Are Nasdaq Stocks Really Overvalued?

The tech-focused index has hit record highs this year before a rough patch in September. How are its biggest companies valued after recent volatility?

Tech stocks have come back to earth in September after a stellar 2020, with the Nasdaq index crashing more than 1,000 points this month. Morningstar analysts are not surprised that the big-name tech stocks have fallen back to earth, as valuations had gotten stretched to the breaking point before September’s sell-off, says managing director Dave Sekera: “Not only is it the most richly valued of all the sectors we cover, but neither it nor any other sector has ever traded at such a high price/fair value ratio since we started calculating this metric in January 2007.”

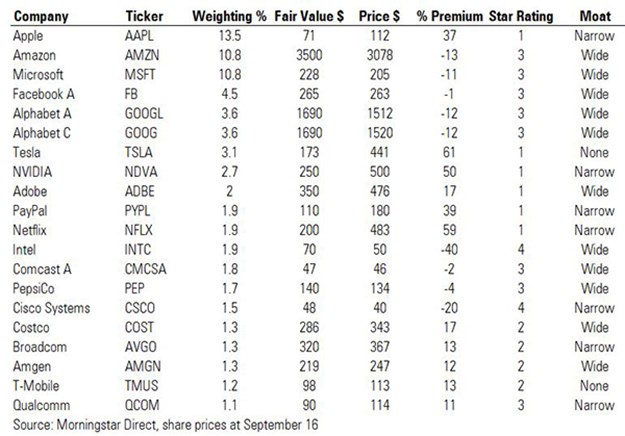

Morningstar’s fair value estimate, which feeds into the star rating for stocks, strips out market sentiment and looks at the company fundamentals, such as cash flow, debt, and profits. So just how overvalued are the top 20 Nasdaq stocks?

Using Morningstar Direct data, we’ve looked at how far off the biggest companies are from their fair values--six companies in the top 20 have a 1-star rating, which means that the shares are significantly overvalued. But some of the big names that have done so well this year--Amazon AMZN, Google owner Alphabet GOOG, and Microsoft MSFT--are still trading below their fair values.

Exhibit 1

The Nasdaq launched in 1971 with a a value of 100 and by early 2010 had passed the 2,000 mark. In June this year, the tech-focused index made its first move above 10,000 points. Plenty of experts think the tech rally is now vulnerable after such a strong run and are reducing their exposure to the sector. Still, the FAANGs have defied predictions of their imminent collapse before: Apple AAPL was considered by some to be overvalued at a $1 trillion market cap in 2018 and it’s now worth $2 trillion, more than the whole of the UK’s FTSE 100 index. Apple has the biggest weighting on the Nasdaq, ahead of Amazon, and just underwent a stock split.

Morningstar analyst Abhinav Davuluri put out a note after the stock split, saying that new Apple investors should be cautious about jumping in now: "We recommend prospective investors wait for a wider margin of safety given the precarious state of the global economy, particularly as shares have appreciated more than 125% from mid-March lows."

ClearBridge chief investment officer Scott Glasser believes tech valuations have become stretched and the recent correction was a healthy one. But that doesn’t change the long-term investment prospects of some of these companies--it just means that people investing now shouldn’t expect too much upside over the next six to 12 months.

Most Overvalued versus Most Undervalued The most overvalued stocks in our list are Apple, Tesla TSLA, NVIDIA NVDA, Adobe ADBE, and Netflix NFLX, all of which have benefited from this year's changes to the way we live and work.

Tesla has benefited from momentum trading and a dramatic re-rating of the company’s prospects, which has pushed shares into the stratosphere this year and sparked a stock split, occurring on the same day as Apple's. Morningstar analysts assign a fair value of $173 to Tesla shares, but they are currently trading at a 61% premium to this at $449. Of the Nasdaq 20, it’s by far the most overvalued, according to Morningstar metrics.

Morningstar analyst David Whiston acknowledges the company’s potential but thinks the global mass adoption of electric vehicles is still years away: “Tesla will have growing pains, recessions to fight through before reaching mass-market volume, more competition, and needs to pay off debt. It is important to keep the hype about Tesla in perspective relative to the firm's limited, though now growing, production capacity.”

Among the 2-star stocks, there are two non-tech companies: retail giant Costco COST, and biotechnology firm Amgen AMGN. These are are trading 17% and 13% above their fair values, respectively, and have both benefited from this year's trends.

Among the most undervalued companies in the top 20, chipmaker Intel INTC is trading 40% below its fair value, according to Morningstar analysis. Along with networking and data firm Cisco Systems CSCO, which is trading 20% below its fair value, Intel is one of two companies in the top 20 with a 4-star rating.

/s3.amazonaws.com/arc-authors/morningstar/31386fbf-60e6-4ce6-aad8-4a4cb1fc6847.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/31386fbf-60e6-4ce6-aad8-4a4cb1fc6847.jpeg)