Morningstar is using recent advances in technology to expand the number of U.S. funds that our analysts rate for investors by nearly sixfold. We’ve created the Morningstar Quantitative Rating for funds, which relies on predictions from a machine-learning model that’s been trained to emulate how our analysts make decisions.

Why we developed the Morningstar Quantitative Rating

The Morningstar Quantitative Rating helps us provide investors with even broader fund coverage, so they can evaluate their investments through multiple lenses to reach their financial goals.

Think of the Quantitative Rating as an extension of the Morningstar Analyst Rating TM for funds. Like the Analyst Rating, it provides a forward-looking assessment of a fund’s ability to outperform its peer group or a relevant benchmark on a risk-adjusted basis over a full market cycle.

The Quantitative Rating fills in the gaps where our analysts don’t currently have coverage. It uses a machine-learning model that’s based on the analysts’ past decisions, their decision-making processes, and the data used to support those decisions.

So, what’s behind the machine-learning technology used to create this new rating? Let’s take a look.

The wisdom of crowds: Why it’s better than phoning a friend

Before we get into the details of machine learning, it’s important to take a step back and discuss the concept of wisdom of crowds. The basic idea is that a group of people can make better decisions than an expert individual.

Consider the game show “Who Wants to Be a Millionaire,” where contestants answer trivia questions for a chance at the top prize of $1 million. If a contestant doesn’t know a trivia answer, then he or she could use a lifeline, such as “ask the audience” or “phone a friend.”

Let’s say your game show winnings depended on using a lifeline. What would you do? Phone a friend? Or would you ask the audience? The data shows that the best thing you can do is ask the audience. Why? Because when you pick a friend to call, you typically choose the smartest person you know. But your smartest friend is worse at answering trivia questions than a group of people with average intelligence.

- Phone a friend - 65% correct

- Ask the audience - 91% correct

Why are crowds smarter? Well, not all crowds are. You need these three things for the phenomenon to work:

- Independence. An individual’s guess cannot be influenced by others. For example, you wouldn’t want people in the audience to discuss as a group what’s the best answer. A medical-related trivia question may prompt a doctor to stand up and provide an opinion. While the doctor may be an expert, his or her influence will destroy the independence of the group.

- Some talent needed. You don’t need people in the crowd to have very much talent. Their guess just needs to be better than random.

- A sizable number of guesses. In practice, you typically need several hundred guesses.

How machine learning powers the Morningstar Quantitative Rating

The machine-learning algorithm that's used in the Quantitative Rating is designed to take advantage of the wisdom-of-crowds effect. To train our model, it’s given access to the current and historical ratings decisions of Morningstar analysts, along with the data used to support those decisions. We do this because the model needs to know what it’s trying to emulate to make a good prediction. The final model is a collection of thousands of models with imperfect information that together can provide a very good approximation for how an analyst would rate a fund.

Once the overall model has been trained based on the past analyst decisions, we can calculate the rating for a new fund by simply collecting all the input data available on that fund. These are things like expense ratio, manager tenure, and past returns. The input data is run through the thousands of underlying models, and, together, they come up with the final rating.

How we tested the Morningstar Quantitative Rating

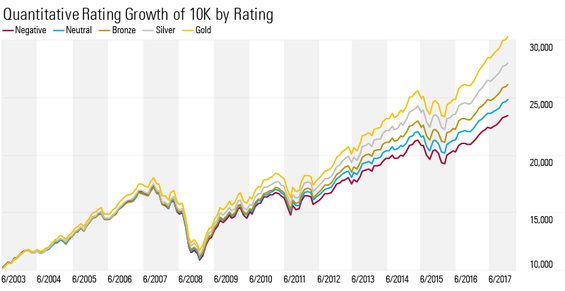

Of course, no rating system—quantitative or analyst—is valuable without empirical evidence of its predictive ability. We have rigorously tested the performance, accuracy, and stability of the Quantitative Rating, and it’s performed very well in our tests. The full analysis is available in our methodology document, but here is a straight forward example. The chart shows the performance of $10,000 invested in an equal-weighted portfolio rebalanced monthly of all the funds in each rating bucket. As you can see, Gold-rated funds performed the best and Negative-rated funds performed the worst.

What funds are covered by the Morningstar Quantitative Rating

Only U.S. open-end funds and exchange-traded funds that don't currently have an Analyst Rating and are in a category that Morningstar currently rates are eligible to receive a Quantitative Rating.

The rating scale for the Quantitative Rating is the same as the Analyst Rating: Gold, Silver, Bronze, Neutral, and Negative. And funds that receive a Quantitative Rating will receive quantitative ratings of Positive, Neutral, or Negative for each of the five pillars—Parent, People, Performance, Price, and Process. U.S. funds will either receive an Analyst Rating or a Quantitative Rating, but not both.

To learn more about how the Morningstar Quantitative Rating differs from our analysts' analyses, check out this video.