Indexers, Pure Managers, and Conglomerates

Some approaches are better than others, but all can succeed.

Adrift? Last month, the New York Times pictured Fidelity as a company wandering through the desert. The article, "Fidelity, Bruised From Crises, Searches for Life After Mutual Funds," suggests that the company's "once-dominant stock pickers are stuck in the past, in more ways than one." A newsletter publisher (Jim Lowell) states, "Fidelity is in an existential crisis."

This is true and not.

It is true that Fidelity is no longer the mutual fund powerhouse. Twenty-five years ago, it was the unquestioned industry leader. It held more assets than any rival, had the highest number of top-performing funds, and glowed in the aura of the world's most-famous fund manager, Peter Lynch, who was recently retired but continued to support the company's brand. Today, none of those things remain. For millennials, Fidelity is just another vaguely familiar name, like Prudential or T. Rowe Price.

This, however, is far from news. Fidelity lost its largest-assets crown before the 1990s ended, due to a performance slump. To be sure, Fidelity retained some hope of regaining its title, if its funds then rallied. They did not. By 2005, the contest was over. Although not yet officially the industry champ (American Funds temporarily occupied the slot), Vanguard was clearly heading where Fidelity could not reach. Now Vanguard is far beyond.

Two Doors Spurned As Fidelity slipped, it faced three choices.

One, it could attempt to out-Vanguard Vanguard, by offering even cheaper index funds and by being an even louder proponent of active management. That wasn’t going to happen. Although Fidelity did launch and promote index funds, and participated in several price wars, it would never become the next Vanguard. No successful active manager has ever tried. Its existing assets are too valuable. Those cows are to be milked, not slaughtered.

Two, it could double down on its existing position. Fidelity achieved its success by being the pre-eminent active stock-fund manager. As I once was told when visiting the portfolio manager’s offices, which were in a different location than the business executives’, “This is where the real Fidelity works.” Fidelity could have concluded that if its funds’ performance was insufficient, to spend what it took to fix the problem.

That, in essence, was American Funds’ decision. It, too, found itself overtaken by Vanguard, although in American Funds’ case the fault lay less with its funds’ returns than it did with excessive shareholder expectations. No matter. Either way, American Funds faced public criticism and steep redemptions. What to do? American Funds selected “more, please.” It no longer could be largest overall fund company--but it could still lead at what it always had done.

That is a reasonable path; in fact, more than reasonable, given that any other choice would hurt the company’s profit margins. There aren’t many businesses better than active investment management. For generating profits, a few extra dollars into the active-management coffers beats a whole lot of revenue collected from other endeavors. American Funds had the good fortune to be entrenched in a high-margin, subscription industry. Digging in when challenged made good sense.

The Third Door Fidelity, however, took the third route: diversification. It wished to become a conglomerate. To Fidelity's credit, this process was under way long before its mutual funds struggled. Back in the day, former Fidelity chairman Ned Johnson was known for investing heavily in technology, and for pursuing new ventures. (One, infamously, was a limousine service called BostonCoach, which Fidelity sold five years ago.) The company plowed many glory-day profits into its investment management unit. But it also used them to forge new paths.

Among those endeavors were: building a major discount-brokerage platform; becoming the biggest 401(k) provider; and expanding its custodial services. All told, as detailed in the NYT article, Fidelity administers $4.4 trillion in assets that it does not manage, as opposed to $2.4 trillion that it does. The latter remains the gold mine--it generates most of Fidelity's revenue, and an even-greater share of its earnings. Nonetheless, the company's newer operations are profitable, and they are growing much more rapidly than is the company's traditional business.

Thus, I would not regard Fidelity as being in a state of transition. Being more than an active-fund manager is what the firm has long sought. True, it hoped to do so from a position of strength. Best to promote the brokerage platform, 401(k) services, and administrative capabilities as the nation’s largest mutual fund manager, rather than as just another major fund provider. But if the best did not happen, the next best would do. Fidelity was determined to become more than just an investment manager--and in that goal, it has succeeded.

Investment Implications There is an investment point to this column, which follows.

Vanguard chose to index (although it does offer many active funds, most of which have fared well), American Funds stuck to its investment-management guns, and Fidelity diversified. Every fund observer salutes the first type of fund company, many commend the second for “maintaining its discipline,” and few, if any, have kind words to say about the third. Ditto for this writer.

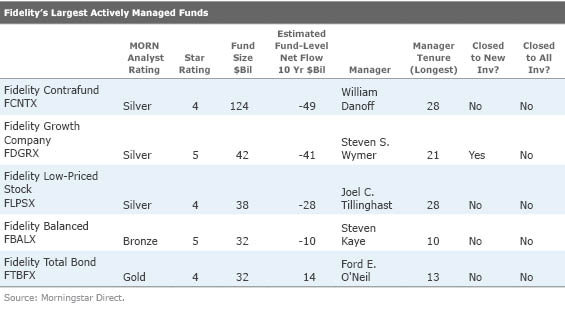

That said, Fidelity looks to be an exception to the rule. As the NYT points out, Fidelity's recent outflows owe to perception, not performance. "In each of the last 10 years, Fidelity's fabled mutual funds have leaked money, no matter how well they have performed." And perform well they have. After a sluggish stretch from the mid-1990s through the mid-2000s, Fidelity's funds have recovered nicely. By and large, they have been above average.

In summary, the NYT's article was broadly correct. As with almost all active fund managers, Fidelity has struggled at times against the indexing tsunami. However, it seems unduly pessimistic--particularly from the shareholder perspective. More than most firms, Fidelity has prepared for change. Its evolution has been long in coming, rather than a sudden reaction. And, while undertaking these developments, it has delivered solid results for its funds' owners.

Thus, my point. An investment company’s structure is important. Some arrangements are likelier to succeed than others. However, the specifics of a case always outweigh the general principle. Today’s Fidelity is one such case.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)