Our Ultimate Stock-Pickers’ Top 10 High-Conviction and New-Money Purchases

Passive inflows continue to make for a difficult stock-picking environment.

By Joshua Aguilar | Associate Equity Analyst

For the past nine years, our primary goal with the Ultimate Stock-Pickers concept has been to uncover investment ideas that not only reflect the most recent transactions of our grouping of top investment managers but are also timely enough for investors to get some value from them. In cross-checking the most current valuation work and opinions of Morningstar’s own cadre of stock analysts against the actions (or inactions) of some of the best equity managers in the business, we hope to uncover a few good ideas each quarter that investors can dig into a bit deeper to see if they warrant an investment.

With nearly 90% of our Ultimate Stock-Pickers having reported their holdings for the fourth quarter of 2017 and the beginning of the first quarter of 2018, we now have a good sense of what stocks piqued their interest during the period. Continuing the theme from 2017’s third quarter was active management's muted search for undervalued equities among well-known, blue-chip names during the most recent period. Even so, in what has become an all-too-familiar tune, many quarterly commentaries continued to highlight the rise in valuations after a nine-year bull market. To their point, even after this month's market correction, the S&P 500 has risen over 100% since Feb. 1, 2008, prior to the crisis, and nearly 20% since the start of 2018, net of the effect of dividends. The fund managers at

“In the United States, a review of a relatively stable long-term valuation measure such as enterprise value-to-sales shows most stocks trading not at one standard deviation above their long-term mean, but two or three. On many valuation metrics, particularly those based on median data, the markets have blown through the peak of the 1999-2000 tech bubble, a period that used to be called the most overvalued in history.

For every bear, however, there is a bull, or at the very least, a counterargument. In the view of Ultimate Stock-Picker Warren Buffett, there are two main levers for predicting future returns. One is some measure of corporate profits to national income, while the second is the level of interest rates. Buffett has previously compared interest rates in finance with gravity in physics. Touching on the notion of opportunity cost from microeconomics, Buffett had this to say about the stock market in an interview with CNBC late last year:

“Valuations make sense with where interest rates are now. In the end, you measure laying out money for an asset in relation to what you are going to get back and the number one yardstick is U.S. government [treasuries]. And when you get 2.30% on the ten-year, I think stocks will do considerably better than that. So, if I have a choice of the two, I'm going to take stocks at that point. On the other hand, if interest rates on the ten-year were five or six [percent], we'd have a different valuation standard for stocks…[however], I can't remember any decision we've ever made based on the Fed…I don't try to guess the market, I just buy businesses I like.”

At Morningstar, we also don't try to predict what the market is going to do. That said, in our own analysis, which aggregates our equity analysts' fair value estimates, stocks appear to continue to trade within a realm of reasonableness. Our own coverage, which we believe is moatier than the collective universe of equities, currently trades at a market fair value of 104%, in line with our most recent early-read article for the third quarter of 2017. That said, prior to the market correction earlier this month, our collective coverage was close to converging upon the all-time high figure of 114%, equating to 111% on Jan. 25, 2018.

Unsurprisingly, a perception of stretched valuations continues to have reverberations in this stock-picking environment. Overall activity levels have consistently dropped from their high during the final period of 2016. The drop in activity levels represent the lowest level of activity in seven periods. Once again, our top managers were net sellers of stocks. Unlike last period, however, where buying activity nearly reached parity with selling activity, our top managers were more pronounced net sellers. Even so, the number of top managers that made new-money purchases during the period remained comparable to last period. As was the case during the prior period, many of the positions that were initiated during this most recent period were relatively small, although a few new-money positions were also high-conviction purchases.

Recall that when we look at the buying activity of our Ultimate Stock-Pickers, we focus on high-conviction purchases and new-money buys. We think of high-conviction purchases as instances when managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the size of the portfolio. We define a new-money buy strictly as an instance where a manager purchases a stock that did not exist in the portfolio in the prior period. New-money buys may be done either with or without conviction, depending on the size of the purchase, and a conviction buy can be a new-money purchase if the holding is new to the portfolio.

We also recognize that the decision to purchase any of the securities highlighted in this article could have been made as early as the start of October, with the prices paid by our managers being much different from today’s trading levels. Therefore, we believe it is always important for investors to assess for themselves the current attractiveness of any security mentioned here based on myriad factors, including our valuation estimates and our moat, stewardship, and uncertainty ratings.

