More Risk, More Reward for U.S. Equity Funds

U.S. stock funds leading the rebound share a common trait: Morningstar Risk ratings of High.

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Investors looking to see which funds fared the best in riding the equity market's fast-and-furious rebound from the coronavirus-driven lows of March 2020 will find at least one common denominator: The winners carried Morningstar Risk ratings of High.

These strategies included funds with heavy concentrations in individual stocks, such as Tesla TSLA, sectors such as communication services, or regions.

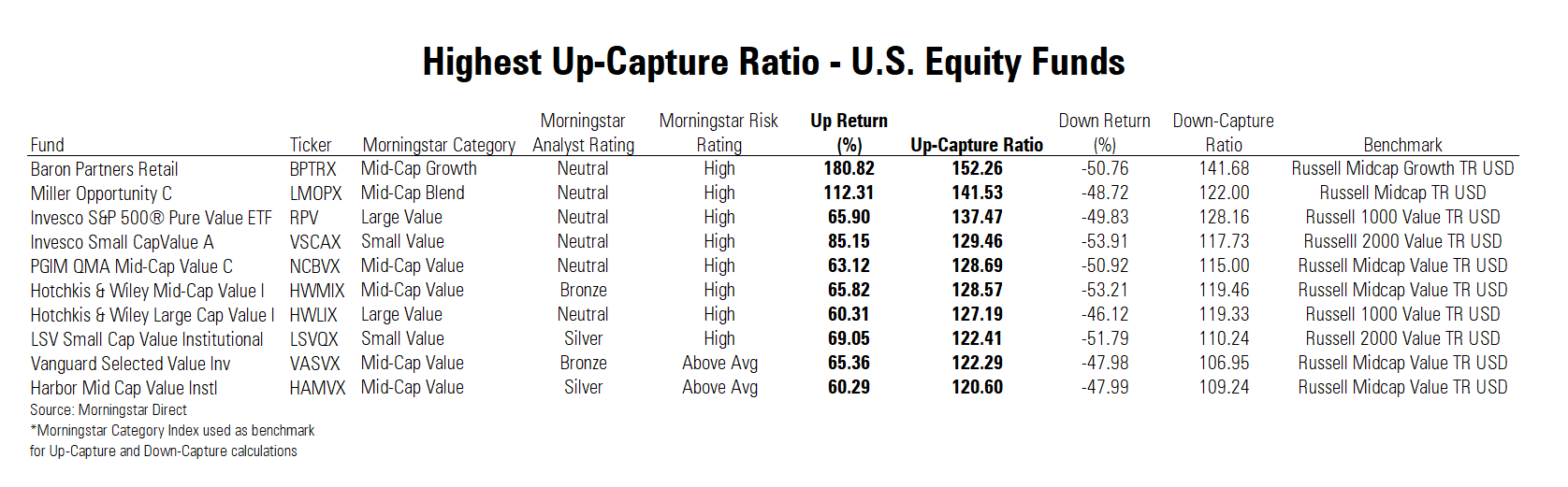

We screened the diversified U.S. stock fund universe for the best performers based on their up-capture ratio. This metric compares a fund's performance with that of a benchmark that aligns with its place in the Morningstar Style Box, such as large-growth funds with the Russell 1000 Growth Index. A large-growth fund with an up-capture ratio of 110 would have returned 110% of the Russell 1000 Growth's performance from the time that index bottomed on Feb. 23, 2020, through Sept. 2, 2020.

