New ETFs Give Fixed-Income Investors Cheaper Options

We examine the 18 new entrants.

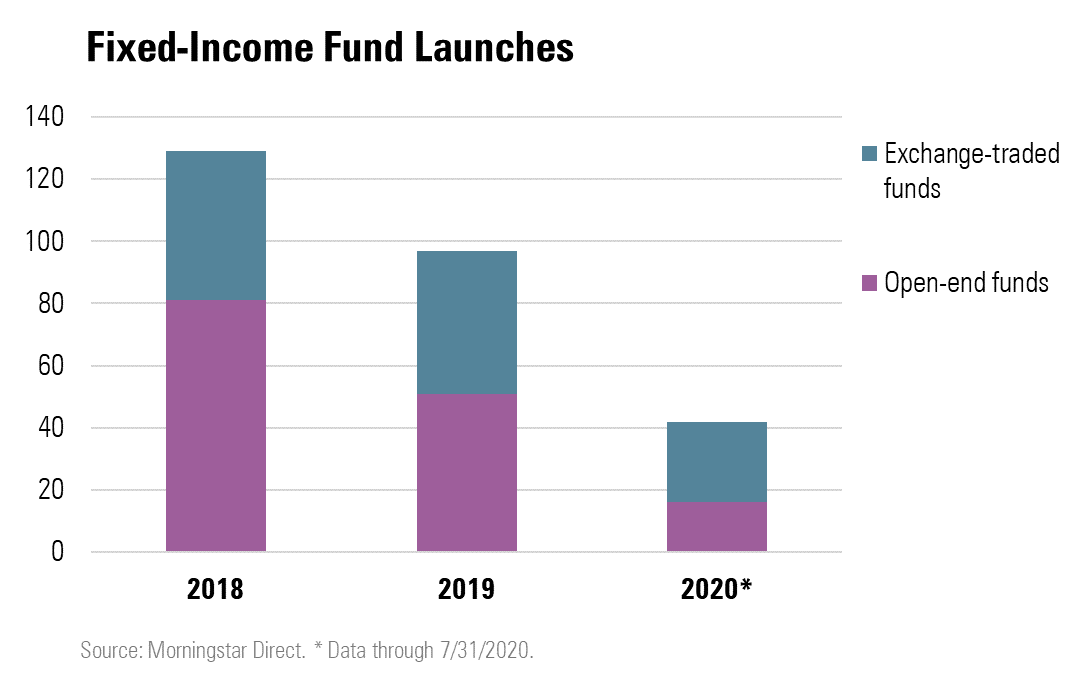

The growing number of bond exchange-traded funds launched in 2020 has made it easier for investors to find cheaper fixed-income funds--both actively managed and index-tracking strategies. This year’s crop of 18 new bond ETFs continues the trend of recent years for an increased number of bond strategies available in an exchange-traded wrapper. Offerings since 2018 include bond ETFs from Vanguard, Pimco, and Fidelity.

