Muni-Fund Investors Have Been Their Own Worst Enemies

A more disciplined approach should lead to better results.

Municipal-bond fund investors have often been their own worst enemies, but they don’t have to be.

With holdings that help finance state and local governments and other essential projects like schools, water systems, bridges, and toll roads, muni funds might seem like a staid backwater of the fixed-income world. When it comes to investor behavior, though, they’ve often been prone to erratic cash flows that have ended up hurting investor returns (also known as dollar-weighted returns or internal rates of return).

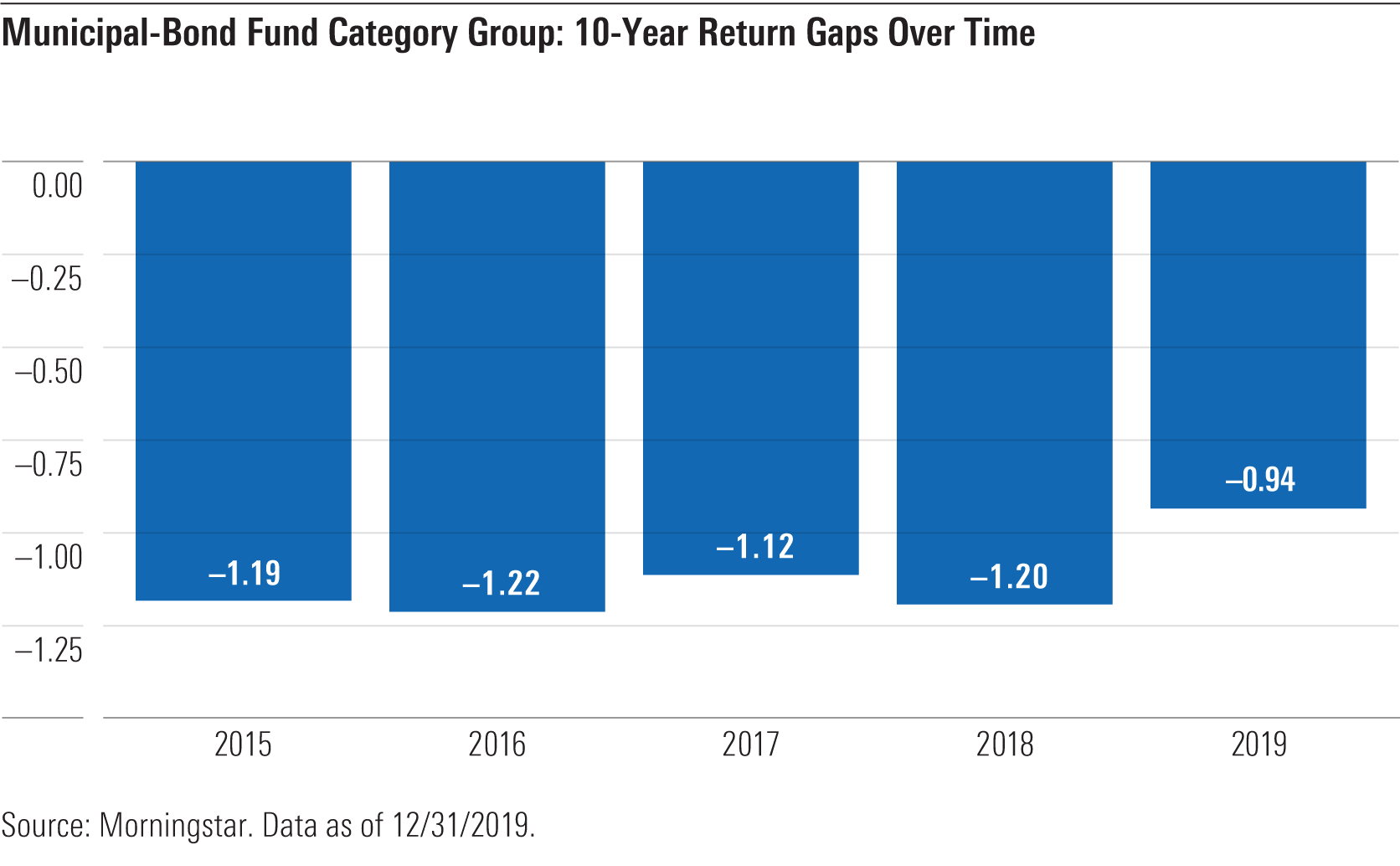

In our annual “Mind the Gap” study, which estimates the gap between investors’ dollar-weighted returns and reported total returns, we found that in aggregate, the returns muni-fund investors earned for the trailing 10-year period ended Dec. 31, 2019, continued to fall short of reported total returns by a fairly wide margin. This gap has averaged about 1.1% per year over the past five 10-year periods. It improved slightly for the most recent 10-year period but still stood at 94 basis points per year, as shown in the chart below. That’s particularly painful given that returns on muni funds aren’t that high to begin with.

