Our Ultimate Stock-Pickers' Top 10 Buys and Sells

Funds focus purchases in basic materials and consumer sectors.

For the past decade, our primary goal with Ultimate Stock-Pickers has been to uncover investment ideas our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we scour the quarterly (in some cases, the monthly) holdings of 26 different investment managers: 22 managers oversee mutual funds covered by Morningstar’s manager research group and four Stock-Pickers run the investment portfolios of large insurance companies. As holdings data becomes available, we attempt to identify trends and outliers among their holdings as well as any meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through our early read on our Ultimate Stock-Pickers' purchasing activity during the second quarter of 2020. The piece itself was an early read on individual purchases—focused on high-conviction and new-money buys—that were made during the period, based on the holdings of almost all our top managers. Now that all our Ultimate Stock-Pickers have reported their holdings for the period, we think it is appropriate to examine our managers' high-conviction purchases and sales in aggregate. As stock prices have changed since our Ultimate Stock-Pickers made their buying and selling decisions, we urge investors to analyze securities at current valuation levels before making any investment decisions and provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help investors along the way.

We were not surprised to see a continuation of a long-standing trend of net selling by our Ultimate Stock-Pickers. We think that this trend is likely primarily driven by the shift toward passive products. Despite the net selling, our Ultimate Stock-Pickers still made several high-conviction purchases as well as sales.

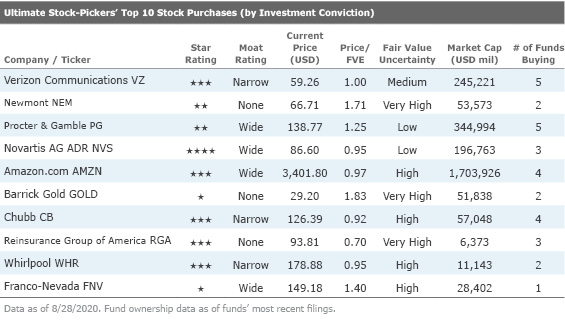

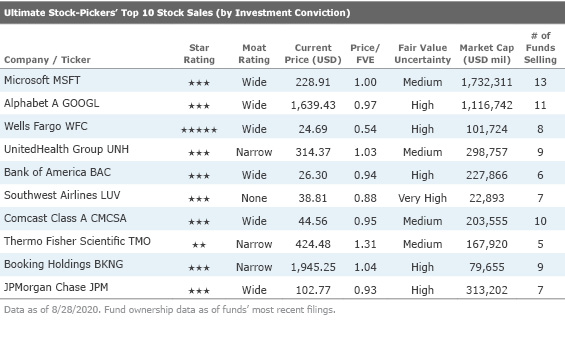

Our Ultimate Stock-Pickers continued their long-standing trend of buying and holding high-quality companies that Morningstar believes have developed sustainable competitive advantages. Morningstar's analysis shows that all the top 10 high-conviction holdings have either a narrow or wide economic moat and that eight of the top 10 conviction holdings have a wide economic moat. Additionally, seven of the 10 companies composing the top 10 high-conviction purchases and nine of the companies on the top 10 high-conviction sales lists have been granted either a narrow or wide economic moat by Morningstar analysts.

From a sector allocation perspective, our Ultimate Stock-Pickers are taking about as active of a stance as they were last quarter. The Ultimate Stock-Pickers remain meaningfully underweight in the consumer cyclical, energy, real estate, technology, and utilities sectors. There has been a shift away from the communication services sector and toward the basic materials sector, with our managers overtaking the S&P 500 in this arena. The Ultimate Stock-Pickers remain meaningfully overweight in the industrials and financial services sectors.

As many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that the composition of our top 10 conviction stock holdings was largely the same as the prior quarter, with the only changes being PepsiCo PEP replacing Booking Holdings BKNG and Amazon AMZN replacing Wells Fargo WFC. We noticed that the relative ordering of the top 10 stock holdings changed somewhat, with UnitedHealth UNH moving up the list and Bank of America BAC and Berkshire Hathaway BRK.B moving down the list. Our Ultimate Stock-Pickers continue to hold companies from the financial services, communication services, technology, healthcare, and consumer sectors with conviction, each contributing two stocks to our list. Our current fair value estimates suggest that none of the top 10 conviction holdings list is undervalued; our research indicates that wide-moat Johnson & Johnson JNJ and narrow-moat Apple AAPL are overvalued at the time of writing. As Bank of America has maintained its position on the top 10 conviction holdings list for quite some time and Berkshire Hathaway recently made a large purchase into the stock, we believe it is worthwhile to discuss the company's performance and take a closer look at Morningstar analyst Eric Compton's outlook on the bank.