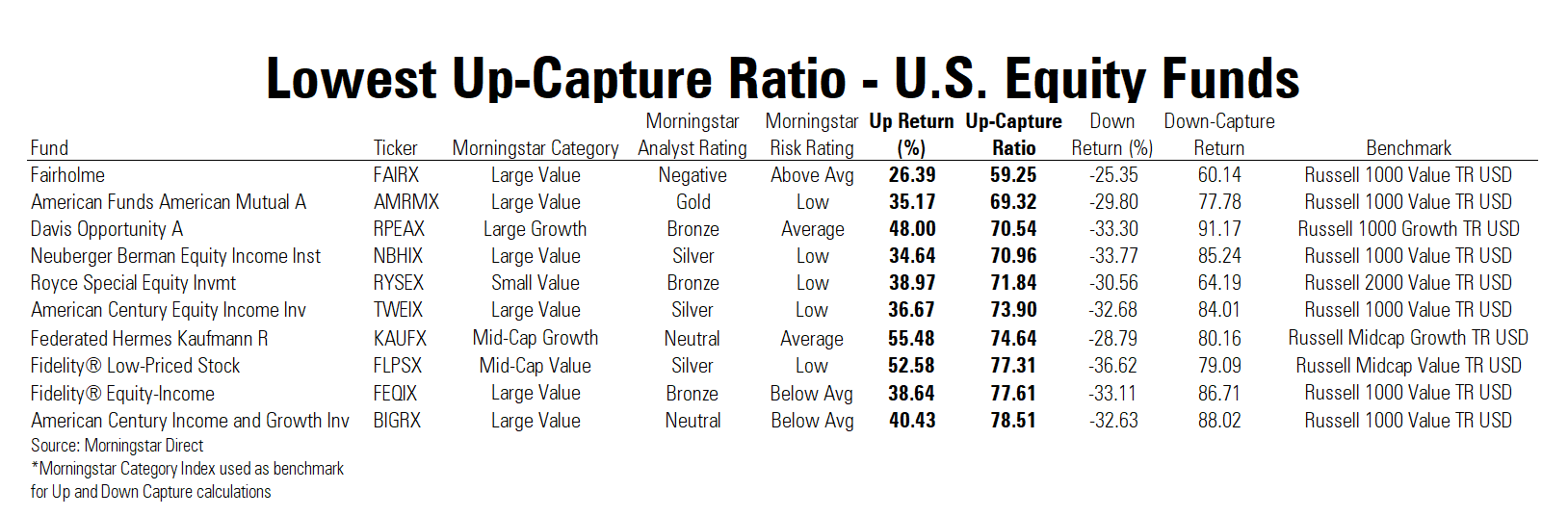

From there we looked at the funds at the top and bottom of the list through the prism of the Morningstar Risk rating, which is based on fund's volatility during periods of investment losses.

The pattern was clear. Of the 10 U.S. stock funds with the higher up-capture ratios, eight carried a High risk rating, and two were Above Average. Of the top 25, 19 were rated High and six Above Average.

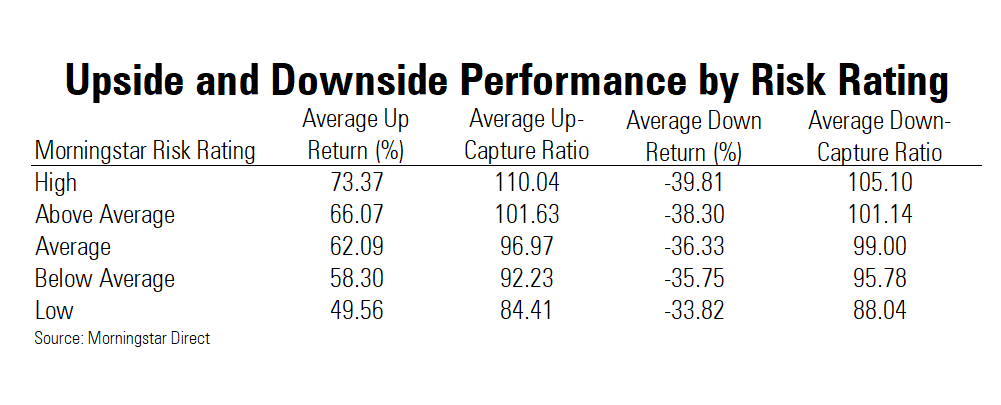

Overall, the high-risk funds had an average up capture of 110.04 compared with their low-risk counterparts' up capture of 84.41.

