Anatomy of a Debacle

Before the collapse, there is a “bacle.”

The views expressed here are those of the author and do not necessarily reflect the views of Morningstar.

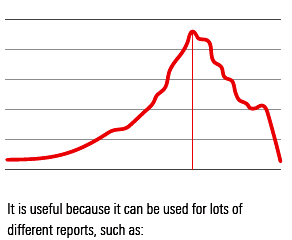

Here is a useful chart.

It is useful because it can be used for lots of different reports, such as:

- My favorite ski mountain

- Earnings per share for our company

- Price of my favorite stock

- Bitcoin price

There are two main parts of the chart. We will start with the last half, because we are all too familiar with it.

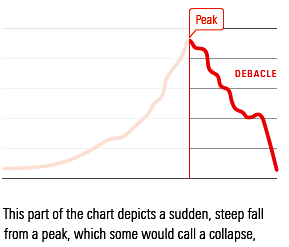

This part of the chart depicts a sudden, steep fall from a peak, which some would call a collapse, or a crash, but today, we are going to use the more sonorous term, Debacle!

Regardless of the terminology, a Debacle is unexpected, fast, destructive, and once you are in it, almost impossible to get out of. If you are a skier or snowmobiler, you might agree this is a fair description of the dreaded avalanche.

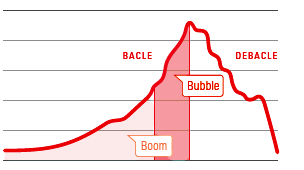

Rule 1: The only practical way to survive an avalanche is to be somewhere else when the mountain decides to have one. Before the Debacle, there is a longer period of general success and prosperity. The last part of this period can be called a bubble, the bit before the bubble is considered a boom, and so on. But there has not been a comprehensive word for the whole half-cycle until now. The well-known investing guru Jeremy Grantham has used the nonce expression "melt-up." That flippancy does not deserve to survive. We need words that express the power of market moves and the logical symmetry of the market cycle: Bacle followed by Debacle.

What can you do in a Debacle? Not much. If you own stocks, you can sell some, but rarely enough. If you are running a business, there is not much you can do, because events move so rapidly you can’t fix anything. The best you can do is try to elbow your way into the lifeboat ahead of me.

Can you avoid the Debacle by not entering the Bacle? Possibly so, but if we are talking about a stock market cycle, and you want to make a living as an analyst or portfolio manager, you have to play, and you should, for there is a lot of money to be made in a Bacle. To make money, and then keep it, we must dissect the structure of the Bacle.

The Bacle begins when prices are low, and there is not much going on, until a good idea shows up. The good idea will spread and create profit and excitement, and eventually generate the whole cycle.

Rule 2: Every bad idea starts as the good idea. There is no need to fear a bad idea. An idea that is bad to begin with cannot go anywhere. Your company compliance manual does not need to have a rule forbidding you to drop a cinder block on your foot. Only good ideas have staying power. For example, when you go to a party, but feel intimidated by a large number of people you don't know, a glass of champagne is a fine way to help you relax, strike up conversations with the other guests, and even make some witty remarks. The first glass is a good idea. The second glass makes you even wittier, a trifle ribald perhaps, but your new friends certainly enjoy your stories. You get on the dance floor and discover you can still do some fancy steps, and wondrously, you are now irresistible. The second glass was a pretty good idea, too. Is a third glass of champagne still a good idea? Nope. You are entering the last stage of your Bacle, and it is time to switch to club soda or the Debacle may be a calamity.

Rule 3: Bacles have three parts. Just as our cocktail party had three levels of intoxication, Bacles have three parts, too. My brilliant friend Paul McCulley described three phases of investment in a Bacle. He in turn pinched the idea from the economist Hyman Minsky.[1]

Minsky had three Bacle investment levels of interesting intoxication:

- Hedged assets

- Speculative assets

- Ponzi assets

What do these three levels refer to?

The 2008 Debacle is classic. It was all about the home mortgage business, so we will pick examples from mortgages. A hedged asset is safe and old fashioned. You lend a buyer money to buy a house subject to a 20% down payment and verified adequate income on the buyer’s part. You can make a decent return on the spread between your bank’s cost of funds (say 3%) and the mortgage (say 6%). You have a secure investment because you have a trustworthy borrower who has equity in a house that is worth more than the mortgage.

After a few years, mortgage defaults have been so low that your boss tells you that the portfolio is too conservative. Profit margins are fine, but we are losing market share. We can grow faster if we relax standards and finance speculative assets. A speculative mortgage has a down payment of only 10%, and the house carrying costs relative to buyer’s income is dangerously high, but a higher interest-rate spread will cover the increased risk. Besides, house prices have been rising, so if you have to foreclose, there is no way you will have to take a loss on the resale.

In the real world in 2006, the mortgage industry went into phase three, Ponzi assets, in which underwriting standards virtually vanished. The reasons you wanted to write these mortgages were only two:

- House prices would keep rising rapidly because they always do.

- We are going to sell the mortgage to someone else, so it won't be our problem.

Obviously, this was close to the peak, and Debacle loomed.

One of Minsky’s insights into the process was to explain why phase one, hedged assets, wasn’t permanent. He showed that the cause of instability was stability. The stable profits made during phase one convince market participants that risks are very low, so taking on more risk means more profits—and for the next few years that is absolutely correct. The first phase of stable prosperity seduces us into level two, big profits, and then level three, euphoria, which is unstable.

Rule 4: The Debacle is caused by the Bacle. How about now? The U.S. stock market has quadrupled from its 2009 low. Can I make this look like a three-phase Bacle? Of course.

- The world didn't end during the financial crisis. Stocks are really cheap, so you can buy a portfolio with a good dividend yield. These are hedged assets.

- ZIRP. With interest rates at zero, any valuation model shows that stocks are cheap, and growth stocks are the cheapest. FAANG! Stocks are speculative assets.

- Euphoria. No down months in 2017, VIX at record low levels. Bitcoin! Even though interest rates are back to normal, and valuations are no longer cheap, no one cares, momentum rules. Ponzi time.

Technical Appendix The word pair Bacle-Debacle will not withstand serious scholarly analysis, but so what? The "x:de-x" construction is growing in popularity. We all board airplanes, but a few weeks ago, I heard a United announcer say, "Arriving Flight 6517 will 'deboard' at Gate 2."

Workers will come and "dewater" your flooded basement. Your software can be loaded on your computer by hitting the install button and then removed by hitting uninstall. Inflation alternates with deflation, tour with detour, offense with defense, fenestration with defenestration.

There are a few loose ends: There is no condition of "mentia," or a kid who is "linquent." The words scent and descent both exist but don't make a meaningful pair.

One of my friends who had a difficult marriage said, “Oh, you mean I am heading from ‘vorce’ to divorce.”

[1] Minsky (1919–96) was an economics professor at the University of California, Berkeley; Washington University in St. Louis; and Bard College. This article originally appeared in the April/May 2018 issue of Morningstar magazine. To learn more about Morningstar magazine, please visit our corporate website.

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_1997613e43634249b59dd28db9b24893_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)