9 Stocks to Avoid in a Struggling Economy

Walk away from these richly trading no-moat names with negative moat trends.

The economy continues to struggle. True, we’ve seen some bright spots of late: jobs data improved last month, and housing start figures were strong, too. But as the pandemic persists, restaurants, movie theaters, and many small businesses are still operating at reduced occupancy levels (if they’re open at all). We’re not out of the woods yet.

Given the uncertain state of affairs--and the general frothiness in the stock market, despite the pullback during the past few weeks--we encourage investors to favor companies with well-established and stable competitive advantages. And of course we recommend buying these names only when they're selling at a significant discount to their fair values.

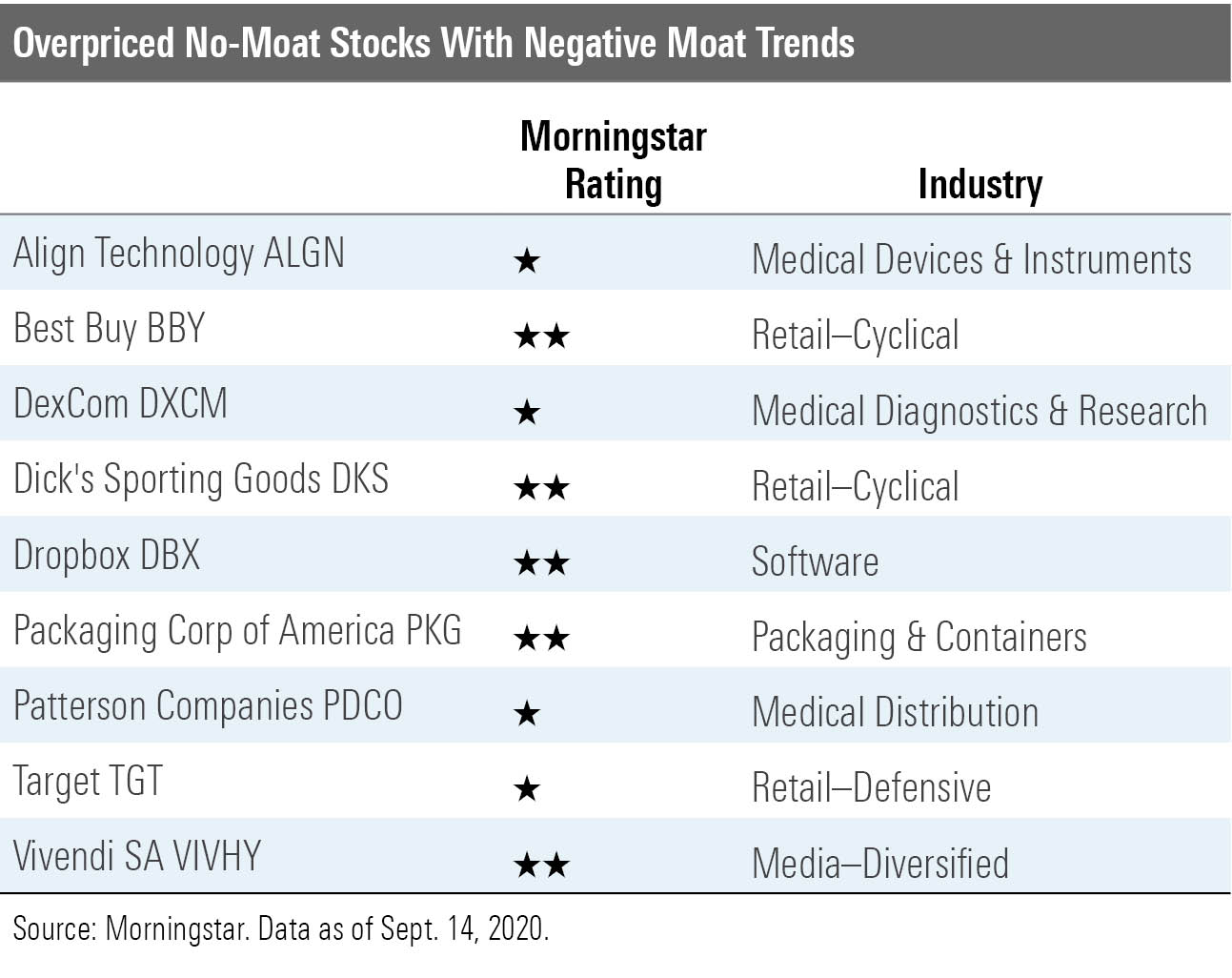

Today, we're taking a look the opposite--overpriced companies that we think lack sustainable competitive advantages. Specifically, we've isolated stocks trading at 1- and 2-star levels without Morningstar Economic Moat Ratings and with negative moat trends.

