A Brave New Bond World

Most of us have never seen a bond market like this.

There's a challenge creeping up on bond managers--and by extension fund shareholders--that has thus far been met with the sound of crickets, but it’s a big one.

Falling market yields would typically prompt the idea of dramatically shortening a portfolio's duration, and vice versa. Effectively, the idea would be to take less risk after high-quality bonds have rallied (when their yields fall) and to add risk after they've lost ground and their yields have gone up. In other words: Buy low, sell high.

There are some managers who make that process the heart of a strategy. And the fund industry looked to promote more unconstrained styles with the freedom to make such moves broadly after the 2008 global financial crisis; most funds with that kind of freedom live in the nontraditional bond Morningstar Category. That group's $130 billion-plus is a drop in the bucket, though, compared with the $3.8 trillion in held in taxable-bond mutual funds overall.

Among the rest, most employ some version of a "buy low, sell high" philosophy, but within the framework of a constrained approach to interest-rate risk. That usually means using an index as the anchor from which to tether a portfolio's duration, plus or minus some margin of years or percentage of the benchmark's.

That has arguably been a great success story for mutual fund investors. Up until the early 1990s, most fund managers had freedom to manage duration more broadly but were eventually caught in the switches by sharp interest-rate shocks, and it became clear just how difficult it was to win consistently with interest-rate bets. Fidelity was something of a retail pioneer back then, and benchmark-driven duration management, previously the province of institutional managers, swept the fund industry. That style has become enshrined in the canon, and there has seemed little reason to question it.

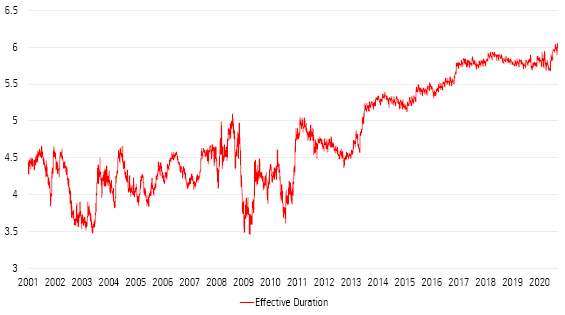

A Tectonic Shift Most core bond funds use the Bloomberg Barclays U.S. Aggregate Bond Index or similar high-quality indexes as benchmarks for "the market," and they all began to slowly morph after the 2008 global financial crisis. Until the crisis, the high-quality U.S. bond market's overall duration had almost always ranged in the neighborhood of four to five years--for decades. Shortly thereafter it began to slowly creep upward. It spiked again during the coronavirus crisis, and as of early September 2020 the duration of the Morningstar Core Bond Index stood above six years.

Exhibit 1: Morningstar Core Bond Index--Effective Duration (Years)

- source: Morningstar Indexes

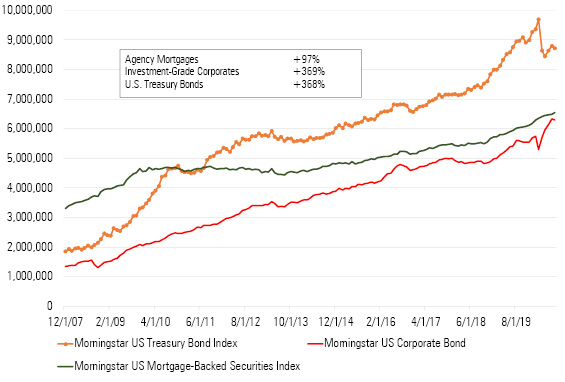

There are several moving parts driving the shift, most notably in the Treasury, investment-grade corporate, and agency mortgage sectors. The impact of the first two has been profound, and the biggest factor has simply been size. Both sectors surged following the crisis while the size of the mortgage market inched up more slowly. At the start of 2008, the two composed roughly 40% of the overall high-grade sector; by August 2020 that figure was 64%.

Exhibit 2: Growth in Mortgage, Corporate, and U.S. Treasury Markets

- source: Morningstar Indexes

That's a big deal because mortgages have always played a moderating role. Their amortizing structures--and prepayments from homeowner refinancing--usually keep their durations shorter than the other two sectors. By growing slowly as those markets ballooned, mortgages became less effective as a check on the overall market's rate sensitivity.

The Treasury and corporate markets didn't just grow and squelch the mortgage market, though--they underwent fundamental change, turbocharging the impact of their growth. If the U.S. Treasury and high-grade companies were going to ramp up borrowing in the trillions of dollars, they were certainly going to take advantage of low rates at the long end of the market and give themselves plenty of time to pay back the debt.

Of the features that underpin duration and interest-rate sensitivity, longer maturities and shriveling coupons are right near the top. Combine that with massive growth and you have changed the very nature of the market itself.

Is It Time to Change Who You Are and What You're Gonna Be? These changes raise a question of whether anchoring bond portfolios to market-like benchmarks makes as much sense when their durations are six years or longer, and a 100-basis-point upward yield shift can lose you 6% or 6.5%, when a shorter duration and the same shift used to mean a 4% to 5% drawdown.

That's not the same thing as asking whether investors should ditch benchmarking and dive into unconstrained strategies. The market's extension hasn't done anything to change the fact that making interest-rate calls is as hard as it's ever been. It does pull back the curtain on an issue that has rarely mattered much to the high-grade bond market though, and that's whether sticking faithfully to broad, market-weighted benchmarks makes sense in all environments.

Should the underlying risk of your bond portfolio be inextricably tied to explosive government and corporate borrowing, and the decisions those actors make, driven by their interests rather than yours? Might you be better off with a benchmark that still holds those sectors, but puts more emphasis back on mortgages, or maybe less concentration in the longest of long maturity, low-coupon debt?

There's no easy answer. You can back-test alternates with different weightings and compositions, but the market is now in such uncharted territory that we don't know if the next 30 years will look anything like the last.

Change is Hard…and Scary Either way, the industry isn't likely to address those questions anytime soon. Asset managers have always said that they choose broadly based, market-weighted benchmarks with strong investor recognition, because that's what the SEC wants. Under that regime, investment-grade, market-value-weighted benchmarks are used by nearly every core bond fund, and any efforts to move away from them, even if only to some modified version, are likely to be a slog. Well-known managers with a strong following might be able to pull it off, but it's hard to imagine that happening in more than a few cases. Plenty thought rates were unsustainably low following the global financial crisis, took a stand by underweighting duration, and saw their relative returns suffer. It would take even greater conviction to switch benchmarks now, and risk falling behind their peers again.

Assuming bond markets continue to carry a similar profile, core bond funds will continue to be drawn into greater interest-rate sensitivity--and volatility. That's by no means an argument to drop them. When portfolios heavy with stocks and other risky assets run into trouble, high-quality bonds with a healthy dose of duration are usually the only ballast. You can see that in the histories of unconstrained funds that built their strategies around slashing interest-rate risk in favor of credit risk and had nowhere to hide when risky assets crashed. Mixing core funds with shorter-maturity, high-quality portfolios, though, might be just one of many options for coping with the market's new reality.

/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)