3 Retailers Ready to Go Back to School

These stores are ready for September stockpiling--and they've developed diverse revenue streams to deal with classes coming online.

With back-to-school season underway, retailers across North America are hoping to see a seasonal bump in sales as students and parents scramble to shop for clothes, stationery, and other school supplies. However, this year things could look a little different.

Millions of jittery parents are unsure what the reopening of schools means for their kids' health and well-being. They're looking for more signs and clarity around government plans, as well as safety measures proposed and put in place by school boards. While there could be implications for retailers, it isn't all doom and gloom.

The school-related stockpiling is inescapable. What it would look like could be a function of whether students opt for in-person or online learning or a combination of both. For the following retailers, it could mean a difference between a seasonal spurt versus sales stretched out over a few months as better management of the coronavirus crisis paves the way for more in-person learning. It must be noted that these retailers have multiple revenue streams from diverse portfolios that are highly attuned to changing consumer behavior and market trends.

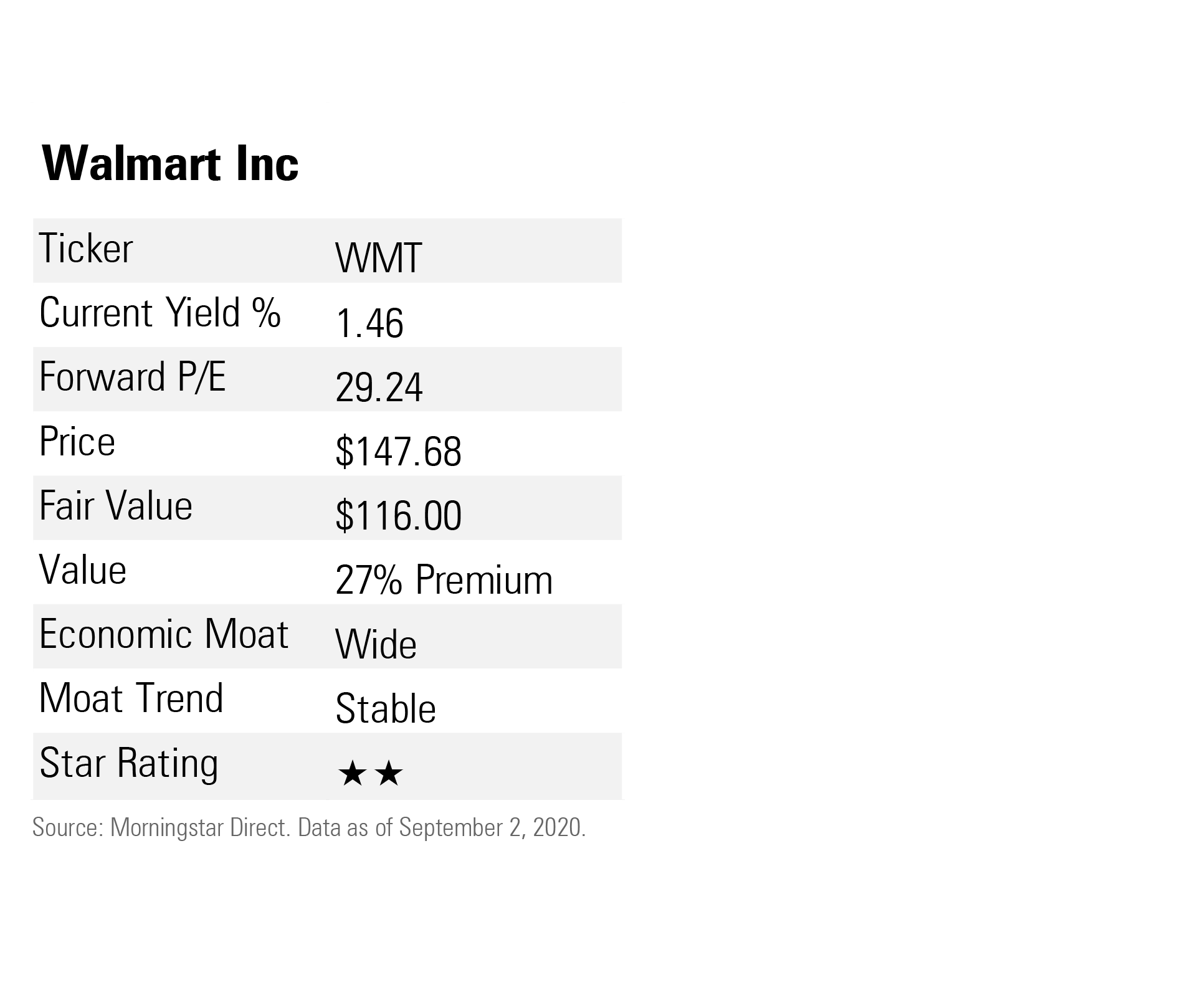

The largest U.S. retailer by sales, Walmart WMT sells a variety of general merchandise and grocery items across the United States (77% of sales in fiscal 2020), Mexico and Central America (6%), the United Kingdom (6%), and Canada (4%). At home, the retailer generates 56% sales from groceries, while general merchandise accounts for 34%, and another 10% comes from health and wellness items.

The biggest challenger to Amazon.com AMZN, Walmart is quickly ramping up its e-commerce offerings through its own site Shoes.com, India-based Flipkart, as well as its 10% ownership of Chinese online retailer JD.com. "With unrivaled scale, prodigious procurement strength, a strong brand, and a growing e-commerce platform, Walmart is the only American retailer that can compete comprehensively with Amazon's retail offering," writes Morningstar's Zain Akbari in his analyst report. While the retail environment is intensely competitive and being disrupted by Amazon, Walmart could hold its own.

The retail giant recently showed interest in buying the popular short-form video application TikTok in partnership with Microsoft MSFT, potentially opening a new battlefront with Amazon. The grocery giant plans to launch a membership program, Walmart+, a subscription-based service to compete with Amazon Prime. "Walmart should be able to compete aggressively, particularly for the roughly 50 million households we estimate do not subscribe to Amazon Prime," says Akbari, who recently upped the stock's fair value estimate to $116 from $111, prompted by bumper second-quarter results.