The Problem With Cash Flows Muni funds have suffered lower investor returns partly because of their erratic--and sometimes poorly timed--cash flows.[1] Investors poured an estimated $49 billion into muni funds in 2012 but then suffered negative returns in 2013 when interest-rate and credit concerns weighed on the market. The same pattern happened in reverse when muni-fund investors pulled out an estimated $60 billion in 2013 and then missed out on stronger returns in 2014.

More recently, muni-fund shareholders again headed for the exits in 2018, pulling out an estimated $24.7 billion on worries that munis would suffer from both rising interest rates and reduced demand because of lower tax rates. By the end of the year, though, returns had stabilized, and investors again flooded into muni funds, pouring in an estimated $58.9 billion in 2019. Many of those assets reversed course when the muni sector was hit by liquidity and credit quality issues during the spring of 2020.

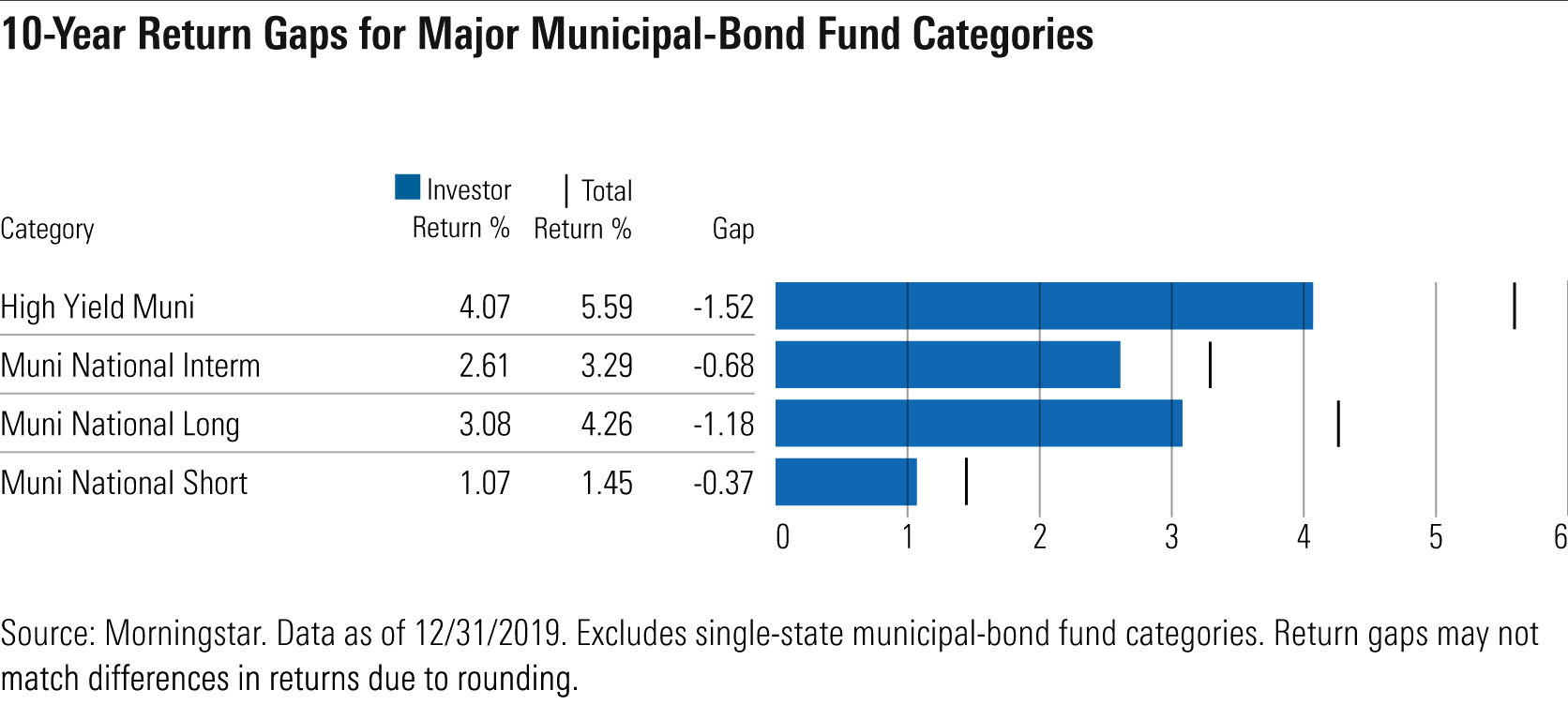

These big swings in cash flows haven’t led to better results. As the chart below shows, investor return gaps were negative for all four major muni-bond Morningstar Categories, with particularly bad results for high-yield and long-term muni funds.

