The Number of Funds Considering ESG Explodes in 2019

Nearly 500 funds added ESG criteria to their prospectuses for the year.

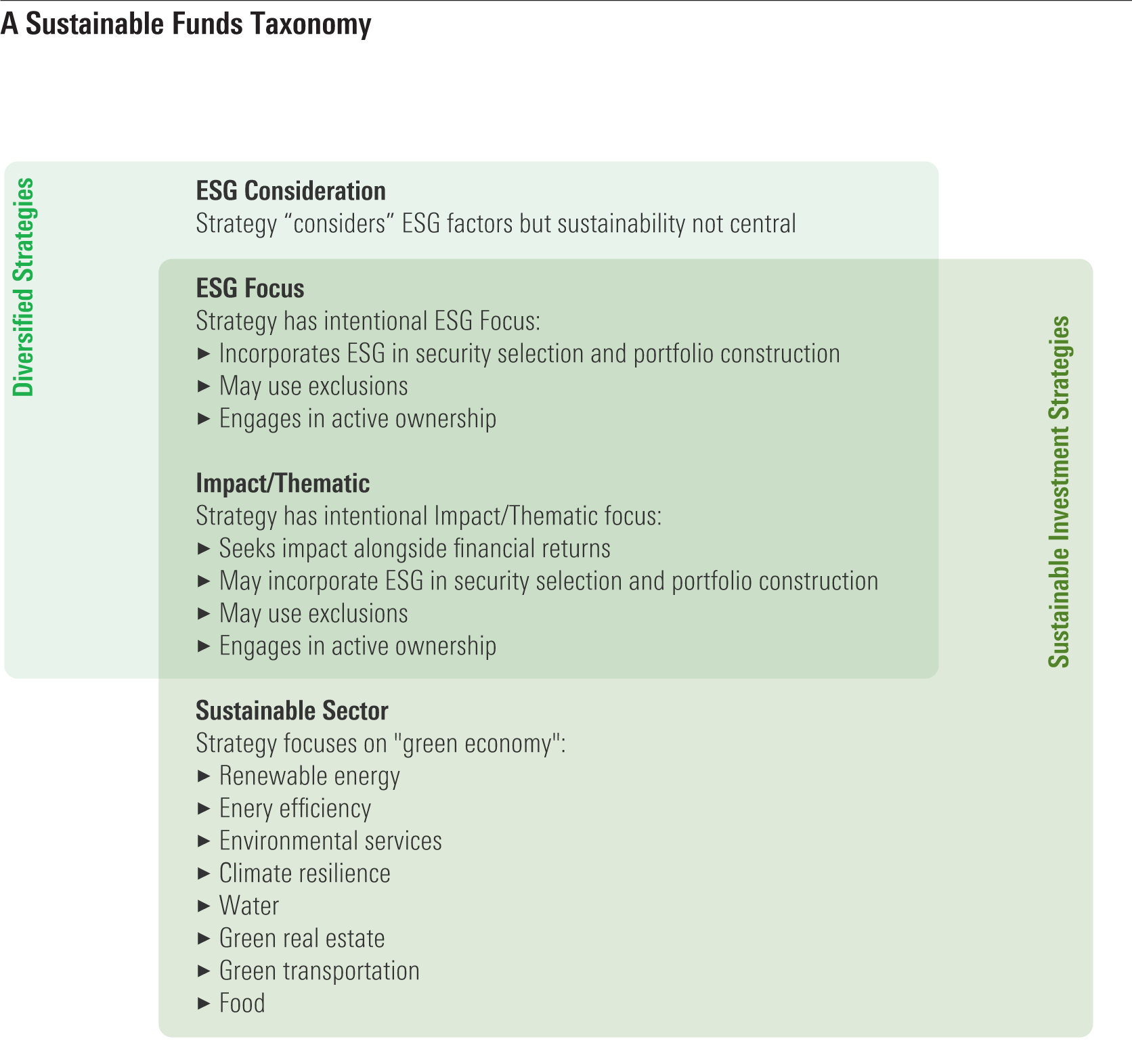

The number of actively managed funds adding environmental, social, and governance criteria to their prospectuses exploded in 2019. These are not what I consider to be full-fledged sustainable investments. They are otherwise conventional funds that now say they consider ESG factors in their investment process. I call them "ESG Consideration" funds.

