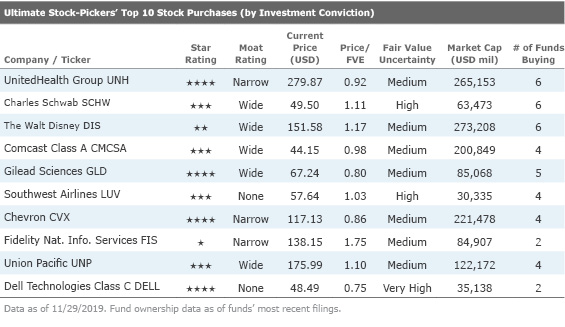

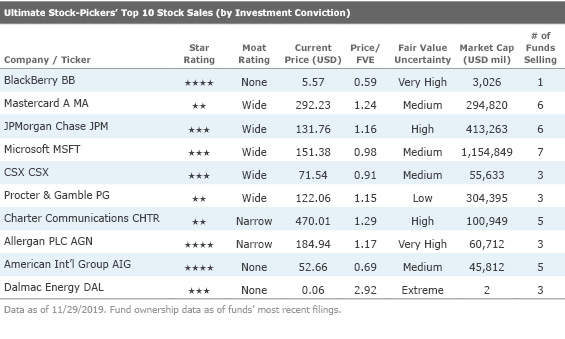

Our Ultimate Stock-Pickers’ Top 10 Buys and Sells

Managers continue to buy wide-moat stocks.

For the past decade, our primary goal with Ultimate Stock-Pickers has been to uncover investment ideas our equity analysts and top investment managers find attractive in a manner timely enough for investors to gain some value. As part of this process, we scour the quarterly (in some cases, the monthly) holdings of 25 different investment managers: 21 managers oversee mutual funds covered by Morningstar's manager research group and four Stock-Pickers run the investment portfolios of large insurance companies. As holdings data becomes available, we attempt to identify trends and outliers among their holdings as well as any meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through the Ultimate Stock-Pickers' purchasing activity during the third quarter of 2019. The piece itself was an early read on the purchases--focused on high-conviction and new-money buys--that were made during the period, based on the holdings of almost all our top managers. As all of our Ultimate Stock-Pickers have reported their holdings for the period, we think that it is appropriate to examine our managers' high-conviction purchases and sales. As stock prices have changed since our Ultimate Stock-Pickers chose to purchase or sell the holding, we urge investors to analyze securities at current valuation levels before making any investment decisions and provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help investors make these decisions.

We were not surprised to see a continuation of a long-standing trend of net selling by our Ultimate Stock-Pickers. We think that this trend may be due to the continuing shift toward passive products. Despite the net selling, our Ultimate Stock-Pickers still made several high-conviction purchases and sales.

Our Ultimate Stock-Pickers continued their long-standing trend of buying, selling, and holding high-quality companies that Morningstar believes have developed sustainable competitive advantages. Morningstar's analysis shows that all the top 10 high-conviction holdings have either a narrow or wide economic moat and that eight of the top 10 conviction holdings have a wide economic moat. Additionally, eight of the 10 companies composing the top 10 high-conviction purchases list have been granted either a narrow or wide economic moat by Morningstar analysts.

From a sector allocation perspective, our Ultimate Stock-Pickers are taking about as active of a stance as they were last quarter. The Ultimate Stock-Pickers remain meaningfully underweight in the real estate, utilities, energy, and communication services sectors. The favorable shift toward the consumer sector has continued, with our managers overtaking the S&P 500 in this arena. The Ultimate Stock-Pickers remain meaningfully overweight in industrials, financial services, and basic materials and are now also overweight in the technology and consumer sectors.

As many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that the composition of our top 10 conviction stock holdings was mostly unchanged compared with the prior quarter. UnitedHealth Group UNH replaced Johnson & Johnson JNJ; otherwise, the list remains unchanged. We noticed that the relative ordering of the top 10 stock holdings altered somewhat, with Comcast CMCSA, Bank of America BAC, and Wells Fargo WFC moving up the list, while Berkshire Hathaway BRK.B , JPMorgan Chase & Co. JPM, and Mastercard Inc. MA moved down the list. Our Ultimate Stock-Pickers continue to hold companies from the financial services and technology sectors with conviction, as these sectors contributed five and two stocks to our list, respectively. We think that most of the top 10 conviction holdings list is fairly valued, with a few notable exceptions. Our research indicates that wide-moat rated Berkshire Hathaway is undervalued, while Apple AAPL, JPMorgan Chase & Co., and Mastercard are overvalued. As Bank of America has moved into the top half of our top 10 stock holdings list, we believe it is worthwhile to discuss the company's performance and take a closer look at Morningstar Analyst Eric Compton's outlook on the bank.

