3 Highly Rated Large-Growth Managers Who Are Wary About the Big 5

History casts doubts on the reign of the five biggest companies.

Concentration is at a high point for U.S. equity benchmarks. At the end of August, the Russell 1000 Growth Index’s weighting in its five biggest holdings--Apple AAPL, Microsoft MSFT, Amazon.com AMZN, Facebook FB, and Alphabet GOOGL--stood at 38.75%. Core indexes aren’t immune, either. Those same five stocks accounted for nearly 24% of the S&P 500, 5.8 percentage points more than what its top five positions totaled in March 2000, around the time the dot-com market bubble burst.

It isn’t clear we’re in another bubble. Unlike many of the highfliers of the dot-com era, the “Big Five” companies all generate lots of cash and two of them pay dividends. The stocks could still do well, as Microsoft did. It was a top holding in March 2000, as in August 2020. Although it swooned and then languished for many years, between those two dates Microsoft returned 9.7% annually, 3.6 and 3.4 percentage points more than the Russell 1000 Growth Index and S&P 500, respectively.

History casts doubts on the group as a whole, however. The S&P 500’s four other top holdings from March 2000 are no longer in its top 20, and each has lagged the index since. Cisco Systems CSCO and General Electric GE even lost money.

At some point, the law of large numbers takes over. Although they’ve switched places, Apple, Microsoft, Amazon, Facebook, and Alphabet have occupied one of the Russell 1000 Growth’s top five spots since July 2015, when their combined weighting was about 15.5%. Their share of the index has increased 2.5 times since then. Applying the same relative growth rate over the next five years, they would account for 97% of the index’s weighting.

Highly rated active managers in the large-growth Morningstar Category have been underweight in the Big Five as a whole. Not one of the 31 funds whose oldest share class has a Morningstar Analyst Rating of Gold or Silver had a combined Big Five stake equal to the Russell 1000 Growth Index’s, as of its most recent portfolio. T. Rowe Price Large Cap Growth’s TRLGX June 2020 portfolio came the closest at 36.85%, 50 basis points less than the index on the same date.

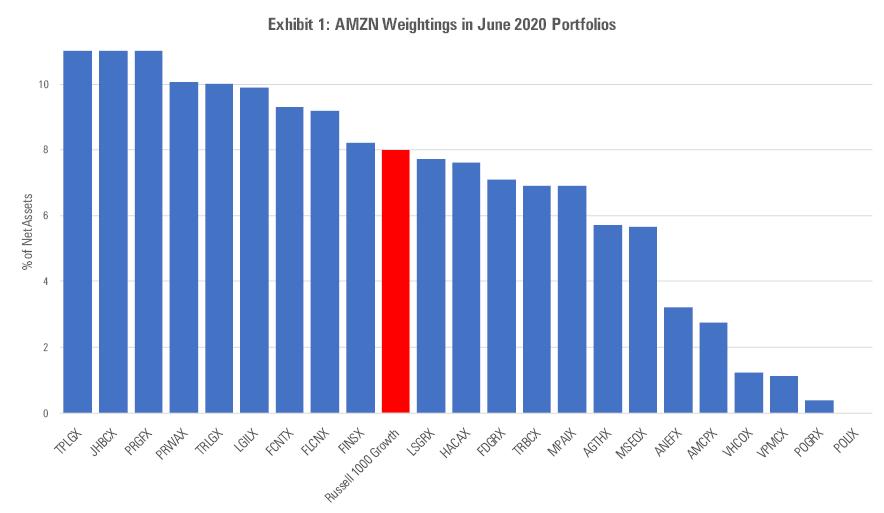

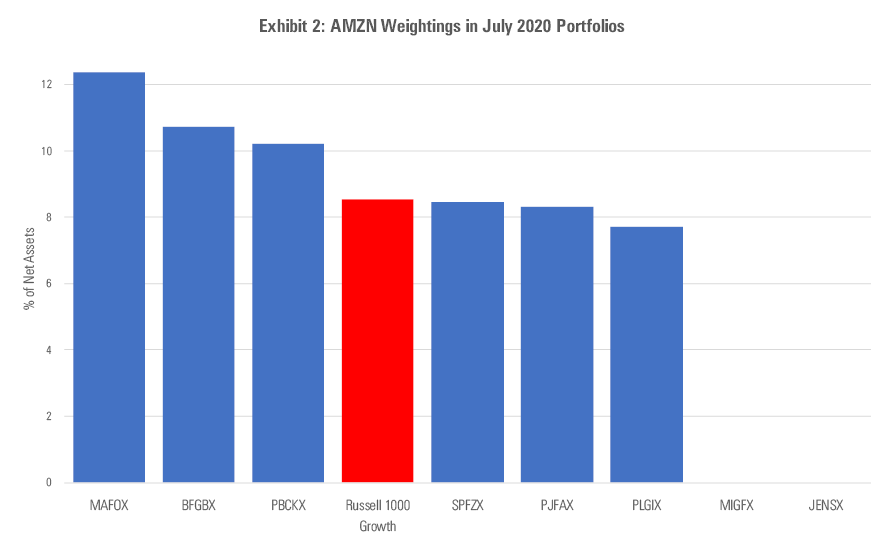

Some strategies were overweight in one or more of the names. No fund overweighted Apple, and only two owned more Microsoft relative to the Russell 1000 Growth Index. Heavy positions in the other three were more common, though. Sixteen managers overweighted Alphabet and 12 each Amazon and Facebook. On average, however, the managers had the most exposure to Amazon. Exhibits 1 and 2 show each fund’s Amazon position relative to the Russell 1000 Growth Index for June and July portfolios, respectively.

- Source: Morningstar Direct.

- Source: Morningstar Direct, fund company websites.

Three managers stand out for shying away from the Big Five. Akre Focus' AKRIX 20-stock portfolio is no stranger to concentration but did not own these five companies as of April 2020. Longtime manager Chuck Akre and comanagers John Neff and Chris Cerrone tend to be valuation-sensitive when initiating positions. Their penchant for businesses with fairly predictable outcomes hasn't kept them from tech names, but the only one of the Big Five they've held is Apple between late 2011 and 2014. That makes the fund's top-third showing in the competitive large-growth category over the past five years through August 2020 more remarkable.

PRIMECAP Odyssey Growth's POGRX June portfolio had the next smallest allocation to the Big Five. More than half of its 5.2% combined stake was in Alphabet, but that was still 1.7 percentage points less than the Russell 1000 Growth Index's weighting then. Primecap's five managers and the analysts who run a small portion of the portfolio had a big bet on airlines entering this year, which explains the fund's dismal results in 2020. The managers, though, have proved they're skilled stock-pickers, and this fund remains a top choice for investors who can tolerate its volatility.

Morgan Stanley Institutional Growth MSEQX had 5.7% of its June portfolio in Amazon, the fund's second-biggest position, but that was its sole Big Five holding. Manager Dennis Lynch and his veteran 14-person Counterpoint Global team have owned all five companies at various points, including a stake in Facebook before its May 2012 IPO. Its most recent portfolio, however, leaned toward less-established names that the team thinks have long growth runways, especially in the IT services and software industries. Along with Amazon, top-five positions in Shopify SHOP and Zoom Video Communications ZM have helped the fund to a spectacular 82.5% year-to-date gain through August.

The fortunes of the Big Five will drive the overall U.S. equity market’s results for good or ill. While there is risk in not owning them, some investors may want to proceed cautiously given their outsize index weightings. Those who’d like to reduce their exposure don’t need to turn to value strategies or overseas stocks but can instead consider one of the three large-growth funds above. Each is open to new investors.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)