Mapping Alternatives

Where these funds land in the style box reveals their diversification benefits.

Alternative strategies come in many different varieties, and funds within the same Morningstar Category that pursue very similar strategies can still have very different diversification characteristics. To help investors gauge a fund’s diversification potential, we launched the Morningstar Style Box for alternative funds in October 2016. This research framework, now available in Morningstar Direct, allows investors to quickly and intuitively evaluate liquid alternatives investments.

In this article, we use the alternatives style box to demonstrate the importance of making good comparisons and conducting thorough evaluations when analyzing alternative investments. We take a bottom-up look at the alternatives universe by placing each liquid alternative fund into one of the style box’s nine regions. We find significant diversity among alternative strategies, even among those in the same Morningstar Category.

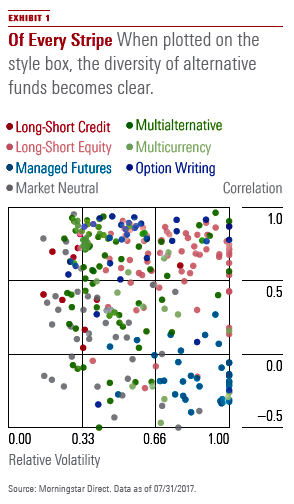

A Varied Universe Many alternative strategies derive their appeal from the potential to improve a traditional portfolio by further diversifying it, either by delivering an uncorrelated return stream or by dampening volatility and reducing downside. In practice, determining whether an alternative strategy can deliver those benefits can be a challenge for investors. The alternatives style box makes it easier to evaluate the diversification benefits a liquid alternative mutual fund has conferred over time. The style box plots alternative funds based on correlation and relative volatility to global equities based on the trailing three years of monthly returns ( EXHIBIT 1 ).

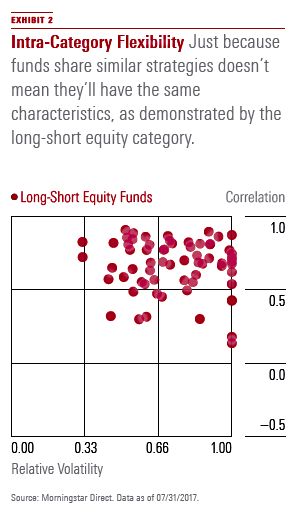

The dispersion of liquid alternative strategies within the alternatives style box is obvious. What’s more striking, however, is the dispersion within each Morningstar Category. Take the long-short equity Morningstar Category, for example. To be included in that category, funds must invest solely in equities, have at least 20% gross short exposure on a consistent basis, and maintain an equity market beta between 0.3 and 0.8. But within those constraints, there is a lot of room for flexibility, which can lead to a wide range of outcomes over any period. These differences appear more plainly when viewed through the alternatives style box ( EXHIBIT 2 ).

Using this information, investors can better assess a long-short fund’s diversification characteristics, which facilitates comparison and more-refined analysis.

Allocation Decisions The alternatives style box forms along two dimensions. The x-axis depicts a fund's volatility over the trailing three years compared with that of the Morningstar Global Equity Markets Index. The y-axis measures the correlation to global equities. By plotting funds along both dimensions, we can place them in the appropriate region of the alternatives style box. While this is not a substitute for a complete research process, the alternatives style box can make it easier to detect subtle differences like these between funds using similar investment strategies.

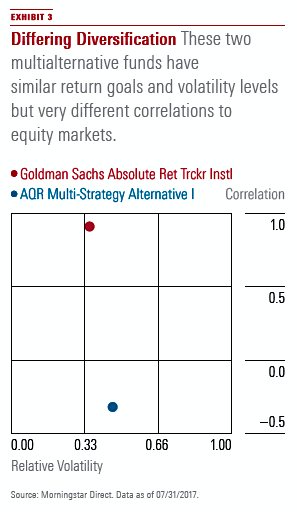

An example can help illustrate this concept and how investors can use the style box to make more informed decisions on how to use an alternative fund in a traditional portfolio. Take, for example,

AQR Multi-Strategy Alternative’s management team fully hedges its portfolio of alternative strategies so there is no long bias toward equities. Of course, that doesn’t mean that over short time periods the fund can’t rise or fall at the same time as equities, but it has shown that over longer periods it does have a low correlation to equity markets. Over the three years ending July 31, its correlation to global equity markets was negative 0.31. An investor using the style box can take the negative correlation to mean that the fund’s returns over that period were not driven by equities. In fact, over this three-year period the fund had positive returns when global equity markets were up and when they were down. That doesn’t mean the fund had no risk or suffered no losses, but its returns were largely independent of the direction of global equities. For portfolio construction purposes, AQR Multi-Strategy Alternative shows it can add diversification by delivering returns from sources besides equity exposure.

