28 Undervalued Stocks

After a turbulent first quarter, our equity analysts name their best ideas in every sector.

Following 2017's spectacular 22% gain, the Morningstar Global Markets Index slipped 0.8% in 2018's first quarter as volatility ticked up. The market-cap-weighted price/fair value estimate ratio for our equity analysts' coverage universe was 0.99 as of March 29, indicating that the median stock we cover is about fairly valued.

Drilling down to the sector level, communication services continues to be the most undervalued sector, with a price/fair value of 0.86, said Damien Conover, Morningstar's director of healthcare equity research. Conover writes in his first-quarter stock market outlook that in addition to opportunities in the communication services sector, we are also finding attractive valuations is in the large-cap drug and biotechnology industries.

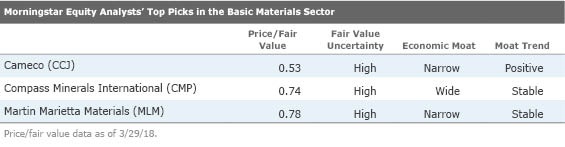

On the other hand, basic materials remains the most expensive sector, with a price/fair value of 1.34. Our belief that basic materials companies are overvalued is hinged on the expectation that China demand will transition away from an investment-led growth model.

Below, our equity analysts provide their takes on the biggest themes and the best remaining investment opportunities in each sector.

Basic Materials On a market-capitalization-weighted basis, our basic materials coverage trades at a 30% premium to our estimate of intrinsic value, remaining the most overvalued sector, says equity analyst Charles Gross. This is primarily driven by our bearish perspectives on most mining and metals companies.

"We expect a structural change in demand growth from China as its economy matures and transitions toward less commodity-intensive and more consumption-driven growth. High-cost miners and those with outsize exposure to iron ore and coking coal tend to look the most overvalued," Gross said.

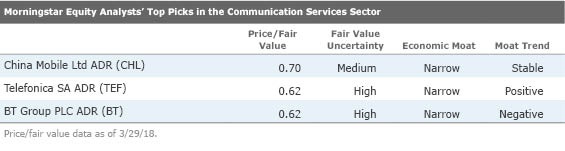

Communication Services The communications services sector is the most undervalued in our coverage, trading at a market-cap-weighted price/fair value of 0.86.

One theme our analysts see in Europe is the move to convergence along with increased fiber and 4G buildouts. Also, in telecom and cable, we continue to see migration from traditional pay-TV providers to over-the-top offerings. The picks below are well positioned to benefit from these themes.

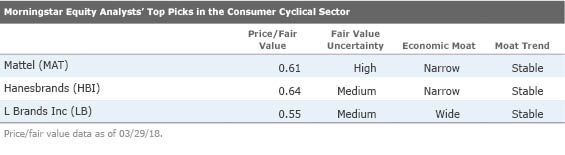

Consumer Cyclical The consumer cyclical sector is about 4% overvalued at present. We attribute this to rising consumer and corporate confidence, a factor that should support spending across numerous discretionary industries, said senior equity analyst Dan Wasiolek.

Specifically, Wasiolek sees consumer spending aided by baby boomer, millennial, and emerging-markets demographic tailwinds over the next several years. Travel is one industry that stands to benefit from favorable sentiment and demographics. Also, though many retailers continue to cede share to online peers, Wasoilek believes there are some opportunities among strong niche players and brand partners.

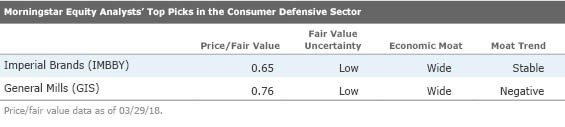

Consumer Defensive After multiple quarters of slightly inflated valuations, the consumer defensive sector retreated modestly and now trades at a roughly 2% discount to our fair value estimates. As such, we now see a few more opportunities for patient investors to build positions in some competitively advantaged names, said equity analyst John Brick.

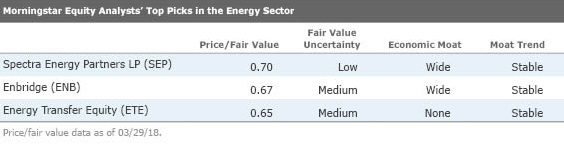

Energy Despite our bearish outlook for near- and long-term oil prices, we see pockets of opportunity in the oil and gas space, says equity analyst Joe Gemino. Energy sector valuations look modestly undervalued at current levels, with an average price/fair value estimate of 0.94.

