Getting Better Results Abroad

A more disciplined investment approach can help investors avoid bad outcomes.

Investors looking to improve their portfolios' diversification by investing in stocks outside the United States haven't had an easy time of it. Non-U.S. equity markets have lagged by a staggering margin over the past decade, with international market benchmarks falling behind their domestic counterparts by about 9 percentage points per year over the trailing 10 years through Aug. 31, 2020. That partly reflects the generally strong U.S. dollar, but non-U.S. stocks have fallen behind their stateside counterparts even before the effect of currency movements, partly because of weaker earnings growth.

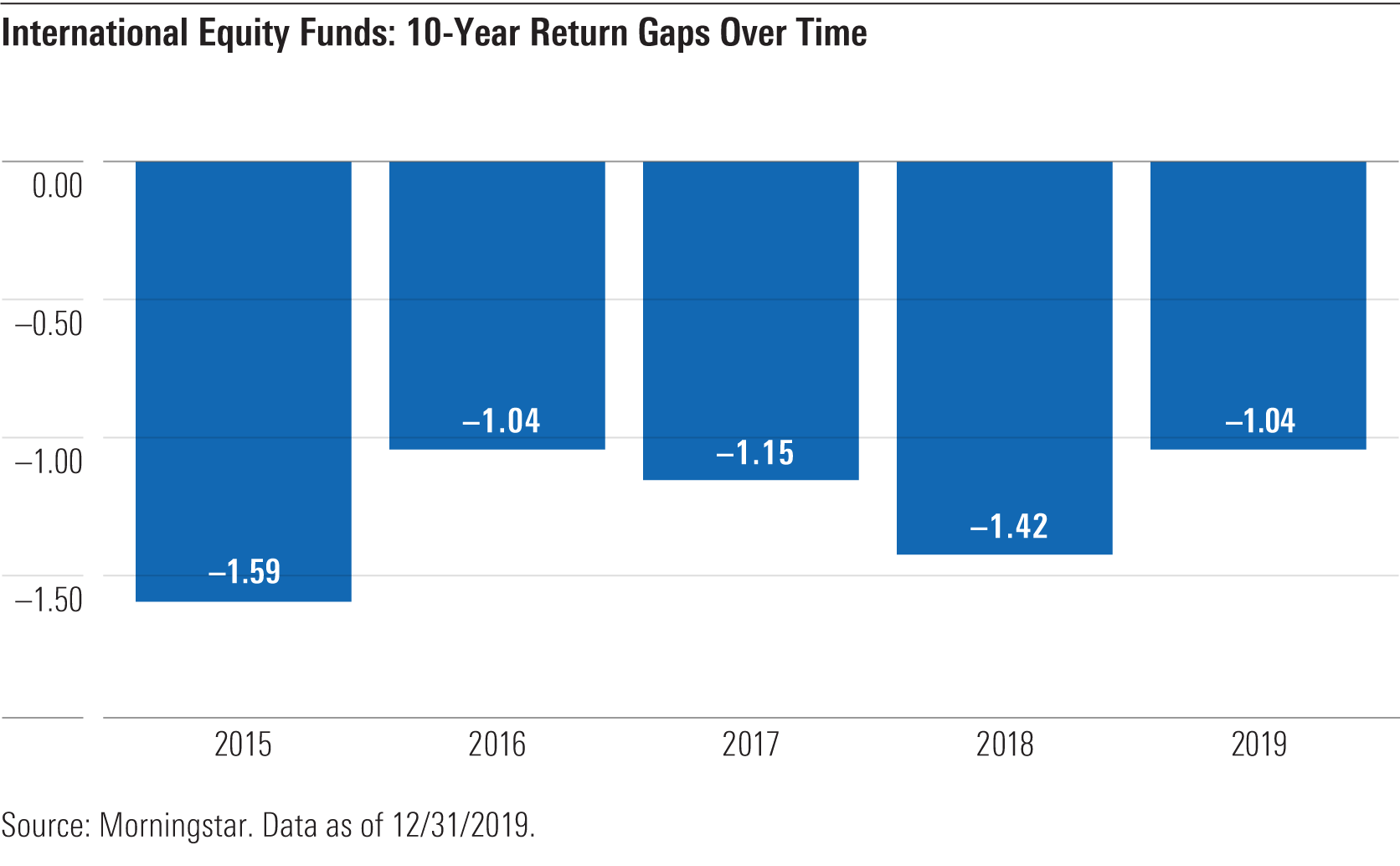

Making matters more depressing, the returns international fund shareholders actually experienced after accounting for cash inflows and outflows have been even worse than reported total returns. In our annual "Mind the Gap" study, which estimates the gap between investors' dollar-weighted returns and reported total returns, we found that in aggregate, the returns international fund investors earned for the most recent 10-year period ended Dec. 31, 2019, continued to fall short of reported total returns by a fairly wide margin. This gap improved slightly compared with previous results, but still stood at about 1 percentage point per year, as shown in the chart below.

