10 Value Stocks With Good Prospects at Great Prices

We examined the nearly 500 holdings in the Morningstar US Value Index and found some appealing bargains.

Strictly speaking, value stocks are equities that exhibit low price/book and price/earnings ratios. Compared with their growth counterparts, value stocks have sluggish cash flow and sales growth, and, importantly, their projected earnings growth is also low. The prospect of much slower growth is why investors aren't willing to pony up a lot of money to own shares of such a business.

Does that mean value stocks are destined to underperform? Not necessarily. In the early 1990s, Fama and French identified the "value premium" as part of their three-factor capital asset pricing model. Essentially, they argued that value stocks outperform growth stocks over time, on a risk-adjusted basis.

Many investors are skeptical of the so-called value premium, arguing that it is disappearing or that it never existed. But there are plenty of advocates for value investing. There are a few theories as to why it works. The first is risk-based: Value stocks' excess returns are compensation for bearing additional risks. Many value stocks are "cheap for a reason"--they are facing a tough economic environment or a tough business outlook. Perhaps they are under some sort of regulatory or litigation risk, or there is uncertainty about the company's future. Maybe there are new managers in charge or the company is undergoing a restructuring, or both.

Another theory as to why value investing has historically led to outsize returns has to do with investor behavior. The idea is that investors often overestimate information or become overconfident in the growth prospects of certain companies, which in turn causes those companies to be overpriced. The companies that are out of the limelight, meanwhile, get shunned or ignored and thus undervalued.

The value premium has been scarce in recent years. Over the trailing 12-month period, the Morningstar US Growth Index has outpaced its Value counterpart by 17.4 percentage points. Value stocks have also underperformed their growth counterparts over the past three- and five-year periods, but by a smaller margin of around 3 percentage points per year in each trailing period. Over 15 years, the disparity shrinks to 0.9 percentage points, and over 20 years value takes the lead, outperforming growth by 1.7 percentage points.

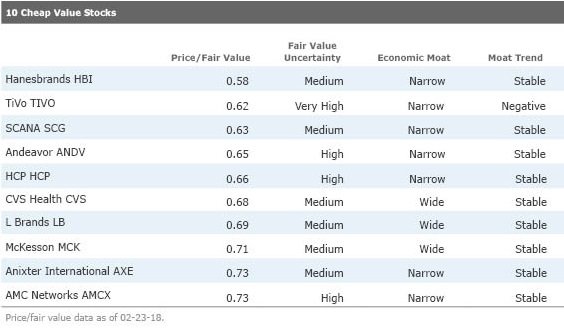

Value's relative underperformance invites the question, are there bargains to be found? We examined the nearly 500 constituents of the Morningstar US Value Index. First we removed companies that our analysts do not cover. Then we focused only on firms that have economic moats of wide or narrow, which means our analysts think the company has a durable competitive advantage that will allow it maintain its profitability over the long term. (This step helps avoid value traps--stocks that appear cheap but are a losing bet.) Finally, we sorted the stocks that passed our screen by price/fair value to find the 10 cheapest value stocks. You can see the results below, along with some highlights from our research reports on three of the companies.

SCANA

SCG

At first blush, this stock sounds like it belongs in the "too hard" pile: Scana decided to abandon its new nuclear plant construction in mid-2017, which created a political and regulatory headache that could have persisted for several years. But the risk was minimized when

Dominion and Scana shareholders will both feel near-term pain, Miller said. But Scana has good longer-term prospects: It owns a difficult-to-replicate network of energy generation, transmission, and distribution assets and provides essential energy sources, natural gas, and electricity. We award Scana a narrow moat rating based on these assets, and shareholders would become part of wide-moat Dominion if the proposed deal closes.

HCP

HCP

HCP is one of the largest healthcare REITs; it owns many high-quality properties in attractive locations. Part of its narrow moat owes to high switching costs: The threat of new supply through ground-up construction is naturally reduced given the increased risk/required return spread between new developments and existing assets, which benefits HCP in good times and protects it in bad times, said equity analyst Brad Schwer.

HCP has faced some near-term difficulties, which have weighed on its stock price: It was forced to spin off its skilled nursing assets, mainly confined to its exposure to struggling operator HCR ManorCare, into a separate, publicly traded real estate investment trust.

But now that that painful chapter is closed, HCP is in a good position to benefit from change that is under way in the healthcare industry. The Affordable Care Act has introduced millions of newly insured individuals to the healthcare system and focused attention on containing costs and increasing quality of care. Additionally, the vast baby boomer generation is still in the early stages of becoming eligible for Medicare and entering senior adulthood. These factors should drive demand for healthcare services for years to come and disproportionately reward top owners and operators of healthcare real estate that can anticipate and adapt to the new landscape, such as HCP, Schwer said.

Anixter International

AXE

Product distribution can be a tough business--low barriers to entry combined with customer and supplier bargaining power can erode returns on invested capital for industry players, says equity analyst Brian Bernard. But despite these competitive pressures, Anixter's scale and ability to monetize its strong network of customers and suppliers has allowed the firm to consistently earn excess returns, and Bernard expects the firm will maintain its competitive advantages over at least the next 10 years.

Anixter has three main businesses--network and security solutions, electrical and electronic solutions, and utility power solutions. Bernard believes each of these businesses benefits from a network effect and cost advantages. Over the past three years, Anixter has completed three transactions (two acquisitions and one sale) that have bolstered the company's market presence, growth potential, and operating flexibility. Indeed, Bernard sees "key growth" drivers for each of Anixter's segments over the next five years.

"Anixter's capital allocation strategy has favored returning cash to shareholders through special dividends and share repurchases," Bernard said. "Once Anixter achieves its targeted leverage ratio of 2.5 to 3 times EBITDA, which we think will happen [in] 2018, we expect the company to resume returning cash to shareholders."

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)