One interesting dynamic worth noting is that we added a new Ultimate Stock-Picker to our 2018 roster in Larry J. Puglia's

As with any new addition, however, generally comes a corresponding drop from our list. In this instance, we removed

Looking more closely at the top 10 high-conviction purchases during the fourth quarter of 2017, the buying activity was similarly diversified compared with last quarter, with some concentrated bets in the consumer cyclical sectors. A few names stuck out to us from this list based on valuation, including wide-moat

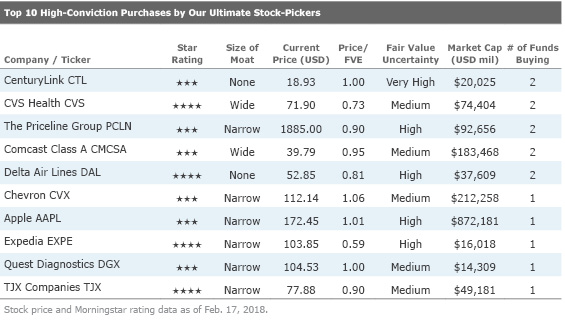

Top 10 High-Conviction Purchases Made by Our Ultimate Stock-Pickers

- source: Morningstar Analysts

Once again, there was a moderate amount of crossover between our two top-10 lists this period, including narrow-moat rated

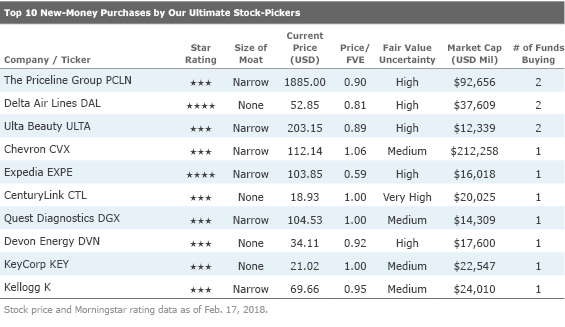

Top 10 New-Money Purchases Made by Our Ultimate Stock-Pickers

- source: Morningstar Analysts

From a valuation perspective, CVS is one of the most attractive names to make our top 10 list of high-conviction purchases. Several of our fund managers dedicated an appreciable amount of real estate to CVS in their respective quarterly commentaries.

“CVS is well positioned in a U.S. health care system that rewards scale, as the company owns the nation’s largest pharmacy benefit manager (PBM), the largest retail pharmacy, and the largest retail clinic. Both the PBM and retail pharmacy segments are as concentrated as they have ever been, and we believe these lines of business protect existing players and pose serious challenges for new entrants. After underperforming the S&P 500 by nearly 60% over the past two years, CVS is now valued at less than 12 times next year’s consensus earnings after adding back amortization of intangible assets. In our view, the market is underestimating the durability of the company’s competitive advantages across multiple end markets. Additionally, the pending acquisition of Aetna, Inc. would bring together two forward-thinking management teams and give them a broad suite of assets through which to address sectorwide trends, like the shift toward value-based care models and the increasing “consumerization” of health care.”

Taking a contrary stance, our newly-minted Ultimate Stock-Picker T. Rowe Blue Chip Growth Fund recently eliminated the holding from its portfolio last quarter. The rationale was as follows:

“CVS Health was eliminated after several inconsistent quarterly reports and the loss of several large accounts. In general, the entire drug distribution and retailing area has been quite competitive, with certain operators designing specialized or narrow networks to maintain or take market share. CVS should reestablish growth after the recent downward revision in earnings, and we could reestablish a position in time. However, we currently favor other companies in this sector.”

The stock currently trades at a 17% discount to Morningstar analyst Vishnu Lekraj's fair value estimate. Lerkraj continues to believe that CVS presents an excellent opportunity for investors seeking to own a high-quality healthcare player at a significant discount. Like Bill Nygren at Oakmark, Lekraj also likes the potential combination with

That said, Lekraj is realistic about the potential bumps on the road ahead as CVS realigns its business model. In his mind, fourth-quarter results reflected this trend as CVS reported decent top-line growth and gross profit expansion. The company reported $2.4 billion in net new business and a 96.5% client retention rate in the fourth quarter of 2017. Lekraj finds these developments highly positive and thinks these trends point to the value CVS and its large PBM peers bring to their payer clients. Even so, Lekraj points out that operating margins did compress as the company made investments in its infrastructure in preparation for the transitioning Anthem contract. He also believes that the lower profits were driven by the onboarding of new business, as new PBM clients usually yield a lower level of profitability over the first few years. He would like to see a resumption of profit expansion per claim over the coming quarters and expects this to be the case, given the scale advantages inherent in the PBM business and the increase in total claims volume.

