The Morningstar Analyst Rating for ETFs

We take a vehicle- and strategy-agnostic approach to helping investors identify best-of-breed funds.

A version of this article was published in the February 2018 issue of Morningstar ETFInvestor.

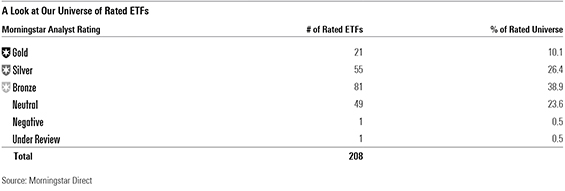

On Nov. 1, 2016, we unveiled Morningstar Analyst Ratings for just over 100 U.S.-listed exchange-traded funds. As of the end of January, we had expanded our rated universe to include 208 ETFs. These funds have collective assets under management amounting to $2.76 trillion. This represents 75% of the $3.65 trillion invested in U.S.-listed ETFs.

Background The Analyst Rating--which follows a Gold, Silver, Bronze, Neutral, and Negative scale--is forward-looking. It expresses our analysts' conviction in a fund's ability to beat its peers, after accounting for fees and risk, through a market cycle.

We’ve been assigning Analyst Ratings to mutual funds for a little more than six years, but with our 2016 launch we extended the ratings to ETFs for the first time. (Note: We had conducted qualitative, forward-looking analysis of ETFs for around eight years leading up to November 2016, but we had not assigned Analyst Ratings to ETFs until then.) Using the Analyst Rating, we believe investors can make sounder decisions about which ETFs to choose or avoid.

Because the Analyst Ratings we assign to ETFs follow the same methodology that we use to assign ratings to traditional mutual funds, it should also make it easier for investors to compare ETFs against relevant mutual funds. That practice has grown more commonplace in recent years as ETFs have become more widely available and the popularity of low-cost, passive funds has taken hold.

A Rating With Purpose The purpose of Morningstar's qualitative, analyst-driven research on funds is to identify those funds that we believe should be able to outperform a relevant peer group, within the context of the level of risk taken, over a market cycle.

The pillars of our analysis are the same regardless of whether we are rating an index-tracking ETF or an actively managed fund: People, Process, Performance, Parent, and Price. However, their relative impact on our overall assessment of a fund differs somewhat when it comes to analyzing and rating ETFs.

Obviously, keeping costs--both explicit (the ETF’s expense ratio) and implicit (the cost of portfolio turnover)--at a minimum is paramount in the context of running an index-tracking fund. As such, it should come as no surprise that our top-rated ETFs are not only among the lowest-cost options in their Morningstar Categories when compared with their actively managed peers, but also against other passive funds.

Although costs are critical, they are just one component of our holistic assessment of ETFs. We also closely scrutinize an ETF’s performance relative to peers in its category. And, as part of our Process Pillar assessment, we carefully analyze an ETF’s underlying benchmark to understand how the portfolio is built and maintained, as well as the techniques that the ETF’s managers employ to track the index with precision.

Stewardship also plays a vital role in our analysis. We tend to favor parent firms that put investors’ interests ahead of commercial goals and that align fund managers’ incentives accordingly. Of course, the skills and experience of the people managing the ETF are an important factor in our analysis. In the management of ETFs, every 0.01% of performance counts, so it is vital to have a seasoned team in place. Thus, we evaluate these matters as part of the People Pillar assessment.

In sum, we reserve our Morningstar Medalist ratings for those low-cost ETFs that we believe will tightly track a sensibly constructed index over a long time frame. We favor ETFs that are backed by experienced managers and sponsored by firms that are good stewards of investors’ capital. And we do so because we believe these attributes are likeliest to translate to outperformance when compared with a relevant peer group over a market cycle.

Having discussed our rationale for incorporating ETFs into our Analyst Rating framework and covered our methodology at a high level, I’d now like to discuss how we scrutinize each of the five pillars that underlie our ratings in more detail. Then, I’ll share a snapshot of the 200-plus ratings we’ve assigned to U.S.-listed ETFs.

People It's a mistake to assume that management doesn't matter when it comes to index funds and ETFs. Skillful managers and traders stand a better chance of tracking their benchmark over time, and they are better equipped to cope with challenging conditions. As is the case with active funds, we prefer teams with long track records. Teams that have run index funds and ETFs for several years--whether with their current firm or with a prior one--will generally earn higher marks than those who are relatively new to the job. Similarly, we prefer teams that focus solely on running index funds and ETFs. We'd rather see indexing treated as a core competency than a sideline.