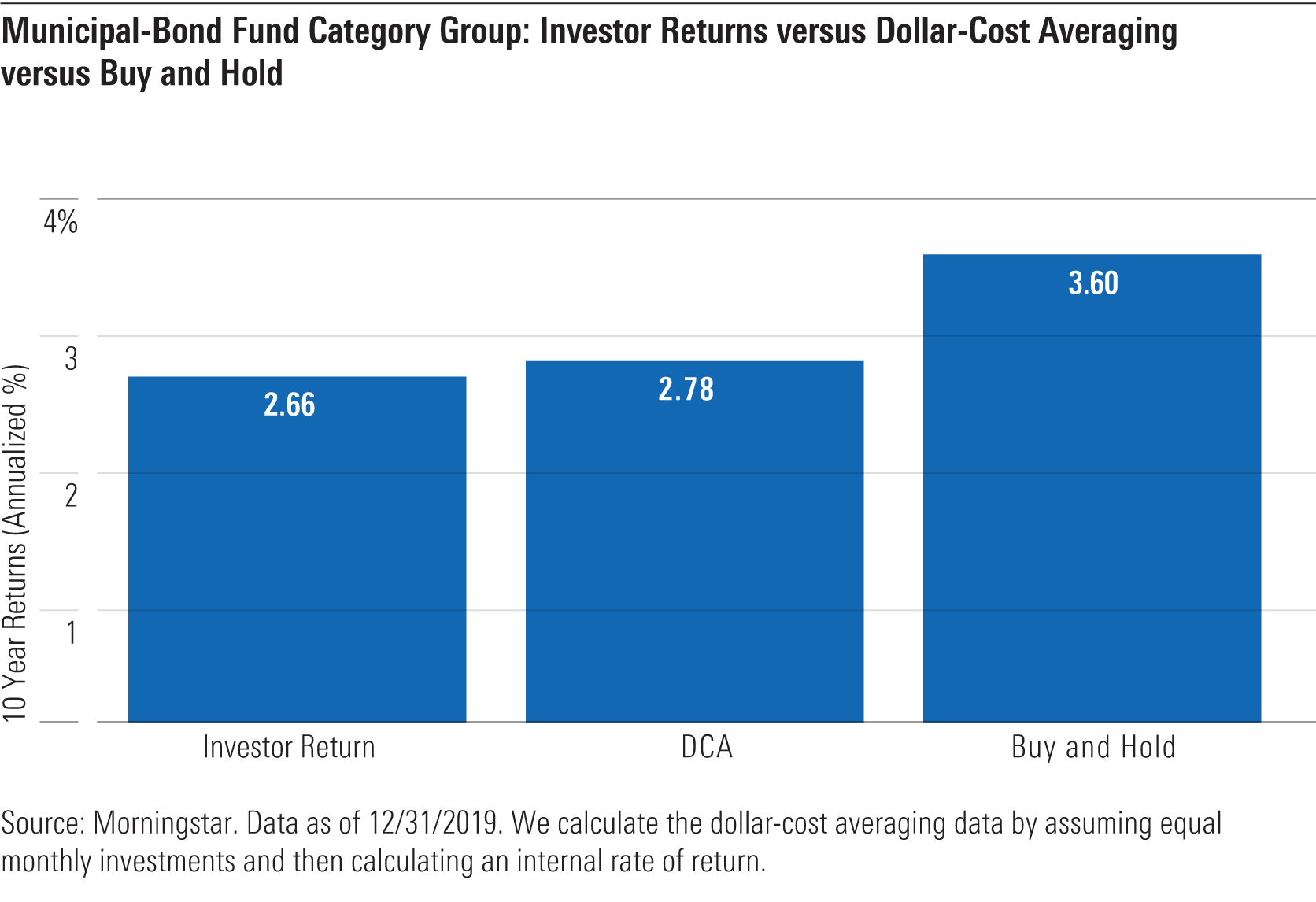

In fact, muni-fund investors would have fared slightly better by simply investing the same amount every month (dollar-cost averaging). Our study found that investors following a systematic investing approach would have improved their investor returns by about 10 basis points per year compared with the dollar-weighted returns they actually experienced.