Lekraj further adds that the news was a lot more positive for CVS’ retail pharmacy segment during the fourth quarter. The firm's management attributed this to a more rational promotion program as well as a robust cold and flu season. However, foot traffic and same-store sales remained tepid as the firm continues to feel the negative effects of being excluded from several restricted PBM retail pharmacy networks. Even so, Lekraj believes this negative volume trend will reverse in the coming year as CVS has partnered with many of its peers and moved back into several restricted PBM networks for 2018. He thinks this pure-play retail segment will continue to be less of a driver of the firm’s operations as management continues to transform CVS into a healthcare services specialist. However, while these retail assets have been a drag on results over the past several quarters, he believes they will play an integral role as the firm looks to leverage them in its evolving services-focused business model.

It should be noted that Lekraj is concerned that CVS has significantly overpaid for Aetna. From his perspective, CVS potentially runs the risk of material shareholder value destruction if the deal is not executed optimally and if it is unable to drive synergies beyond cost savings. On balance, however, he believes CVS is making the correct long-term strategic moves given the secular trends occurring throughout the entire healthcare market.

The other compelling bargain to make our list of high-conviction purchases was narrow-moat

In addition, replicating Priceline's leading network in Europe, while not an insurmountable hurdle, is costly. Wasiolek points out that boutique hotels, which constitute a substantial portion of the region's market, face some labor and expense constraints to joining multiple distribution channels. That said, Expedia is accelerating its marketing spending in 2018 to further expand its international presence, which he believes should support its network advantage over time. Wasiolek also adds that in emerging markets, the company has improved its position by selling its majority-owned subsidiary eLong and replacing it with an unknown

Wasiolek expects Expedia to leverage its technology, marketing, and conversion expertise across its more recently acquired brand HomeAway, as was the case with the successful revitalization of the Travelocity brand in 2015, leading to healthy sustained bookings growth. While Wasiolek concedes that focused entry from companies with the customer traffic and budgets to replicate Expedia's network are its main risk, he believes that successfully replicating Expedia's network would require significant time and expense.

Another entry on our high-conviction purchase list that looked somewhat attractive was narrow-moat TJX. We have highlighted the name in prior editions of this publication. While not a pound-the-table bargain at only a 10% discount to Morningstar analyst Bridget Weishaar's fair value estimate, the firm does represent a stable, moaty company with a superior uncertainty rating relative to most of the other names that made our lists (or that we are highlighting for this edition). Weishaar believes TJX offers investors an attractive domestic and international growth story, strong free cash flow generation, and a proven record of success in both strong and weak economic environments through its well-known brands like T.J. Maxx, Marshalls, and HomeGoods. While the apparel retail space offers limited opportunities for sustainable competitive differentiation, Weishaar believes that TJX has achieved this through cost advantages and a proprietary inventory management system. She points out the company has generated a 29% average adjusted return on invested capital over the past three years, and she sees it continuing to achieve returns well above her cost of capital estimate for at least the next 10 years.

Through its off-price retailing model, Weishaar believes TJX has achieved significant bargaining power with suppliers. The company offers wholesalers, department stores, and specialty stores the opportunity to clear excess inventory at very favorable terms to the supplier. These stipulations include a willingness to purchase less-than-full assortments of items, styles, and sizes as well as quantities ranging from small to very large. Because TJX is the largest off-price retailer and has international operations, Weishaar thinks the firm is uniquely positioned to manage large volume and disperse merchandise across a geographically diverse network of stores. A large cash balance enables the company to pay suppliers promptly, and it generally does not ask for typical retail concessions, delivery concessions, or return privileges. In return, TJX can acquire brand-name merchandise at a significantly discounted price and then sell it at a 20%-60% discount to traditional retailers.

Weishaar also thinks scale has given TJX better access to the supplier network. The company has more than 1,000 buyers stocking inventory from over 18,000 vendors in 100-plus countries. She believes the size of the buyer force is an essential component of the company's opportunistic buying strategy of purchasing inventory for the immediate or upcoming season. She further thinks the large vendor base allows buyers to capitalize on current market trends and source only the most popular fashions.