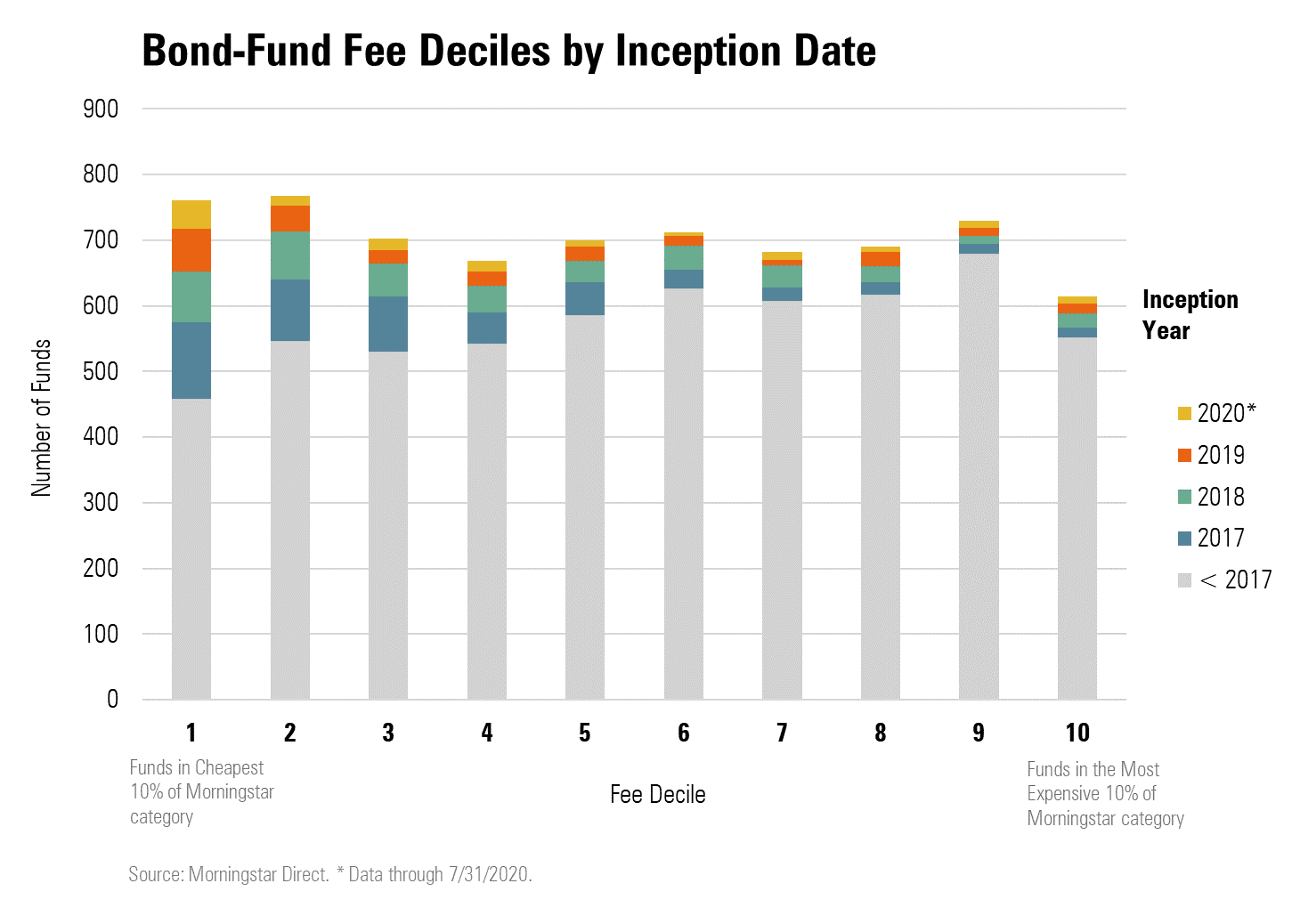

These newer funds have increased fee competition in most bond categories--good news for investors. Of the fixed-income funds that are among the cheapest 10% of their respective Morningstar Categories, 40% were launched in the past four years.

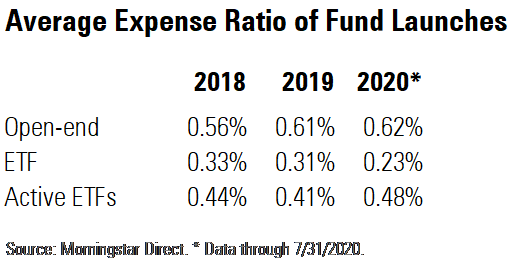

Seven of the 18 fixed-income ETFs launched this year are actively managed strategies. While expenses on these funds are slightly higher than the average ETF, they are still lower than what investors pay for actively managed open-end funds.

Hartford Core Bond ETF HCRB is one of the actively managed ETFs launched this year; the $137.5 million fund carries an expense ratio of 0.29%, below the average intermediate core bond fee of 0.53%. The fund is one of three intermediate core bond funds launched this year, which is already home to the largest number of passive fixed-income funds. Goldman Sachs Access Investment Grade Corporate 1-5 Year Bond ETF GSIG launched in April, and its 0.14% expense ratio puts it in the cheapest 10% of funds in the intermediate core bond category.

