February 2018 U.S. Morningstar Analyst Ratings Activity

There were several notable upgrades and downgrades this past month.

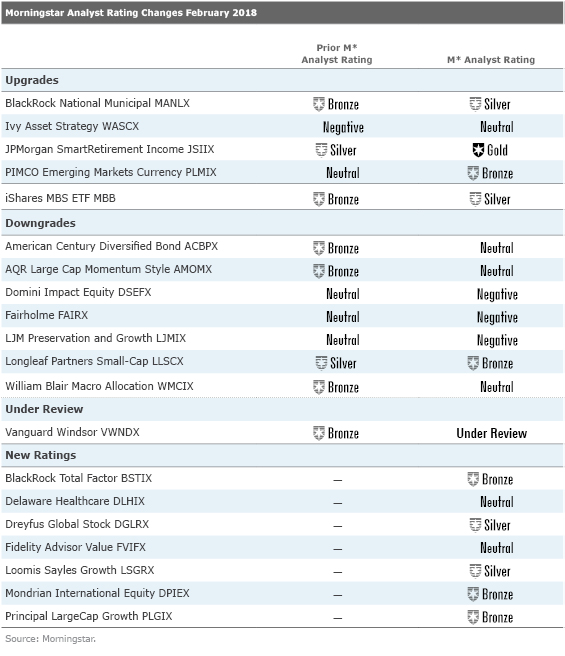

In February, Morningstar manager research analysts upgraded the Morningstar Analyst Ratings of four funds and one target-date series, downgraded the ratings of seven funds, and affirmed ratings on 75 funds and three target-date series. The team also assigned new ratings to eight funds and placed one fund under review. Below are some of February’s highlights, followed by the full list of ratings changes.

Upgrades

Downgrades

LJMIX was downgraded to Negative from Neutral in February because of its steep losses, poor risk controls, and inadequate oversight. The fund’s managers, Anish Parvataneni and Tony Caine, employed a short-volatility strategy that sold put-options on S&P 500 futures without owning the underlying security, which left it vulnerable to a margin call during a period of volatility. The fund lost 56% on Feb. 5 alone and accepted new money on Feb. 6 before communicating the previous day’s net asset value loss. In total, the fund lost 81% of its value over the two-day period of Feb. 5 and Feb. 6, 2018. The fund closed to new investors on Feb. 7, and the managers are expected to liquidate its remaining assets, although not much else is clear because the firm ceased communication with Morningstar and fundholders as of Feb. 9, 2018. These disastrous losses, poor management, and absent fundholder communication are big red flags. Although the fund’s high 2.24% expense ratio had deterred many investors, those who did invest incurred a permanent loss of capital.

New Ratings

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/15a9df65-8689-4043-bfce-e3748d3af498.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/15a9df65-8689-4043-bfce-e3748d3af498.jpg)