Many Bubbles, Few Troubles

As with forecast recessions, several bubbles are proclaimed for each that arrives.

Testing the Claim On my desk is "Yes, It's a Bubble. So What?," by Research Affiliates. Being a fellow practitioner of the dark art of clickbait, I will not criticize the title. Whatever works. But I do confess, whenever I see the word "bubble," my instant response is "Says who?"

Consider the Research Affiliates paper's opening: "U.S. stock market valuations now exceed all historical valuation levels, except for those hit at the peak of the dot-com craze. This raises an obvious question for investors: Today, in early 2018, and has been the case over the last year, is the U.S. stock market in another bubble?" The authors' immediate answer is "Yes."

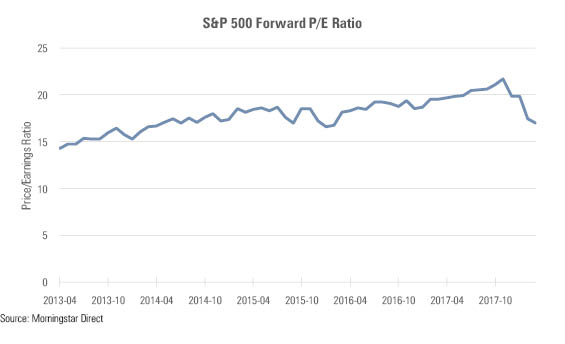

The paper does not attempt to support that assertion, presumably because the authors view it as self-evident. No matter what reasonable measure of U.S. stock-market valuation that one selects, it will show prices to be high. Let's test that. One common valuation measure is forward-looking price/earnings ratio. Morningstar calculates that figure, dividing 1) share price by 2) forecast earnings for the current fiscal year. These results can then be rolled up to give a stock market's aggregate figure.

Below is a graph for the S&P 500's forward price/earnings ratio, as computed by Morningstar over the trailing five years.

Hmm. The S&P 500's figure is currently 17. In spring 2017, it was just below 20. Three years back it was 18, and five years ago it was 14. Rather than describing a bubble, the forward P/E ratio appears to indicate "market as usual."

The Longer View Perhaps Research Affiliates is directionally correct, but the timing is exaggerated. The paper implies that the bubble is 12 months old ("the case over the last year"), but it may extend somewhat longer, back to 2015 or so. If so, that wouldn't weaken the paper's case, because bubbles don't immediately pop. Sometimes they linger for several years. Justice does not always come swiftly.

However, these forward P/E levels are not new. From the 2008 stock-market crash through 2015, forward P/E ratios were consistently lower than today's, but not that much lower, averaging about 14. Surely the difference between 17 and 14 does not constitute a bubble. What's more, the S&P 500's forward P/E ratio was 18 in 2003, and nobody calls that year a bubble, given that stocks were recovering from losses.

This isn't to say Research Associates couldn't defend its assertion. Forward P/E ratios are one way to judge stock prices. Other approaches could yield different conclusions. (For example, the market's relative trailing P/E ratios make it look more expensive than the forward view.) By selecting the measures that support their case-- as I did myself when choosing forward P/E ratios--the authors could raise concerns about current stock prices. But they would be hard-pressed to demonstrate a bubble.

The Real Target As it turns out, that is not their intention. The paper's actual target is not the overall U.S. stock market, but instead global technology companies. The authors point out that the world's seven most-valuable firms, as determined by market cap, are all technology businesses. Five reside in the United States, two in China. The authors expect "at least six" of those seven stocks to underperform over the next decade.

That discussion is a good read, and the headline's apparently flippant "So what?" is intended seriously. At the paper's conclusion, the authors provide several investment recommendations for those who share their belief that the major global technology stocks are severely overpriced. Thus, in addition to the somewhat abstract exploration of whether technology valuations can be justified, the authors offer direct, useful suggestions. (To quote my often-disappointed editors, don't forget to give the audience action items. Usually, I forget.)

I don't see a bubble--certainly not with the overall U.S. stock market. With a forward earnings yield of 6% (earnings yield being the inverse of a P/E ratio: earnings divided by price), at a time when 10-year Treasuries pay 3% and annual inflation hovers around 1%-3%, stocks are not dear when compared with the alternatives. At some point, of course, the economy will turn; those P/E ratios will spike because earnings collapse; and stocks will get shellacked. But the same could have been written in 2012, and 2013, and so forth. Without further evidence, why believe this year is different?

With global technology stocks, the authors are on firmer ground. It is indeed true that the leading companies must grow their businesses dramatically to justify their stock prices. Sometimes, such minor miracles occur. For 15 years, skeptics have argued that

Unsure Things But the thing is, real bubbles aren't modified by the word "perhaps." In my 30 years at Morningstar, I have encountered only two true bubbles in the stock and bond markets: speculation that led to what I regarded as obviously inflated security prices, accompanied by what appeared to outsiders as a mob mentality among buyers. One was Japanese stocks in the 1980s; the other, U.S. tech firms in the late 1990s. Even at the time, I felt that doom was inevitable.

Not so with today's leading tech companies. They are expensive, certainly. That said, those companies have real, dominant businesses. It is possible, if not necessarily probable, that their business growth will match the sky-high expectations and they will continue to outperform other stocks. Even if that doesn't happen, there is a good chance that their returns will be positive.

Many bubbles are proclaimed, but few arrive. The word is not useful; rather than signal something extraordinary, it has come to mean "securities I don't like because they strike me as being too expensive."

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)