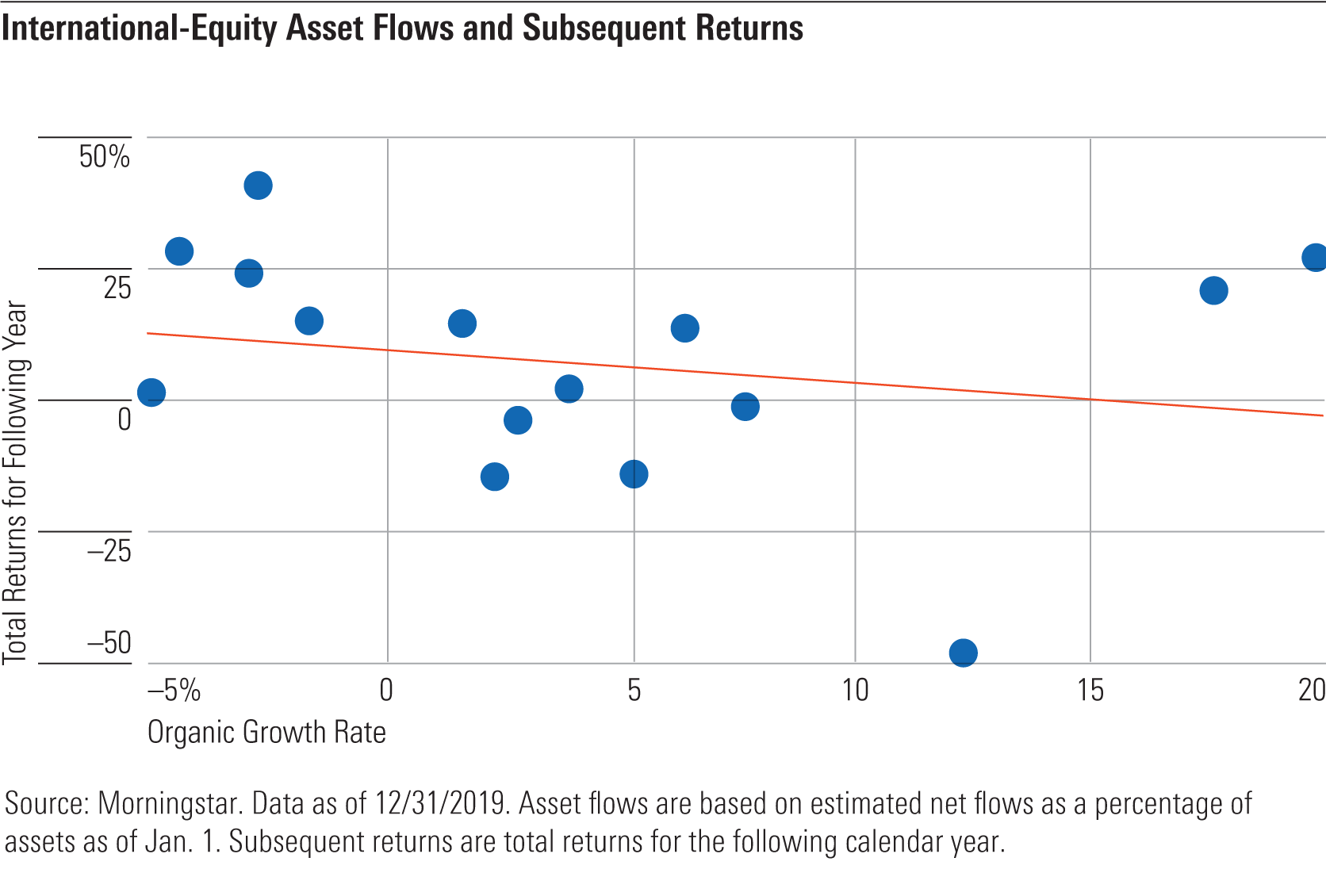

Bad Timing = Bad Results Simply put, international investors have suffered because of poorly timed cash flows. More often than not, years when investors added more assets to international-equity funds have been followed by a downturn in total returns and vice versa, as shown in the chart below.