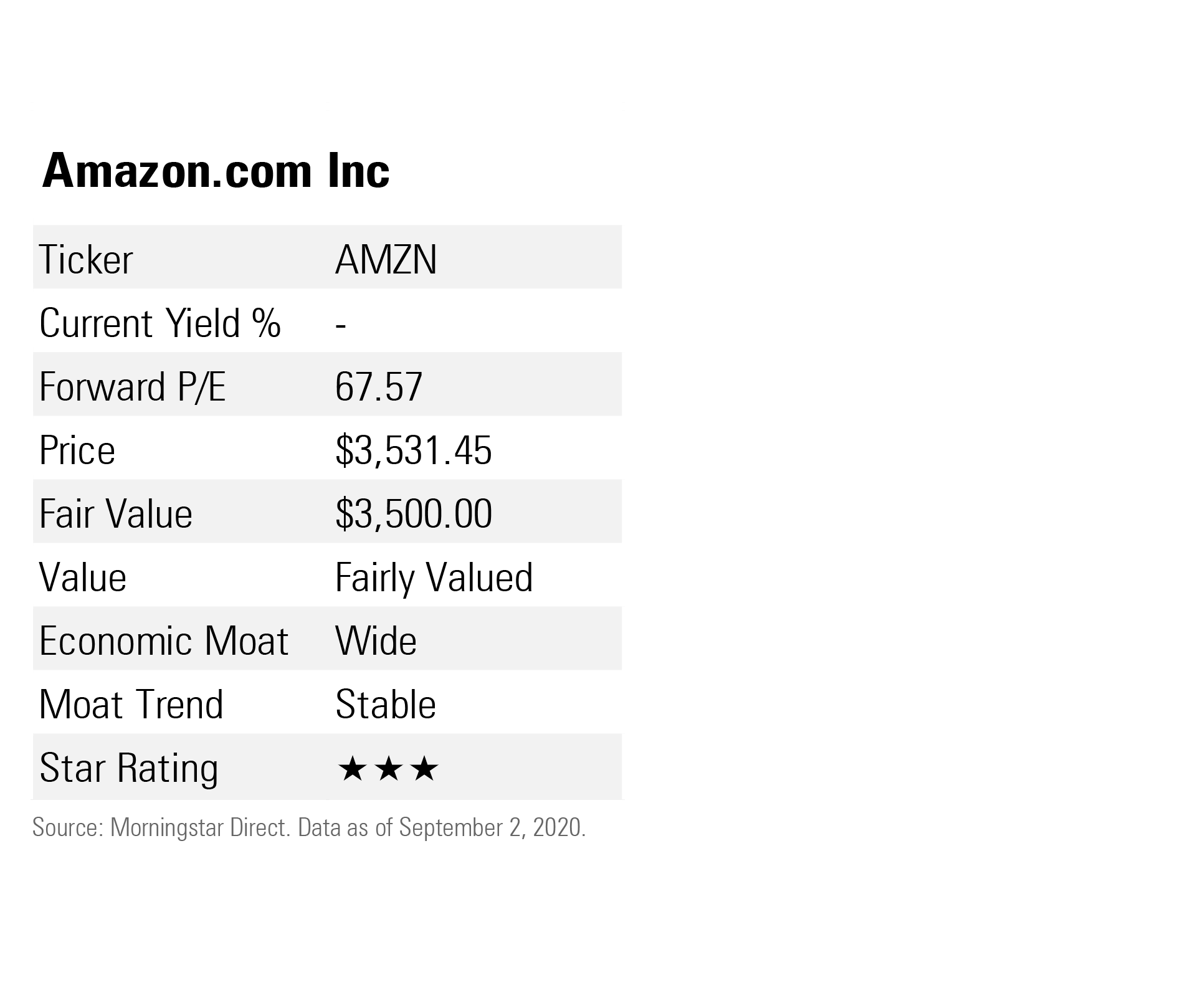

Online retail juggernaut Amazon racked up $281 billion in 2019. Online product and digital-media sales accounted for 50% of net revenue in 2019, while commissions, related fulfillment and shipping fees, and other third-party seller services (19%), Amazon Web Services (13%), and Prime membership (7%) made up the bulk of the rest.

Amazon is the direct beneficiary of some of the trends that emerged or accelerated during the pandemic. "As containment efforts persist and consumers isolate themselves, we believe certain Amazon services will continue to see increased adoption," writes Morningstar sector strategist R.J. Hottovy in his analyst report, adding that the company "finds itself in a unique position amid the global COVID-19 outbreak."

While demand for online shopping spiked because of the lockdown, the shift to telecommuting boosted its cloud business (Amazon Web Services), which benefited from increased enterprise cloud computing, storage, networking, content delivery, and mobile app and digital security usage.

"We view Amazon as the most disruptive force in retail," continues Hottovy, who recently raised the stock's fair value to $3,500 from $2,750. "Its operational efficiency, network effect, and laser focus on customer service provide sustainable competitive advantages that traditional retailers cannot match."

Amazon, which owns one of the widest economic moats in the consumer sector, is likely to reshape retail, digital media, enterprise software, and other categories for years to come.

Dollar Tree DLTR operates 7,500 namesake discount stores in the U.S. and Canada and more than 7,700 Family Dollar units. The eponymous chain sells branded and private-label goods at $1 apiece. Nearly half of its 2019 sales came from consumables (including food, health and beauty, and household paper and cleaning products), about 45% from variety items (including toys and housewares), and 5% from seasonal merchandise.

The company saw a jump in second-quarter same-store sales as an economic downdraft and rising unemployment owing to COVID-19 forced consumers to shop at discount retailers. "Dollar Tree's namesake banner has a long history of strong performance, enabled by its differentiated value proposition," writes equity analyst Akbari in his report, noting the company's "wide assortment of products at $1 or less has appealed to customers, drawing a broad range of low- to middle-income consumers."

The concept still has room to grow with rising square footage as it expands to new markets. "The chain's fast-changing assortment creates a treasure hunt experience that draws customers and is difficult for online retailers to match," adds Akbari, who lifted the stock's fair value to $88 from $85 because of better-than-expected quarterly performance.

Small basket sizes and the average transaction resulting in a modest bill insulate the company against the digital threat.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)