Our Ultimate Stock-Pickers’ Top 10 Dividend-Yielding Stocks

Our top managers' high-quality dividend stocks reveal some new names worth highlighting.

By Joshua Aguilar | Associate Equity Analyst

The vast majority of our

have never been mistaken for dividend investors. That said, a handful of them--

As you may recall from our previous dividend-themed articles, when we screen for top dividend-paying stocks among the holdings of our Ultimate Stock-Pickers we try to hone in on the highest-quality names that are currently held with conviction by our top managers. We do this by taking an initial list of the dividend-paying stocks held in the portfolios of our Ultimate Stock-Pickers and then narrow it down by concentrating on firms that we believe have competitive advantages, which, in our view, should allow them to generate the excess returns they'll need to maintain their dividends longer term. We also look for firms where there is lower uncertainty on our analysts' part regarding their future cash flows. We accomplish this by screening for holdings that are widely held (by five or more of our top managers), are yielding more than the S&P 500, represent firms with wide or narrow economic moats, and have uncertainty ratings of either low or medium.

Once our filtering process is complete, we create two different tables--one that reflects the top 10 stocks with the highest dividend yields, and the another that represents the stocks that are the most widely held by our top managers while also paying dividends in excess of the S&P 500. In our view, finding stocks that are yielding more than the benchmark index and operate in more stable industries where there is less uncertainty surrounding their future cash flows should offer some downside protection for investors. With markets at or near all-time highs and interest rates still at lower-than-normal levels, many investors are left searching for yield wherever they can find it. We should note, though, that the dividend yield calculations in each of these two tables are based on regular dividends that have been declared during the past 12 months and do not include the impact of any special (or supplemental) dividends that may have been paid out (or declared) during that time.

Looking back to our list of top 10 dividend-yielding stocks from

, we note that six names--wide-moat rated Wells Fargo,

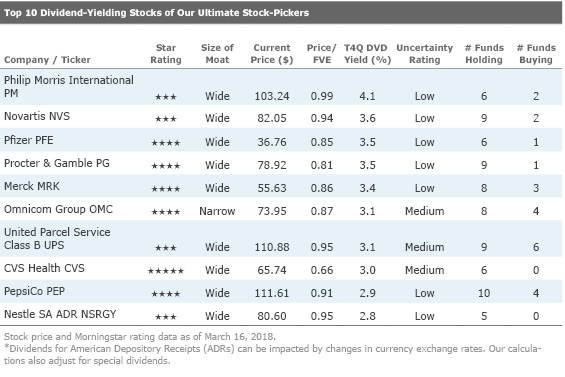

Top 10 Dividend-Yielding Stocks of Our Ultimate Stock-Pickers

Despite repeated warnings by our top managers over the state of rising valuations and interest rates, the S&P 500 TR Index has risen over 11.1% over the trailing six months. Investors continue to shrug off such concerns and are still allocating dollars to equities. While not all stocks have recovered--with the Communication Services sector trading in aggregate at a discount of about 17% to our fair value estimates--most have rallied. As a consequence, several sectors that have traditionally been associated with yield and safety--like Utilities and Consumer Defensive--continue to be bid up in the process. Searching for yield in this type of environment can be fraught with risks, including everything from price risk to the risk that a firm cannot meet its commitment to its dividend. In an effort to offset some of these risks, we eliminate stocks with higher uncertainty ratings from our screening process. Even after doing this, we're still looking at two of our top 10 dividend-yielding names trading at 95% or more of our analysts' fair value estimates, with two additional names trading at 90% or more of our analysts' fair value estimates. If purchased at today's prices, we believe they would potentially diminish the opportunity for outsized total returns for long-term investors. With that in mind, we expect to focus on the names that have both a solid yield and a more favorable price to fair value ratio. CVS, which we extensively profiled in a recent issue, trades at the most substantial discount of any of our top-yielding names, with a discrepancy of 34% from our analyst's fair value estimate. Other names that appeared attractive to us were wide-moat rated

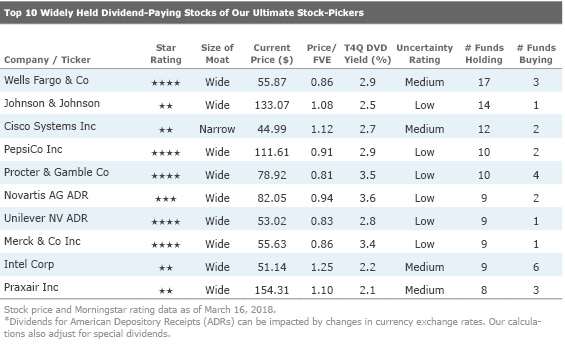

Widely Held Dividend-Paying Stocks of Our Ultimate Stock-Pickers

Looking more closely at the list of top 10 widely held securities that met our criteria for dividend-paying stocks this time around, there was greater overlap with our list of top 10 dividend-yielding stocks, with wide-moat rated Merck, Novartis, Pepsi, and Procter & Gamble making both lists. Continuing a theme from our