Wide-moat rated Bank of America is currently held by 11 funds. The bank is one of the biggest financial services firms in the United States, with four core segments including consumer banking, global wealth and investment management, global banking, and global markets. This high uncertainly stock currently trades at about the same level as Morningstar Analyst Eric Compton’s fair value estimate of $31.

Compton argues that Bank of America has built sustainable economic advantages as a result of its scale and its position as the second-largest American bank by assets. The bank additionally maintains a top-level share in many of its services, including one of the highest deposit shares, high retail mortgage and HELOC share, and strong small business lending share across the country. Moreover, the bank is one of the top five global investment banks. Its leading position has allowed it to enjoy lower costs as a result of a low-cost deposit base and high operational efficiency.

There are additional switching costs as the bank’s scale allows it to generate economies of scale and economies of scope as it integrates its product offerings and cross-sells them. Compton predicts that Bank of America’s scale will also allow it to invest more in technological advancements. This ability to invest in technology that can be scaled combined with millions of customer data points will allow it to remain advantaged over competitors in the long run.

Bank of America is finally starting to show growth in its many businesses after a shaky decade of recovery from the 2008 financial crisis. While some previously ill-timed acquisitions led to trouble for the bank’s shareholders and caused years of settling legal fines and working through regulatory issues, Bank of America has greatly cleaned up its business and is finally showing decent returns.

Bearish investors continue to believe that its growth rate and operational complexity will be unmanageable in the long run. They also contend that other digital competitors will reshape the industry and help it move away from the traditional branched banking system. Further, as the credit outlook remains neutral to even negative, the rate outlook remains hazy, and as competition in the sector grows, returns will eventually go down. While Compton acknowledges that the macro environment could turn against the banks at some point, as far as the underlying business operations of Bank of America are concerned, he remains positive. He argues that the bank’s strategy of efficiency improvement, risk reduction, and business simplification has helped it recover from previous missteps. And its latest performance shows that the bank and its strategies are finally working.

While expense control has certainly been a focus, Bank of America has also concentrated on growth. Decent growth in consumer deposits and checking accounts was accompanied by growth on the retail wealth management side. The bank is expanding into new markets and building new financial centers. Bank of America has seen an increase in clients from the commercial perspective as well, and after some share losses within its investment banking unit, the segment has turned things around and is capturing a greater share of fee income once again.

According to Compton, as Bank of America continues to grow, its diverse product offerings, solid capital levels, improving efficiencies, and continued investments indicate sustainably high future performance.

As we previously mentioned, our Ultimate Stock-Pickers' Top 10 Conviction Stock Purchases list is almost entirely composed of names that have been given moats by Morningstar equity analysts. We found that our Ultimate Stock-Pickers did not focus on any one sector in particular, with purchases distributed among five sectors. We have covered several of the undervalued names on the conviction purchases list in the previous editions of Ultimate Stock-Pickers. From a valuation and quality perspective, the cheapest wide-moat stock is Gilead Sciences GILD, a biotechnology firm invested in drug research, which received conviction purchases from the American Century Value I AVLIX fund and the Parnassus Core Equity Investor PRBLX fund. We covered Gilead in our last article. While wide-moat Walt Disney DIS is not meaningfully undervalued, it is essential to discuss due to its recent splash in the streaming services arena.

Disney currently trades at a premium to Morningstar analyst Neil Macker's fair value estimate of $130, though a fair amount of this can be attributed to the advent of Disney+, the company's new streaming service. Macker expects his fair value estimate to increase to incorporate the effects of Disney+ in the near future.

Disney is a globally recognized name and a giant in the media and entertainment world. The company's world-class brand is much sought after and maintains its reach across multiple platforms, including television, film, home videos, theme parks, merchandising, and musicals. Its widely recognized animated franchises also continue to grow as they produce increasing quantities of original films. The Marvel franchise has been performing exceptionally well, and contracts to produce several more films remain in place. Acquiring LucasFilm, the parent of Star Wars, has helped Disney capture yet another segment of viewers. The company's amusement parks are also nearly impossible to replicate as its bevy of characters give them a special appeal.