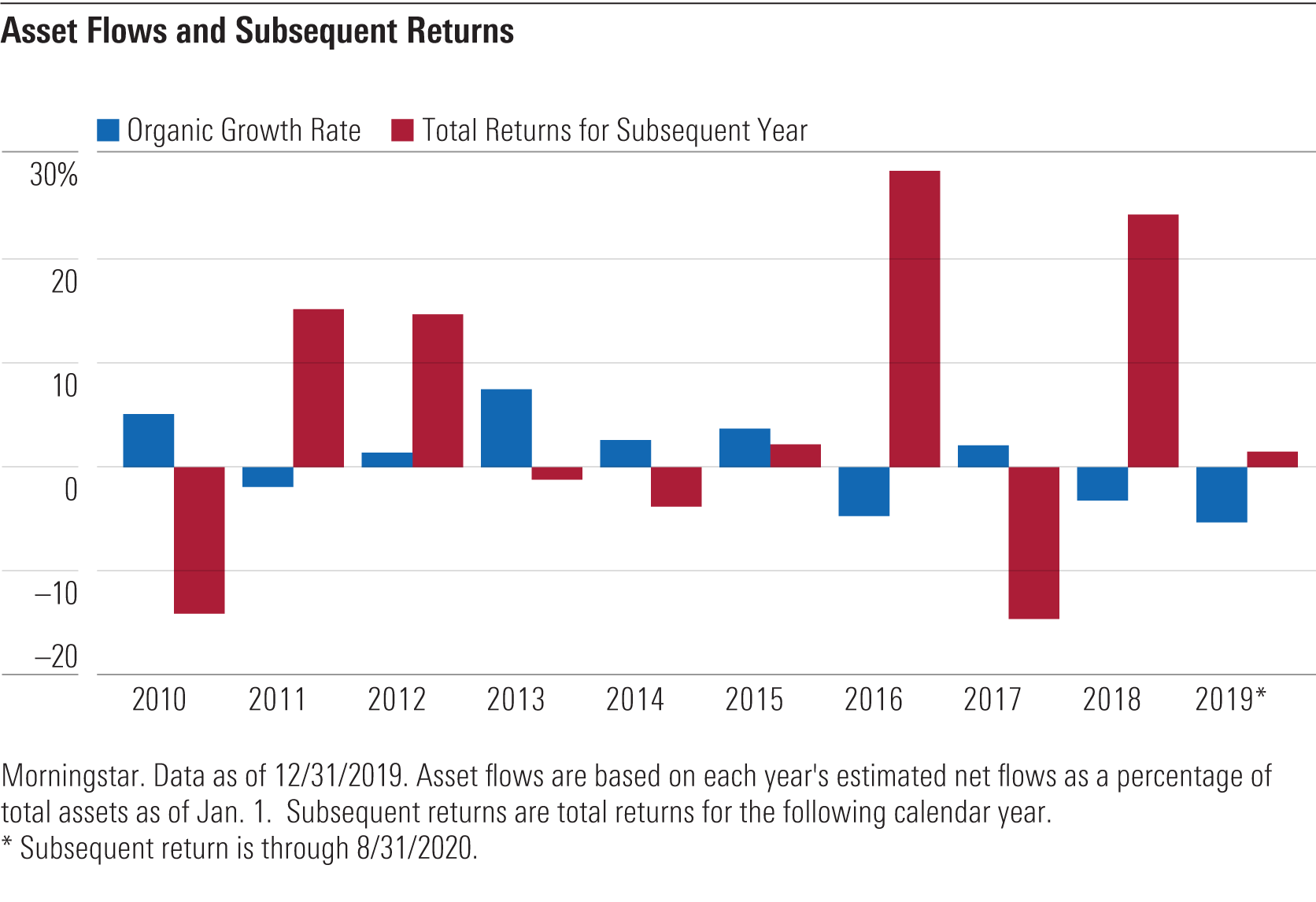

The bar graph below shows the year-by-year results in more detail. The blue bars show each year's organic growth rate--the estimated net inflows or outflows for international-equity funds as a group, calculated as a percentage of starting assets for each year. The red bars show total returns for the following year. In nearly every case, the bars go in opposite directions, meaning that positive cash flows were followed by negative returns or vice versa.

The past few years have been a good example of this pattern. In 2016, for example, net outflows totaled about 5% of assets, but investors who sold missed out on significant gains in 2017. Small net inflows in 2017 were followed by painful losses in 2018. Outflows turned negative again in 2018, only to be followed by double-digit gains in 2019. In effect, international-equity investors have bought after big runups and sold after downturns--the opposite of the classic advice to buy low and sell high.

Improving Your Results While investing outside the U.S. has been challenging, there are a few ways to improve your odds of success. The suggestions below can help narrow the gap between reported total returns and the returns you actually experience.