Source: Morningstar.

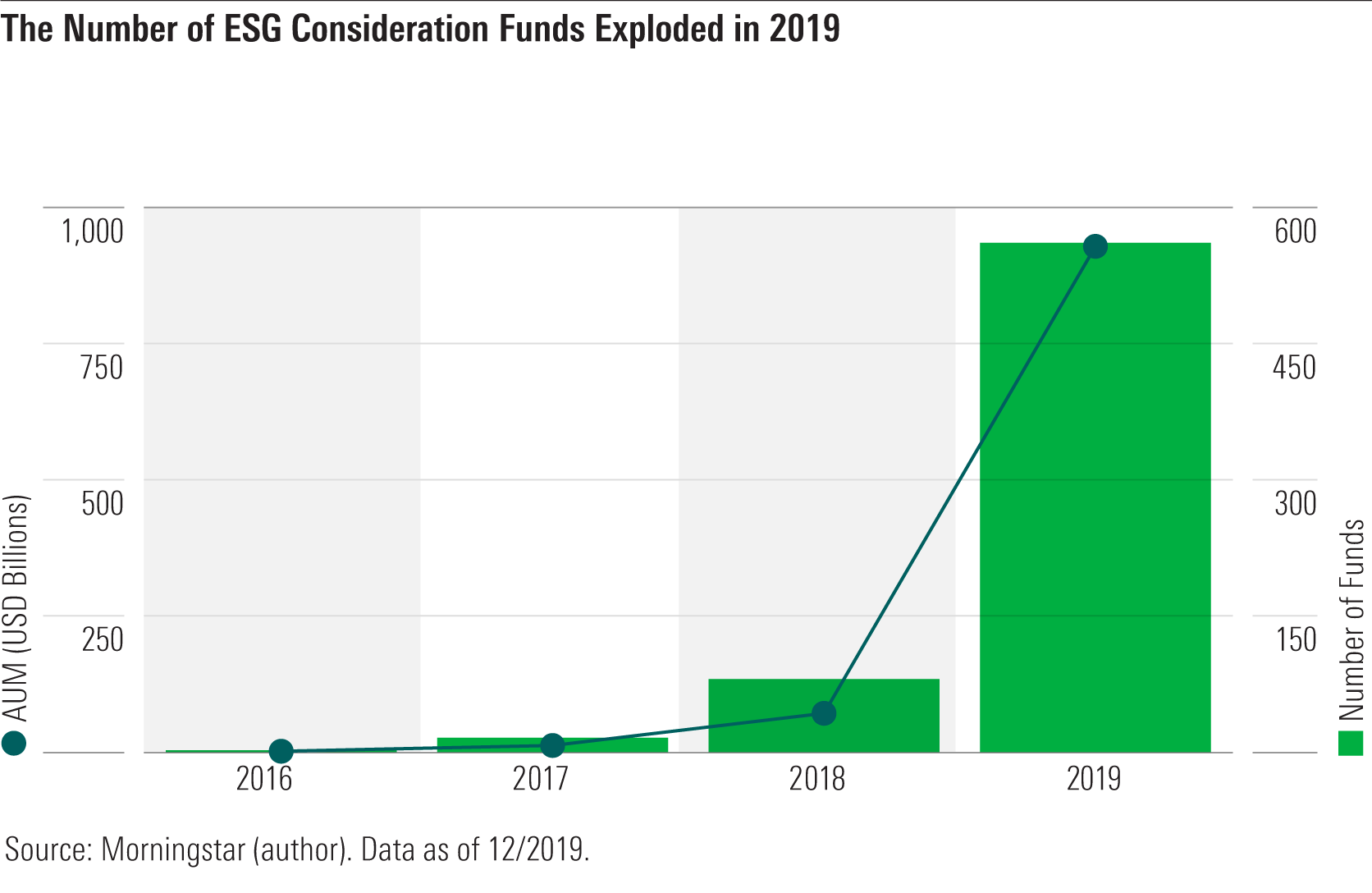

After a few funds added ESG language to their prospectuses in 2016 and 2017, the trend took off in 2018 when more than 50 funds did so. Then in 2019, nearly 500 funds added ESG language to their prospectuses.