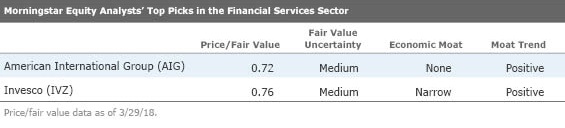

Financial Services The global financial services sector appears to be slightly overvalued, trading at a price/fair value ratio of 1.04. In the near term, regulation and competition is leading to business model changes and mergers among asset managers, wealth management firms, and life insurance companies. Specifically, fiduciary regulations are increasing scrutiny on distribution strategies and the scale needed to compete, says Michael Wong, director of financial services equity research for North America.

U.S. banks, meanwhile, are likely to benefit from tax cuts being signed into law, expectations of continued economic growth, regulatory relief that's already playing out, and a normalizing rate environment. Our near-term outlook for bank performance is positive. Read our analysts' regional and industry outlooks here.

Healthcare In aggregate, valuations in the healthcare sector have slightly decreased to a price/fair value of 1.01, down from 1.04 at the start of the year. Drilling deeper, however, the differences in industry valuations suggest drug, biotech, and drug supply chain industries are the most undervalued areas, says Damien Conover, director of healthcare equity research. You can read more on Conover's take on what corporate tax reform means for the industry, as well as his top picks in the sector.

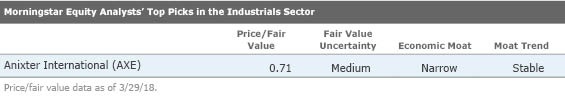

Industrials We consider the industrials sector to be slightly overvalued at a market-capitalization-weighted price/fair value estimate ratio of 1.06. Demand for industrial products is healthy, and most industrial firms are executing well, says director of industrials equity research Keith Schoonmaker. He also believes that U.S. corporate tax law changes will benefit many industrial firms "both directly from lower cash tax outflows, and also via stronger capital purchases for customers."

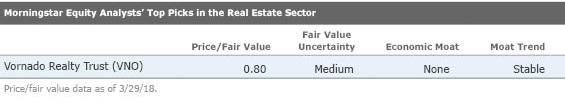

Real Estate Morningstar's real estate coverage appears fairly valued at current levels. Equity analyst Brad Schwer views themes in commercial real estate as generally defensive in nature, with lingering concerns about increasing bond yields associated with future rate hikes. Despite these concerns, though, Schwer says underlying performance has remained healthy overall, as REITs have been focused on repositioning and strengthening their portfolios, deleveraging, and capital recycling.

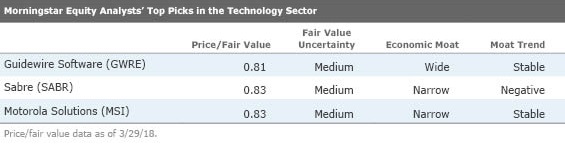

Technology We view technology stocks as overvalued at a market-cap-weighted price/fair value of 1.08, writes director of technology, media, and telecom equity research Brian Colello in his fourth-quarter technology sector wrap-up. The shift toward enterprise cloud computing remains the single most important trend in technology, which has ramifications for dozens of stocks across our coverage, Colello said. Another ongoing trend in technology remains mergers and acquisitions.

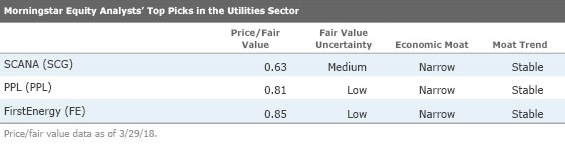

Utilities Earnings and dividend growth will be the story for utilities investors in 2018 and 2019, says energy and utilities strategist Travis Miller. Utilities across our domestic coverage universe--which now trade at a price/fair value of 0.97--have aggressive investment plans with mostly constructive public policy support. As long as energy prices remain stable, we expect 5%-7% annual earnings and dividend growth across the sector during the next few years, Miller said.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2UWGQD7LCJCYNF3WQ5HHLP7UBE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)