2 ETF Upgrades Highlight Ratings Activity in August

Morningstar analysts rated 527 share classes and vehicles and 117 unique strategies during the month.

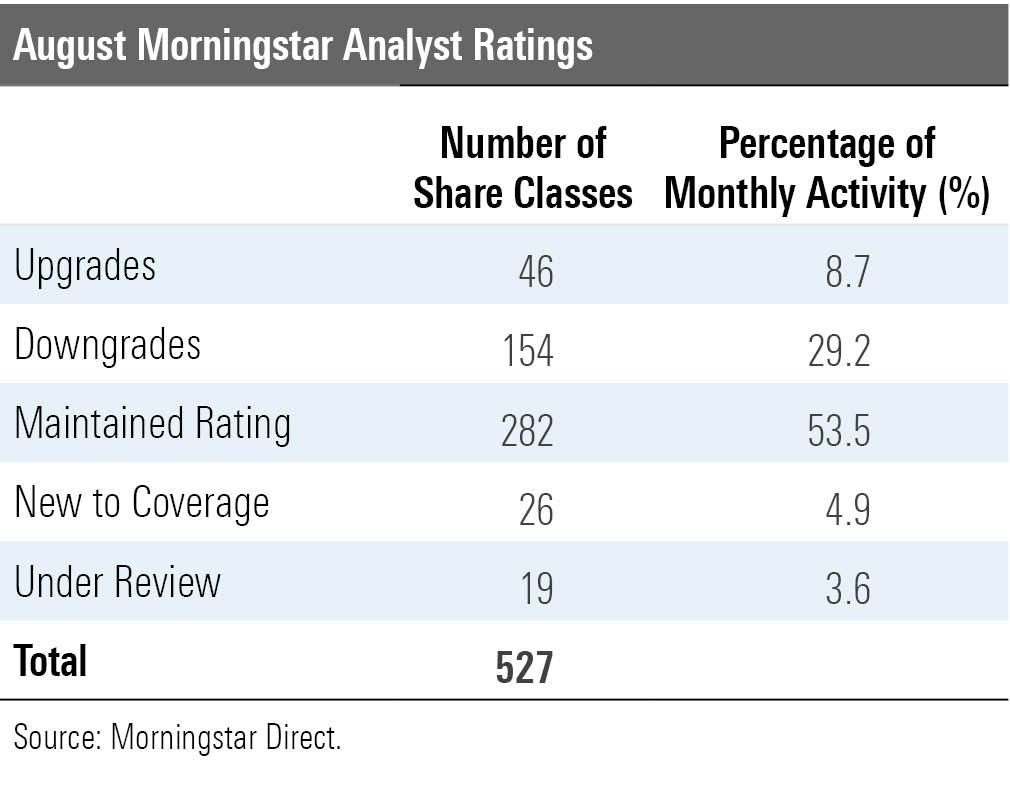

Morningstar updated the Analyst Ratings for 527 fund share classes, exchange-traded funds, and separately managed accounts/collective investment trusts in August 2020. Of these, 282 maintained their previous rating, 154 were downgrades, 46 were upgrades, 26 were new to coverage, and 19 came Under Review because of material changes, such as manager departures.

Sifting out multiple share classes and vehicles, Morningstar rated 117 unique strategies in August 2020. Of these, five received a rating for the first time, with the rest having at least one investment vehicle type that a Morningstar analyst previously covered. This month's upgrades and downgrades were primarily driven by Morningstar's enhanced Analyst Rating methodology, which places a greater emphasis on fees.

Upgrades

Vanguard Short-Term Treasury ETF VGSH earned an upgrade under the enhanced Morningstar Analyst Rating methodology to Gold from Silver because of low fees. This strategy tracks the Bloomberg Barclays U.S. Treasury 1-3 Year Index, which includes U.S. Treasury bonds with one to three years until maturity. The index weights securities by market value, but Treasury issuing activity drives portfolio composition. Fees are important among government-bond funds because they tend to have a narrow range of returns. This fund's fees rank among the cheapest in its Morningstar Category, which should give it an edge over most peers.

Baron Growth's BGRFX Analyst Rating moved to Silver from Bronze after its first run through the enhanced rating methodology. Founder Ron Baron still leads this flagship strategy, which looks for businesses with unique and hard-to-replicate assets. He holds his picks even as they grow well past small-cap territory. To justify such long holding periods, Baron seeks companies with strong finances and flexible, savvy long-term-focused management teams. Baron, in his mid-70s, promoted Neal Rosenberg to comanager in 2018 to answer succession concerns, but he remains engaged.

IShares Edge MSCI USA Value Factor ETF VLUE moved up a notch to Silver from Bronze in its first pass through the enhanced rating methodology. This strategy replicates the MSCI USA Enhanced Value Index, which selects stocks that look cheap versus their MSCI USA Index sectors, according to scores based on several valuation metrics. The fund weights its holdings by both market-cap and value characteristics but keeps sector helpings neutral to avoid unintended bets. While the fund takes more risk than the Russell 1000 Value Index, it should provide better risk-adjusted performance over the long term.

New to Coverage Invesco S&P MidCap Low Volatility ETF XMLV debuted with an Analyst Rating of Silver. The fund ranks the constituents of the S&P MidCap 400 Index each quarter by their past 12-month volatility and gives the least volatile names the largest weightings. This strategy has been less volatile than its benchmark and has held up better in downturns, but it will lag during bull markets. It may not beat the market over the long term, but it should offer a better risk/reward profile.

Downgrades Harding Loevner Global Equity's HLMGX People rating dropped to Above Average from High, bringing down its Analyst Rating to Bronze from Silver for all share classes. Co-lead manager Ferrill Roll will leave the strategy at the end of 2020 when he becomes sole CIO. Comanager Jingyi Li will join Peter Baughan as co-lead manager at that time, and comanagers Christopher Mack, Richard Schmidt, and Scott Crawshaw will remain. Li and Baughan will continue to run the sound, repeatable process that has earned good long-term results at other Harding Loevner strategies. This process looks for significant competitive advantages and strong growth rates. While Li has a solid resume, he has limited manager experience, all of it as a comanager.

Fidelity Extended Market Index's FSMAX Analyst Rating moved to Silver from Gold after its first run through Morningstar's enhanced rating methodology. Personnel turnover at the five-member Geode Capital Management team that runs all of Fidelity's index-tracking funds limits the strategy's People Pillar rating to Average and downgrades its overall rating. The portfolio tracks the Dow Jones U.S. Completion Total Stock Market Index of stocks not included in the S&P 500. The fund's mix of mid-, small-, and even large-cap stocks has made it more volatile than the typical mid-cap blend fund, but its returns over the 10 years through August 2020 still ranked in the peer group's top 10%.

/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)