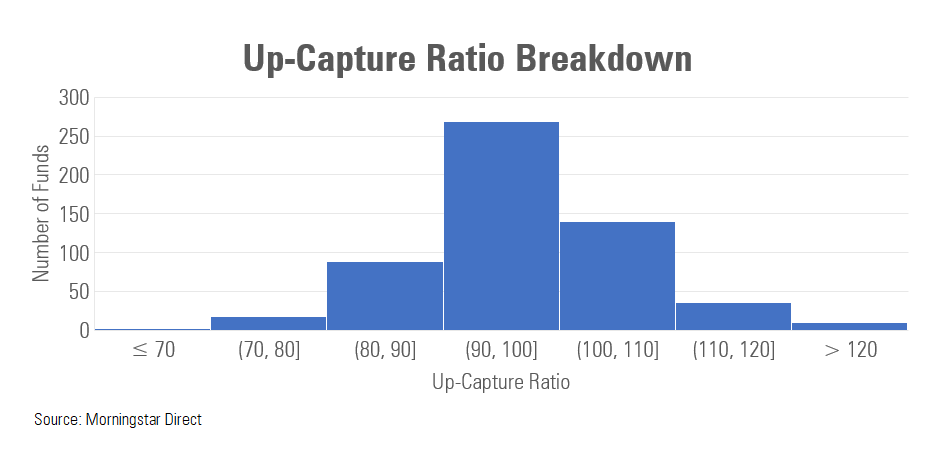

The following chart shows the distribution of how stock funds performed relative to the benchmarks. For this data, up capture was measured using each benchmark's respective trough and peak. For value benchmarks, the uptrend started in late March and peaked in mid-June. Growth benchmarks, on the other hand, also began their rally in late March but more recently peaked in early September. The oldest share class of each U.S. equity fund under Morningstar coverage was used, totaling 562 funds.

On average, stock funds underperformed their benchmarks, with an up capture of less than 100.

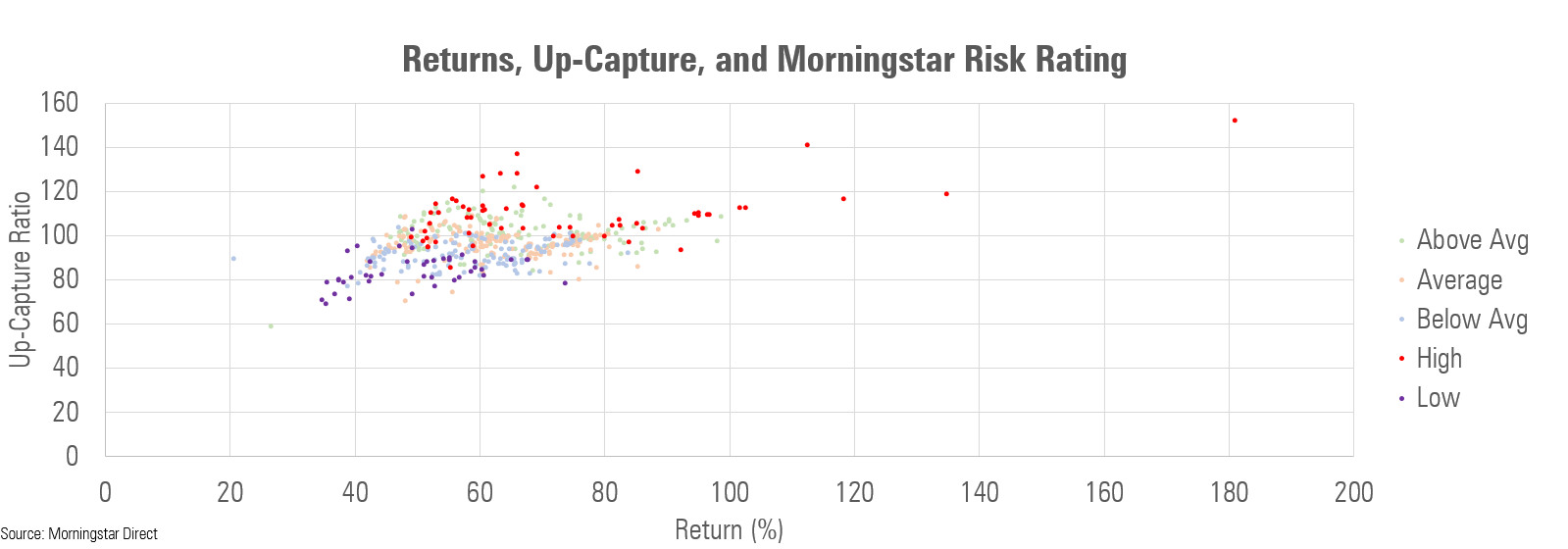

The connection between risk and performance during the market's post-COVID-19 sell-off becomes clear in the following chart. For this we plotted funds' up-capture statistics against their return and then highlighted the funds by risk rating.