Asset managers that did so across all or substantial portions of their fund lineups in 2019 included BMO (26 funds), ClearBridge (19), Eaton Vance (77), MFS (67), and Franklin Templeton (20).

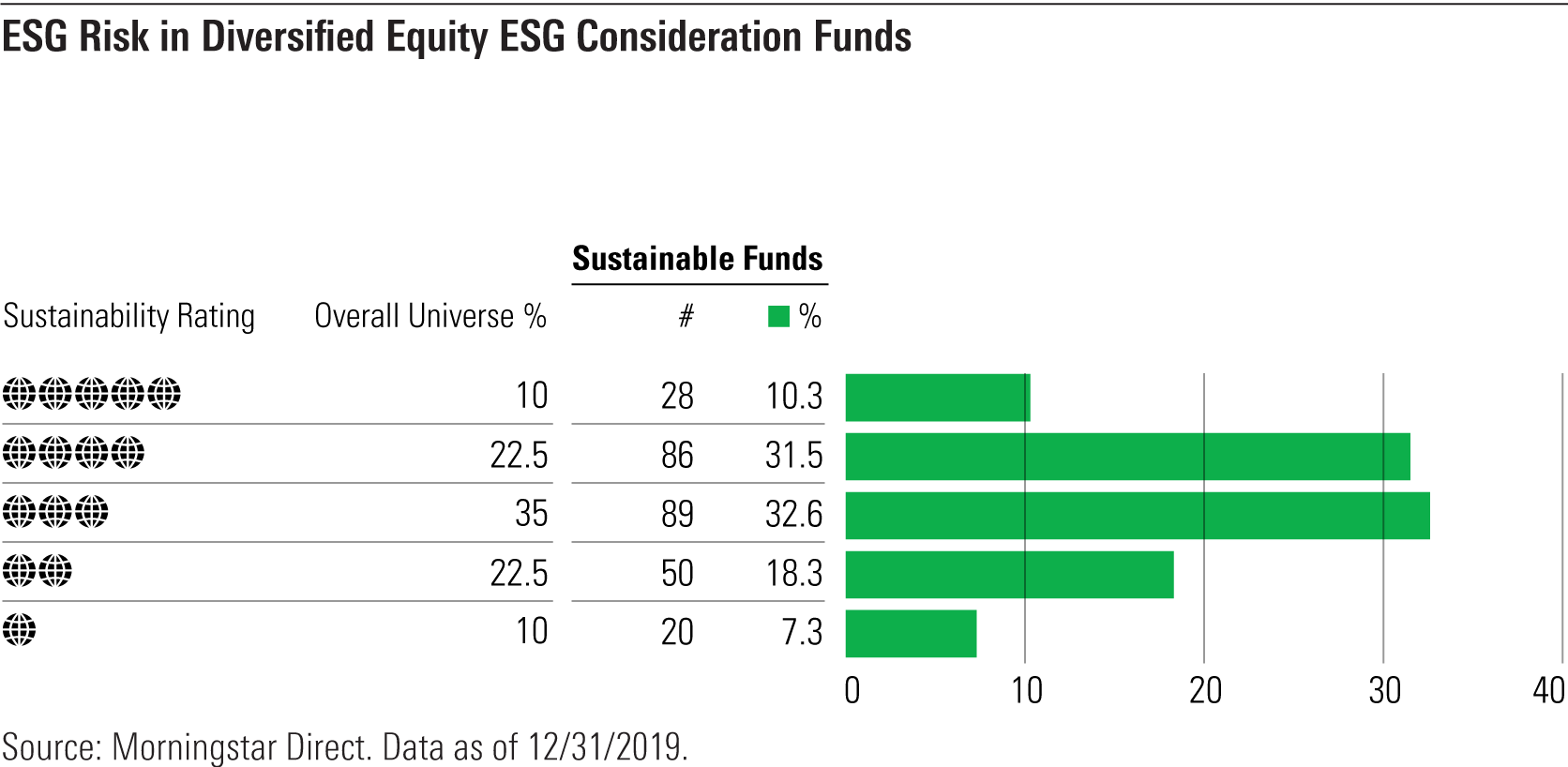

Overall, as reported in the recent Sustainable Funds U.S. Landscape Report, there were 564 ESG Consideration funds with $933 billion in assets under management at the end of 2019. Twenty-three of the funds have more than $1 billion in assets. Most (302) are equity funds, spanning U.S., international developed, and emerging markets. But another 223 are fixed-income funds and the balance a smattering of allocation, commodities, and convertibles funds.

Why Is This Happening? The explosive growth of funds considering ESG reflects the now widespread recognition among asset managers of the materiality of ESG factors in evaluating investments, the greater capacity of asset managers to evaluate ESG factors through increased analytical resources and personnel, and, no doubt, a desire on the part of asset managers to signal their ESG awareness to end investors.

The view that ESG factors are relevant to all investments has become increasingly mainstream, as illustrated by the CFA Institute's position statement, released in 2018: "The CFA Institute encourages all investment professionals to consider ESG factors, where relevant, as an important part of the analytical and investment decision-making process, regardless of investment style, asset class, or investment approach." Moreover, the CFA Institute's view is that factoring ESG into the investment process "is consistent with a manager's fiduciary duty to consider all relevant information and material risks in investment analysis and decision-making."