Why did we choose these data points to screen on? Companies without moats are less likely to be able to stay ahead of their moaty competitors over time--they don't have significant competitive advantages over their peers. Moreover, when we assign a company a negative moat trend, we think that the competitive advantages it does have are eroding, making it more challenging for the company to profitably defend its current market position over time.

Nine stocks made the list.

Here's what our analysts have to say about the competitive positions of three of the names on the list.

Best Buy BBY "As one of the world's leading consumer electronics specialty retailers, Best Buy would appear to be well positioned to capitalize on consumer demand for connected electronic devices. The company has delivered solid fundamentals the past several years owing to operational improvements and exposure to favorable consumer electronics product cycles, but we believe online retailers, mass merchants, warehouse clubs, and vendors themselves have reshaped the economics behind the consumer electronics retail category, eroding the retailer's once-narrow moat (a rating we removed in 2009) and making market share gains more difficult. Although Best Buy possesses a recognizable brand name, an evolving portfolio of service offerings, and a management team better prepared for evolving consumer electronics retail industry changes, we're not convinced that it can fend off rivals without sacrificing margins longer term.

"Because of a heavy reliance on new product innovation and increasingly faster speeds to commoditization, the consumer electronics retail industry is characterized by intense competition and minimal customer switching costs. As mass merchants and online retailers have enhanced their consumer electronic product assortments and original-equipment manufacturers have built out their own retail and direct-to-consumer channels, suppliers have become less dependent on Best Buy for distribution, in our view. Although stores-within-stores and other partnerships with Alphabet GOOG, Samsung, Microsoft MSFT, Sony SNE, and Amazon.com AMZN indicate that consumer electronics OEMs still view Best Buy as a viable product distribution channel, we harbor longer-term concerns that these manufacturers will find ways to bypass the traditional retail direct-sales model and expand their own direct-to-consumer presence (including greater exclusivity for new product launches and trade-in plans like Apple's iPhone upgrade program), extracting a greater proportion of the economic profits from each consumer electronics transaction in the process."

--R.J. Hottovy, strategist

Dropbox DBX "Dropbox gained initial traction following its founding in 2007, as it was one of the first companies to take file storage to the cloud. Dropbox was able to capitalize on that initial success and has used a "freemium" adoption model to grow to 500 million users and over $1.6 billion in revenue in 2019. Large incumbents, like Microsoft and Alphabet, with competing storage offerings have been catching up in recent years and transformed cloud storage into what we see as a commodity offering, limiting incentive to upgrade. We note that Dropbox's revenue was derived from only 14.6 million paying users as of March 2020 and are concerned that Dropbox will struggle to migrate users into paying customers in the long run.

"We believe that cloud storage companies compete on the basis of user experience, ease of use, features, performance, security, third-party integrations, and pricing. Dropbox has attempted to move beyond storage and create collaboration tools to help drive user upgrades. We believe users do not see significant product differentiation in collaboration tools, which is why paid user penetration remains so low. Framed another way, over 97% of Dropbox users view the service only as a free cloud storage offering.

"We believe Dropbox's low conversion rate partially stems from its lack of focus on enterprise customers, and we struggle to see how Dropbox will gain a foothold in the enterprise business without dedicating more resources to drive growth of this customer segment. In our view, enterprises have higher customer lifetime value and represent a larger market opportunity than individual users. Dropbox notes that even though only 30% of their paid users are signed up for business accounts, over 80% of all paid users utilize their Dropbox account for business purposes. Thus, we are skeptical that this group of paying users will increase enterprise adoption and believe that companies will instead choose to utilize the storage and collaboration tools offered as part of their existing Office Suite product."

--Brian Colello, director

Target TGT "Target has adapted to retail digitization, but we believe it faces a highly competitive environment with negligible customer switching costs, exacting pressure to elevate service while holding prices low. Without the scale of Walmart WMT and Amazon or the differentiated business models that characterize moat-endowed defensive retailers we cover, we expect that no-moat Target will be vulnerable to the competitive onslaught.

"While the environment is challenged, we believe retail's future is omnichannel, with customers demanding a range of fulfillment options (ship to home, delivery, click-and-collect, and in-store purchasing) that should benefit firms with dense store networks. We favorably view Target's efforts (started in 2017) to renovate its stores to serve as omnichannel fulfillment centers and believe it should remain better positioned than its smaller rivals, fueled partly by cost leverage and its owned brands.

"Still, Walmart and Amazon define the space, driving prices down as they deploy unparalleled scale in ways we believe Target cannot match. With only around 20% of its sales coming from food (which generates recurring traffic), we believe Target must invest to remain at the top of shoppers' minds. With customers increasingly starting product searches on digital properties owned by either Amazon or (particularly for non-Prime members) Walmart, we expect Target will have to compete on the two giants' terms."

--Zain Akbari, analyst

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)