Our Favorite Core Passive Bond Funds and ETFs

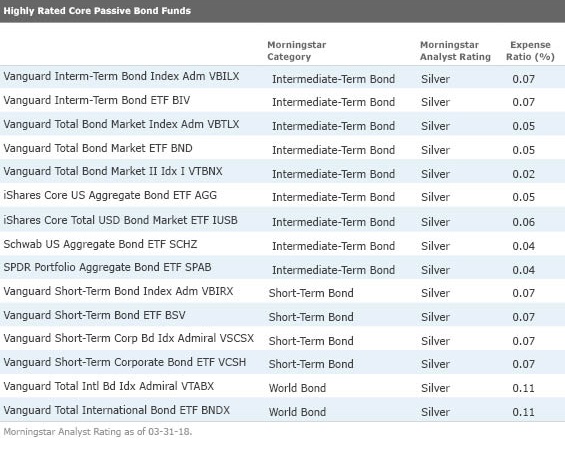

Passive bond funds such as these 15 Silver medalists have increasingly captured investors' attention.

This article is part of Morningstar's Guide to Passive Investing special report.

For many years, our fund flows showed that fixed income was one area where many investors preferred active management. Owing to the Fed's historic zero interest-rate policy that stretched from December 2008 to December 2016, bond yields were meager. Investors looking for yield were rewarded for taking on credit risk.

And passive bond funds aren't really the place to go if you're looking for credit risk. Most bond index funds market-cap weight their holdings. As a result the funds' holdings skew toward the heaviest debt issuers: In the U.S. investment-grade market, that's the U.S. Treasury. As a result, most index funds have higher exposure to U.S. Treasuries than their actively managed counterparts. For example, funds that track the Bloomberg Barclays Aggregate Bond Index have nearly 72% of assets devoted to AAA-rated bonds. (The intermediate-term bond category average is 39% in AAA.) This higher quality profile has held back passive bond funds' returns--most have middling returns compared with their category peers, even on a risk-adjusted basis.

Of course, credit risk is a double-edged sword. It has been rewarded over the past several years as the economy has expanded and stocks have gained, but funds that take on a lot of credit risk tend to underperform when credit spreads widen. On the other hand, funds that focus on higher quality issues often hold up better during tough economic environments. U.S. Treasuries, which take on no credit risk, will give you the lowest correlation to equities. That means that when equities sell off, high-quality bonds are the best ballast in your portfolio.

Lately fund flows have revealed a pivot in investor preference, as money increasingly moves to passive bond funds. The reasons for the shift are probably the same as those that fuel investment in passive equity funds: Index funds are straightforward, low-maintenance investments with low costs.

Indeed, the low-cost element shouldn't be minimized, especially when it comes to fixed-income investing. The distribution of returns among different bond funds is predictably narrower than it is for more volatile assets such as stock funds. Therefore, each basis point you pay in fund fees matters more.

Most of the 15 high-conviction passive funds listed below fall into the intermediate-term bond category, which is home to most core bond strategies. We've also included some highly rated passive picks in the short-term bond category, which may be appropriate for investors with a short time horizon or a very low risk tolerance. Lastly, world bond index funds could be appropriate for investors comfortable taking on additional currency risk (though the two Vanguard funds listed below hedge their currency exposure).

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)