Goldman Sachs Absolute Return Tracker can benefit a portfolio in a different way. As EXHIBIT 3 shows, the fund has a strong correlation to equity markets of 0.9. The fund seeks to replicate the return and risk profile of a broad universe of hedge funds by identifying the factors driving the group’s returns. Because it is trying to replicate hedge fund returns, it will only fully hedge its portfolio against the equity market if hedge funds are. The high correlation signals that the direction of hedge fund returns is being explained by whether equity markets rise or fall. The fund’s low relative volatility indicates it’s only going to move a fraction as much as the stock market, though. So, investors can use the fund to lower the overall volatility of a portfolio by swapping it for equity exposure, but they should still expect the fund to largely follow the path of the stock market. Of course, if lowering portfolio volatility is the only goal, that can be achieved more cheaply by adding additional cash or fixed income to a portfolio. Investors must consider whether the return potential of an alternative fund with a high correlation to equities outweighs the extra risk compared with those alternatives.

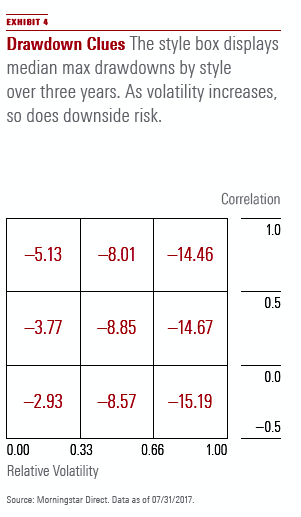

Considering Volatility and Downside Risk The alternatives style box not only facilitates comparison of funds, but also gives visual clues into a fund's downside risk. Given the positive relationship between volatility and downside capture, it stands to reason that as relative volatility—that is, the x-axis of the alternatives style box—increases, so too does drawdown potential. Thus, as funds are plotted from left to right across the style box, the maximum drawdown potential also increases.

To illustrate, EXHIBIT 4 shows the average maximum drawdowns for each region of the alternatives style box over the three years ending in July. For comparison, the maximum drawdown of the global equity index was 13.3%.

It’s apparent that the alternatives style box can make relative risks and potential downside easier to observe and evaluate.

Four Corners To further show how alternatives strategies come in many different varieties and diversification benefits, we examine the funds that fall into the corners of the alternatives style box.

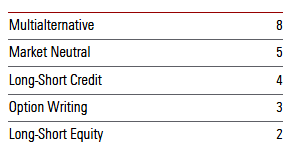

Alternative Funds With High Correlation and Low Relative Volatility In the top left region of the alternatives style box, we find funds that have a high correlation to global equities (above 0.5 over the trailing three years) and a low relative volatility (less than 33% the volatility of global stocks when measured by monthly standard deviation over the trailing three years). Here is the breakdown of funds in this square of the style box by Morningstar category as of July:

Highly correlated, less-volatile alternative funds are often considered as a partial stand-in for fixed income, which has a similar risk/reward profile. Over the measurement period in this example, the Bloomberg Barclays US Aggregate Bond Index had 27% of the relative volatility of global equities, for example.

These funds’ high correlation to equities should give investors pause, though, as it indicates performance tends to be influenced by the direction of global stocks. In a market where stocks are falling, these strategies are likely to fall as well, albeit less given their lower relative volatility. Still, investors who have turned to these funds in lieu of fixed income amid concern about rising interest rates should keep in mind that they could disappoint in an equity market sell-off, during which it’s not uncommon for bonds to rally. In such a scenario, they’d probably be better off in bond funds.

Over the three years ending July 31, for example, the average high-correlation/low-volatility alternative fund captured 22% of the global equity benchmark’s downside, but bonds tended to deliver gains. The Bloomberg Barclays US Aggregate Bond Index gained 12% during those down periods over the same span.

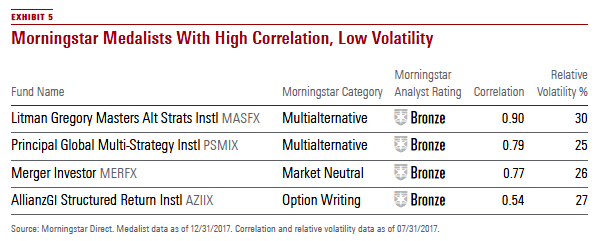

These funds may still appeal to more conservative investors, though even they should be mindful of how they’ll mesh with other holdings as part of a broader portfolio. For investors willing to take the plunge, there are a handful of funds with these characteristics that we recommend (EXHIBIT 5 ).

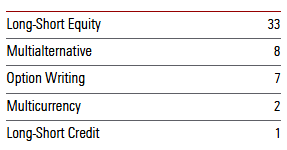

Alternative Funds With High Correlation and High Relative Volatility In the top right portion of the alternatives style box are liquid alternative funds that are highly correlated with global equities and relatively volatile. These funds hail predominantly from the long-short equity category. To be included in the category, a fund must consistently have a beta to equities of between 0.3 and 0.8 (for categorization purposes, in the United States the S&P 500 is typically used as the benchmark) and gross short exposure of at least 20%. Given their high relative volatility and net long exposure to equities, these funds tend to be considered as a substitute for other growth assets, like long-only equities.

