5 Under-the-Radar Funds, and How the Morningstar Prospects List Has Performed

A list of up-and-comers and a performance check.

A version of this article was originally published in the fourth-quarter 2017 edition of Morningstar Prospects, which highlights promising managers that Morningstar Manager Research analysts currently do not cover but may cover in the future. The full list and publication are available to subscribers of Morningstar Direct. Morningstar Prospects will be published on a biannual basis in the future.

Morningstar Prospects--a list of up-and-coming or under-the-radar investment strategies that Morningstar Manager Research thinks might be worthy of full coverage someday--added 10 new strategies in the fourth quarter of 2017. We highlight five of them below, followed by a discussion of the performance of the Prospects list.

A Sensible, Quant-Driven Approach to Global Equities AQR Global Equity AQGIX uses a systematic and unique approach to global equity investing, as it selects stocks and determines country weightings and currency exposure separately. For stock selection, the managers use a quantitative model to rank stocks from each country in the MSCI World Index using well-established factors (such as value and momentum) and more-proprietary ones (such as those that seek to quantify investor sentiment). The portfolio will tilt toward highly rated companies. Then the managers use two macroeconomic-focused models to determine which countries and currencies to overweight or underweight, or even sell short. The fund holds stocks and uses derivatives for its country and currency bets. Historically, the fund has had a large-cap focus with a slight value tilt. Over the trailing three and five years through 2017, the fund generated top-quartile risk-adjusted returns within the world large-stock Morningstar Category.

Listed managers include Cliff Asness, AQR's founder, and Jacques Friedman, head of the global stock-selection team. But, as with most AQR funds, a large team of highly credentialed individuals works together to design and monitor the process and manage the portfolio.

An Alts Strategy Seeking to Benefit From Corporate Change BlackRock Event Driven Equity BILPX bets on companies that are undergoing mergers, management changes, or similar corporate events. When a deal occurs, the fund buys stock in companies expected to benefit (typically the acquisition) and shorts stocks expected to decline (typically the acquirer). The fund aims to maintain a low correlation to equity markets while delivering 6%-8% annualized net returns.

The fund gets an edge from its seasoned team and its parent company's scale. Lead manager Mark McKenna joined BlackRock in 2014, bringing a decade of event-driven experience as well as three longtime colleagues with similar expertise. BlackRock provides McKenna's squad with ample resources, including proprietary risk models and legal guidance. The team also enjoys boardroom access thanks to BlackRock's significant holdings across equity markets.

The fund holds stocks and credit instruments, and stocks usually constitute a larger portion of the portfolio. The fund also invests across sectors and borders, although the portfolio typically has a U.S. tilt. While the number of positions varies, each is capped at 3% risk to the fund's net asset value; a proprietary risk model guides position sizing.

Investors should be aware that the fund had a different strategy, manager, and name before May 2015, when it underwent a total overhaul.

A Proven Mid-Cap Team Takes on Large-Cap Stocks

Principal Blue Chip PBCKX employs the same process that lead manager Bill Nolin has executed to near perfection since late 2000 at

Seeking Global Growth Renowned growth-equity shop Jennison Associates hired Mark Baribeau and Tom Davis in 2011 to run its first world-stock strategy, Prudential Jennison Global Opportunities PRJZX. The managers, previously of Loomis Sayles, scour the globe for market-leading businesses with high growth rates and healthy balance sheets. Baribeau and Davis gauge companies' long-term growth prospects by conducting deep research and evaluating their competitive advantages. To become one of the fund's 35-45 holdings, a company should benefit from valuable intellectual property, economies of scale, or network effects and should be trading at a price that doesn't fully reflect the growth anticipated by the managers.

The management duo is helped by two long-tenured fundamental research analysts dedicated to the strategy (both of whom had also worked at Loomis Sayles) and 13 global growth sector specialists. This portfolio is no benchmark-hugger. Over the past five years, tech and consumer discretionary stocks have been heavily favored: Those two sectors constituted more than two thirds of the portfolio as of November 2017, much more than the index's 30% stake. Since its March 2012 inception, the fund has trounced the MSCI All-Country World Index and beaten more than 90% of its world large-stock category peers.

A Cheap Target-Date Lineup State Street Global Advisors only launched its State Street Target Retirement mutual funds in December 2014, but it first began managing custom target-date mandates in 1995 and launched its flagship collective investment trust target-date funds in 2005. That longer history largely explains why plan sponsors and investors have already invested a combined $4.4 billion in these relatively nascent funds.

Both the mutual fund and CIT target-date offerings use index-based underlying holdings, and, while they have similar asset-class exposures and generally follow the same asset-allocation glide path, they're not clones of one another. For instance, the CIT offering includes exposure to commodities, which are not in the mutual fund version. The underlying holdings also track slightly different indexes in some instances.

The series generally has above-average equity exposure across the glide path. For instance, at retirement, the series has 50% equity exposure compared with an industry average of 43%. And in contrast to some index-based offerings, these funds take a more granular approach to asset allocation. By separating exposure to U.S. large- and small-cap stocks, for example, the team overweights small-cap equities for younger investors and underweights small caps for those in retirement, whereas some peers simply use a broad U.S. equity index fund. Similar to index-based competitors, the series' low fees offer an enduring advantage over most actively managed options. Uniformly priced at 0.13%, the series' K shares eschew revenue sharing, and it is the series' lowest-priced and most heavily used share class. It is not the cheapest target-date series available, but it is notably lower-priced than the target-date market place's 0.81% asset-weighted average expense ratio.

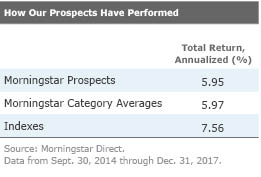

The Performance of Morningstar Prospects The Prospects list launched in September 2014, so a look at its returns thus far was in order. In the table below, you'll find the performance of the funds on the list compared with their Morningstar Categories as well as the appropriate benchmarks for those categories from that date through December 2017. Our methodology: We equal-weight each fund (oldest-share class only) on the list, reconstituting the portfolio quarterly to reflect changes. We add funds to the portfolio in the quarter they first appear in Prospects and remove them--either because they've graduated to coverage or otherwise been removed--in the quarter we announce their removal. We compare this portfolio to a blended category average that mirrors the category classifications of the funds in Prospects, as well as a blended index that mirrors the indexes assigned to the funds in the Prospects list.

We do not necessarily expect every fund that we add to Prospects to outperform. Indeed, some of the funds featured can be noteworthy for reasons other than our conviction in future performance. For instance, a fund may pursue an interesting strategy or have gathered a large sum of assets in a short period. Or it could be a proven manager at the helm of a new fund, but where it's not yet clear whether it'll be run in the same style as her previous charge. Thus, while we would expect the performance of Prospects to be above average over longer periods, the list hasn't been assembled solely for that purpose and, therefore, might experience stretches of underperformance. (It's also worth noting that the Prospects portfolio doesn't capture the performance of funds after they graduate to full analyst coverage.)

Viewed in that light, the Prospects portfolio's underperformance doesn't come as a huge surprise. It's a relatively short time frame, and during that time, active funds--which dominate the list--have had difficulty overcoming their costless benchmarks. That said, we expect performance versus the category average benchmark to improve, and we will keep readers apprised of its progress over time.

/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)