Presidential Elections Don't Matter (for Investments)

The silly season is upon us.

History's Lesson Investment manager Howard Marks states that the stock market will "breathe a sigh of relief" if President Trump is re-elected. The Wall Street Journal opines "Get Ready for the Biden Stock Boom." (The Wall Street Journal?) Echoing the sentiment, The New York Times writes, "Why a Biden Presidency Could Be Bullish for Stocks." (Well, that's no surprise.)

Uh-huh. The rank order of the nominal performance for the Dow Jones Industrial Average during the first three years in office for each of the past 10 Presidents (excluding John Kennedy and Gerald Ford, who didn't serve 36 months) has been:

1) Bill Clinton (D) 2) Dwight Eisenhower (R) 3) Barack Obama (D) 4) Donald Trump (R) 5) George H.W. Bush (R) 6) Ronald Reagan (R) 7) Lyndon Johnson (D) 8) George W. Bush (R) 9) Richard Nixon (R) 10) Jimmy Carter (D)

The effect that dominates the list is not party affiliation but instead the president's timing. Aside from George W. Bush, who was unlucky enough to catch both the technology-stock decline and the 2008 financial crisis, the bottom performances all happened during the 1960s, 1970s, and 1980s, which were afflicted by global inflation concerns. In contrast, the happiest showings came from those presidents who swerved during the start and end of the time period.

(Note: It would have been better to use real performance for the Dow Jones rather than nominal, but doing so would have required more effort, without altering the conclusion. In fact, it would have strengthened it.)

The same applies to bonds. Since President Eisenhower took office, the highest price on 10-year Treasury notes has occurred over the past eight years, during President Obama's second term and President Trump's current session. Anybody care to argue that those two presidents are politically similar? Or that if Hillary Clinton had won the 2016 election, bond prices would now be different?

More likely that bond prices would be at current levels if a potted plant had won the presidency in 2012 and then was re-elected in a landslide in 2016.

The Economy, Too Nor do presidential elections much affect the general economy. This statement, I realize, is more controversial than dismissing their investment implications. It's one thing to acknowledge that economics don't necessarily translate into security prices. Many additional factors influence investment performances, including whether the markets had anticipated those economic developments, investor demand, and (for corporations) shareholder responsiveness. However, it's quite another thing to deny the link between politics and the economy altogether.

But I must do so. Over the years, I have seen countless economic predictions based on political beliefs, with claims made about the effects of tax-code amendments, changes to business regulations, trade policies, and so forth. To a first approximation of the truth, none of those forecasts occurred.

The reason being that there's no actual science behind such assertions. One can't put an economy into a laboratory, control for a single element, and then run multiple simulations to assess that element's importance. One must instead conduct correlation studies that contain many factors and few data points. Inevitably, the findings are suggestive rather than being statistically significant.

I see no reason to accept those suggestions. Of course, I cannot disprove such contentions, any more than their proponents can demonstrate them. The lack of knowledge about how political decisions affect the economy cuts both ways. But in such cases, when information is lacking, adopting the null hypothesis seems appropriate. Barring evidence to the contrary, assume that the item is irrelevant.

