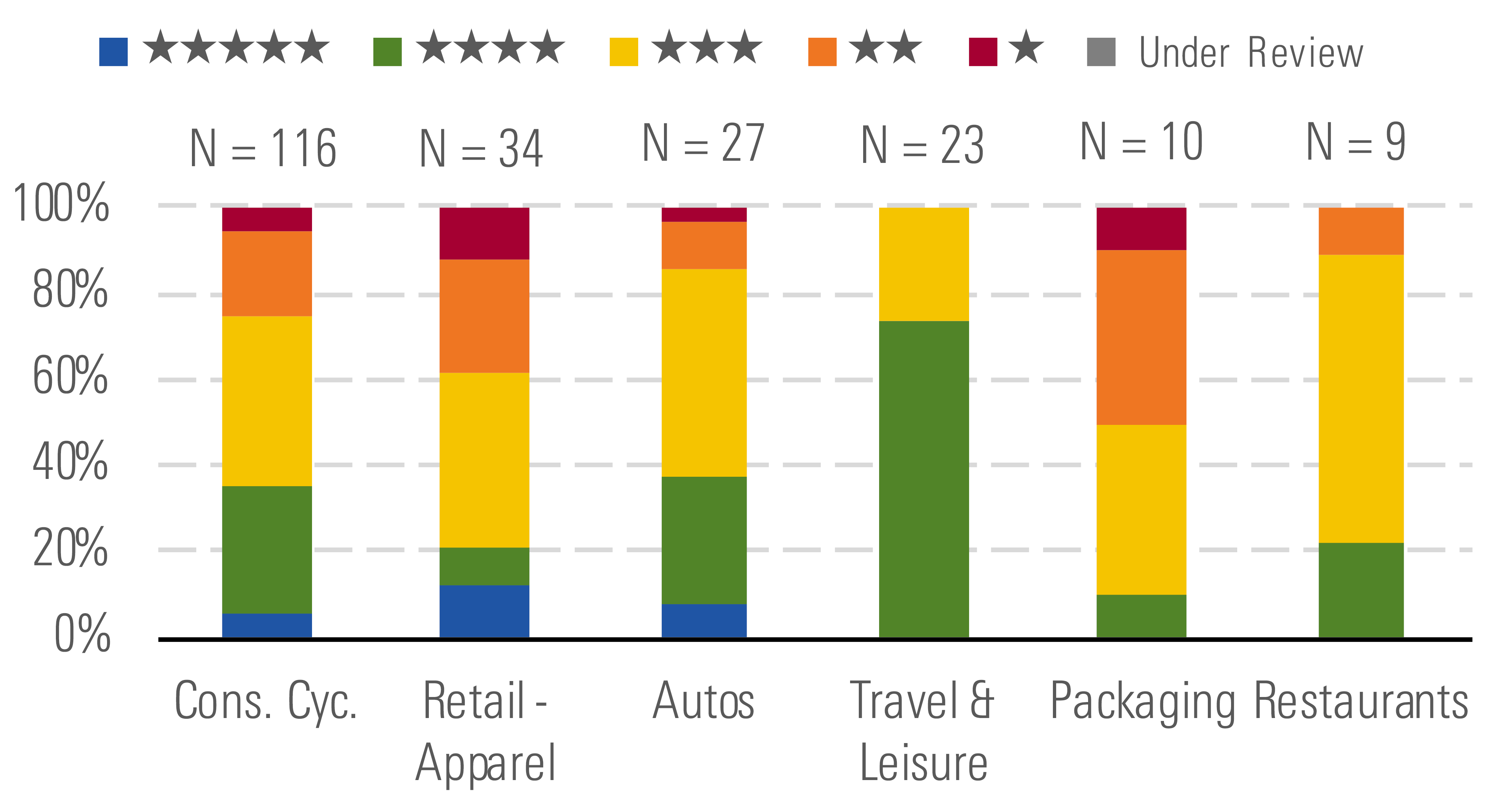

Despite these recent gains and our view that the sector is fairly valued, we still believe there is opportunity in travel and leisure, where more than 50% of the subsector trades in 4-star territory.