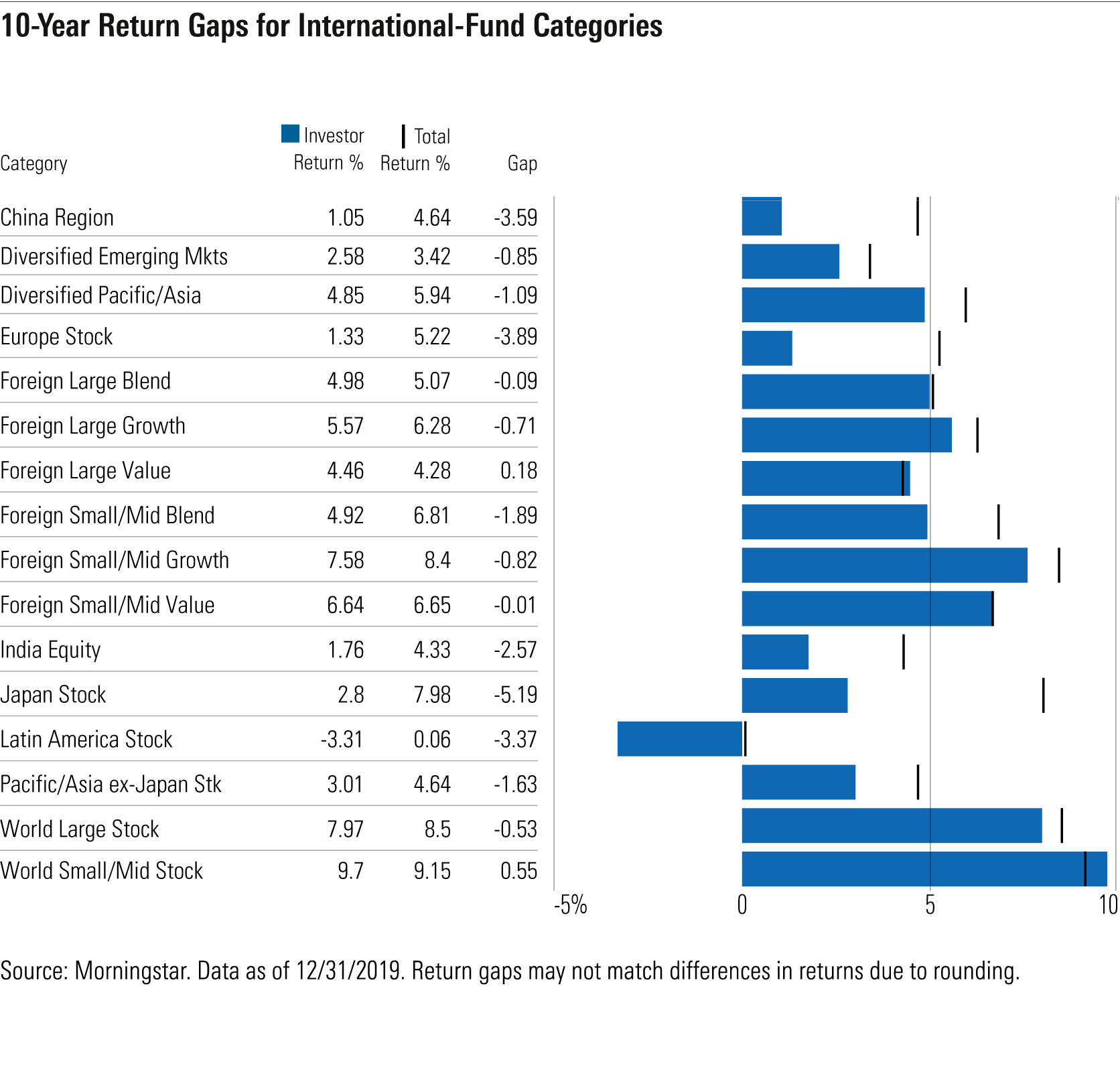

Favor broadly diversified funds instead of betting on specific regions. Investors in highly specialized categories--such as funds focusing on Japan, Latin America, Europe, or China--have suffered the biggest investor return gaps, but those investing in broadly diversified categories--such as foreign large blend and world large stock--have fared significantly better. If you're trying to add international diversification, chances are you'll have far better results with a more mainstream offering. Betting on a specific region increases the odds that you'll be tempted to bail out at the wrong time.

Look for lower-volatility funds. This tip is closely related to the one above, as highly specialized international funds also tend to have elevated levels of risk, as measured by standard deviation. In our study, we looked at the relationship between volatility and investor returns. We did this by ranking the funds in each category by standard deviation and then dividing them into quintiles. There wasn't a perfect relationship, but funds with the lowest volatility generally had narrower return gaps compared with higher-volatility offerings. For international-equity funds, funds in the least-volatile quintile had investor return gaps of negative 0.51%, compared with negative 2.39% for those in the most-volatile quintile.

Favor funds with more reasonable expenses. In our most recent Mind the Gap study, we didn't find a direct relationship between underlying fund expenses and investor returns. In other studies, though, we've found a fairly strong relationship between fund expenses and performance. In the semiannual Morningstar Active/Passive Barometer study, for example, we found that success rates (defined as the percentage of funds that generated better returns compared with the average passively managed fund) were significantly stronger for funds with lower costs. Favoring low-cost funds won't necessarily improve your dollar-weighted returns, but it can help tilt the odds in your favor with respect to underlying fund performance.