As stated, one company on the top 10 stock holding list that is within our coverage universe is wide-moat Bank of America, currently held by 11 funds. This high uncertainty stock currently trades at about a 6% discount to Morningstar analyst Eric Compton's fair value estimate of $28.

Berkshire Hathaway purchased an additional 108 million shares of Bank of America this quarter, updating its stake to 10.9% of the total portfolio.

According to Compton, Bank of America has built sustainable competitive advantages as a result of cost advantages and switching costs. Being the second-largest U.S. bank in terms of assets, the bank is a leader in most of the areas it competes in with its peers. This is evidenced by a variety of factors, including its top two share in small-business lending, retail mortgages, and home equity lines of credit, its presence as one of the top corporate franchises in the country, and its role as one of the top deposit gatherers in the country. The acquisition of Merrill Lynch by Bank of America has also catapulted the bank to a top position within wealth management, including online retail brokerages and financial advisory. In addition, the bank has one of the largest shares in debit and credit card issuance, maintains its position as a top five global investment bank, is a top U.S.-based merchant acquirer, and is one of the top fee-earners from trading, as well. The bank is also able to invest heavily in technology, which in Compton's view puts it in a good long-term competitive position.

Bank of America was hit hard from an underwriting perspective during the previous financial crisis. Since then, the bank has worked toward reducing risk by modifying risky subprime loan and second mortgage exposure, and by rebalancing its portfolio exposure between the consumer and commercial side. Compton argues that management has set the tone from the top, and the bank has been growing much more responsibly since 2008.

The bank has lagged its peers from an operating efficiency perspective, caused to a large degree by post-crisis fines (highest out of the big four banks) accompanied by extended costs due to several large acquisitions pre-Great Recession. Since then, Bank of America has worked toward correcting this, consolidating 30% of its branches and reducing a large proportion of its headcount. Bank of America is now able to operate as efficiently as peers. Even though it does not necessarily outperform peers on an absolute basis, it is still more than able to match peers all while maintaining a $10 billion technology budget. The bank also has a better fee income mix than many competitors, making it better insulated during uncertain times.

Compton highlights that after years of restructuring and cleaning up operations, Bank of America is back on offense. The bank has increased mobile adoption, expanded its product offerings, and has grown into new markets, opening financial centers in new geographies. The bank's adequate capital levels, scope of products, and further room to for cost-cutting positions the banks well for the future.

While Bank of America has not been immune to the impacts of the COVID-19 pandemic, it has performed better than some of its competitors so far. Bank of America's exposure to COVID-19-related industries appears to be quite manageable. The bank has displayed some recovery from the previous quarter in spite of another large provisioning build, indicating its resilience and ability to survive during a downturn. Compton emphasizes that the story about the banks is not one about current results; it is more about maintaining a solid position in terms of capital and liquidity to weather the recession. Bank of America is a much better operator and a much more conservative underwriter now compared with the last crisis, and he believes the bank has adequate capital and will come out of this downturn intact.

As we previously mentioned, our Ultimate Stock-Pickers' top 10 conviction stock purchases list is almost entirely composed of names that have been given moats by Morningstar equity analysts. We found that our Ultimate Stock-Pickers made three purchases in the basic materials and consumer sectors, two in the financial services sector, and one each in the communication services and healthcare sectors. From a valuation and quality perspective, the cheapest wide-moat stock is Novartisb NVS, which received purchases from three funds. Since Procter & Gamble PG received buying attention from five funds, and since its price meaningfully differs from our analyst's fair value estimate, we believe it is essential to discuss this company.

Wide-moat rated Procter & Gamble currently trades at around a 25% premium to Morningstar analyst Erin Lash's fair value estimate of $111. The company faced many years of stagnant revenue, though it has since reported an impressive mid-single-digit rate of organic growth for the last eight quarters.

Lash argues that even though the current pandemic is undoubtedly contributing to higher sales of Procter & Gamble's products, P&G's prudent actions prior to the pandemic, such as refining its brand mix, have enabled the company to respond effectively to customer preferences and contributed to improved returns. The company now has a more holistic approach to businesswide brand investments, focusing on evaluating product performance, packaging, messaging, execution, and product value. Lash states this should give the company a long-term competitive edge.