Opportunities exist in travel and leisure. - source: Morningstar

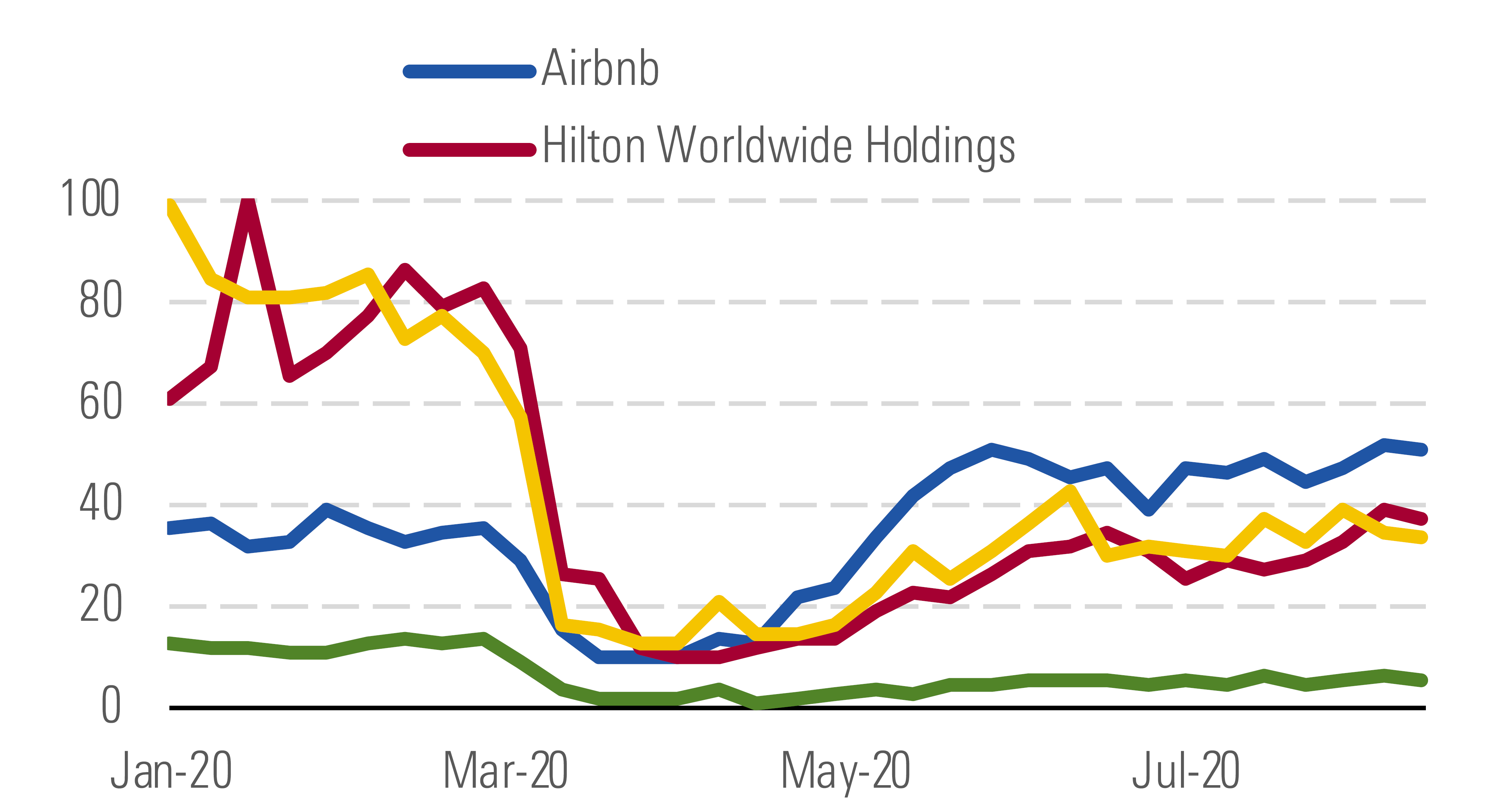

As mandatory lockdowns and travel restrictions are lifted, we foresee consumers beginning to travel again, albeit in a slightly different form than before the pandemic. Data from Edison Trends shows homestay company Airbnb exceeding three major hotel companies in online spending as a percentage of peak levels as travelers seek to avoid crowded, once-popular locations in exchange for more self-contained remote trips. Home stays offer an advantage over traditional hotels, as they allow the occupant to control more of the environment and cut down on communal spaces. While there has been an uptick in travel this summer, even Airbnb is still at about 50% of peak levels, indicating that the industry has room to rebound further. We expect this trend to continue, with car and local travel rebounding before international and air travel.

Home stays have recovered faster than traditional hotels. - source: Morningstar

That said, in our long-term outlook we assume a full recovery in travel demand based on past demand shocks by 2024 (with the exception of cruise lines, which may take longer) as most of the subsector has strong liquidity and can continue to operate at decreased levels through 2021. We believe companies with a robust balance sheet are best positioned to weather the current travel uncertainty.