Additionally, Weishaar believes a unique inventory strategy coupled with an effective inventory management system has allowed TJX to achieve above-average revenue growth and profitability. As commercially available retail inventory management systems are not readily adaptable to the off-price retailing format, TJX has developed a proprietary system to meet its needs. This system has effectively matched store merchandise to local preferences and demographics and has maintained lean inventory levels. In fiscal 2017, TJX posted an inventory turnover rate of 57 days. She thinks high inventory turnover not only minimizes markdowns but also keeps the merchandise fresh, yields quick adjustment capabilities, and increases the frequency of customer visits. In Weishaar's opinion, the development of this proprietary inventory management system gives the company a significant competitive advantage as the system would be costly and time-consuming for competitors to build and fine tune.

Finally, with TJX, investors can also take advantage of an exemplary-rated management team steering the ship at the narrow-moat firm. The management team has extensive retail experience within and outside the company. Pivotally, management has actively participated in shareholder-friendly activities in the form of dividends and share repurchases.

Turning over to our list of new-money purchases, the final name we are highlighting is no-moat Delta Air Lines. It's also a name we've highlighted before. Additionally, the name was both a high-conviction purchase and new-money purchase for

“We identified [Delta] as likely to show improving revenue and cash flow. Delta’s superior route structure includes the most attractive hubs in the U.S. market. Coupled with a recently upgraded fleet of planes and newly renovated terminals, Delta is delivering a more consistent product. Ultimately this execution, along with a consolidated industry, should translate into more stable earnings than in the past.”

This "consolidated industry leading to a more rational oligopoly" thesis was also ostensibly a pivotal reason for Warren Buffett's investment in the Big Four airlines last year after an investor day presentation from

Morningstar analyst Chris Higgins recently increased his fair value estimate for Delta to $65 per share from $63 per share, mostly due to better-than-anticipated impacts from both the price of oil and U.S. tax reform. The shares currently trade at an attractive 19% discount to his revised fair value estimate. Regarding the argument espoused in Sound Shore's commentary about "comparably more attractive hubs lead to superior route structures," Higgins concludes it's not enough to award Delta a network effect moat source. It's one of two arguments Higgins hears when Delta bulls argue that the legacy airliner merits a narrow-moat rating. Higgins states that one could posit Delta enjoys network effects at major hubs like Atlanta, as customers value the frequencies Delta can offer. However, Higgins counters that the constant threat of entry, and in many instances, the actual entrance of ultra-low-cost carriers, constrains pricing power on many routes. Higgins points to the recent downward move in fares for Delta as evidence of this constrained pricing power.

Moreover, Higgins adds that industry trade studies demonstrate that the S-curve phenomenon—which asserts that carriers with a frequency advantage enjoy disproportional market share—appears to be breaking down, or at least is weaker than previously believed. Higgins points out that this is particularly the case in markets where low-cost carriers operate. While he acknowledges that the move by Delta and other network carriers to offer basic and premium economy should help recapture some S-curve effects, he nevertheless believes that the traditional relationship that network planners observe between frequency and market share is weaker in the low-cost carrier era.

Regarding the second frequently articulated argument for the existence of a rational oligopoly—and by extension, efficient scale—Higgins counters that the primary difference between airlines and rails is the contestable nature of the aviation market. He adds that the railroad industry exhibits high entry barriers. Rails are nonportable assets that require contiguous land and maintenance of large quantities of track. In addition, he argues that creating a railroad requires prohibitively high capital expenditures and entails significant regulatory barriers. These significant barriers include the need to lay new tracks as well as securing the necessary right-of-way. On the other hand, skies are open in three dimensions, aircraft are leasable and portable assets, and the airport infrastructure is not owned or maintained by the airlines. The result, Higgins concludes, is a contestable market that must price competitively, regardless of the status quo competitive dynamics.

Nevertheless, Higgins still sees the stock as undervalued, and like Sound Shore, attributes this to superior execution. He attributes this execution to Delta's strategy of operating a comparably older aircraft fleet, with lower capital costs. Moreover, Delta's maintenance operations are among the lowest in the industry on a per-seat block hour basis, allowing the firm to maintain old aircraft more cost-effectively than peers. In addition, Delta has pursued the part-out of older aircraft to constrain spare-part expenses. Joint ventures further allow Delta to access markets it otherwise could not reach. Finally, Higgins believes Delta drives a hard bargain with aircraft manufacturers and hunts for deals on used aircraft. As such, Higgins concludes that Delta remains one of the best-managed airlines, with the highest operating margins among U.S. network carriers, a clean balance sheet, and a commitment to returning 70% of its free cash flow to investors.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_d910b80e854840d1a85bd7c01c1e0aed_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)