Death Is a Way of Life for Liquid Alternatives

Alternative funds have been liquidating much faster than other groups of funds over the past five years.

It wasn't long ago that liquid alternatives were hip, cool, and fresh options to protect a portfolio from the next big market crash. About one third of liquid alternatives funds that existed at some point during the past five years didn't make it that far, though.

While alternative strategies may indeed help stabilize portfolios in the next bear market, whenever it happens, investor interest in these potentially diversifying strategies has cooled off.

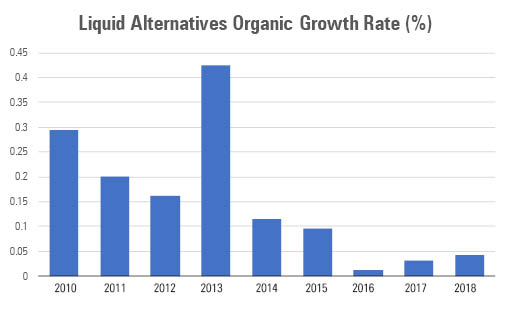

Exhibit 1 shows the annual organic growth rates for funds in Morningstar's broad alternatives category.

If you removed a small handful of firms like AQR, Blackstone, and J.P. Morgan, which are raking in cash, the growth rates over the past three years would in fact turn decidedly negative. In 2016, for example, AQR's alternative strategies gathered $9.6 billion of net inflows; the rest of the liquid alternatives funds had combined net withdrawals of $6.8 billion.

Source: Morningstar Direct. The 2018 figure is the trailing 12-month organic growth rate as of 05-31-2018.

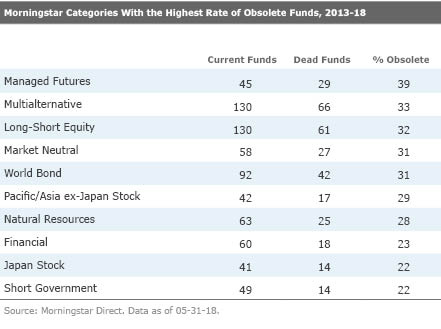

Asset-management firms seem loath to stick around and see if investors will come back. Exhibit 2 shows the 10 Morningstar Categories with the highest rate of obsolete funds over the five years ended May 31, 2018. To find the percentage of obsolete funds, we looked at total unique funds that existed over the period in each category and the number of unique funds that were liquidated or merged away over the period. We excluded categories with less than 50 total unique funds during the period.

The four categories with the highest rate of fund deaths over the five years fell under the liquid alternatives umbrella. Basically, if you blindly bought a managed-futures, multialternative, long-short equity, or market-neutral fund over the past five years, there's about a 33% chance the fund no longer exists. That's a crummy track record for the fund companies launching these products. Sure, the past five years have been a tough environment to diversify away from traditional equity and fixed income, but these numbers do not suggest firms were launching these products with high conviction in their long-term success. A "throw everything at the wall and see what sticks" approach seems to have been more en vogue.

Investors can face significant costs when a fund closes or is merged away. They may be forced to sell and lock in losses, or they may be on the hook for taxes tied to embedded capital gains. Funds that are merged into other funds, rather than liquidated, avoid those costs, but investors may find themselves in a fund that no longer meets their objectives; this risk is heightened in liquid alts because companies don't typically have many similar options available. Due-diligence costs for finding a replacement fund or evaluating the acquiring fund are not trivial either. Moreover, there aren't passive replacements investors can use to keep their asset allocation in check while looking for another, say, long-short equity fund. So, if you don't have a ready backup, it may throw your long-term strategic asset allocation off.

Picking Funds More Likely to Survive In 2017, Morningstar's quantitative team published an exhaustive paper looking at which factors put funds most at risk of closing. We won't rehash all the points in this article, but there were some findings particularly relevant to liquid alternatives.

First, the bad news. A couple of the findings point to a continuation of high closing rates among liquid alternatives funds. Our research showed that funds in categories with historically high rates of closings were more likely to close in the future. The research also found that small and slow-growing funds were more likely to close. We already covered the slowing growth above, but size is also a struggle for a lot of liquid alternative funds. In the long-short equity category, for example, 74 of the 115 distinct funds had less than $100 million in assets as of June 30, 2018. There's nothing magic about $100 million in assets, but with less than that, revenue streams can be thin compared with the costs of running and marketing a mutual fund, even with liquid alternatives' bloated expense ratios.

One thing investors can do to improve their odds of choosing a fund that is going to be around for the long term is to look for firms that have historically been good stewards of investor capital. The Parent rating, one of the five pillars we use to assign our forward-looking Morningstar Analyst Ratings, includes an assessment of a firm's management of its fund lineup. We don't like to see firms launch products willy-nilly to capture the latest trend. Instead, new fund launches should fall within a firm's area of investment expertise. This increases the chances they will stick with the strategy over the long term.

After all, it's hard to invest for the long term when the funds you're using are short-lived. Fund companies could serve investors better by sticking to strategies they believe have a good chance of success. For investors seeking strategies that could offer greater diversification, it would behoove them to stick to more-proven asset-management firms.

Financial professionals are accessing this research in our investment analysis platform, Morningstar Cloud. Try it today.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)