Better still would be the tried-and-true approach: Buy and hold. Those who invested a lump sum at the beginning of 2010 and just held tight for the next 10 years would have earned significantly better returns than either dollar-cost averaging or the actual investor returns.

A Better Approach to Muni Funds Following a buy-and-hold approach may be easier said than done. Muni funds can be prone to somewhat erratic performance because of credit quality issues and lack of liquidity. Overall, intermediate-term muni funds, which account for the majority of muni-fund assets, have had both higher volatility and deeper quarterly losses compared with their taxable-bond fund counterparts.

Even so, taking a step back to find the right fit in a muni fund can make your holdings easier to live with. These quality screens won't directly improve your dollar-weighted returns, but they should reduce the odds that you'll be tempted to sell at the wrong time.

1. Make sure muni funds make sense for your situation. Muni funds can be appealing mainly because of their tax-advantaged status. But depending on your tax situation and the current level of muni yields, there may or may not be a significant yield advantage for muni funds after you take taxes into account.

The best way to figure this out is to calculate a taxable-equivalent yield, which allows you to make apples-to-apples comparisons between the aftertax income from taxable and tax-exempt vehicles. To calculate it, take the nominal (or pretax) yield for the tax-advantaged vehicle and divide it by the percentage of income you'll keep after taxes (or 1 minus your tax rate). The answer represents how much income you would have to receive from a taxable investment to make it more competitive than the municipal choice.

As I wrote a few months ago, the yield advantage for muni funds steadily shrank during 2019. After widening amid 2020's market turmoil, yield spreads have narrowed again. SEC yields averaged about 1.08% for intermediate-term muni funds as of July 31, 2020. That translates into an aftertax yield advantage of about 15 basis points for investors in the 24% tax bracket compared with intermediate-core bond funds. The higher your tax bracket and the larger the account balance, the bigger the tax advantage.

2. Keep credit quality top of mind. Credit quality is another important consideration, especially given the shaky state of many state and local budgets. Funds that bill themselves as high-yield often dip into lower-credit-quality rungs, but that has led to heavier losses during bond market downturns, such as 2008, when the average high-yield muni fund lost 25%. Although default rates on muni funds have typically been low overall, potential or actual defaults can roil the market from time to time, such as when the city of Detroit filed for bankruptcy in 2013. For high-yield munis, liquidity is a related risk factor that can lead to heavier losses during periods of market stress. The wide gap between investor returns and total returns for high-yield muni funds--1.5 percentage points per year--underscores how difficult these funds can be to use effectively.

The muni national intermediate category offers less generous yields but is a safer bet in terms of credit quality and default risk. That’s especially true given the current economic downturn, which is putting pressure on finances for many state and local governments.

3. Every basis point counts for expenses. Expenses are another key factor to consider. The average fund in the intermediate-term muni category has an expense ratio of about 0.6%, but lower is better. That's especially true given the narrow range of returns for fixed-income funds. In particular, passively managed index funds can be a compelling option for cost-conscious investors because of their low expense ratios. As we pointed out in a previous article, index-based muni funds have improved their ability to track market benchmarks in recent years despite the challenges of the muni market, with its sprawling size, limited liquidity, and larger number of unrated bonds. In the intermediate-term muni category, investors can now choose from several passively managed mutual funds and exchange-traded funds from fund families including Fidelity, iShares, and Vanguard.

4. Be aware of interest-rate risk. Investors willing to take on additional risk can eke out extra yield by going further out on the yield curve. The average long-term muni fund currently boasts an SEC yield of 1.66%, which translates into a taxable-equivalent yield of 2.18% for investors in the 24% tax bracket. That yield comes with some risk of higher volatility, as any increase in interest rates would depress prices on longer-duration bonds. That's probably not likely to happen in the next couple of years, though, as the Fed has indicated that it doesn't plan to raise the benchmark interest rate until at least 2023.

Even so, it’s worth doing a gut check on your ability to take on additional interest-rate risk, as investor returns for long-term muni funds have lagged those on short- and intermediate-term offerings.

Conclusion Investors following a buy-and-hold approach would have had a far better investor experience with muni funds over the past 10 years. Therefore, it's important to take a long-term view and resist the urge to bail out at the first sign of trouble. Favoring funds with higher credit quality and low expenses can go a long way toward ensuring that the muni fund you choose is one you can live with. While poor timing and volatile cash flows have been the bane of many muni-fund investors, a consistent investment approach should lead to better results over time.

[1] All cash flow and asset figures referenced in this article are based on the data set included in our study, which includes mutual funds and ETFs that were created before Jan. 1, 2010.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)