First-Quarter Volatility Doesn't Slow Sustainable Funds

Funds continue to add ESG criteria to their investment processes.

Sustainable funds turned in good performance, grew their assets, and multiplied in number in the first quarter.

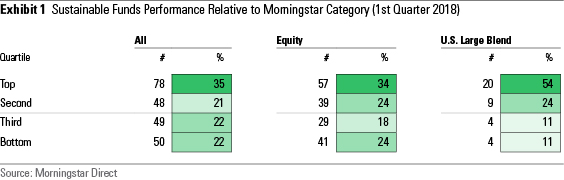

Performance Sustainable funds had an opportunity to show off their lower-volatility character during a quarter in which the S&P 500 posted its first quarterly loss since the third quarter of 2015. Driven by the strong performance of the group's core U.S. equity funds, one third of sustainable funds finished in the top quartile of their Morningstar Categories and 55% finished in the top half. Among sustainable funds in the large-blend Morningstar Category, 20 out of 37 finished in the top quartile, 28 beat the S&P 500, and 29 finished in the category's top half.

While sustainable funds pursue a range of investment strategies, a common element among them is that the consideration of environmental, social, and governance factors generally leads to a preference for companies that manage material environmental and social issues effectively and have strong corporate governance practices. These tend to be lower-volatility companies that hold up better during downturns.

While core sustainable funds were helped somewhat by their lower weightings in energy and utilities, they had overweightings in consumer defensive, which was one of the worst-performing sectors. Core sustainable funds, on average, had weightings to other sectors, including technology, in line with the S&P 500.

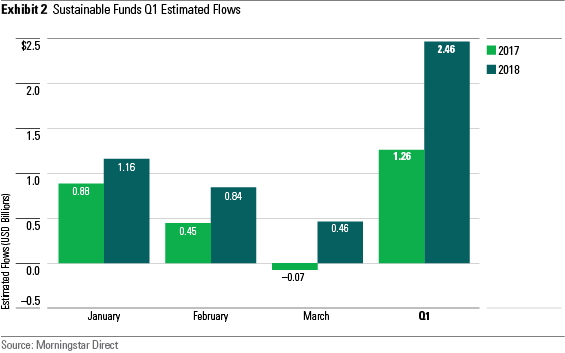

Flows

The sustainable funds group pulled in nearly $2.5 billion in estimated flows in the first quarter. That’s roughly twice the estimated flows the group received in the first quarter of 2017. The largest flow went to Calvert Emerging Markets Equity CVMAX, which pulled in about $422 million, followed by

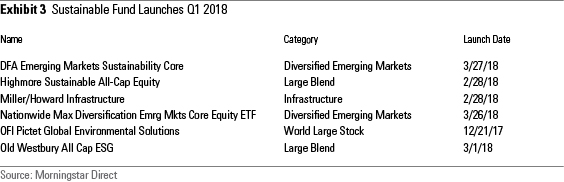

Size The sustainable funds group in the United States continued to grow in the first quarter. At the end of 2017, I counted 240 open-end funds and exchange-traded sustainable investment portfolios available to U.S. investors. At the end of the first quarter, that group numbered 267. These are funds that, by prospectus, state that they incorporate ESG criteria into their investment process, pursue a sustainability-related theme, or seek measurable sustainable impact alongside financial return.

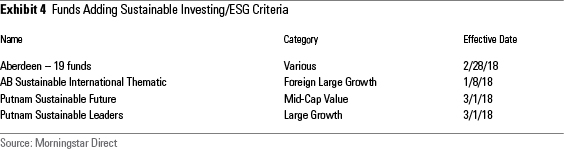

Of the 28 funds new to the group, most were pre-existing offerings that added sustainability or ESG criteria to their prospectus. They include three emerging-markets equity funds, five bond funds, two alternatives funds, and an infrastructure fund. One fund, Parnassus Asia, closed.

Aberdeen Asset Management, by itself, accounted for most of the new additions. The firm added ESG criteria to all 19 of its funds available to US investors, effective March 1. Nine of those are international equity funds, including

Putnam has given a complete sustainability face-lift to two of its funds. In March, Putnam Multi-Cap Growth became Putnam Sustainable Leaders PNOPX and Putnam Multi-Cap Value became Putnam Sustainable Future PMVAX. With assets north of $4 billion, Putnam Sustainable Leaders becomes the fourth-largest sustainable fund in the U.S. It now focuses on companies with a “commitment to sustainable business practices” that are helping drive their growth potential. The smaller Putnam Sustainable Future, by contrast, will focus more on impact by selecting companies that “provide solutions that directly contribute to sustainable, social, environmental, and economic development.”

Slowly, but surely, the move toward sustainable investing continues.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)