, the vast majority of names on our list of top 10 widely held securities are held by nine or more funds. While our top managers remained net sellers for the period, as they were in the prior seven periods, the buying activity that did occur was focused to some degree on these higher-yielding names.

With valuation and safety being a top concern for investors, especially with markets again hovering near all-time highs relative to normalized interest rates, we continue to believe that the best way for investors to protect their capital is to invest in quality businesses trading at attractive prices. As such, we focus on names whose business prospects have a lower uncertainty, along with defensible moats, and that are currently the most undervalued--a list that includes two of our top dividend-yielding stocks in wide-moat rated Procter & Gamble and Merck. We think these names are more likely to offer investors both the yield they are looking for and prices that provide a relatively better margin of safety. We would, however, advise our readers to stay away from wide-moat rated Intel, which trades at a sizable premium to our analyst's fair value estimate. We think the name would offer an unattractive return on a risk-adjusted basis.

Procter & Gamble Co

PG

Wide-moat rated Procter & Gamble appeared on both of our top 10 lists for the period. The stock currently trades at a 19% discount to Morningstar analyst Erin Lash's fair value estimate and is also the name trading at the most appreciable discount on our list of widely held names. The fund managers at

Even as the market's confidence in P&G’s ability to drive accelerating sales growth has yet to take hold, Lash thinks P&G is poised to increase underlying sales at a 4% clip in the longer term, with nearly two thirds of its annual growth from increased volume and the remainder from higher prices and improved mix. Furthermore, she adds that the firm is driving efficiency gains with its current $10 billion cost-saving effort by reducing overhead, lowering material costs from product design and formulation efficiencies, and increasing manufacturing and marketing productivity. Lash believes that the combination of these initiatives will allow P&G to up its core brand spend behind product innovation and marketing to combat competitive pressures, which should result in improved profits. Continuing on the theme of focus, in her view, Lash thinks that the benefits of P&G's more focused investments should allow it to yield improvements across its product mix, driving accelerating sales and volume growth, and as a result, aid its brand. Her long-term forecast, furthermore, calls for operating margins to improve about 500 basis points to more than 24% over the course of the next 10 years.

Commenting on the dividend specifically, Lash points out that the firm has consistently prioritized returning excess cash to shareholders. She furthermore adds that it currently pays one of the more attractive dividend across the household and personal care space. In this context, P&G’s dividend yields north of 3% annually, far in excess of the low single digits its peers boast. Lash highlights the fact that the firm has paid a stable or growing dividend for nearly 130 years, and she forecasts the dividend to grow at a mid- to high-single-digit clip over the course of the next 10 years. Furthermore, despite its tepid top-line gains and CEO David Taylor’s past suggestion that it is open to pursuing select acquisition opportunities as a way to enhance its competitive capabilities, Lash doesn’t posit P&G will do so imprudently. She's still skeptical that there is much appetite to raid the piggy bank for a large acquisition at P&G. Rather, she thinks select bolt-on acquisitions that grant the firm entry to less penetrated geographic regions or distribution channels could be in the cards.

In summary, from Lash's vantage point, she believes that P&G’s efforts to rationalize its product mix, reinvest behind its brands, extract costs, and return excess cash to shareholders are wise. Finally, she thinks the current discount is creating an attractive opportunity for long-term investors to build a position in a wide-moat name at a discount.

Pfizer Inc

PFE

Big pharma name Pfizer is a wide-moat rated name that made our top 10 list of dividend-yielding names. The firm currently trades at a 15% discount to analyst Damien Conover's fair value estimate. Conover believes that Pfizer's foundation remains solid, based on strong cash flows generated from a basket of diverse drugs. From Conover's view, the company's large size confers significant competitive advantages in developing new drugs. He believes this unmatched heft, combined with a broad portfolio of patent-protected drugs, has helped Pfizer build a wide economic moat around its business.

Conover adds that Pfizer's size establishes one of the largest economies of scale in the pharmaceutical industry. In a business where drug development needs a lot of shots on goal to be successful, Conover believes that Pfizer has the financial resources and the established research power to support the development of more new drugs. Also, after many years of struggling to bring out important new drugs, he points out that Pfizer is now launching several potential blockbusters in cancer, heart disease, and immunology.