Long-short equity strategies boast several potential benefits that can recommend them. For example, adding a long-short equity strategy to a diversified portfolio can lower overall portfolio volatility without sacrificing a significant portion of the equity market’s upside. In addition, short-selling can give managers an opportunity to add excess returns in ways a long-only fund can’t.

Morningstar analysts recommend only one fund that falls in the high-correlation, high-volatility region of the alternatives style box as of July 31: Bronze-rated

Investors should treat the due diligence of long-short equity funds as they would any active equity manager. The fund’s returns are going to be driven by management’s ability to identify stocks that are both undervalued and overvalued. Some long-short equity funds do add an element of market timing by varying net exposure levels depending on the manager’s view of the broader equity market. These more tactical equity managers can be more easily identified by how their alternatives style box position changes over time.

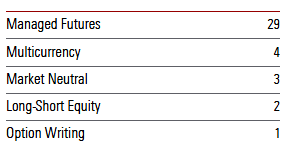

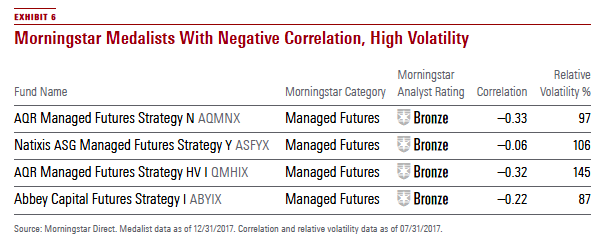

Alternative Funds With Negative Correlation and High Relative Volatility The opposite corner of the style box is composed of alternative funds that have exhibited a lower (in this case negative) correlation to global equities and higher (at least two thirds that of the index) volatility over the trailing three-year period.

Although the style box’s rightmost border ends at a relative volatility of 1—where a fund’s volatility is equal to that of global equity markets— in practice some managed futures, multialternative, and long-short equity funds can be more volatile than global equities over a three-year period. (We plot those funds on the style box’s border.)

Most of the funds that fall into the lower right corner of the alternatives style box are classified in the managed-futures category. Other strategies, like

While having a low or negative correlation to stocks may seem like a desirable characteristic in an alternative fund, because it shows the fund is being driven by different risk factors than equities, it’s important that investors understand why a fund has acted like it has. Managed-futures funds look to profit from trends across multiple asset classes. To follow trends, managed-futures funds use futures contracts. Futures typically require a small amount of capital to be held as collateral, so the funds can have higher notional leverage than strategies that rely on physical securities. Essentially, they bet that winners will keep winning and losers will keep losing. The potential to benefit from assets falling in value, like oil in late 2014 or stocks during the financial crisis, contributes to the strategy’s low and sometimes negative correlation to global stocks.

Even though managed-futures funds may have a negative correlation to global equities, trend-following has shown it can still generate positive long-term returns, which investors should expect from an alternatives strategy regardless of its correlation to equities. To be sure, that doesn’t make them a replacement for high-quality bonds, which have similar diversification characteristics and much lower volatility. For investors comfortable taking on equitylike risk in their alternative fund, managed futures could be an attractive option. Other funds with a negative correlation to equities may be positioned to only gain when stock markets fall, which would be less useful over the long term given that equities generally rise over long time periods. There are four funds that fall into this style box that are Morningstar Medalists ( EXHIBIT 6 ).

Alternative Funds With Negative Correlation and Low Relative Volatility In the bottom left corner of the alternatives style box are funds with a negative correlation to equities and low relative volatility. The further a fund is plotted toward the bottom of the style box, the more negatively correlated it is. It's important to remember that a negative correlation of less than 0.5 doesn't imply the strategy will always act in the exact inverse of stocks. It does signal that the strategy is not dependent on the direction of stocks to generate returns, though, which can make it a useful building block for a portfolio. This section of the style box is the most sparsely populated:

One of the funds is a Morningstar Medalist:

Similar to other lower-volatility alternative funds, investors may see these strategies as an option to replace some fixed-income exposure. Unlike the funds in the top left corner of the alternatives style box, these strategies’ negative correlations to equities show they had more of a defensive posture when equities sold off.

Each of the funds had a negative downside capture over the trailing three years, which means they generated gains while stocks were down, on average, over that period. That doesn’t mean the funds were riskless over that period, of course. It simply means stock market risk was not the main risk driving returns. As stocks are likely the riskiest part of investor portfolios, identifying alternatives that court risks other than stock market beta is ideal.

Set Expectations The examples in this article cover a short period of time, and the results shouldn't be expected to hold over every market environment. Still, we believe the factors that investors should consider as part of their due-diligence process when evaluating an alternative strategy are unlikely to change regardless of whether the process starts today, tomorrow, or several years from now. Paying attention to how a strategy has been correlated to equity markets over time and in specific market periods, like the volatile third quarter of 2015, and what kind of volatility it has exhibited relative to equities, could help investors better set expectations for alternatives. As liquid alternative funds continue to develop track records, we'll be able to examine how these factors change over different market environments. For now, investors should still consider these factors as part of the evaluation process.

This article originally appeared in the February/March 2018 issue of Morningstar magazine. To learn more about Morningstar magazine, please visit our corporate website.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)