Decide how much currency exposure you're comfortable with. Leaving your currency exposure unhedged can improve diversification because currencies don't always move in the same direction as each other or with their underlying equity markets. On the other hand, currency exposure adds another layer of risk. If you're extremely risk-averse, it may make sense to favor funds that hedge their currency exposure (although hedging won't improve returns if the U.S. dollar continues to lose ground). Currency exposure won't directly impact your investor returns, but it's another factor to consider before venturing overseas.

Consider dollar-cost averaging. As part of our study, we looked at a hypothetical scenario in which an investor contributed equal monthly investments (dollar-cost averaging) to funds in each broad category group. For international-equity funds, we found that investors would have fared significantly better by investing a consistent amount month in and month out instead of piling in after periods of strong performance and bailing out after weaker years. In fact, dollar-cost averaging would have improved investor returns for international-equity funds by about 0.9 percentage points per year, on average, simply by helping shareholders avoid the adverse effects of bad timing.

Conclusion Despite the challenges inherent in investing outside the United States, non-U.S. exposure is still a crucial component of a diversified portfolio. Domestic stocks have enjoyed a decade or more of outperformance, but that's not likely to continue forever. Valuations on U.S. stocks have also been at a premium, suggesting there may be better opportunities overseas. In addition, the U.S. dollar has already started weakening against other major currencies over the past few months. If the U.S. dollar continues losing ground, that would provide a tailwind for international-equity funds with unhedged currency exposure.

That said, international-equity investing hasn't been easy even in the best of times. But following a more disciplined, consistent investment approach should lead to better results over time.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)