In addition, he highlights the fact that Pfizer's vast financial resources support a leading salesforce. Conover believes that Pfizer's commitment to postapproval studies provides its salespeople with an armamentarium of data for their marketing campaigns. Further, Conover adds that Pfizer's leading salesforces in emerging countries position the company to benefit from the dramatically increasing wealth in nations such as Brazil, Russia, India, China, and Turkey.

That said, while entrenched as an industry leader, Conover points out that Pfizer faces challenges in the near term. The loss of patent protection on several drugs will weigh on future growth, in Conover's view. Specifically, Conover believes that the eventual 2019-20 U.S. patent losses on Lyrica will slow long-term growth.

Even so, Conover believes that Pfizer's operations can withstand the upcoming generic competition, and the 2009 acquisition of Wyeth helped insulate Pfizer from any one particular patent loss. Following the merger, Pfizer has a much stronger position in the vaccine industry with meningitis vaccine Prevnar 13. Conover points out that vaccines tend to be more resistant to generic competition because of the manufacturing complexity and relatively lower prices.

Merck & Co Inc

MRK

Merck is the other big pharma name appearing on both our top 10 list of dividend-yielding stocks and widely held dividend-paying names. The stock currently trades at a 14% discount to our analyst's fair value estimate. Morningstar’s director of healthcare equity research also covers this name. Damien Conover believes that Merck's combination of a wide lineup of high-margin drugs and a pipeline of new drugs should ensure strong returns on invested capital over the long term. Furthermore, Conover thinks that Merck is through the worst of its patent cliff, which should remove the heightened generic competition that the company has experienced over the past five years. And after several years of only moderate research and development productivity, Conover's assessment is that Merck's drug development strategy is yielding important new drugs.

Conover points out that Merck's new products have mitigated the generic competition, offsetting the recent major patent losses. In particular, he highlights Keytruda, which for cancer represents a key blockbuster with multi-billion-dollar potential. Conover thinks that Keytruda holds a first-mover advantage in one of the largest cancer indications of non-small-cell lung cancer. Also, Conover expects new cancer drug combinations will further propel Merck's overall drug sales. However, he expects intense competition in the cancer market with several competitive drugs likely to report important clinical data in 2018. Other headwinds include increasing generic competition, which he believes is likely to create a major drag on overall growth.

After several years of mixed results, Conover believes that Merck's R&D productivity is improving as the company shifts more toward areas of unmet medical need. Merck experienced major setbacks with cardiovascular disease and migraine drugs, which Conover attributes to side effects or lack of compelling efficacy. For example, safety questions ended the development of one of Merck's osteoporosis drugs and a mixed tradeoff profile between efficacy and safety stopped the filing of an atherosclerosis drug. Lastly, Merck's key late-stage drug for atherosclerosis is chemically similar to two others that both failed to receive U.S. Food and Drug Administration approval. Despite these setbacks, however, Conover points out that Merck has had some solid successes, including a solid launch for Keytruda in oncology. Following on this success, Merck is shifting its focus toward areas of unmet medical need in specialty-care areas, and Conover believes that Keytruda is leading this new direction.

Intel Corp

INTC

Wide-moat rated Intel is a widely held dividend-paying name that we believe is materially overvalued. The stock trades at a 25% premium to Morningstar analyst Abhinav Davuluri's $41 fair value estimate per share, which he recently increased from $36 after taking a fresh look at his model and incorporating beneficial assumptions from U.S. tax reform. Nevertheless, Davuluri still recommends a wider margin of safety for prospective investors, as he doesn't believe the market fully considers the execution risk faced by wide-moat Intel as it pivots away from personal computers (PCs) into artificial intelligence and automotive. Furthermore, in the near term, Davuluri sees Intel’s PC-derived revenue declining in the low single digits. Additionally, Davuluri believes that the firm’s foray into 3D NAND manufacturing to support its Solid State Drive (SSD) business for servers, however, will depress gross margins. Intel has also demonstrated an inability to break into the smartphone market at a reasonable level, which could be a cause for concern, as mobile devices continue to proliferate at the expense of PCs. Also, the rise of alternative solutions in the data center is potentially a cause for concern, as

Disclosure: Except for Berkshire Hathaway (BRK.B), Joshua Aguilar has no ownership interest in any of the securities mentioned here. Eric Compton has no ownership interest in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2UWGQD7LCJCYNF3WQ5HHLP7UBE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)