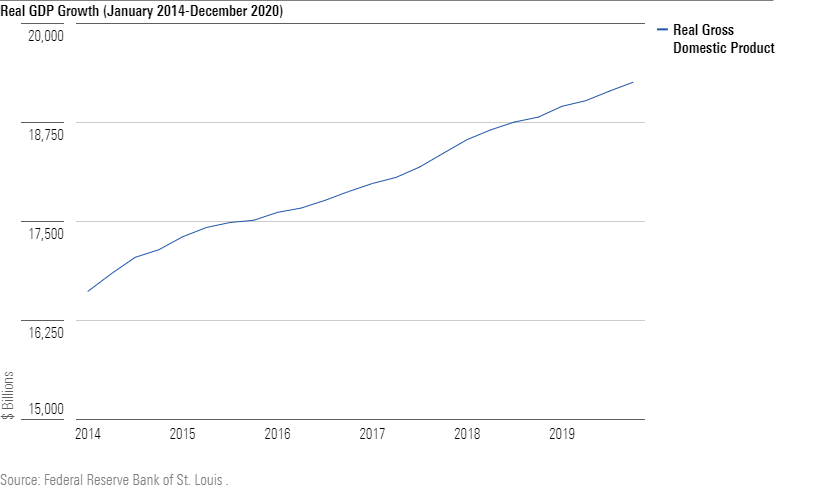

Two Examples Such a policy certainly seems to accord with the surface results. Consider U.S. economic output from 2014 through 2019, which incorporates the final three years of President Obama's administration and the first three of President Trump's. It would be difficult to find two presidencies that were more adamantly opposed, with each candidate sharply criticizing the other. Their tax, regulatory, and trade policies were different, as were their foreign relations.

Yet here was the nation's gross domestic product during those six years, expressed in real terms:

If you see any significant difference between the two halves of the graph, that misperception is on you. The annualized growth rate was 2.5% for the first three years and 2.4% for the second period.

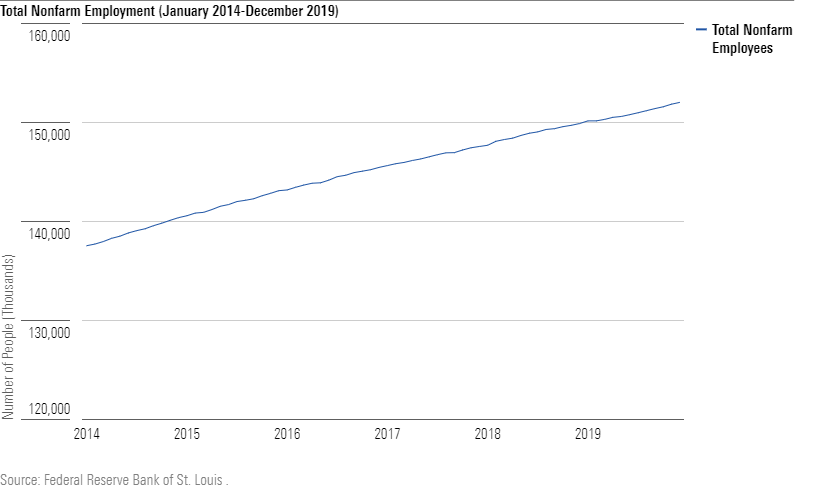

So, too, for employment increases. Every presidential candidate claims to have mastered the art of job creation, thereby bolstering the idea that presidents possess such abilities. Once again, Presidents Obama and Trump implemented opposing policies, which, if one believes that presidential actions matter, should have led to dramatically different totals. Below are the U.S. nonfarm employment figures, also from 2014 through 2019:

The job-growth rate under President Obama's final three years was modestly higher than during the first three of the Trump administration, at 1.8% annualized versus 1.5%, but that apparent advantage is countered by the reality that it becomes more difficult to add jobs as the unemployment rate declines--which it continued to do, reaching a 50-year low in December 2019. Call it a draw.

A Psychological Need If political claims about investments and the economy can be so easily challenged, why do they persist? The immediate response is that persuasion wins elections, rather than facts; and that not only do presidential candidates prefer to believe in the myth, but so do reporters and their audience. There isn't much demand for articles that read "No story here, look elsewhere." (Tell me about it.)

However, there is a deeper reason, which is that attributing power to presidents brings order to chaos. If the harvest fails, one could investigate if the soil was adequate, the crops appropriate, and the cultivation suitable. Unfortunately, doing so requires much effort and might not yield a simple answer. Easier to blame the gods. Then all will quickly make sense.

Which is fine. Blame the gods, if you wish. But exclude them from your investment and economic analysis. Their prophecies are false.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)