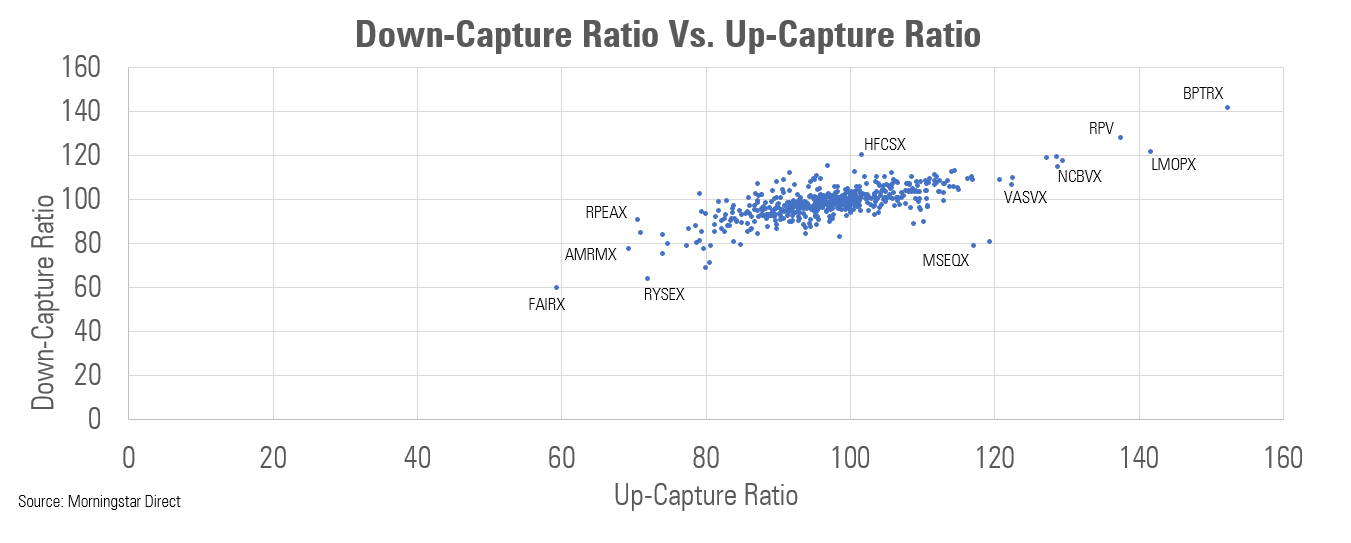

Of course, it's also important for investors to understand how these funds performed during the market collapse. The following chart highlights that the funds with the higher up captures also tended to suffer the largest relative declines. To get the down-capture data, the returns of each fund during the drawdown were compared with the peak and trough dates of the fund's Morningstar Category index. This index was used as the calculation benchmark for each fund to determine the down-capture ratio. The peak of the benchmarks varied from mid-January to mid/late February, but they all bottomed out in late March.

Because the funds that performed well during the rally were also the riskier funds, those funds were also hit the hardest during the initial drawdown.

The following table summarizes the relative performance along the spectrum of risk for funds during this roller-coaster market. One takeaway: While the gap in average returns between high- and low-risk funds was nearly 24 percentage points, low-risk funds outperformed high-risk funds in the downdraft by only an average of 6 percentage points. That may in part reflect the nature of the February-March stock market plunge, which especially in its early days was broad-based and indiscriminate. The rally, however, was concentrated in sectors such as technology and communication services.

So, which funds fared the best? The following table lists the U.S. stock funds with the 10 best up-capture ratios based on their respective benchmarks.

At the top of the list is Baron Partners BPTRX with an up-capture ratio of 152.26 and a massive 180.82% trough-to-peak return. Morningstar senior analyst Christopher Franz pointed to the fund's heavy weight in Tesla as a key driver of its performance. As of June 30, 2020, the fund had allocated over 30% of its portfolio to electric vehicle company. The fund has an impressive long-term track record, ranking in the top percentile of the mid-cap growth category for the last one-, three-, five-, 10-, and 15-year periods.