What Does It Mean for These Funds? Adding a line in the prospectus about ESG does not fundamentally change these funds' overall investment processes. But it does formally convey to investors that the funds may use ESG to inform their investment decisions.

Unlike fully committed sustainable funds, ESG Consideration funds do not apply ESG criteria to every investment decision. ESG is not central to their strategies at either the security-selection or portfolio-construction stage. These funds typically do not use any exclusionary screens, impact analysis, or shareholder engagement as a formal part of their process. They are best thought of simply as funds that consider ESG information to be relevant to a thorough investment process.

Is ESG Consideration Good for Investors? Having more funds recognize the relevance of ESG is a good thing for investors who, after all, are paying their fund managers to bring to bear all material, relevant information in making investment decisions. Having more funds formally acknowledge a role for ESG in their prospectuses helps advisors and fund investors understand and identify those managers that are doing so. Investors for whom ESG consideration might be a factor in fund selection have an expanding universe from which to choose.

But Is It Greenwashing? On the other hand, simply adding a line in a prospectus about ESG consideration doesn't reflect a commitment to sustainable investing or a significant change in a fund's investment process. And though these funds are not being rebranded or marketed as sustainable funds (at least not yet), the fact that they now consider ESG could be a way to sell them to consultants and advisors looking for ESG funds, allowing them to grab some of the growing ESG market share and stem the tide of net outflows from these actively managed funds.

