How International Is Your Foreign-Stock Fund?

Revenue by region highlights hidden U.S. and emerging-markets exposures in foreign stock funds.

This article originally appeared in Morningstar Direct Cloud and Morningstar Office Cloud.

The global economy has become more global, a trend that continues despite "trade war" headlines. For investors trying to assess the diversification benefits of international-equity funds, it's important to have a clear understanding of how much overseas economic exposure a portfolio truly has.

In March, we published an article examining how some major U.S. stock exchange-traded funds are more exposed overseas than the traditional ways of assessing country exposure would suggest. In this piece, we look at some of the largest foreign-equity funds to see where their economic exposures lie. Some foreign funds have hidden added exposure to the United States, while others may have significant revenue dependencies in emerging-markets economies.

Traditionally, investors rely on a stock holding's "business country"--such as where the company is headquartered or where its stock is listed--to determine country allocation.

Using Morningstar's new Revenue Exposure by Region dataset, investors can get a more nuanced view of their fund's geographical exposure based on the revenue streams of the underlying companies. A recent white paper, available to Morningstar Direct clients here, and methodology documents, available here and here, provide more details on how revenue by region works.

As an example of how exposure can be hidden, Nestle NSRGF, the world's largest food company, is headquartered in Switzerland. It's a top holding in many funds and is considered part of Morningstar's Euro-ex eurozone region on a business country basis.

But by labeling the company as Swiss, investors miss more than half the story. Only 2.4% of the Nesquick-maker's revenue comes from the region. Instead, its largest revenue bases are the United States at 29.7%, the eurozone at 19.2%, and emerging-Asia at 13.3%.

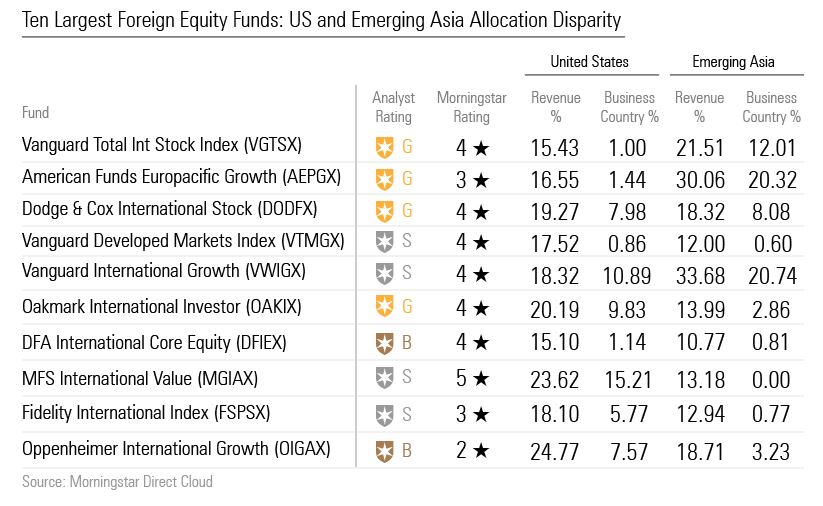

When looking at the 10 largest foreign-equity funds, U.S. and emerging-Asia allocations are understated by business country data as opposed to revenue streams.

Vanguard International Growth VWIGX has 33.7% of total revenue in the emerging-Asia region, which includes mainland China. However, the second-largest revenue base is the U.S. with 18.3% of revenue. An investor measuring the fund's exposure to the U.S. economy by business company would see only 10.9% of the fund's holdings based in America.

The fund's top holdings include Amazon.com AMZN, Illumina ILMN, and Tesla TSLA, which are all based in the U.S. and have over half of their revenue in the region. Amazon.com gets 67.7% of its revenue from the U.S. Tesla earns 52.9% of its revenue in the U.S. and 19.4% in emerging Asia. At the same time, U.S.-listed Spotify SPOT, a top 30-holding of the fund, earns 38.6% of revenue in the U.S., 18.1% in emerging Asia, 10.9% in the United Kingdom, and 12.4% in the eurozone.

There are also foreign-based companies in the Vanguard portfolio that earn significant revenue from U.S. markets. This is the case for Japanese conglomerate SoftBank Group, a top-20 holding, which splits revenue between the U.S. and Japan at 44.1% and 48.5%, respectively.

U.K. and eurozone exposures are doubled when measuring by business region as opposed to revenue exposure. Netherlands-based ASML Holding ASML, a leader in chip manufacturing, gets only 4.9% of revenue from the eurozone and over 70% from Asian countries. U.K.-based Rolls-Royce RYCEF, meanwhile, gets 27.1% of the company's revenue from the U.S., 22.8% from Asia, and only 11.5% locally.

Oppenheimer International Growth OIGAX, which has a Morningstar Analyst Rating of Bronze, is more heavily weighted to the U.S. than Vanguard International Growth. Almost a fourth of the fund's revenue is sourced from the U.S. market.

Based on business region, asset allocation to the European, Japanese, and U.K. markets looks much larger than when determined by revenue, while estimates for Asian and U.S. exposure go in the opposite direction.

Top holdings in the Oppenheimer fund include German business software company SAP SAP and European healthcare companies Novo Nordisk NOVO B and Grifols GRF. Although their business region is European (Novo Nordisk is in the Euro-ex eurozone region), each has a large revenue base in the U.S., the highest being Grifols at 62%.

The big gap between the two metrics for allocations to the Euro–ex eurozone region gap comes down to companies based in Denmark and Switzerland. Being relatively small countries, the multinational companies based there tend to have revenue streams that extend to eurozone countries, outside of their region. For example, Lonza Group LONN, a Swiss biotech firm, has 14.2% of revenue in the Euro-ex eurozone region and 17.1% in the eurozone.

Bronze-rated John Hancock International Growth GOIOX has a strong tilt toward Asian emerging markets when viewed through the revenue-by-region lens.

The fund also owns stocks with multinational revenue streams, including France's Airbus AIR and U.K. pharmaceutical company AstraZeneca AZN, which receive only 16.3% and 14.4% from their home region, respectively. Airbus generates 17.4% of its revenue in the U.S. and 29% in emerging Asia.

When looking at foreign small-cap funds, the narrative changes, and we see less U.S. and emerging-markets revenue exposure. (It’s a similar trend for U.S. small-cap equity funds.)

Bronze-rated DFA International Small Cap Value DISVX has more than 2,000 underlying holdings, so the revenue breakdown doesn't have a tilt generated by concentrated top holdings. And small companies focus mostly on domestic business and get their revenue primarily from the countries where they are headquartered and listed.

The fund's largest holding, Bellway BWY, a U.K. real estate developer, has all revenue coming from its home region. Phoenix Group PHNX, a U.K. insurance firm, also has 100% of revenue in its home region.

Neutral-rated Goldman Sachs International Small Cap Insights GICIX, which has fewer than 500 holdings, displays similar qualities. It is diversified among foreign markets, with its largest revenue exposure to Japan (26.48%).

At first glance, all four funds give investors international exposure. But with Morningstar's Revenue Exposure by Region data, a more nuanced story emerges.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)