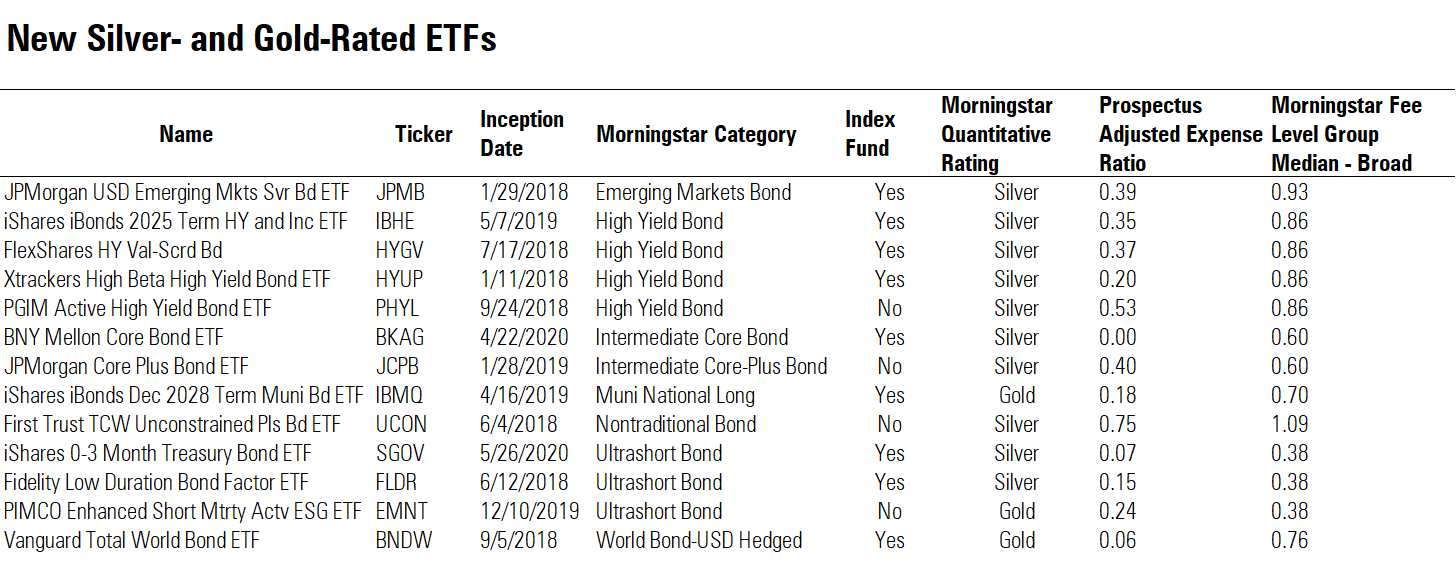

Low-Cost Bond ETFs With High Morningstar Quantitative Ratings Which of the low-cost funds rank the highest by Morningstar's quantitative metrics? Newer funds typically aren't reviewed immediately by Morningstar's analysts, so we used the forward-looking Morningstar Quantitative Rating to pick out the highest rated funds launched in the past two years.

Multiple funds with Gold and Silver Morningstar Quantitative Ratings have opened their doors in the high-yield category. BNY Mellon High Yield Beta ETF BKHY launched in April, and its 0.22% expense ratio is 0.6 percentage points lower than the median expense ratio for high-yield funds of 0.86%. Another high-yield fund, PGIM Active High Yield Bond ETF PHYL, carries a below-median expense ratio of 0.53%.

In the ultrashort category, three funds launched in the past three years that received Gold or Silver quantitative ratings. Pimco Enhanced Short Maturity Active ESG ETF EMNT carries an expense ratio of 0.24% and invests in short-term fixed-income securities with a concentration on socially conscious companies. The fund was added to the Morningstar Prospects list by our Manager Research analysts in July. Fidelity also offers a cheap ultrashort fund--Fidelity Low Duration Bond Factor ETF FLDR is 13 percentage points lower than the median fund in the category with an expense ratio of 0.15%.

The best deal out of the new ETFs may be the Vanguard Total World Bond ETF BNDW, launched in 2018. BNDW carries an expense ratio of 0.06% and offers exposure to world bond funds at a significantly lower cost than other funds in the category. (The median world bond expense ratio is 0.76%.)

JPMorgan USD Emerging Markets Sovereign Bond ETF JPMB offers a low-cost option in a typically more expensive category. With fees of 0.39%, JPMB lands well below the median expense ratio for all emerging-markets bonds at 0.93%.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)