While it's possible that a prolonged downturn could reduce a consumer's propensity to spend, Procter & Gamble's brands should exhibit some degree of resilience to this phenomenon. After the previous recession, with quarterly sales edging up at more muted levels for some time, the company worked toward improving returns by focusing on innovation, improving its product mix, and shedding discretionary products and offerings such as its professional beauty brands, to improve its competitive positioning and market share. Lash states that it's reassuring to see the company continue to focus on some of these tenets via brand spend instead of reducing investments here due to the uncertain macroeconomic environment.

Lash posits that the company maintains a sustainable competitive advantage as a result of intangible assets and cost advantages. Procter & Gamble is a leading household and personal-care manufacturer, having 25% share in baby care, 25% in feminine protection, 25% in fabric care, and 60% in blades and razors; this makes the company a valuable retail partner, strengthening its branding power. Its retailer relationships exhibit a level of stickiness, as the company has the capacity to invest in new products and advertise fares to potential customers, thus creating customer traffic in physical stores and on e-commerce platforms. Retailers would be hesitant to source out-of-stock products from untested suppliers, and Procter & Gamble's wide range of offerings brings value to these retailers. The company's products help increase store traffic, supporting Lash's intangible assets argument on the basis of brand recognition.

Procter & Gamble has amassed size and market share for many years, improving its competitive positioning. This has also helped the firm spend less per unit of products sold, especially in comparison with peers, further reinforcing a cost advantage.

Starting in 2014, Procter & Gamble shed over 100 products that were proving to be unprofitable. Lash states that this proves the company's desire to be a more nimble and responsive player. In spite of reducing its product offerings, the firm still holds an enviable position in its relationship with retailers, which supports its competitive advantage.

The Ultimate Stock-Pickers’ top 10 conviction sales list contains some new names compared with the previous quarter. Five of the conviction sales are also conviction holdings—wide-moat Alphabet GOOGL, Microsoft MSFT, Comcast CMCSA, and Bank of America, and narrow-moat UnitedHealth appear on both lists. Much of the selling activity came from the financial services sector, which contributed three names to the conviction sales list. Only one of the 10 names on this list is overvalued according to Morningstar estimates—narrow-moat Thermo Fisher Scientific TMO currently trades at a 31% premium to fair value. One such name is no-moat rated Southwest Airlines LUV, which trades at about a 12% discount to Morningstar analyst Burkett Huey's fair value estimate of $44.

Southwest has achieved its position as the largest domestic carrier in the U.S. through cost-cutting and growing market share by offering attractive, lower-cost fares. According to Huey, Southwest's strategy of being customer friendly provides it with something close to resembling a brand asset within the airlines industry. Huey also highlights that more than 85% of the firm's sales are through its own distribution channels, making price comparisons difficult, while other airlines are much more reliant on third-party distributors to obtain customers.

From a leisure travel perspective, Huey doesn't expect any massive share shifts, as the steep decline in passenger traffic due to COVID-19 will make it difficult to support market expansion. Even so, maintaining share in a market that has been hit so hard by COVID-19 can seem like small comfort. Recovery in commercial aviation will be led by the return of leisure travel as compared with business travel, as individuals are more likely to risk travel for personal reasons.

While Southwest had shifted gears and attempted to target higher-yielding business travelers as potential customers, the pandemic has led to a steep decline in business travel that Huey expects will be longer-lasting compared with leisure travel. Southwest's ability to attract the highest-yielding business travelers is further hampered by its dearth of transoceanic routes and premium offerings, though Huey believes the airline's lower-cost offerings should help the firm garner some share here in an environment where businesses are focused on cost-cutting.

The COVID-19 pandemic has led to the largest demand shock for airlines in history. This has led to forced capacity reduction, with aircraft that are still flying routes doing so at low load factors. While Huey expects Southwest and its competitors to face near-term losses as a result, he argues that Southwest is well positioned compared with its peers since the recovery in flying is likely to be led by leisure travel, and Southwest is better positioned within the leisure travel market as compared with the business travel market. Therefore, Southwest is expected to comparatively outperform, as the firm's business model is more profitable in lower-fare environments favoring leisure travel.

Southwest still has a difficult road ahead, most recently reporting an 87% decline in revenue. The timing of an economic recovery remains uncertain, which can explain why our Ultimate Stock-Pickers did not want to bear such risks in their portfolios.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Nupur Balain has an ownership interest in Bank of America. Eric Compton has no ownership interests in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)