Just as with active funds, we give teams that manage index funds and ETFs credit if they invest in their funds. It signals their commitment to the overall philosophy of indexing. That said, it is important to recognize that index fund and ETF managers are unique from their peers overseeing active funds. Members of teams managing index funds and/or ETFs are not as highly compensated as managers of active funds, and they tend to manage a relatively larger number of funds; this somewhat diminishes the importance of coinvestment. As such, we tend to make a more holistic assessment of these managers’ compensation and how it aligns their interests with those of fund shareholders.

Process: Portfolio Construction Our analysis of index funds' and ETFs' process focuses on the construction of these funds' underlying benchmarks and the systems and portfolio-management techniques their sponsors have put in place to achieve high-fidelity tracking of said benchmarks. As such, our assessment of these funds' process spills over into understanding the capabilities of the index provider as well. In all matters related to process, we place a premium on transparency and independence.

In the case of index funds and ETFs, much of their portfolio construction and management process is defined by the methodology of their benchmark indexes. We closely examine these funds’ underlying indexes to understand what their rules will ulti-mately yield in terms of the risk/reward profile of the resulting portfolio, its representativeness of the opportunity set available to active managers within a fund’s respective category, the potential for concentration risks, the existence of embedded active bets (that is, strategic beta), and considerations of portfolio turnover.

My colleagues Daniel Sotiroff and Phillip Yoo animate our approach to scrutinizing the makeup of these funds' underlying indexes in great detail with some useful examples in the February 2018 issue of Morningstar ETFInvestor. I'll spare the detail here.

Process: Portfolio Management After examining process as defined by the makeup of an index fund's or ETF's underlying benchmark, we move on to understanding how these funds' managers set about tracking their indexes. For these funds' managers, tight tracking is a never-ending task that involves numerous trade-offs and requires, among other things, robust systems and a capable team.

Parent Our Parent rating for index funds and ETFs is identical to that for actively managed funds from the same parent firm. This is because our parent-level assessment takes a holistic view of an asset manager's operations, culture, fees, and so on.

Performance We examine index mutual funds' and ETFs' performance through two separate lenses. We first assess these funds' performance relative to their peers in their respective categories. We then focus on tracking efficiency. High-fidelity tracking performance is requisite for index-tracking funds.

We view index funds and ETFs as valid alternatives to actively managed funds. Reasonably priced index funds and ETFs can be tough competition for active managers. Studies have shown that many active managers, particularly those burdened by high fees, have a tough time beating inexpensive index funds and ETFs over time. As such, competitively priced index funds and ETFs that track broad-based benchmarks representative of the opportunity set available to their active category peers will generally earn high marks for performance.

Price The premise of indexing is predicated on low costs, so this is a key pillar in our analysis of index funds and ETFs. To succeed, index funds and ETFs must have a substantial cost advantage over competing active funds. The best index funds and ETFs are often the cheapest, so we favor funds that have lower expense ratios over other index funds and ETFs in the same category. Where applicable, we include other less-visible costs in our assessment of fees. Examples of such costs include acquired fund fees and swap costs.

The Tally Of the 200-plus ETFs that we've rated, three fourths are Morningstar Medalists. We have a positive view of these funds' prospects relative to their category peers. The positive skew largely reflects what we've chosen to cover. In deciding which funds to cover, we take into consideration funds' investment merit and investor interest. Thus, our universe represents some of the largest, most broadly diversified, and lowest-cost funds--many of which are backed by top-rated stewards of fund shareholders' capital.

But indexing is not always a prudent strategy, particularly when ETFs and index funds fail to deliver on the key principles that have driven much of their success: low costs and broad diversification. Many of the funds in our rated universe fall short on one or both measures. This is reflected in the fact that about one fourth of the funds in our initial rated universe have received a Neutral rating, while one fund has been rated Negative.

Conclusion Most investors do not have a black-or-white, active-or-passive view of the world. In fact, many are becoming increasingly strategy- and vehicle-agnostic, looking to select best-of-breed approaches to portfolio construction irrespective of where they are located on the active-passive continuum or whether they're a fund or ETF. They are simply looking to select the type of vehicle that best meets their needs. This is evidenced by the continued growth of assets under management in ETFs around the world.

By incorporating ETFs into our Analyst Rating framework, we are leveling the field to help investors to pick the best funds from an ever-expanding list of choices.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)