Next in line is Miller Opportunity LMOPX, which has a Morningstar Analyst Rating of Neutral and is run by veteran fund manager Bill Miller. It registered an up-capture ratio of 141.5 and a return of over 112%. Morningstar senior analyst Kevin McDevitt points to the fund's top-10 holdings Amazon.com AMZN, Facebook FB, and Alphabet GOOG as fueling the returns. "Beyond that, the fund's 34% position in consumer discretionary names, like Amazon, Peloton PTON, which Miller bought in 2019's third quarter, and Farfetch FTCH, has been a home run," McDevitt said. Miller Opportunity has been on a hot streak, ranking in the top 5% of the mid-cap blend category for the past one- and three-year time frames and in the top third for the past five years

Neutral-rated Invesco S&P 500 Pure Value ETF RPV rounds out the top three. "RPV is one of the riskiest funds in the large-value category," said Morningstar's director of passive strategies Alex Bryan. "It has a high market beta, tending to outperform in market rallies and underperform during downturns. That's because it has considerable exposure to cyclical areas of the market, like consumer cyclical, energy, basic-materials, and financial-services stocks." Bryan added that the fund's "holdings often have weak fundamentals and trade at low valuations for good reason." Despite its short-term outperformance, the Invesco fund has struggled in the long term. The fund ranks in the bottom 97th percentile of its category over the past five years, with an annualized total return of 2.8%.

Negative-rated Fairholme FAIRX had the lowest up-capture ratio. McDevitt noted in his analyst report that the fund was facing a liquidity crisis back in 2016 and that cash was 42.7% of assets in August 2019. He also noted that, "The rest of the portfolio remains highly concentrated and speculative." The longer-term performance of Fairholme has also been grim. As of Sept. 16, 2020, the fund was in the bottom 100th percentile with just a 0.71% annualized return over the past five-year period. Going back 10 years, the fund was still in the lowest percentile for its category.

The second-worst performer of the group was American Funds American Mutual AMRMX. Strategist Alec Lucas noted that its performance was in line with its history. "American Funds American Mutual is a conservative large-cap strategy aimed at capital preservation as much as capital appreciation," he said. The fund has regularly kept a double-digit stake in cash and bonds combined. As of June 30, 2020, it had 7.2% of its assets in cash and another 1.0% in bonds, Lucas noted.

In addition, Lucas said, "Stock-specific issues contributed to its low down-capture ratio, too." For example, top-five holding Gilead Sciences GILD held up well in the coronavirus sell-off, but its share price actually declined in the subsequent rally.

Over the long term, American Funds American Mutual has been a strong performer. As of Sept. 16, it was in the top quintile in the large-value category over the past 10-year period. Over the past five-year period, the fund was in the top decile of funds in its category, with a 9.91% annualized return.

Ranking slightly better in its up-capture ratio was the Davis Opportunity RPEAX, which Lucas also covers. He said that as of June 30, 2020, the fund had roughly 20% of its assets in non-U.S. securities. This included an 11.2% stake in the preferred stock of three foreign private companies. He then went on to note, "Davis Opportunity's valuations for Didi and Grab both peaked in September 2019 but have come down since the global pandemic hit and haven't risen back up." The Davis fund has been a long-term laggard for overall performance, finishing in the 91st percentile over the past 10-year period. As of Sept. 16, the fund had performed even worse over the past five-year period, finishing in the 95th percentile of the large-growth category.

The fourth-lowest up capture was Neuberger Berman Equity Income NBHIX. Morningstar's Nicholas Goralka notes in his analysis that, "The team uses bottom-up analysis to search for stable, financially prudent companies with strong dividend histories." He then goes on to say, "The resulting portfolio offers investors strong downside protection." Over the past 10-year period, the fund ranks in the bottom quintile in the large-value category.

Royce Special Equity RYSEX placed fifth-lowest for up capture. "Manager Charlie Dreifus tends to avoid debt-laden firms, and while many such firms took a beating in the early days of the pandemic, the government's actions and the Federal Reserve's rush to shore up the corporate debt market eased some pressures on those firms and many of them rallied strongly," said Morningstar senior analyst Tony Thomas. "Special Equity missed much of that."

The portfolio's performance was also weighed down by a lack of healthcare exposure. "Even though that's not much of the benchmark, it was a segment that did pretty well," Thomas noted. However, Royce Special Equity has performed quite well over the long term, ranking in the 12th percentile in the small-value category over the past five-year period. And over the past 10 years, it has an annualized return of 7.83%, putting it in the top half of its category.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)