Disney's involvement in the streaming services industry will only further benefit the company. Under the Disney+ umbrella, subscribers gain access to Hulu and ESPN+ alongside the company's own curated collection of programs and movies. Macker believes that offering new and established content will help the company grow its subscriber base even more and position it well for the future.

Macker establishes the company's wide-moat rating on the basis of strong pricing power due to branding. This pricing power is primarily demonstrated by the company's several Disney-branded businesses and its media networks segment. In spite of a highly competitive marketplace, the addition of Twenty-first Century Fox's entertainment collection will further bolster Disney's position and protect it from stiff competition in future years.

One of Macker's guiding premises is that content-creation will always increase in value no matter the change in the mode of distribution. In the end, having a vast quantity of content is going to be one of the primary attractions for consumers. Companies that can generate the most streamable content are likely to gain greater market share and hence earn more revenue. As Disney continues to acquire and develop high-quality content, we believe it will remain one of the top entertainment providers for years to come. Disney's other media components include heavyweights such as ESPN, a key player in the U.S. sports entertainment business, ABC, one of the most recognizable broadcast channels in the country, and the Disney Channel, one of the two top cable television networks aimed at children.

The company is able to monetize its characters across a multitude of platforms. While the highly recognizable, traditional Disney characters continue to attract a younger audience, the company has diversified its universe to appeal to adults as well. The Pixar and Marvel franchises, accompanied by the acquisition of LucasFilm have helped capture the adult segment. This widening of franchises will further contribute to Disney+ subscriptions and also create more opportunity in its merchandising, parks and resorts, TV programming, and Broadway show offerings. As Disney's universe grows, we foresee its value growing over the years.

From a bearish perspective, it can be difficult to predict how the individual will consume content in the future, especially given the evolving nature of the industry. Developing appealing streamable content is a difficult game. However, given Disney's success with that in the past, the company should not face any large hurdles in the near future.

Furthermore, if the economy enters a downturn as some have predicted, Disney's media networks, as well as the parks business, could suffer. Growth could stagnate, and Disney+ may have a difficult time attracting new subscribers. Even so, Macker believes that Disney will remain better positioned than some of its competitors due to its unique product offerings, brand appeal, and its role as a powerhouse in the media world.

While Disney may appear overvalued at the moment, Macker expects the company's new streaming services platform to increase our Morningstar fair value estimate by approximately 7%-8%, bringing it more closely in line with where the stock is trading today. In 2020, the company's focus on its direct-to-consumer efforts will help expand its streaming service's position globally. As Disney continues to transform and successfully adapts to the ways we consume content, it will demonstrate sustained growth in the future.

The Top 10 Ultimate Stock-Pickers conviction sales list contains some new names compared with the previous quarter. Three of the conviction sales are also conviction holdings—wide-moat Microsoft, wide-moat JPMorgan Chase & Co., and wide-moat Mastercard appear on both lists. Much of the selling activity came from the financial services sector, which contributed three names to the conviction sales list. Six of the 10 names on this list are overvalued according to Morningstar estimates. One such company is wide-moat Mastercard, which currently trades at over a 20% premium to Morningstar analyst Brett Horn's fair value estimate of $236.

Mastercard maintains its wide-moat rating through network effects and cost advantages. Both consumers and merchants benefit from convenience as the network of users grows and Mastercard's influence continues to expand. Horn believes the presence of a network effect is supported by the presence of a few dominant players in the industry that have managed to gain universal acceptance as their reach has grown. This leads to quite significant cost advantages that further contribute to the company's wide moat. Mastercard is also well positioned in the long run for shifts in electronic payments, as it still receives a fee regardless of whether the payment was via credit, debit, or mobile devices. These factors explain why some of our Ultimate Stock-Pickers still hold Mastercard—the company's wide moat, position as an industry leader, and potential for further growth in digital payments make Mastercard an attractive long-term investment.

However, Mastercard faces some potential headwinds that could explain the company's presence among the top 10 conviction sales. As pressure on cross-border transactions grows, Mastercard may be adversely affected as these transactions can be lucrative to building and maintaining networks. As small, regional networks develop their cross-border capacities, Horn believes they could challenge giants such as Mastercard and Visa. The new entrants could ensnare market share that would eat into Mastercard's current network. However, Horn affirms that Mastercard is an established player in the field and should remain unaffected by regional challengers for several years.

An economic downturn could also harm revenue growth for the company, as fee income would decline alongside a fall in transactions. However, Horn does not foresee any other major industry trends that would hinder Mastercard's growth in the future.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Nupur Balain and Eric Compton have no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)