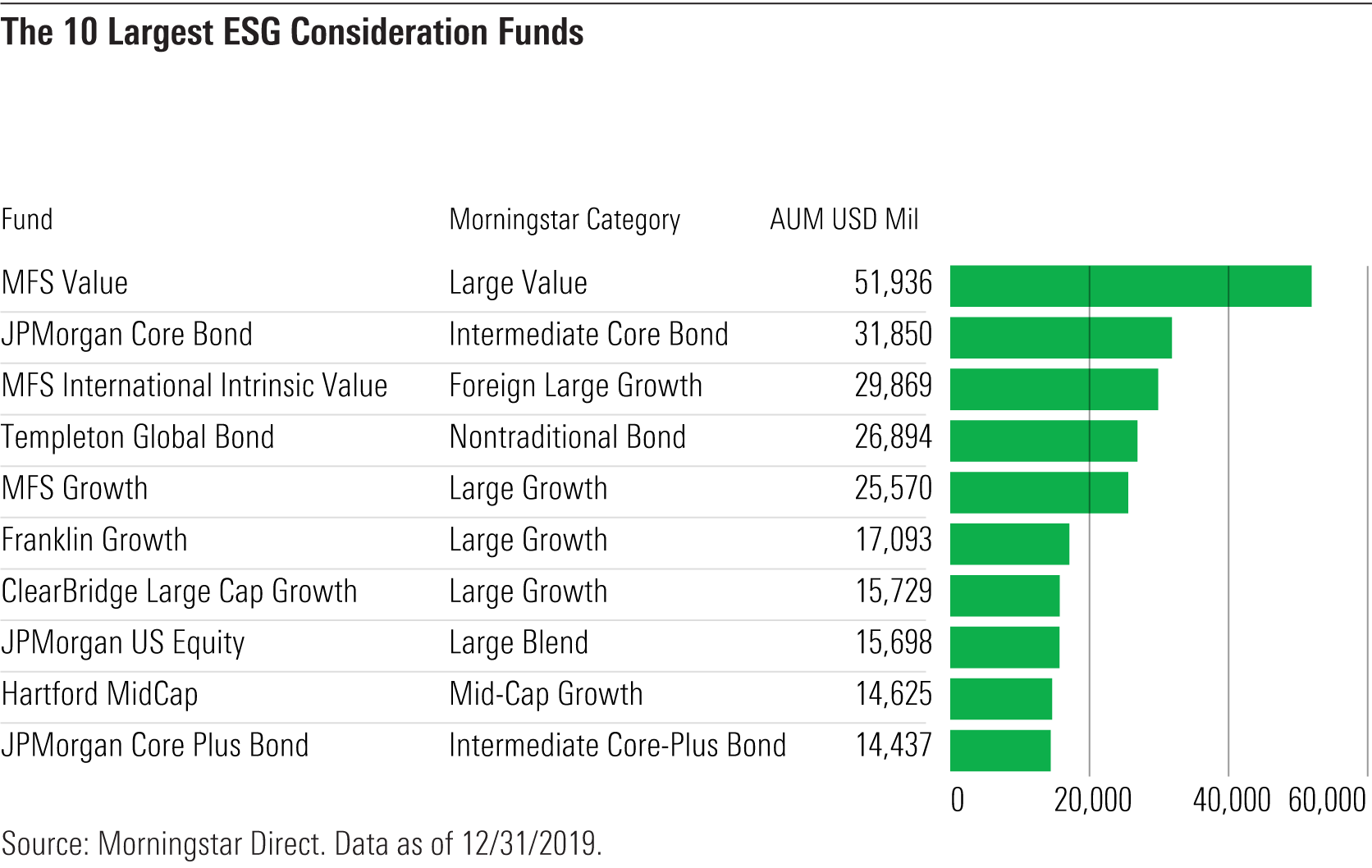

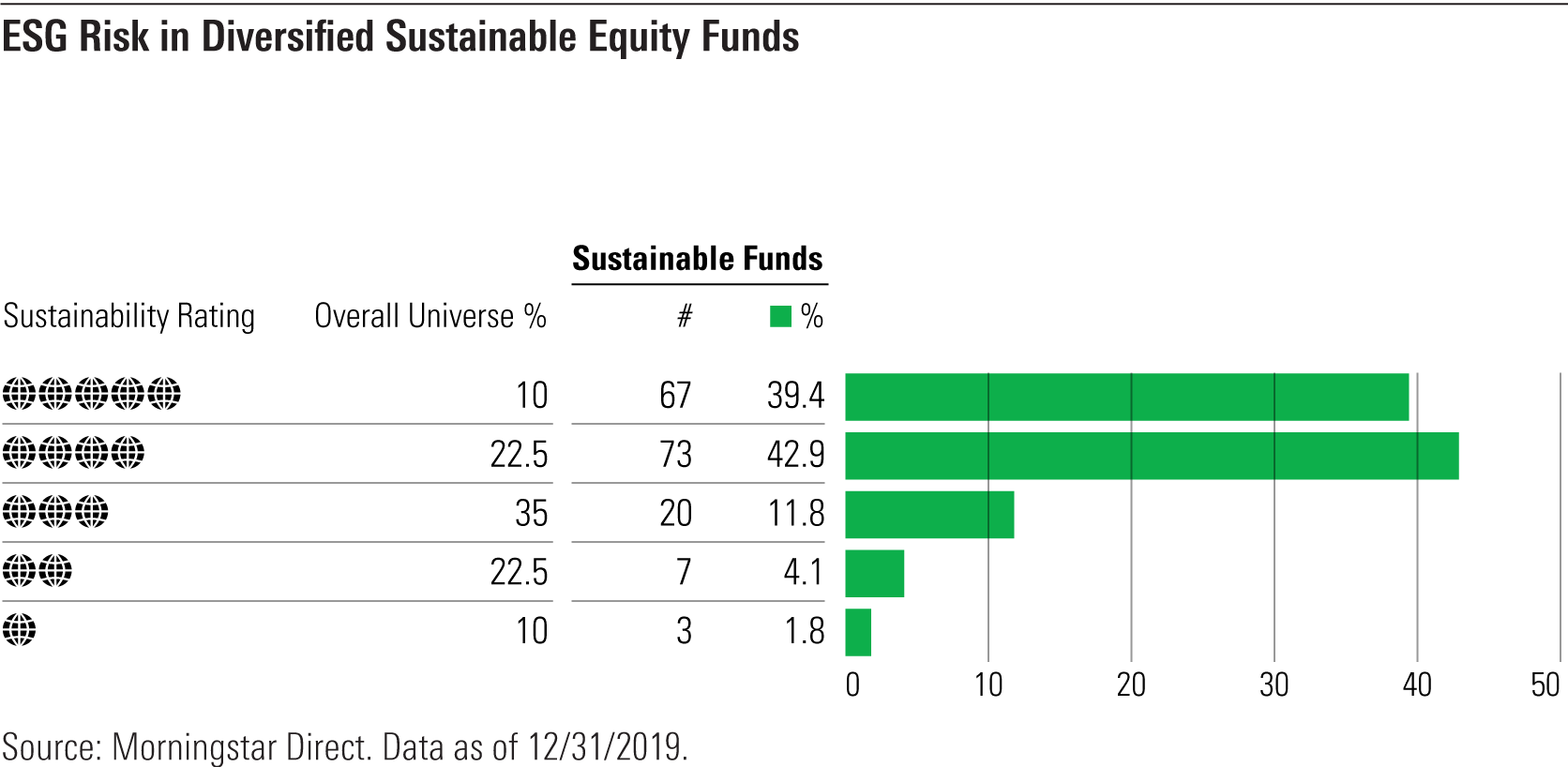

Indeed, there is a clear distinction to be made between ESG Consideration funds and those with a clear commitment to sustainable investing. The typical diversified sustainable fund's portfolio is tilted toward companies that its managers believe are addressing material sustainability challenges in ways that will make them better investments and away from companies that are not. These funds have significantly better Morningstar Sustainability Ratings than ESG Consideration funds, as can be seen in the two exhibits below.

More than four in five (82%) diversified sustainable funds receive the highest Morningstar Sustainability Ratings of 4 or 5 globes, compared with only a third in the overall funds universe. ESG Consideration funds, by contrast, don't fare nearly that well, with only 42% receiving 4 or 5 globes, although the distribution of globe ratings for ESG Consideration funds is skewed somewhat more positively than for the overall fund universe.

On balance, sustainable investors have been arguing for years that some consideration of ESG factors should be a routine part of investing. The rapidly increasing number of ESG Consideration funds demonstrates that this is happening. At the same time, investors should be aware of the differences between sustainable funds and ESG Consideration funds. Those who want to orient their investments around sustainability and impact should focus on sustainable funds, the ranks of which are also growing rapidly.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)