3 Ways to Follow Jeremy Grantham's Advice on Climate-Aware Investing

Grantham's 'race of our lives' speech outlined the dire consequences of climate change.

In his sobering keynote address at last week's Morningstar Investment Conference, GMO's Jeremy Grantham argued that we are in "the race of our lives" to stave off the worst effects of climate change. Grantham noted that the development of greener technologies and renewable energy is accelerating, resulting in a decarbonizing economy that is the biggest economic event since the industrial revolution. But climate change now appears to be happening faster than expected. Thus, it’s a race against time to mitigate the destabilizing consequences of global warming.

Capitalism's "complete inability to deal with externalities, tragedies of the common, and the very long term” helped cause these problems and is ill-suited to helping solve them.

"We deforest the land, we degrade our soils, we pollute and overuse our water and we treat air like an open sewer, and we do it all off the balance sheet. Anything that happens to a corporation over 25 years out doesn’t exist for them; therefore, as I like to say, grandchildren have no value to them."

Against that rather dire backdrop, what can and should investors do to become more climate-aware and to have an impact on the outcome of "the race of our lives"?Grantham mentioned three things investors could do: divest from fossil fuels, invest in green solutions, and encourage corporate sustainability in the companies they own.

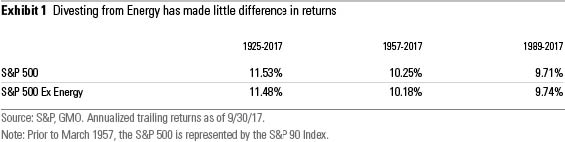

Divest from fossil fuels. Divestiture usually comes with a warning from investment professionals that limiting an investment universe risks underperformance. But it's more accurate to say that divestiture will simply raise your portfolio's tracking error relative to a market-based index. That could result in underperformance or outperformance, but over the long run, it's likely to be a wash, as illustrated in Exhibit 1.

Grantham and his colleagues at GMO looked at what happens when you remove a single sector from an S&P 500-based portfolio. They created S&P 500 portfolios ex energy, ex healthcare, and ex the other eight sectors in the index, going back to 1989, 1957, and 1925. They found that the range of returns for the ex portfolios was only 50-60 basis points annualized, distributed above and below the S&P 500's return. In the case of the ex energy portfolio, it underperformed the S&P 500 by just 5 basis points annualized from 1925 to 2017, underperformed by 7 basis points annualized from 1957 to 2017, and outperformed by 3 basis points annualized from 1989 to 2017.

Grantham's conclusion: "You can divest from oil--or about anything else--without much consequence for performance." Yet today, the rationale for divesting from fossil fuels isn't just about aligning with an investor's values, it reflects a forward-looking view that these industries are in long-term decline and their reserves will become stranded assets.

"Oil may have a last hurrah before the electric cars arrive, but when they do, there will be some tough times for a long time."

While some funds advertise themselves as fossil-fuel-free, Morningstar's new carbon metrics can help you identify fossil-fuel-free portfolios. We calculate every equity portfolio's exposure to fossil fuels on an asset-weighted basis to reflect holdings that are involved in thermal coal extraction or power generation and oil and gas production, products and services, and power generation.

Investors may also want to consider funds that earn Morningstar's new Low Carbon badge. While not all these funds are fossil-fuel-free, many of them are. To get the badge, funds must have been underweight fossil fuel by at least 30% relative to broad market-weighted indexes over the past year and also have "low" carbon risk. Having low carbon risk means that the fund's holdings, on an asset-weighted basis, are unlikely to face significant material risks related to the transition to a low-carbon economy.

Invest in companies building the green economy.

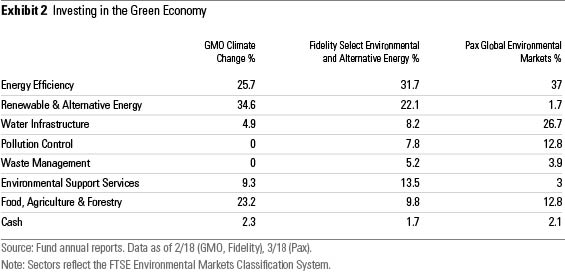

It would be nice for everyday investors to be able to access a fund like the one run by Grantham's firm. GMO Climate Change GCCHX, which launched last year, focuses mainly on companies in renewable energy; energy efficiency; and food, agriculture, and forestry. Alas, I don't know about you, but I don't have the $5 million minimum investment, and anyway, the fund is only about a year old. (Maybe

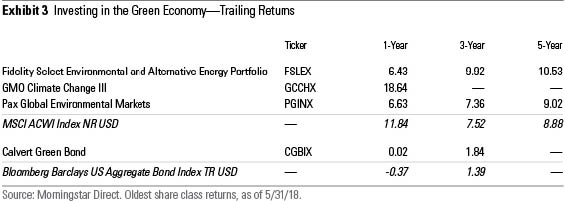

In the meantime, here are three fund ideas that invest in green solutions, all with longer track records: Fidelity Select Environmental and Alternative Energy Portfolio FSLEX focuses on renewable energy and energy efficiency (about 55% of assets combined) with smaller allocations to water; pollution control; and food, agriculture and forestry, in a mostly U.S. portfolio. It has returned 10.5% annualized over the trailing five years.

Pax Global Environmental Markets PGINX focuses on energy efficiency; water; pollution control; and food, agriculture, and forestry. Unlike the GMO and Fidelity funds, this one tends not to directly invest in renewable energy. Its 9% five-year annualized return is just ahead of the MSCI All-Country World Index's.

Calvert Green Bond CGBIX is a way to direct capital to companies developing or providing environmental solutions and to support environmental projects via an intermediate-term bond fund. This fund's portfolio is investment-grade, with most exposure to corporates and to bonds issued by government-related entities intended to support green projects. The fund's three-year trailing return through May ranked in the top quartile of the intermediate-bond Morningstar Category.

Urge companies in your portfolio to be more sustainable. There are areas of the market particularly vulnerable to climate change--namely, those reliant on fossil fuels--and there are pockets of the market that are generating the green solutions necessary to decarbonize the economy and respond to the challenges posed by global warming. But there is a third way to invest that aligns with Grantham's verdict on capitalism. And that is investing in a way that encourages companies across the economy to be more sustainable. That means encouraging a change in the corporate mindset away from short-termism and abdication of responsibility for externalities to one focused on long-term sustainability and positive impact.

How can you do that as a fund investor? You can use the Morningstar Sustainability Rating to evaluate the funds you own or are considering for purchase. A fund with five globes is one whose underlying holdings score better relative to its peers on the set of environmental, social, and corporate governance issues material to their businesses. You can look for funds with four or five globes and avoid those with one or two globes. The globe rating is a useful starting point for embedding sustainability into your portfolio.

You can also invest in funds that have a sustainability mandate enshrined in their prospectuses. While they vary in their specific approaches, these are funds that are consciously incorporating sustainability (also known as environmental, social, and governance) criteria into their investment processes. Many of them also actively engage with the companies they own to directly encourage more sustainable behavior. In so doing, these funds, along with many other large institutional investors, are helping provide the space for corporate executives to think long-term, think sustainably, and think about their firms' impact on society and the environment.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)