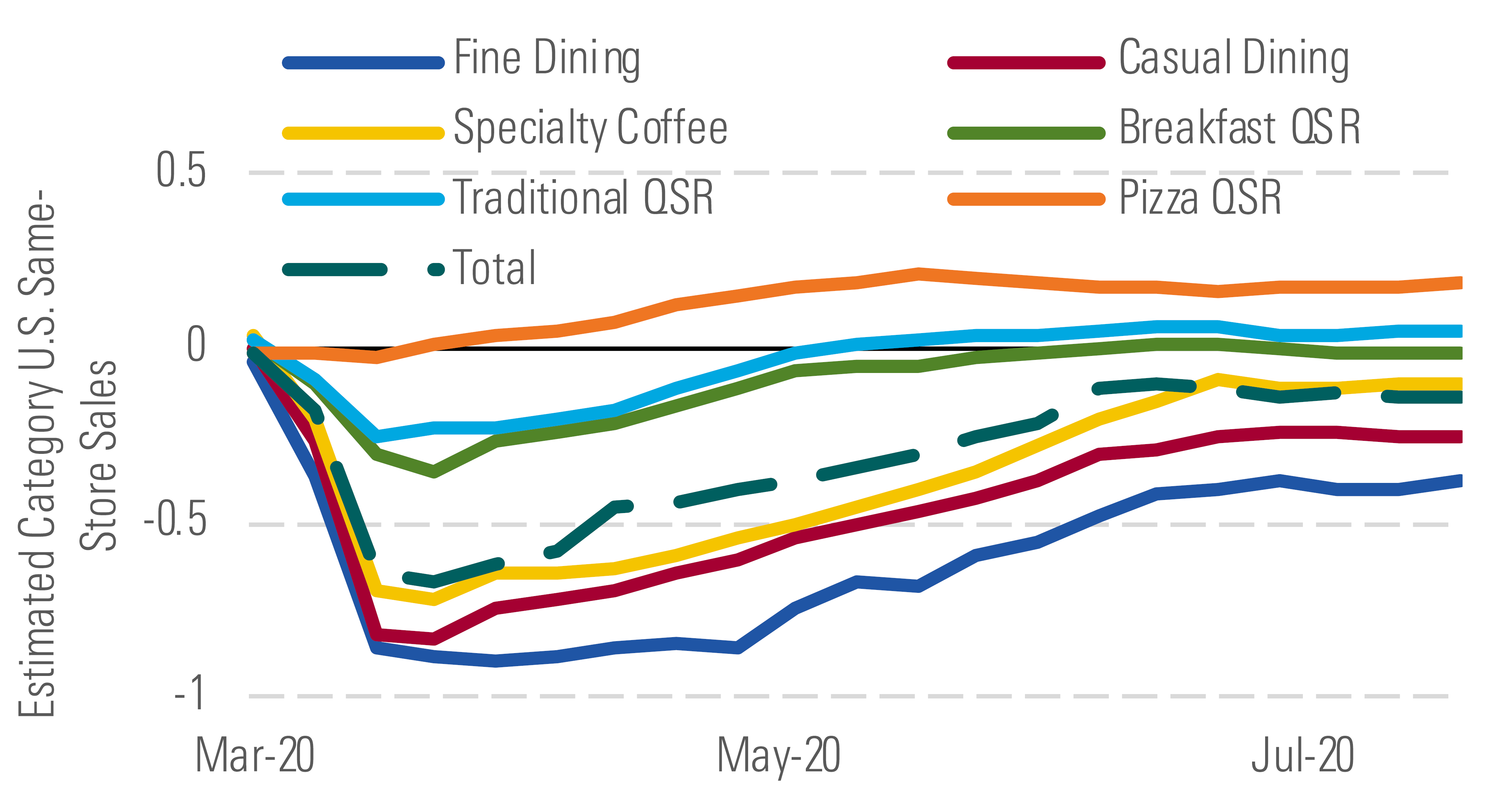

Restaurants’ recoveries have been similarly fragmented, with fast-casual and quick-service restaurants (especially within the pizza segment) rebounding more quickly than more upscale establishments. We expect more restaurants to permanently close as we get closer to the winter months, as limitations on indoor dining could lead to reduce capacity again. However, we believe this opens up opportunity for surviving businesses to take share, and we anticipate a strong return in 2021. We also foresee the trend toward digital ordering and delivery to continue even past the pandemic.

Not all restaurant categories are recovering at the same pace. - source: Morningstar

Top Picks

Macy's M Star Rating: ★★★★★ Economic Moat Rating: None Fair Value Estimate: $16.30 Fair Value Uncertainty: High

No-moat Macy’s has struggled to adjust to market changes in recent years, but we view it as undervalued at a 63% discount to our fair value estimate. While the COVID-19 crisis poses a major challenge, Macy’s large e-commerce (54% of second-quarter sales), liquidity of more than $4 billion, and cost cutting should allow it to survive. We think the firm will achieve planned run-rate savings of $2.1 billion by the end of 2022 through layoffs, closures of at least 125 low-performing stores, and operating efficiencies. Also, there is value in Macy’s large real estate holdings, which can be monetized if necessary.

Nordstrom JWN Star Rating: ★★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $33.50 Fair Value Uncertainty: High

We view Nordstrom as attractive, as it trades at about a 60% discount to our estimate of its intrinsic value. While its sales and earnings continue to be affected by the pandemic, we believe its solid expense control, ownership of the off-price Rack chain, and strong e-commerce (61% of second-quarter sales) offset some of the impact and expect it will return to profitability next year. Over time, we see opportunities for Nordstrom to gain share as some rivals are hampered by financial difficulties and store closures. We continue to believe Nordstrom has a brand-based intangible asset, the source of our narrow moat rating.

Tapestry TPR Star Rating: ★★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $35 Fair Value Uncertainty: High

We believe Tapestry, currently trading at about a 50% discount to our fair value estimate, offers a good opportunity for investors. While the firm will continue to be affected by the COVID-19 crisis in fiscal 2021, it announced a plan—the Acceleration Program—to improve e-commerce, focus on core styles, and cut costs by about 10%. We believe Tapestry will return to profitability this year and that Coach’s brand strength, the source of our narrow moat rating, remains intact. Coach also benefits from its large direct-to-consumer operation (94% of fiscal 2020 sales) and exposure to China, the world’s fastest-growing luxury market.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)